Crypto firm Tether said to have $8B worth of gold stockpiled in Swiss vault

Stock image.

Stock image.Tether Holdings SA, issuer of the world’s largest stablecoin, is said to have stockpiled $8 billion worth of gold in a secure vault in Switzerland, according to a Bloomberg report.

In a statement to Bloomberg this week, the El Salvador-based crypto firm confirmed that it holds around 80 metric tons of gold, the majority of which are owned outright by the company. The amount, it adds, makes Tether “one of the largest gold holders in the world outside of banks and nation states,” comparable to that of UBS Group.

Tether is the issuer of the USDT stablecoin, a cryptocurrency whose value is pegged to the USD on a near one-to-one basis. The company receives dollars in return for the tokens it issues and makes money from that collateral by investing in assets like gold.

Since its launch in 2014, USDT has grown to become the largest cryptocurrency by trading volume, with about $159 billion currently in circulation. According to the company’s latest report issued in March, bullion accounts for 5% its reserves, with a market value of approximately $8 billion.

In an interview with Bloomberg, Tether chief executive Paolo Ardoino described its gold vault as “one of the most secure in the world,” though he did not provide further details aside from a generic location (Switzerland), citing security reasons.

Explaining the company’s strategy to accumulate gold, Ardoino said he views gold a “safer asset” than any national currency, including the US dollar, particularly when there are rising concerns over America’s debt levels. He went on to say that central banks within the BRICS nations have been stockpiling bullion, which contributed to rising gold values.

However, its growing allocation to gold could raise regulatory challenges due to the soaring popularity of stablecoins in recent years. Draft legislation in the US such as the GENIUS Act, and European frameworks like MiCA, would restrict stablecoin reserves to cash or near‑cash instruments – excluding commodities like gold. If these rules take effect, Tether may need to adjust its holdings to maintain compliance in regulated markets.

In addition to USDT, the company also issues the XAUT stablecoin, which is backed one-to-one by an ounce of gold and can be redeemed for physical gold, collected directly in Switzerland. To date, it has issued tokens equivalent to 7.7 tons of gold or $819 million, a paltry amount relative to the more liquid gold-backed exchange-traded funds.

Ardoino also noted that the company opted to self‑custody its bullion to avoid the costs associated with commercial vault operators, which typically charge around 50 basis points. If Tether’s gold token were to grow to $100 billion in circulation, “it’s a lot of money to pay”, he said.

Gold prices have rallied about 25% this year, as investors reach for safe havens to hedge against geopolitical tensions and an expanding trade war. Strong demand from central banks and sovereign institutions has also supported bullion’s rise.

Tether Holdings SA, issuer of the world’s largest stablecoin, is said to have stockpiled $8 billion worth of gold in a secure vault in Switzerland, according to a Bloomberg report.

In a statement to Bloomberg this week, the El Salvador-based crypto firm confirmed that it holds around 80 metric tons of gold, the majority of which are owned outright by the company. The amount, it adds, makes Tether “one of the largest gold holders in the world outside of banks and nation states,” comparable to that of UBS Group.

Tether is the issuer of the USDT stablecoin, a cryptocurrency whose value is pegged to the USD on a near one-to-one basis. The company receives dollars in return for the tokens it issues and makes money from that collateral by investing in assets like gold.

Since its launch in 2014, USDT has grown to become the largest cryptocurrency by trading volume, with about $159 billion currently in circulation. According to the company’s latest report issued in March, bullion accounts for 5% its reserves, with a market value of approximately $8 billion.

In an interview with Bloomberg, Tether chief executive Paolo Ardoino described its gold vault as “one of the most secure in the world,” though he did not provide further details aside from a generic location (Switzerland), citing security reasons.

Explaining the company’s strategy to accumulate gold, Ardoino said he views gold a “safer asset” than any national currency, including the US dollar, particularly when there are rising concerns over America’s debt levels. He went on to say that central banks within the BRICS nations have been stockpiling bullion, which contributed to rising gold values.

However, its growing allocation to gold could raise regulatory challenges due to the soaring popularity of stablecoins in recent years. Draft legislation in the US such as the GENIUS Act, and European frameworks like MiCA, would restrict stablecoin reserves to cash or near‑cash instruments – excluding commodities like gold. If these rules take effect, Tether may need to adjust its holdings to maintain compliance in regulated markets.

In addition to USDT, the company also issues the XAUT stablecoin, which is backed one-to-one by an ounce of gold and can be redeemed for physical gold, collected directly in Switzerland. To date, it has issued tokens equivalent to 7.7 tons of gold or $819 million, a paltry amount relative to the more liquid gold-backed exchange-traded funds.

Ardoino also noted that the company opted to self‑custody its bullion to avoid the costs associated with commercial vault operators, which typically charge around 50 basis points. If Tether’s gold token were to grow to $100 billion in circulation, “it’s a lot of money to pay”, he said.

Gold prices have rallied about 25% this year, as investors reach for safe havens to hedge against geopolitical tensions and an expanding trade war. Strong demand from central banks and sovereign institutions has also supported bullion’s rise.

Gold price climbs to two-week high as Trump unleashes new tariffs

Gold climbed to its highest in two weeks on Friday as investors rushed toward the safe-haven metal after US President Donald Trump widened the global trade war with a new wave of tariffs.

