LI

Tesla Fires Up America’s First Major Lithium Refinery

- Tesla has brought the largest and most advanced lithium refinery in the U.S. online.

- Tesla is using a first-of-its-kind process to convert spodumene ore directly into battery-grade lithium hydroxide.

- The refinery is a major step toward reducing U.S. dependence on China for refined lithium, cutting emissions, creating jobs, and regionalizing critical mineral supply.

This week, Tesla North America and Elon Musk announced that the largest and most advanced lithium refinery in the United States is now operational.

The Tesla Lithium Refinery just outside of Corpus Christi, Texas, is another step toward the U.S. goal of having domestic refined lithium resources to counter China’s market dominance.

“Our Lithium Refinery ushers in energy independence for North America,” Tesla North America said in the caption of a video announcing that the plant is operational, just two years after breaking ground.

The refinery converts spodumene ore directly into battery-grade lithium hydroxide, in a first-of-its-kind process in North America.

Tesla uses a new technology platform that allows a cleaner, simpler, and cheaper process to obtain battery-grade lithium from the raw material, spodumene ore, says Jason Bevan, Site Manager for Tesla’s Gulf Coast Lithium Refinery.

Tesla says it sustainably sources spodumene and brings it to site where it runs it through a series of conveyance systems, takes it through a kiln and a cooler. From there, the material is taken through an alkaline leech and additional purification steps, and then into crystallization to produce battery-grade lithium hydroxide.

“Our process is more sustainable than traditional methods and eliminates hazardous byproducts and instead produces a co-product named anhydrite used in concrete mixes,” a refinery employee says in the Tesla video.

Tesla notes that this refinery enables it to have access to the critical minerals for energy storage, for battery manufacturing, and ultimately for EV growth.

The first-of-its-kind lithium refinery in North America also enables Tesla to accelerate its mission by “regionalizing supply chains for battery minerals and materials, by providing jobs, by cutting emissions from transportation that's required for those supply chains.

“It really allows us to usher in energy independence for North America,” Tesla says.

