Column: Copper market pays the price for forgetting its TACO hedge

The copper market got the tariff right but the products wrong.

US President Donald Trump’s proclamation “to address the effects of copper imports on America’s national security” was not what traders were expecting.

There will be 50% tariffs on copper imports effective Friday but only on semi-manufactured products such as wire and tube. Refined copper is excluded, at least until January 2027, when a tariff may be phased in if warranted.

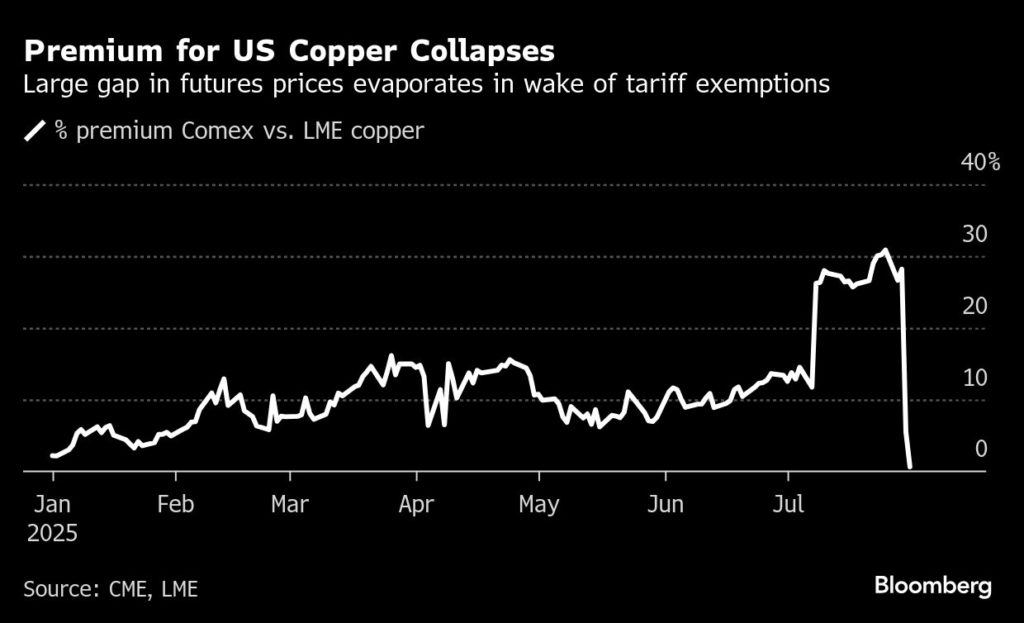

The tariff trade, which has defined the copper market since February, has imploded. The CME’s US contract plummeted by more than 20% on the news, wiping out the previous high premium over the London Metal Exchange (LME) price.

The United States is now awash with metal it doesn’t need after traders shipped huge tonnages through the yawning arbitrage gap.

The copper market forgot Trump’s tendency to back down on his most extreme tariff threats. It has, to borrow a current investor meme, just been TACO’d, which stands for Trump Always Chickens Out.

Copper products targeted

The tariffs on semi-finished copper products cover between 400,000 and 500,000 metric tons of annual US imports.

America imports considerably more copper as refined metal. Imports last year were just over 900,000 tons.

Canada is the largest single supplier of copper products to the US, but the supplier base is highly diverse. Last year’s imports of copper tubes, for example, came from 32 different countries.

The tariffs will also be extended down the product chain to copper-intensive derivative products such as cables, connectors and electrical components, likely ensnaring more supplier countries.

The new tariff wall should be a boost for domestic processors, but only if they have the capacity to cover the range and quality of what is currently being imported.

The number of product-specific exemptions granted in the coming months will provide an answer.

Scrap wars heat up

The tariff wall on products will be complemented by restrictions on exports of US mined concentrates and recyclable copper.

A quarter of domestically-produced “copper input materials” will be required to be sold in the United States from 2027. That rate will rise to 30% in 2028 and 40% in 2029.

That may need more capacity than exists at the current three domestic smelters, even assuming Grupo Mexico reactivates its idle Hayden plant in Arizona.

“High-quality copper scrap” will also be subject to a 25% minimum domestic sales requirement to stimulate domestic recycling.

It’s not clear what types of scrap qualify or how such a measure is going to work in practice, but the move marks an escalation in the simmering scrap wars.

The European Union is also considering export quotas on recyclable copper to stop what it calls “scrap leakage.”

The prime target is China, which is the world’s largest buyer of secondary raw material.

The country imported 2.25 million tons of copper scrap in 2024, the highest annual total since 2018, the year before authorities tightened up the purity specifications on imported material.

Imports have already slowed this year thanks to a 42% drop in shipments from the United States due to the high CME price premium.

Growing resource nationalism in the global scrap market promises profound structural changes in the flow of recyclable materials.

Can we have our copper back now?

But not for refined copper, which is what everyone was expecting.

Big trade houses have shipped over half a million tons of copper to the United States for a trade that is now redundant, even if it was a bonanza for those involved.

CME warehouses currently hold 232,195 tons of copper, which is the highest tonnage since 2004. Metal is still arriving daily thanks to the last-minute dash to beat what traders thought was the August 1 deadline.

The supply chain in the rest of the world is still compensating for the huge suction effect created by the prospect of tariffs.

China exported almost 260,000 tons of refined copper between March and June, compared with 78,000 tons in the prior four-month period.

Some of it was delivered against a short squeeze on the London market created by the raid on LME stocks for US-deliverable brands of copper.

Some of it was non-Chinese metal stripped from bonded warehouses and shipped directly to the United States.