Spot gold gained as much as 1.2% to $3,368.88 per ounce during the early hours of trading, before settling around the $3,350 mark. US gold futures rose 1.6% to $3,381.60 an ounce.

Meanwhile, global equities fell after Trump ramped up his tariff assault on Canada with a 35% tariff and unveiled plans to impose blanket tariffs of 15% or 20% on most other trading partners.

The US President also announced a 50% tariff on copper imports earlier this week, sending the industrial metal’s price to a record.

“We are in an environment where the uncertainty premium is back in the market, and gold is getting a safe-haven bid,” Aakash Doshi, global head of gold strategy at State Street Global Advisors, told Reuters.

“I think the range in the third quarter is most likely between $3,100 and $3,500. It’s been a very strong first half of the year, and I believe we’re now in a bit more of a consolidation phase.”

Further supporting bullion is the rising likelihood of a US rate cut later this month following the latest comments by Federal Reserve governor Christopher Waller. A lower borrowing rate typically benefits gold, as the metal yields no interest.

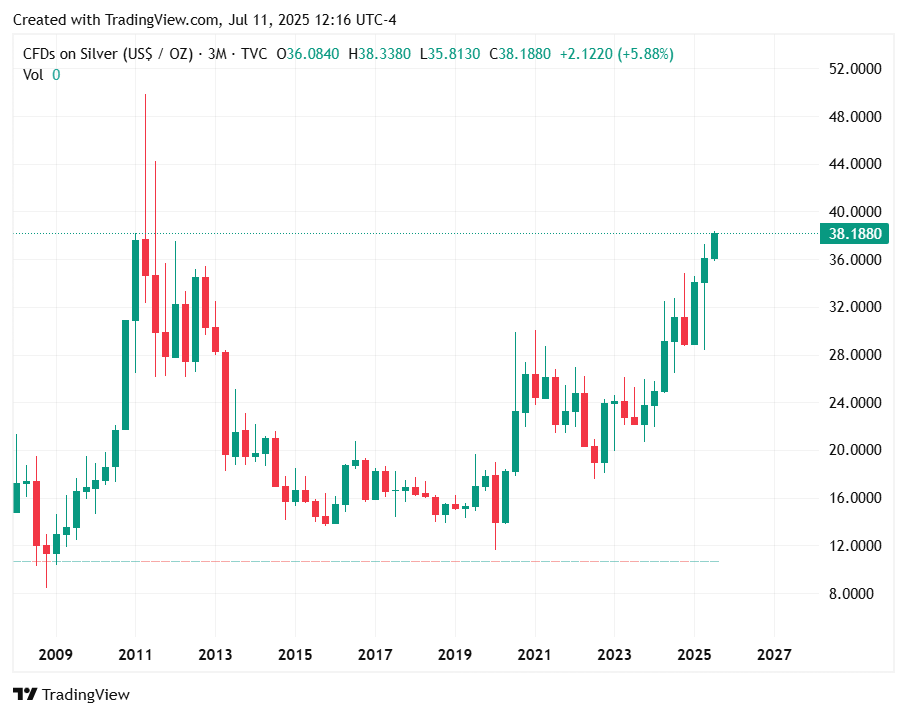

Elsewhere, gold’s sister metal silver hit its highest level since September 2011 following a surge in the US premiums. With these gains, the silver-to-gold ratio has risen far above historical norms.

Both metals have gone up by 27% year to date.

(With files from Reuters)

Silver price soars to $39, the highest since 2011

Silver jumped to a near 14-year high Friday amid signs of a short squeeze on the precious metal in the London market that led to a surge in US premiums.

Spot silver rose as much as 3% to $38.34 per ounce, the highest since September 2011. US silver futures climbed even higher at nearly 4%, with September contracts touching an intraday high of $39 an ounce.

Such a wide price gap between the two major markets is unusual, as it is typically eliminated quickly through arbitrage. Earlier this year, silver experienced a similar price dislocation amid speculation of US tariffs on precious metals.

That arbitrage opportunity also pushed leases up, as traders looked to secure metal for shipment to COMEX-linked warehouses in New York. However, the rush to move silver ended quickly once the White House exempted bullion from the levies.

Higher lease rates normally indicate a tightening market. On Friday, the implied annualized one-month borrowing costs for silver in London jumped to approximately 4.5%, well above the typical near-zero rate.

Most of the silver in London is held by exchange-traded funds (ETFs), meaning it is not available to lend or buy. The metal has recently been bolstered by solid inflows into ETFs, with holdings up by 1.1 million ounces on Thursday, according to data compiled by Bloomberg.

Daniel Ghali of TD Securities has argued that the outflow of silver caused by the tariff arbitrage opportunity has left inventories of freely available silver in the market critically low.

“Our estimates of LBMA silver’s free-float now stands at its lowest levels in recorded history,” Ghali wrote in a note Thursday. “Silver’s illusion of liquidity tells us that silver markets will only rebalance through some form of a squeeze on physical.”

Silver has risen 27% this year, with gains recently outpacing its sister metal gold. Silver has a dual character, valued both for its uses as a store of value and an industrial input.

Due to its importance in clean energy technologies, in particular solar panels, demand for silver is expected to remain strong in the coming years, with the market facing another year in deficit, according to industry group the Silver Institute.

(With files from Bloomberg)

No comments:

Post a Comment