GRAPHIC: Grasberg mine accident tightens global copper supply estimates

Metals analysts are cutting their estimates of global copper supplies for this year and next after an accident at the giant Grasberg mine dramatically tightened the outlook for the market.

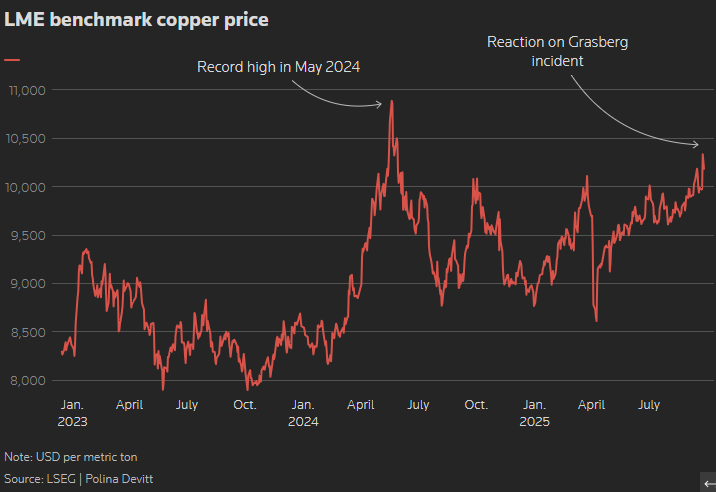

Copper prices hit 15-month highs of $10,485 a metric ton last week after Freeport-McMoRan declared force majeure at its Grasberg mine and cut sales forecast from the Indonesian unit for this year and 2026.

Freeport’s Grasberg operation located in Indonesia suspended operations on September 8 after a deadly mud slide.

The world’s second-largest copper mine behind Chile’s Escondida faces a lengthy damage assessment process and a clear-up while the search for missing workers continues.

“The scale of this disruption is very big,” said Albert Mackenzie, a copper analyst at Benchmark Mineral Intelligence.

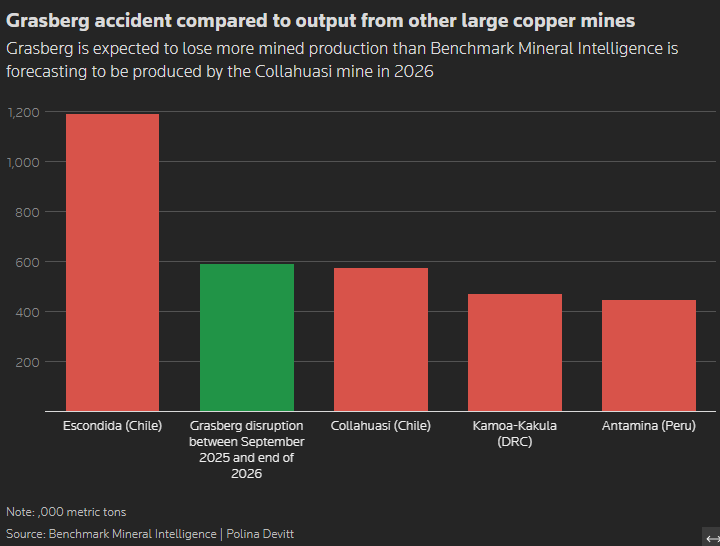

Benchmark’s analysis suggests the disruption will amount to 591,000 tons of lost copper output between September 2025 and the end of 2026.

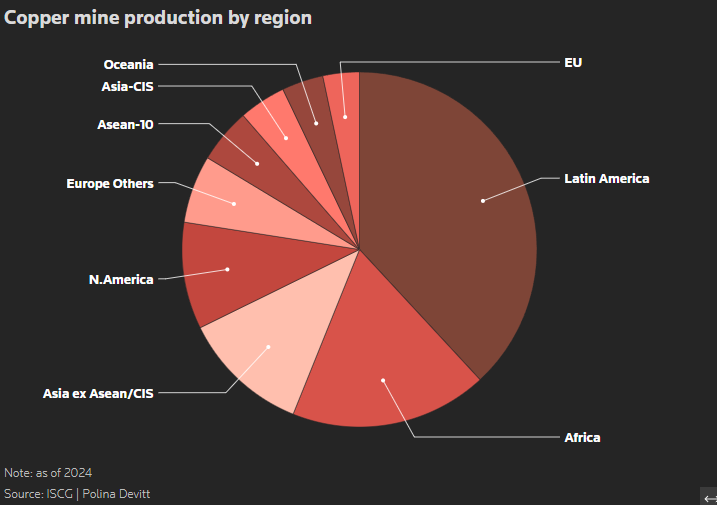

This amounts to 2.6% of the 2024 global mine production estimated at around 23 million tons by analysts.

Supply losses from Grasberg mean the global copper market is facing a significantly wider deficit of around 400,000 tons in 2025, according to Benchmark Minerals.

The disruption has shifted Goldman Sachs’ 2025 copper market balance from a projected surplus of 105,000 tons to a deficit of 55,500 tons. It expects a small surplus in 2026.

With the losses in Grasberg’s September-December production, the copper market faces the largest deficit since 2004, Societe Generale said on Monday.

The suspension at Grasberg follows other large disruptions this year including Kamoa-Kakula in the Democratic Republic of Congo and El Teniente mine in Chile.

This year’s mine supply was already expected to come in below every forecast over the past 15 years and this is now exacerbated by unexpected supply disruptions, Bank of America analyst Michael Widmer said in a note.

BofA raised its estimate of the 2026 copper market deficit to 350,000 tons from a previous 162,000 tons and upgraded its 2026 and 2027 copper price forecast by 11% and 12.5% to $11,313 a ton and $13,500 respectively.

Copper’s record high was in May 2024, when it hit $11,104.50 a ton.