China’s surging export flows have depleted Shanghai Futures Exchange stocks, which have fallen to 73,423 tons, the lowest level since December.

While the futures tariff trade has collapsed overnight, the physical supply chain will take longer to readjust.

Analysts are already running the numbers to gauge whether it makes sense for copper to reverse flow back out of the United States.

Same time next year?

Is that it for the copper tariff trade?

Probably not, given the explicit reference to the option of a phased tariff on imports of refined copper, starting at 15% in 2027 and rising to 30% in 2028.

It will depend on an update on the state of the domestic market by Commerce Secretary Howard Lutnick scheduled for the end of June next year.

It also depends, of course, on whether Trump changes his mind again before then.

You never know with Tariff Man.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Elaine Hardcastle)

Copper price posts second weekly drop after Trump’s tariff surprise

Copper registered a second weekly decline in London as the market digested the impact of President Donald Trump’s shock decision to exempt refined forms of the metal from hefty US import tariffs.

The industrial metal steadied on Friday on the London Metal Exchange, but was down 1.4% for the week. In the US, where traders had been moving large volumes of copper to in anticipation of the tariffs, copper has plunged by more than 20% this week.

Trump imposed 50% tariffs on semi-finished copper products such as pipes, wires, rods, sheets and tubes from Friday, but exempted less-processed forms of the metal including ore, concentrates and cathodes. New York futures’ big premium over London evaporated in response.

Traders are now rushing to book storage space for copper in a bet that Trump’s decision will prompt a wave of supplies that have been stockpiled in the US to be shifted to LME warehouses. Holdings of the metal in warehouses monitored by the LME, Comex and the Shanghai Futures Exchange have recovered in July after dropping in each of the previous four months.

Copper prices may come under pressure in the near term due to the unwind of the US copper tariff trade, wrote Daniel Major, analyst at UBS Group AG. “We remain structurally constructive on the fundamental outlook for copper, but have become more cautions on the near-term outlook as we are concerned that the physical market has been distorted by tariffs,” he said.

Copper edged up 0.2% to settle at $9,630.50 a ton on the LME at 5:50 p.m. in London. Comex copper rose 1.9% to settle at $4.4355 a pound. Other main LME metals except zinc advanced.

Trump tariff surprise triggers implosion of massive copper trade

The global copper market is reeling from its biggest shock yet in a year of policy surprises, violent price swings and unprecedented trade dislocation.

US President Donald Trump went ahead with 50% tariffs on copper imports but exempted refined metals, which are the mainstay of international trading. The move triggered a record plunge for US prices after a period of fat profits for traders who hurried metal to America before the levies kicked in. A large premium for New York futures over London evaporated.

“The blow-out in the CME-LME spread has been touted as one of the most profitable commodity trades in modern history,” Daniel Ghali of TD Securities Inc. wrote in a note. “In a single session, the White House’s proclamation on copper tariffs annihilated the spread and catalyzed CME copper’s largest intraday fall on record.”

Copper futures on Comex in New York fell by 22% as traders recalibrated the value of metal in the US versus the rest of the world. With prices on the London Metal Exchange falling by a much smaller margin, Comex front-month futures swung to a discount against the LME benchmark from a premium of more than 30% a week ago.

The decision to exempt refined copper will roil global trade of the metal, which plays a crucial role in the world economy thanks to its use in electrical wiring. Massive volumes now sit in US warehouses, and there’s already speculation about potential re-exports.

Copper rush

When Trump first flagged the likelihood of tariffs early this year, US prices soared relative to the rest of the world, and major traders scurried to get metal to American ports in a trade that some industry veterans said was the biggest of their lifetimes.

Early in July, Trump said the tariff would be a higher-than-expected 50%, ratcheting up the potential rewards. That spurred a last-minute rush, with at least one copper-laden ship heading for Hawaii before the end of this month.

“This has badly deviated from market expectations,” said Li Xuezhi, head of research at Chaos Ternary Futures Co., a unit of a commodities hedge fund in Shanghai. Those betting on higher US prices have “wasted all their efforts,” and global copper flows will return to normal, he said.

Analysts at Goldman Sachs Group Inc. said they were “surprised” by the exemptions but added that they don’t see it changing market fundamentals and don’t expect large-scale re-exports from the US. Comex prices should stay at least on a par with LME prices, they said.

Copper fell 0.9% to settle at $9,611 on the LME 6:08 p.m. London time, while Comex copper was 22% lower at $4.371 a pound.

Supply security

The President’s announcement — less than 48 hours before tariffs were due to start — illustrates his white-knuckle approach to trade policy and the challenges he faces in revamping America’s metals industry. Some key players in the US copper sector had argued that the country simply didn’t have sufficient capacity to replace all its imports so quickly.

The 50% tariff announced Wednesday will apply to semi-finished products such as pipes, wires, rods, sheets and tubes, and to copper-intensive goods like pipe fittings, cables, connectors and electrical components, according to the White House statement.

Less-processed goods — including ore, concentrates, mattes, cathodes and anodes — aren’t subject to the tariffs.

Still, the prospect of import tariffs on refined copper hasn’t entirely disappeared. The Department of Commerce instead recommended delayed imposition, with a rate set at 15% starting in 2027 and rising to 30% in 2028. Trump directed the department to provide an update on US copper markets by the end of June 2026.

“While we are surprised by the near complete roll-back on the proposed copper tariffs, we think this shows the Trump Administration is still focused on security of supply for copper,” the Goldman Sachs analysts, including Eoin Dinsmore, head of industrial metals research, said in the note.

No comments:

Post a Comment