National targets for new nuclear 'far exceed a tripling of global capacity'

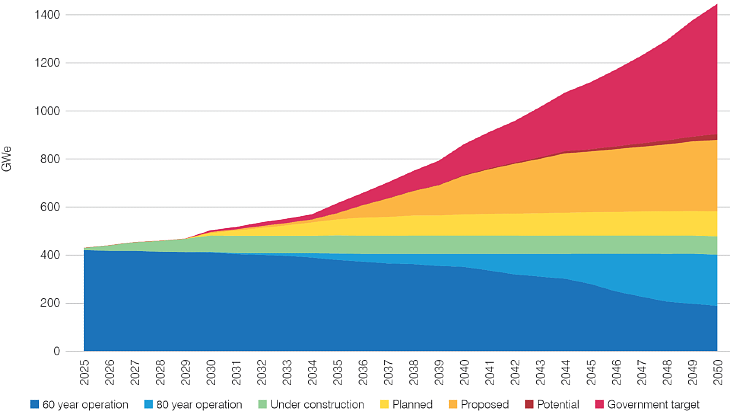

There are currently about 440 nuclear power reactors with a combined capacity of almost 397 GWe (net) operating in 31 countries, with at least 70 power reactors under construction, which will add another 77 GWe. Nuclear generation reached an all-time high of 2,667 TWh in 2024. The goal of at least tripling global nuclear capacity by 2050 has been endorsed by more than 30 countries since the United Nations Climate Change Conference (COP28) in Dubai in December 2023.

In its inaugural World Nuclear Outlook Report, World Nuclear Association (WNA) has compiled national government targets and goals for nuclear capacity for 2050 and assessed them alongside plans for continued and extended operation of existing reactors, completion of those under construction, and realisation of planned and proposed projects. It has found that they would more than meet the tripling target.

"Global nuclear capacity would expand significantly to 2050 if the continued operation of existing reactors and the deployment of new nuclear build meet targets set by governments for national nuclear capacity," the report says. "When all operable, under construction, planned, proposed, and potential reactors are combined with government targets, the total global capacity could reach 1,446 GWe by 2050."

The association notes: "Most growth to 2030 stems from reactors currently under construction; planned projects drive expansion to 2035; and proposed, potential, and government-driven programmes account for the increase in capacity after 2035."

It adds: "The 542 GWe of additional capacity associated with government targets beyond projects assessed as planned, proposed or potential is not yet supported by identified projects, and the level of commitment through policy or other governmental measures varies significantly from country to country."

The report says that achieving the projected 2050 capacity requires scaling annual grid connections from 14.4 GWe per year in 2026-2030, to 22.3 GWe per year in 2031-2035, to 49.2 GWe per year in 2036-2040, 51.6 GWe per year in 2041-2045 and 65.3 GWe per year in 2046-2050. It notes that the required 65.3 GWe per year during 2046-2050 is "roughly double the historic peak build rate seen in the 1980s".

In conclusion, the World Nuclear Outlook Report says: "National nuclear capacity goals to 2050 exceed the global tripling target and reflect strong alignment between national objectives and global decarbonisation needs. Achieving these ambitions will require unprecedented construction rates, strategic lifetime extension of existing reactors, and significant policy and market reforms. If nations deliver on their commitments, nuclear power would play a critical role in ensuring secure, affordable, and net-zero-compatible energy for a rapidly expanding and electrified global economy."

However, the report says that governments must "take immediate and sustained action" to deliver on their own national targets for nuclear capacity. "To secure a clean, reliable, and resilient energy future for all, governments must take action now implementing clear execution plans that can realise policy promises," it says. "Experienced countries, multilateral development institutions and the global nuclear industry should collaborate to support emerging economies interested in deploying nuclear energy for the first time."

The association recommends that governments recognise that nuclear energy is a central pillar in meeting global climate goals and that it should be integrated into long-term decarbonisation and energy security planning. It calls for them to set "durable, actionable nuclear policies and industrial strategies to enable long-term investment and to maintain industrial capabilities, workforce and supply chains". They should also support the continued operation of existing reactors to 60-80 years "where technically feasible". Electricity markets should be reformed to ensure equitable treatment of nuclear energy alongside other low-carbon sources. Governments should also support the acceleration of licensing, siting, and financing mechanisms to facilitate an increase in construction rates."