Anglo American's Strategic Moves Reshape Global Copper Landscape

- Anglo American and Codelco have finalized an agreement to merge operations at their Los Bronces and Andina copper mines, aiming to unlock up to $5 billion in value and increase copper production by 2.7 million metric tons over 21 years

- .

- The copper market is facing an expected deficit by the end of the decade due to a lack of greenfield projects and increased demand from the energy transition, particularly for battery technology.

- Anglo American also announced a merger with Canadian company Teck Resources, forming a critical minerals conglomerate that will be one of the world's largest copper producers, with over 70% exposure to copper.

The copper market recently experienced a significant development that could have big implications for global supply. Metals and mining multinational Anglo American has finalized an agreement with National Copper Corporation of Chile (Codelco) to merge operations at their respective Los Bronces and Andina copper mines, putting them among the top 5 largest sites in the world. According to a September 16 announcement, the agreement will unlock up to $5 billion in value from the adjacent sites.

“The joint mine plan has been developed to unlock an additional 2.7 million metric tons of copper production over a 21-year period once relevant permits are in place, currently expected in 2030,” the company said in its announcement. The firm later added that, “The expected additional copper production of about 120,000 metric tons per year is to be shared equally, with about 15% lower unit costs relative to standalone operations and with minimal incremental capital expenditure.”

Details of the Deal, Ownership Stakes

A new operating company, jointly owned by Anglo American’s 50.1%-owned subsidiary, Anglo American Sur (AAS), and Codelco, will coordinate the execution of the joint mine plan and optimize processing capacity across the two sites. The fact that AAS had signed a memorandum of understanding with Codelco on the joint operations was originally announced in February.

“Each party will retain full ownership of its respective assets (including mining concessions, plants and ancillary infrastructure) and will continue to exploit their respective concessions separately,” the company stated.It is worth noting that Japan’s Mitsubishi Corporation holds 20.4% in AAS, while the Codelco/Mitsui joint venture Becrux holds the remaining 29.5%.

According to information in Anglo American’s 2024 results, Los Bronces has approximately 8 million metric tons of copper ore reserves. However, annual production at that site was down 20% year on year to 172,400 metric tons, from 215,500 metric tons. This was mainly due to one of the sites being on care and maintenance since July 2024 and the anticipation of lower ore grade. In comparison, Codelco indicated in a 2016 report that Andina has reserves equivalent to 36.8 million metric tons, with an average ore grade of 0.78%.

Copper Market Faces Deficit, Rising Prices

Copper market watchers have warned of an expected deficit in copper by the decade’s end. These insiders cite the lack of greenfield projects and increased demand for the base metal in the energy transition, particularly with regard to battery technology.

For instance, a September 8 report by Reuters citing London-headquartered multinational professional services network EY indicated that battery electric vehicles will exceed half of new light vehicle sales in Europe by 2032 as well as exceed hybrid sales by 2030. Meanwhile, copper’s three-month price on the London Metal Exchange was $9,964 per metric ton on September 17, off 1.78% on the day from $10,145. The latest price is nonetheless 47% higher than the $6,737.50 reported on September 17, 2020.

Anglo American Also Merging with Teck Resources

Anglo American’s announcement of its operations tie-up comes one week after the company declared it had reached an agreement to merge with Canadian company Teck Resources. That transaction will form a critical minerals conglomerate and offer over 70% of exposure to copper.

“Anglo Teck will be one of the world’s largest copper producers, and will benefit from some of the world’s highest quality copper endowments, with major brownfield and greenfield copper development projects, located in attractive and well-established mining jurisdictions, to further grow the business,” Anglo said in its September 9 announcement.

The deal creates $800 million in synergies and gives Anglo American shareholders approximately 62.4% of the new company, to be called “Anglo Teck.” Meanwhile, shareholders in the Canadian firm will hold the remaining 37.6%. Representatives added that the new company will have a total of six copper assets as well as premium iron ore and zinc operations.

A Look at Anglo American’s Assets

Anglo American’s copper assets include the Quellaveco copper mine in Peru, which started operating in 2022. Information on the company’s website states that the site has a forecasted copper production of 300,000 metric tons per year over the next 10 years.

Anglo also has the Shishen and Kolomela iron ore mines in South Africa, along with the wholly owned Minas-Rio asset. This is in addition to two ferronickel mines in Brazil’s Goías state, Baro Alto and Codemin, as well as the Niquelândia processing plant. Finally, Anglo possesses sites in Australia and South Africa for the mining and production of manganese, which is used as a deoxidizer in steelmaking as well as a hardening agent.

Teck Resources Holdings, Copper Market Reaction

Meanwhile, information on the New York- and Toronto-listed company’s website states that Teck has one operating copper asset in Canada and a 22.5% stake in the Antamina zinc-copper deposit in Perushowed. Teck also owns 90% of the Chilean copper mine Carmen de Andacollo and a 60% stake in the Quebrada Blanca copper project, the latter of which is also ramping up production.

In 2024, Teck produced 446,000 metric tons of copper concentrate, a 50% increase from the previous year due to the ramp-up of the Quebrada Blanca project. Teck had 270,000 metric tons of copper produced in 2022 from its three operations in South America and Canada. According to information from the company’s website, Teck Resources’ total proven and probable copper reserves amount to 33 million metric tons.

One industry watcher praised the deal with Anglo. “It keeps the assets out of Chinese hands or Glencore’s,” that source told MetalMiner. He also pointed to several synergies between Quebrada Blanca and Collahuasi mine. “Teck owns most of QB, whilst Anglo has 44% of Collahuasi. There should be some opportunities for shared infrastructure and maybe blending when Collahuasi has high arsenic.”

By Christopher Rivituso

No comments:

Post a Comment