CU

How tight supply, AI demand propelled copper price towards $12,000

Copper is closing in on the $12,000 a metric ton mark as expectations of soaring demand from data centres that power artificial intelligence and tight supplies collide with shortages outside the United States.

Valued for its exceptional electrical conductivity, copper wiring is vital in power grids that feed data centres, electric vehicles and the infrastructure needed for the energy transition.

Copper prices are up 35% so far this year and heading for their largest gain since 2009, due to mining disruptions and stockpiling in the US. On Friday, they touched $11,952 a ton.

“Investors who want a broad basket of AI interests will also buy into financial products which include hard assets that feed into data centres,” said Benchmark Mineral Intelligence analyst Daan de Jonge. “Investors will buy copper-related assets such as ETFs.”

Canada’s Sprott Asset Management launched the world’s first physically backed exchange-traded copper fund in mid-2024. The fund, which holds nearly 10,000 tons of physical copper, has shot up by almost 46% this year to nearly 14 Canadian dollars per unit.

A recent Reuters survey of analysts’ forecasts shows the copper market will see a deficit of 124,000 tons this year and 150,000 tons next year.

Copper demand growth is being driven by billions of dollars being invested worldwide to modernize and expand power grids. Data centres and clean energy require vast amounts of electricity.

The energy transition, which includes renewable energy technology such as wind and solar, is also expected to boost copper demand.

Macquarie expects global copper demand at 27 million tons this year, up 2.7% from 2024, with demand in top metals consumer China rising 3.7%. It forecasts global demand growth outside China at 3% next year.

“Bullish sentiment is being driven by the narrative around tight supply, supported by macro news flows,” said Macquarie analyst Alice Fox.

A magnet for traders

Supply disruptions include an accident at Freeport McMoRan’s giant Grasberg mine in Indonesia in September, while miners such as Glencore have cut production guidance for 2026, reinforcing expectations of tight supplies.

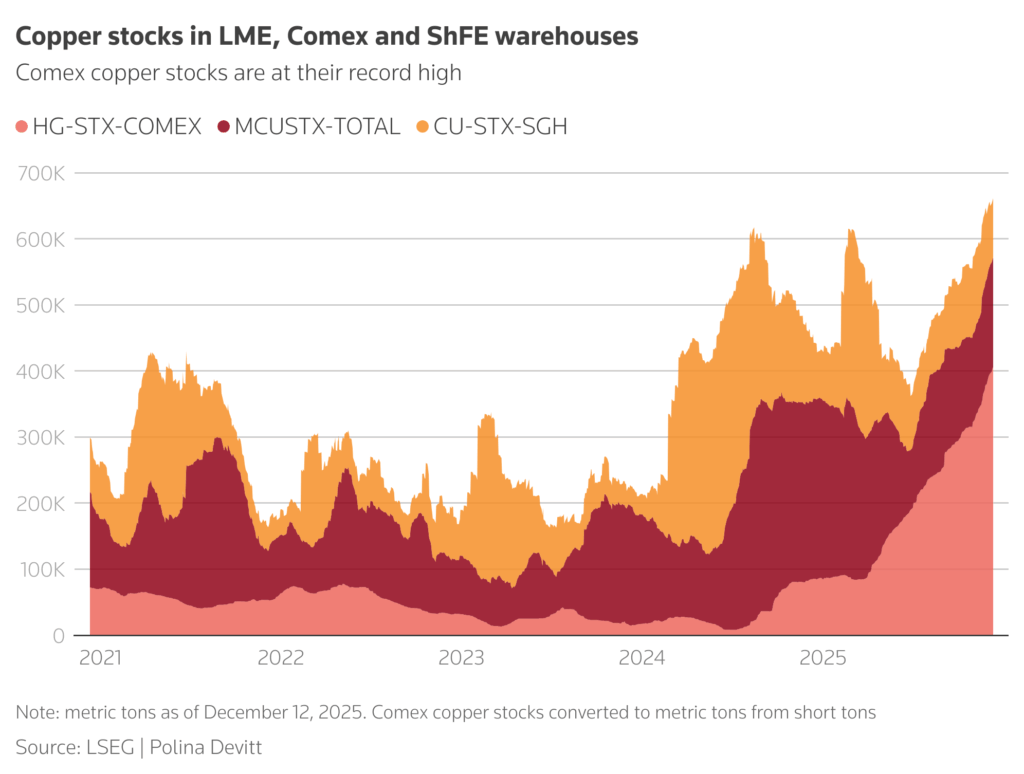

The overall amount of copper stored in exchange warehouses – the London Metal Exchange, US-based Comex and the Shanghai Futures Exchange – is up 54% so far this year at 661,021 tons.

Traders have been shipping copper to the United States since March due to higher prices on Comex ahead of US President Donald Trump’s planned import tariffs. Higher prices are needed to cover the import tariff.

Stocks on Comex at a record high of 405,782 tons amount to 61% of total exchange stocks versus 20% at the start of 2025.

“It feels incredibly tight because all of this material is going to the US,” said BMI’s de Jonge.