With regards to financial institutions, World Nuclear Association recommends they implement technology-neutral lending and environmental, social and corporate governance (ESG) policies to ensure nuclear and other low-carbon sources are evaluated using equivalent criteria. They should also support the deployment of nuclear in emerging economies.

The association calls for the nuclear industry itself to expand manufacturing and supply chain capacity, including fuel cycle infrastructure, while optimising series build to reduce costs and shorten build times. In addition, it should develop large-scale deployment strategies to meet post-2035 demand, including for non-grid applications utilising novel reactor technologies.

Speaking from the World Economic Forum Annual Meeting 2026 in Davos, World Nuclear Association Director General Sama Bilbao y León said: "Our analysis indicates that governments have ambitions that exceed the goal to triple nuclear capacity by 2050. Now, forward-thinking governments, global industry leaders, and civil society need to work together and take timely action to turn those ambitions into action. This is our chance to deliver a cleaner, more secure energy future for everyone everywhere, powered by affordable 24/7, low-carbon nuclear energy."

- Japan is shifting its energy policy to redevelop its nuclear energy capacity, aiming for 20 percent of its power from nuclear energy by 2040 to support climate goals.

- The world’s largest nuclear facility, the Kashiwazaki-Kariwa plant, is preparing to restart operations, which marks a major step in the government's nuclear deployment plans despite significant public opposition and safety concerns.

- Public confidence in the nuclear sector has been harmed by the 2011 Fukushima disaster and further damaged by recent news of a utility, Chubu Electric Power, fabricating seismic risk data.

Alongside plans to establish a strong renewable energy sector, Japan aims to redevelop its nuclear energy capacity to boost its power and support its climate goals. However, with memories of the Fukushima nuclear disaster still fresh, many in Japan are worried about the risks involved with developing the country’s nuclear capacity. Nevertheless, the government has big plans for a new nuclear era, commencing with the restarting of the world’s biggest nuclear facility.

The 2011 Fukushima Daiichi accident is viewed as the second-worst nuclear disaster after the Chornobyl disaster of 1986. On 11th March 2011, a magnitude-9.0 earthquake hit the north of Japan, with the shock from the quake provoking a tsunami, the waves of which damaged the backup generators at the Fukushima Daiichi plant. Although all three of the operating reactors were successfully shut down, the loss of power caused cooling systems to fail in each of them.

Rising residual heat within each reactor’s core caused the fuel rods in reactors 1, 2, and 3 to overheat and partially melt down, leading to the release of radiation. Three explosions resulted from the buildup of pressurised hydrogen gas in the following days, leading to fears of leaked radiation and the evacuation of tens of thousands of people within a 30 km radius of the plant.

The accident prompted a widespread distrust of nuclear power in Japan for more than a decade. However, in February 2025, Japan’s Economy, Trade and Industry Ministry published a draft revision of the national basic energy plan, in which the statement on moving away from nuclear power has been removed. Later that month, the Cabinet approved the revised Seventh Strategic Energy Plan, which stated the aim of producing 20 percent of power from nuclear energy by 2040. This marked a significant shift in Japan’s approach to nuclear power.

Before 2011, Japan had 54 reactors that provided around 30 percent of the country's electricity. At present, just 14 of 33 operable reactors are producing power, while efforts to restart others have been thwarted due to public opposition.

Japan is home to the world’s largest nuclear facility, the 8.2 GW Kashiwazaki-Kariwa plant, which covers 4.2 km2 of land in Niigata prefecture, 220km north-west of Tokyo. The facility was developed in 2012, but it has yet to come online, as, following the Fukushima disaster, the poor public perception of safety in the nuclear sector led the government to shut down several nuclear reactors.

Kashiwazaki-Kariwa is operated by Tokyo Electric Power (Tepco), the same utility that managed Fukushima. Tepco aimed to restart one of the seven reactors at Kashiwazaki on 19th January, but was forced to delay the restart as an alarm malfunctioned during a test of equipment, although the company expects to bring it online within the next few days. The restarting of reactor No. 6 will increase Tokyo’s electricity supply by around 2 percent, as well as mark a major step forward in the government’s plans to deploy more nuclear power in the coming years.

However, many in Japan are still wary about the risks involved with nuclear power projects. Many of those living with proximity to Kashiwazaki-Kariwa are worried about the potential for another Fukushima-scale event, which could lead up to 420,000 residents to be evacuated from across a 30 km radius.

However, Tepco says it has learnt from the mistakes of the Fukushima incident. Since its development, 6,000 workers have continued working at Kashiwazaki. Seawalls and watertight doors have been installed at the facility to ensure greater protection against a potential tsunami. The plant is also fitted with mobile diesel-powered generators and a large fleet of fire engines capable of providing water to cool reactors in the case of an emergency. In addition, upgraded filtering systems have been fitted to control the spread of radioactive materials.

However, public confidence in nuclear power companies has been further harmed due to recent news of a firm fabricating data. It was found that Chubu Electric Power, a utility in central Japan, fabricated seismic risk data during a regulatory review, ahead of a possible restart of two reactors at its idle Hamaoka plant. In response, Japan’s Nuclear Regulation Authority (NRA) scrapped the safety screening at the plant, which is located on the coast, around 200 km west of Tokyo, in an area prone to Nankai Trough megaquakes. The NRA is now considering inspecting Chubu’s headquarters.

Nuclear power is now widely viewed as one of the safest forms of energy production, on a global scale, which has led several countries to invest in a new era of nuclear power. Despite overwhelming public opposition to the development of Japan’s nuclear power sector, the government plans to gradually restart several reactors and expand nuclear capacity in the coming decades to support decarbonisation aims.

By Felicity Bradstock for Oilprice.com

EnergyX enters nuclear materials market

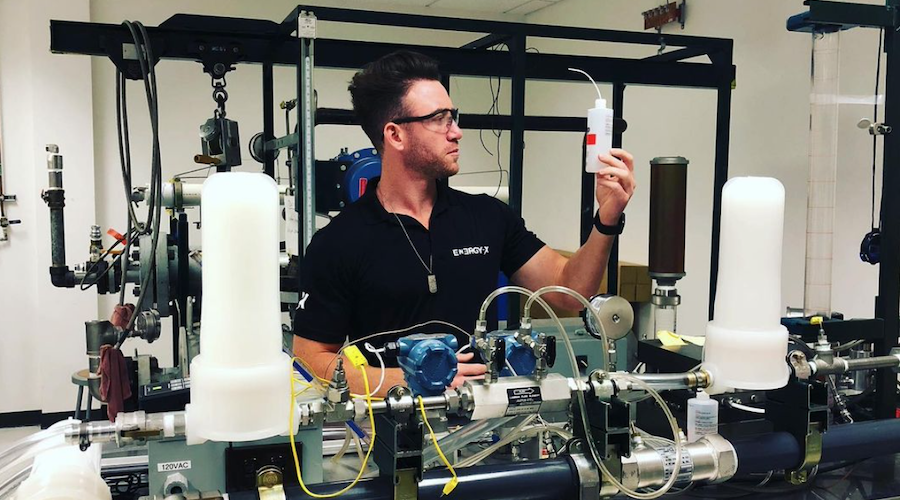

Energy Exploration Technologies (EnergyX) has announced the launch of the company’s new proprietary nuclear materials technology platform: NUKE-it.

The platform is focused on producing nuclear-grade critical materials, including lithium isotopes and high-purity lithium compounds. It is designed to meet stringent purity, performance and supply chain requirements that traditional lithium suppliers are often unable to support, the company said.

Last year, EnergyX acquired Daytona Lithium, which owns mineral rights in southwest Arkansas, where it is progressing its Lonestar lithium project with a near-completed demonstration plant.

The company also bought another 35,000 acres in the Smackover Formation, an underground geological formation stretching from Florida to Texas filled with lithium-rich brine, in a $26 million deal. The acquisition expanded the company’s landholding to 47,500 acres.

NUKE-it marks EnergyX’s formal entry into the nuclear materials sector, positioning the company as a future domestic supplier of critical lithium isotopes required for both fusion and fission reactors.

The new initiative, the company said, is designed to develop advanced technologies to support next-generation nuclear energy reactor supply chains, also including uranium and thorium materials production.

Uranium is present in the Smackover, particularly within the upper limestone reservoirs of southern Arkansas and northern Louisiana.

Under its new technology platform, EnergyX said it is developing 15% enriched Lithium-6 (Li-6), a critical element for tokamak fusion reactors, as well as highly purified 99.999% Lithium-7 (Li-7) for fission-based thorium molten salt reactors (MSRs).

Uranium and thorium technology and production are planned to follow, the company said, adding that these initial nuclear-grade lithium salts will be engineered for reactor-grade performance.

This expansion is an extension of EnergyX’s proprietary GET-Lit DLE technology suite of lithium extraction, refining, purification, material conversion and production capabilities.

Several of the underlying technologies in GET-Lit have similarities and are being applied to nuclear lithium isotope production, addressing a growing supply gap for high-spec nuclear materials.

The platform aligns with US clean energy, industrial resilience, and national security priorities, including efforts to strengthen domestic supply chains for critical materials required in advanced energy systems, the company said.

“EnergyX has always been focused on developing technologies to produce advanced materials for the energy transition,” founder and CEO Teague Egan said in a new release.

“Nuclear energy is one of the most important opportunities of the century to enable the clean energy transition and deliver clean, sustainable, immense, ‘always-on’ power, especially as electricity demand accelerates from data centers and the AI revolution,” Egan said.

EDF seeking maximum use of existing UK reactors

EDF said its UK nuclear fleet performance was "very good" in 2025, meeting 12% of total UK electricity consumption. The company said it plans to operate its last two Advanced Gas-cooled Reactors until at least 2030 and is seeking a 20-year licence extension for the Sizewell B pressurised water reactor.

_86096.jpg)

EDF Energy manages the UK's eight nuclear power plant sites, five that are operating (Sizewell B, Torness, Heysham 2, Heysham 1 and Hartlepool) and three that have entered decommissioning (Hunterston B, Hinkley Point B and Dungeness B). It took over the sites when it acquired British Energy in 2009. The company is also constructing the new Hinkley Point C plant in Somerset, and there are advanced plans for a replica of Hinkley Point C at Sizewell C in Suffolk.

In its latest UK Nuclear Fleet Stakeholder Update, EDF Energy said total output from the five operating plants was 32.9 TWh last year, which was 12% lower than in 2024 due primarily to an extended outage at the Hartlepool plant. The company said the plan for 2026 was to produce about 36 TWh, followed by about 37 TWh in 2027.

EDF Energy noted that output was more than treble the amount originally expected from these plants when EDF acquired the fleet in 2009. The youngest of the Advanced Gas-cooled Reactor (AGR) plants (Torness and Heysham 2) were originally due to stop generating in 2023 but investment in the fleet so far of GBP8.6 billion (USD11.6 billion), along with careful stewardship, has enabled four plants to stay online, preventing Sizewell B being left as the UK's sole generating nuclear plant. The company said it will invest more than GBP1.2 billion in the plants over the 2026-28 period.

"We have achieved 38 years' worth of life extensions across our AGR stations delivering an extra 263 TWh of low-carbon electricity," EDF Energy noted. "That is more than the lifetime output of Heysham 1 (254 TWh), demonstrating the huge value in extending station lifetimes when possible."

In September 2025, the estimated generating lifetimes of the Hartlepool and Heysham 1 AGR plants were extended by a further year, to March 2028. EDF said its ambition was "to generate from the AGR power stations until at least 2030, subject to plant inspections, reliability and regulatory support".

In November, the UK Government said the retirement of the AGRs "risks leaving a dangerous gap in Britain's low-carbon energy supply". EDF said it has an ambition "to generate low-carbon electricity from all four generating AGR stations for as long as it is safe and commercially viable to do so, though now the stations are in the latter stages of their generating lives further extensions will not be for long. We will keep their lifetimes under review to assess whether further life extensions can be achieved".

The Sizewell B pressurised water reactor (PWR) performed "exceptionally" in 2025, achieving a load factor of 99% and generating 10.4 TWh of electricity. "Operating the power station beyond 2035 to at least 2055 is technically feasible, has been achieved at similar power stations worldwide and would provide a reliable, clean source of power as new nuclear and renewable projects are brought online," EDF Energy said. "However, volatility in the energy markets over the past few years has reinforced the importance of securing an appropriate commercial model for Sizewell B's longer-term output."

It added: "We are working with government and private companies to develop the future of our sites with plans starting to be shaped for new nuclear at Cottam and Hartlepool. Heysham in Lancashire and Torness in Scotland are both sites with lots of advantages for new developments."

Three of the AGR plants acquired by EDF - Hunterston B, Hinkley Point B and Dungeness B - are now in the decommissioning stage. In April, Hunterston B completed its defueling mission on time and on budget, becoming the first of the AGR plants to be declared free of all used nuclear fuel. In November, Hinkley Point B completed the removal of all used fuel from its reactors. Once each site has been defueled by EDF, it will be transferred to the UK's Nuclear Decommissioning Authority for its subsidiary, Nuclear Restoration Services, to carry out the next stages of decommissioning. The first plant, Hunterston B, is due to transfer in April 2026 and Hinkley Point B will follow in October 2026.

Denmark begins study on potential use of nuclear energy

_10275.jpg)

In 1985, the Danish parliament passed a resolution that nuclear power plants would not be built in the country. However, in a parliamentary vote in May last year, two-thirds of Danish MPs supported the country launching an investigation into the possible use of nuclear power to enhance its energy security. The analysis is aimed at allowing a subsequent debate on the possible lifting of the ban on nuclear power to take place on an informed basis.

"Although the government does not consider conventional nuclear power to be relevant in Denmark, there has been increasing interest in new nuclear power technologies such as small modular reactors (SMRs) in Denmark and the EU in recent years," the ministry noted. "This should be seen, among other things, in light of the ongoing development of SMR solutions, increased focus on ensuring balance in a fossil-free energy system with a view to increased focus on European energy independence, stable and low energy prices, stable electricity supply and increased business interest."

The ministry has now said that the basis for the analysis of new nuclear power technologies is in place and that initial work on the analysis has begun.

The analysis aims to uncover the following: whether SMRs could be included in the Danish energy system, including in relation to economic costs and benefits; the need for new national regulation, authority structure and competencies relevant to the possible establishment of nuclear plants in Denmark, as well as a specific work plan for how and in what sequence identified needs can be handled in order to constitute a sufficient basis for such plants to be established, and for what decisions must be taken if it is politically desired to lift the ban; and commercial interests and potential for the development and supply of components for SMRs, as well as for larger commercial enterprises in Denmark as potential buyers of electricity and/or heat from SMRs.

The analysis will also include an immediate estimation of a range of expected resource needs and considerations regarding authority organisation and departmental responsibility across the state in the event of a lifting of the ban and the development, testing and establishment of SMRs in Denmark. This will also include an immediate estimation of the need for new full-time equivalents in state authorities.

"The analysis does not in itself result in the launch of new initiatives with a view to the establishment of new nuclear power technologies in Denmark, but could form the basis for a discussion on this," the ministry said.

"Green energy from the sun and wind is now and will continue to be the backbone of the Danish energy supply, but we can also see that it cannot stand alone," said Minister for Climate, Energy and Utilities Lars Aagaard. "Therefore, we must be open to whether other technologies can provide us with green energy in the future. Small modular nuclear reactors may be an option here. However, mass-produced SMRs are neither a quick fix nor a free pass, and we must have a basis for getting control of the regulatory processes, safety, waste, competencies and responsibility. With this analysis, we will have a solid, informed basis on which to make political decisions."

He added: "I approach nuclear power with an open mind, and I hope that everyone's pulse will slow down. Debating the lifting of a ban without considering whether you will also do everything else that comes with it just sends a signal without substance. There may be great potential in SMRs down the road, so it should not be about ideology, but about doing things thoroughly and in the right order."

The analysis is expected to be completed in the second quarter of 2026.

In December, several Danish business organisations, universities and companies launched the Nuclear Power Alliance with the aim of advocating for a technology-neutral approach to nuclear power in the country. The alliance is led by, among others, the Confederation of Danish Industry, Dansk Metal and the Novo Nordisk Foundation. Its members also include chemical engineering firm Topsoe and engineering consultancy Niras, as well as the private equity fund 92 Capital, which concentrates its investments in the nuclear energy sector.

Kairos secures HALEU for Hermes' first fuel load

_91873.jpg)

Kairos is building the Hermes Low-Power Demonstration Reactor - known as Hermes 1 - in Oak Ridge, Tennessee. It was one of the first round of companies conditionally selected by the Department of Energy (DOE) last year to receive high-assay low-enriched uranium (HALEU) under a programme enabling nuclear developers to request HALEU from DOE sources including the National Nuclear Security Administration.

Kairos said it has now successfully completed negotiations to secure the HALEU required for the Hermes 1 programme. It will use the material to produce HALEU TRISO (tri-structural isotropic) fuel pebbles for the reactor, in partnership with Los Alamos National Laboratory, using manufacturing processes it has developed and optimised in its own labs.

_89294d8c.jpg)

Hermes 1 is under construction in Tennessee (Image: Kairos)

Hermes 1, a scaled demonstration of Kairos' KP-FHR fluoride salt-cooled high-temperature reactor technology, is the first non-light-water reactor to be approved for construction by the US Nuclear Regulatory Commission. