Chinese automakers are significantly increasing their presence in global markets, particularly in emerging economies, with competitively priced and feature-rich electric vehicles.

While the U.S., Canada, and the EU impose tariffs, markets like Bangkok, Johannesburg, and Sao Paulo are embracing Chinese EVs, leading to a surge in export numbers.

Traditional automakers like Ford are acknowledging the competitive threat, especially in regions like India and South America, as Chinese brands gain market share through strategic marketing and affordability.

Chinese EVs like Great Wall, BYD, Chery, and SAIC are flooding the streets in places other than the U.S., according to a new report from Bloomberg.

While the U.S., Canada, and the EU impose tariffs to protect domestic automakers, emerging markets are embracing Chinese vehicles, creating fresh competition for global carmakers.

Places like "Bangkok to Johannesburg to Sao Paulo" are being dominated by the new low cost, sleek EVs that China has been churning out en masse over the last half decade.

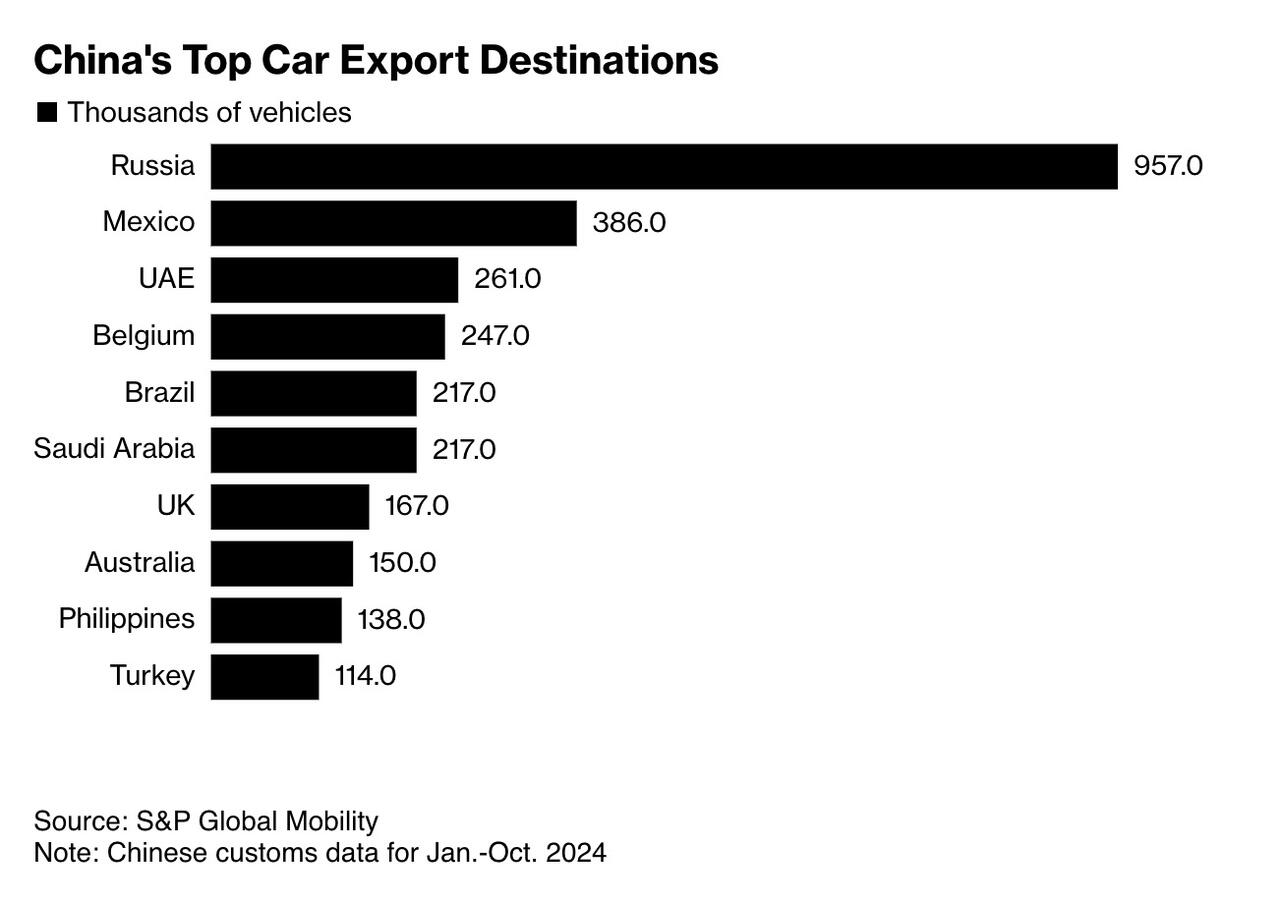

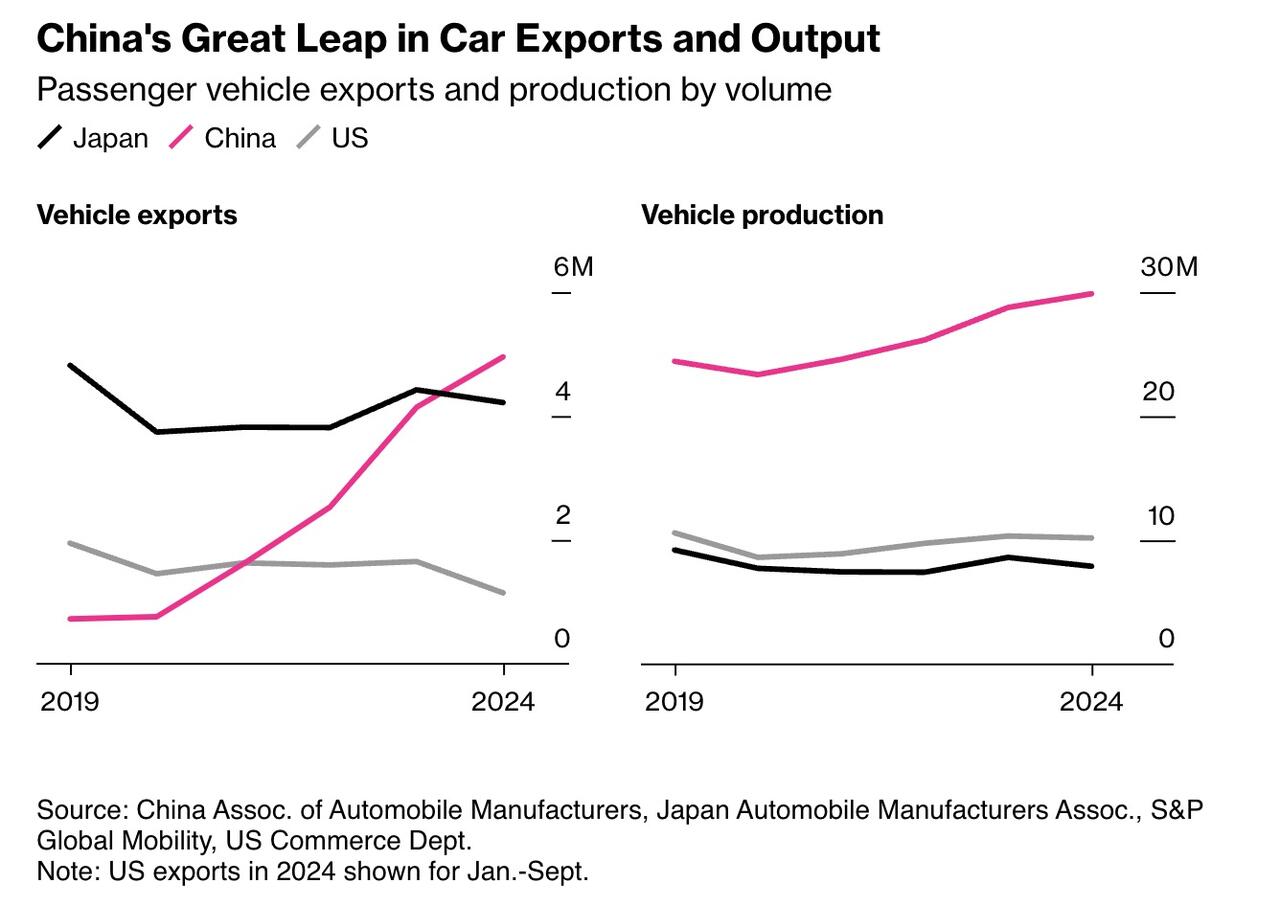

Bloomberg writes that China now leads global vehicle exports, shipping 4.9 million passenger cars in 2024—up from less than 1 million in 2020, according to the China Association of Automobile Manufacturers.

“Chinese automakers have pushed into lots of global markets with high quality and competitively priced vehicles,” said Abby Chun Tu of S&P Global Mobility, comparing their strategy to past successes of South Korean and Japanese brands. Unlike their predecessors, they also offer advanced software and feature-rich models, even at lower price points.

Despite concerns in the U.S. and Europe over China’s EV dominance, most Chinese car exports remain gas-powered, as many developing nations lack EV infrastructure.

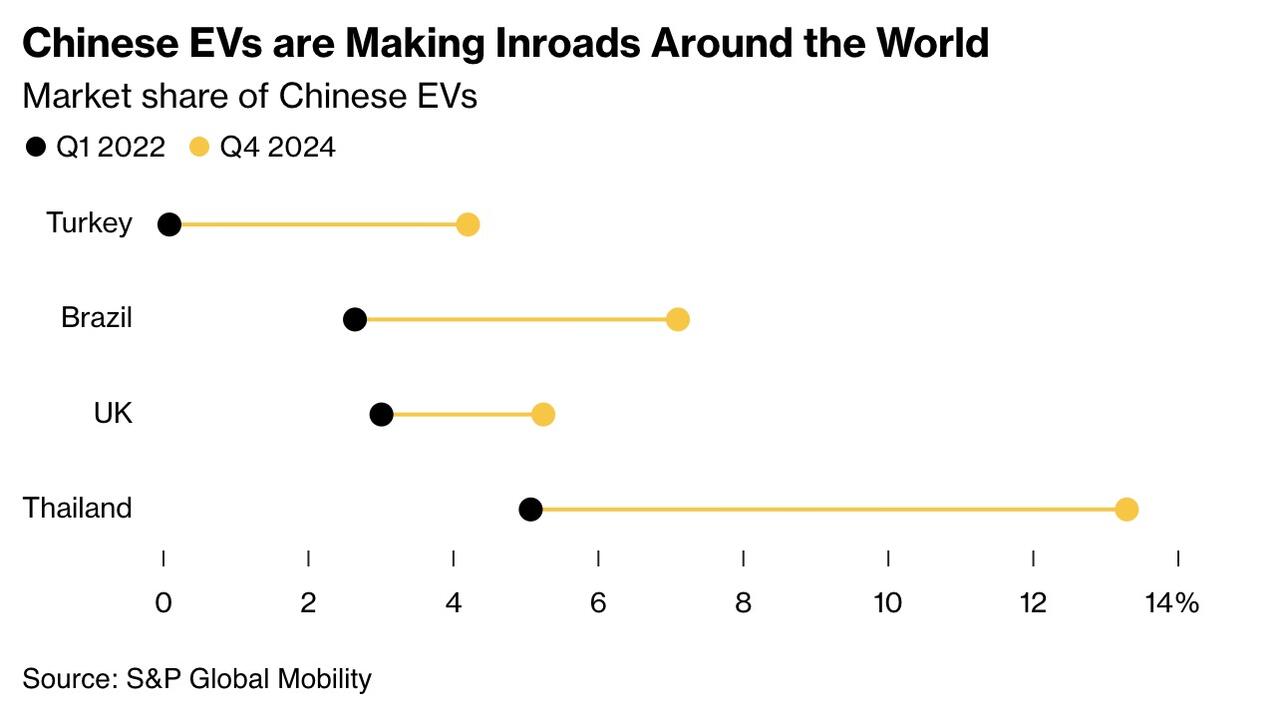

With a growing foothold, China’s global auto market share could rise from 3% today to 13% by 2030—hitting 39% in Africa and the Middle East, according to AlixPartners.

Ford CEO Jim Farley acknowledged the competitive threat, saying, “In emerging markets like India, especially South America, they’re being dominated by the Chinese.”

Ford has exited Brazil, where BYD took over its former plant, but aims to hold ground in South Africa and Thailand. “We have to think about future-proofing that,” Farley said.

The article concludes, stating GM and Stellantis see Chinese automakers as a threat but partner with them to stay competitive.

Chinese brands gain ground with marketing and low prices. In Brazil, BYD featured Pelé in ads, and Luiz Palladino compared his Haval H6 EV to BMW, saying, “It has everything I want.”

Tax breaks helped China’s foothold in Brazil, with BYD and Great Wall building plants. “The Chinese found a great opportunity,” said Ricardo Roa of KPMG.

In Thailand, Chinese brands now hold 13.3% of the market and 71% of EV sales. As Japanese automakers retreat, Chinese rivals take over.

At Bangkok’s Motor Expo, Wiyawit Petra, a longtime Toyota and Honda driver, considered a BYD hybrid. “I want to open my heart to something new now,” he said. “It’s also affordable, so it’s worth the risk.”

By Zerohedge.com