Refined copper was given an exemption from the 50% import tariffs that came into force on August 1, but US levies on the metal remain under review with an update due by June.

(By Polina Devitt, Pratima Desai and Tom Daly; Editing by Nia Williams)

SolGold weighs higher $1.1B Jiangxi bid as copper M&A heats up

Ecuador-focused miner SolGold (LON: SOLG) has opened the door to a takeover from China’s Jiangxi Copper (JCC), which returned with a higher all-cash proposal valuing the company at about £842 million ($1.13 billion).

JCC, already SolGold’s largest shareholder with 12.2%, first approached the company in November 23 with a non-binding proposal that was rejected. On November 28, it came back with a 26-pence per share offer that the board also rebuffed. The latest 28-pence bid marks JCC’s third attempt and lifts the price by 7.7%.

SolGold said it would recommend shareholders accept the fresh bid if JCC tables it as a firm offer on those terms.

A successful acquisition would hand JCC full control of SolGold’s flagship Cascabel copper-gold project in northern Ecuador, one of South America’s largest undeveloped copper-gold resources.

The new bid comes as copper assets attract intense interest on expectations of a looming supply crunch driven by electrification. The heightened demand has sparked major dealmaking attempts, including BHP’s unsuccessful runs at Anglo American (LON: AAL).

Investors unsure

Despite the sweetened proposal, SolGold’s shares fell more than 10% to 25.1 pence on Friday. They were last trading at 25.75p, still below the bid price, as investors show caution toward large mining deals.

The offer still faces Chinese regulatory approval for outbound investment, a process JCC has started but one that has become more complex under tighter scrutiny in Beijing.

BHP (ASX: BHP) and Newmont (NYSE: NEM), which each own about 10% of SolGold, showed acquisition interest five years ago, then looked elsewhere after funding disputes and changes in scope at Cascabel.

JCC, which operates in countries including Peru, Kazakhstan and Zambia, has support from major SolGold shareholders BHP, Newmont and Maxit Capital, which together hold 40.7%.

Argentina’s Mendoza province approves $559M copper mine

Argentina’s Mendoza province has approved its first large-scale mining project in more than two decades after giving the greenlight to PSJ Cobre Mendocino, a joint venture between Switzerland’s Zonda Metals and Argentine company Alberdi Energy.

This week, Mendoza’s Senate endorsed Cobre Mendocino’s environmental impact statement, ending a lengthy review process that attracted groups such as Greenpeace over water and waste concerns. The project will now enter the feasibility reports stage. It follows more than 13 years of studies, a recent 10-day public hearing and more than 9,500 written submissions with public support exceeding 60%.

“This institutional decision allows us to take another step in a process that has been long, transparent and highly participatory,” CEO Fabián Gregorio said in a statement. “We are now entering a technical feasibility stage, during which we will continue building the project together with the community, institutions and productive stakeholders.”

Argentina, despite boasting an abundance of copper resources, has not produced the metal since the closure of the Alumbrera mine in 2018. On the federal level, Argentine President Javier Milei is keen to attract mining development through an incentive program known as RIGI. Recipients include McEwen’s (TSX, NYSE: MUX) Los Azules copper project.

16-year mine

Located in Uspallata, in the department of Las Heras, the Cobre Mendocino mine is expected to produce 40,000 tonnes of copper concentrates annually over a 16-year life. It contemplates an initial capital investment of $559 million and a construction period of 18 to 24 months.

The company has maintained that the project will use a conventional flotation process to produce copper concentrates without using any illegal substances. The project is expected to generate 3,900 jobs during construction and about 2,400 while operating, including both direct and indirect employment.

With legislative approval, Cobre Mendocino is planning detailed engineering studies, cost and financing analysis to feed into feasibility reports. Operations, closure planning and markets will also be assessed before a potential construction decision.

Kazakhmys says it will have new controlling shareholder

Kazakh copper producer Kazakhmys said on Wednesday it had signed a framework agreement that would transfer control of the company to a new shareholder.

“The signing of the document is the starting point for the transfer of control. In the near future, all necessary measures and obligations under the agreement will be carried out in accordance with established procedures, followed by the signing of a share purchase agreement,” the company said in a statement.

The agreement was inked by Kazakhmys’ president, Vladimir Kim, and its board chair Eduard Ogay.

Kazakhmys did not say who would take control. Local media named construction company Qazaq Stroy, founded and majority-owned by Nurlan Artykbayev, as the new shareholder of Kazakhmys. The preliminary transaction amount was $3.85 billion, local media reported.

Kazakhmys declined to name the new owner when asked by Reuters and referred journalists to its published statement. Qazaq Stroy did not immediately respond to a comment request.

Kazakhmys ranks 20th in the world in terms of copper concentrate production, producing 271,000 tonnes annually, and 12th in terms of crude and cathode copper production, producing 377,000 tonnes and 365,000 tonnes respectively, taking into account tolling raw materials.

In its statement, Kazakhmys said the change of shareholder would not affect its production or contractual obligations.

(By Mariya Gordeyeva and Lucy Papachristou; Editing by Mark Trevelyan)

No comments:

Post a Comment