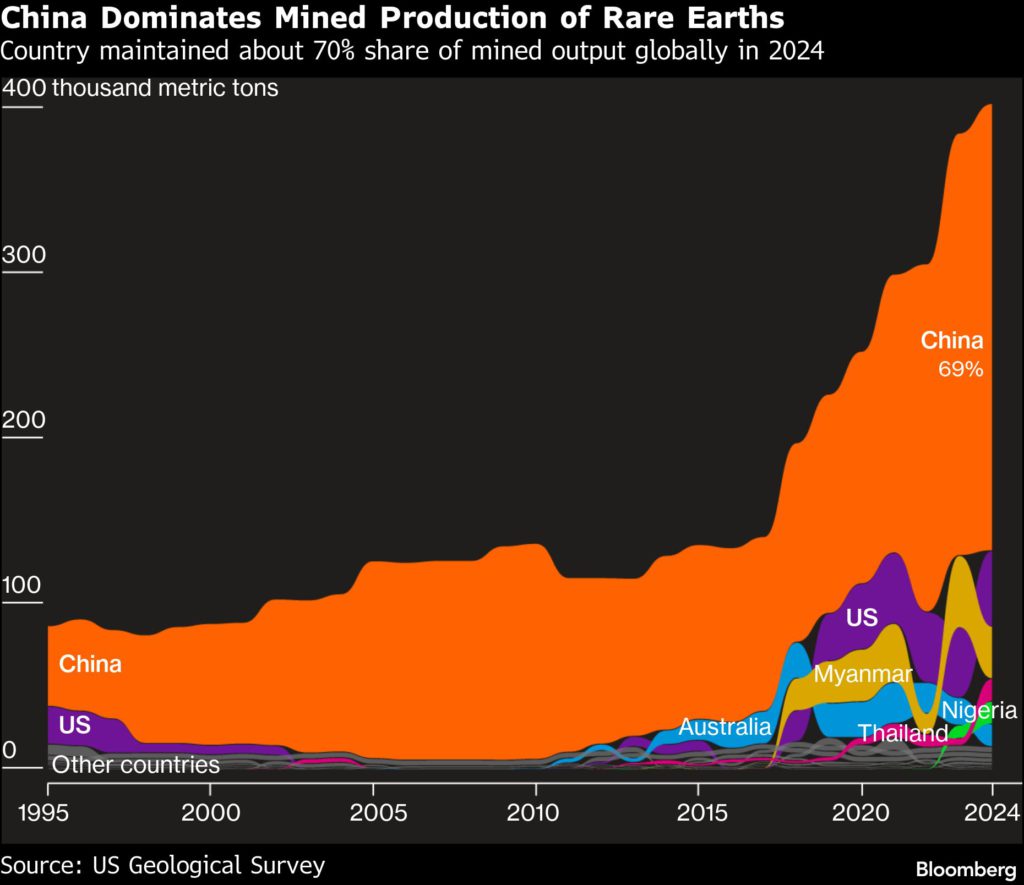

The company’s new domestic lithium refinery is one of the first concrete steps for America to reduce dependence on refined lithium supply on China.

The U.S. has been trying for years to break that industrial and national security dependence on critical minerals used in battery technology and defense, military, and automotive technologies.

The Trump Administration took this fight a notch up by directly investing, through the Departments of Defense and Energy, in minority stakes in North American lithium producers and refiners. That’s to ensure access to a domestic supply of key minerals and create jobs in the minerals supply chain.

The U.S. Administration is increasingly looking to have a direct equity involvement in America’s critical minerals supply chain, in the race to close the gap with China.

Direct Administration bets on lithium mining projects were a key theme in the sector last year.

For example, the Department of Energy (DOE) has agreed to provide a $2.26 billion loan to Vancouver-based Lithium Americas Corp. to help it complete a major lithium project in Humboldt County in northern Nevada.

For the first draw on the DOE loan, the Department received a 5% equity stake in Lithium Americas through warrants to purchase common shares, as well as a 5% economic stake in Lithium Americas’ joint venture with GM for the Thacker Pass lithium project in Nevada.

Lithium Americas targets late 2027 for the mechanical completion of the Thacker Pass project, in which GM last year bought a 38% interest for $625 million in total cash and letters of credit.

Thacker Pass is expected to be the biggest lithium supply project in the Western hemisphere. Thacker Pass alone is expected to raise nearly ten times the current U.S.-sourced lithium volumes.

In addition, in July 2025, U.S. rare earths miner and magnet producer MP Materials Corp announced it had entered into a public-private partnership with the Department of Defense (DoD) to accelerate the build-out of an end-to-end U.S. rare earth magnet supply chain and reduce foreign dependency.

The direct involvement of the U.S. federal government highlights the importance the Administration places on securing domestically-sourced critical minerals and reducing dependence on foreign suppliers, most notably China.

By Charles Kennedy for Oilprice.com

Portugal’s Lifthium wins $210 million grant for lithium refinery

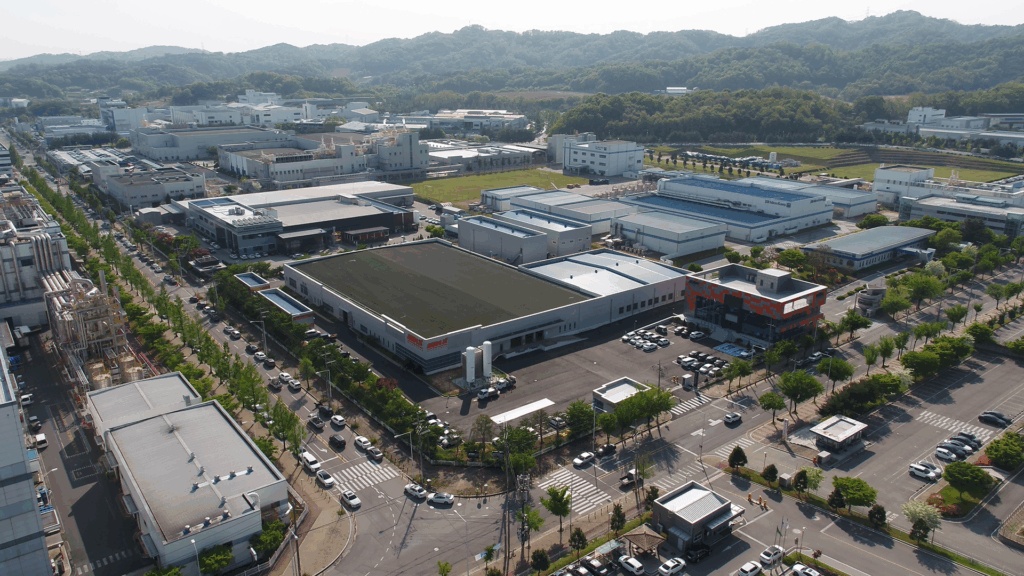

The Estarreja chemical complex. Credit: Bondalti

The Estarreja chemical complex. Credit: BondaltiPortugal’s Lifthium Energy has been awarded a 180 million euro ($210 million) government grant to build a lithium refinery in the country’s north for the fast-growing electric vehicle battery market.

With 60,000 metric tons of reserves, Portugal is Europe’s top lithium producer, supplying mainly the ceramics industry. It has only recently sought to produce battery-grade lithium.

The company said the non-refundable grant was awarded under the European Union’s Temporary Crisis and Transition Framework, which allows state incentives to speed the green and industrial transition.

Lifthium, 85% owned by Portuguese conglomerate Jose de Mello with the remainder by its subsidiary Bondalti, will build the refinery in the northern town of Estarreja, about 50 km (31 miles) south of Porto.

Bondalti, Portugal’s largest chemicals producer, already operates sites there and Lifthium aims to start operations by 2030.

Lifthium CEO Duarte Braga said the project was advancing “with rigour and prudence”, as the lithium market and Europe’s industrial environment had become significantly more challenging over the past two years.

He said the public incentive was important, but the focus now was on securing a strategic partner and firming up market and financing conditions before a final investment decision.

In addition to the Estarreja plant, Lifthium may build another refinery in Spain, he said.

The company is aiming for annual refining capacity of 50,000 tons of lithium hydroxide, enough to supply batteries for two million EVs, using proprietary technology designed to meet Europe’s environmental and industrial standards.

The government hopes to launch a long-delayed tender for lithium prospecting licences this year, seen as key to building a domestic lithium value chain and cutting Europe’s reliance on imports from countries including China.

($1 = 0.8594 euros)

(By Sergio Goncalves; Editing by Mark Potter)

Portugal’s Lifthium Energy has been awarded a 180 million euro ($210 million) government grant to build a lithium refinery in the country’s north for the fast-growing electric vehicle battery market.

With 60,000 metric tons of reserves, Portugal is Europe’s top lithium producer, supplying mainly the ceramics industry. It has only recently sought to produce battery-grade lithium.

The company said the non-refundable grant was awarded under the European Union’s Temporary Crisis and Transition Framework, which allows state incentives to speed the green and industrial transition.

Lifthium, 85% owned by Portuguese conglomerate Jose de Mello with the remainder by its subsidiary Bondalti, will build the refinery in the northern town of Estarreja, about 50 km (31 miles) south of Porto.

Bondalti, Portugal’s largest chemicals producer, already operates sites there and Lifthium aims to start operations by 2030.

Lifthium CEO Duarte Braga said the project was advancing “with rigour and prudence”, as the lithium market and Europe’s industrial environment had become significantly more challenging over the past two years.

He said the public incentive was important, but the focus now was on securing a strategic partner and firming up market and financing conditions before a final investment decision.

In addition to the Estarreja plant, Lifthium may build another refinery in Spain, he said.

The company is aiming for annual refining capacity of 50,000 tons of lithium hydroxide, enough to supply batteries for two million EVs, using proprietary technology designed to meet Europe’s environmental and industrial standards.

The government hopes to launch a long-delayed tender for lithium prospecting licences this year, seen as key to building a domestic lithium value chain and cutting Europe’s reliance on imports from countries including China.

($1 = 0.8594 euros)

(By Sergio Goncalves; Editing by Mark Potter)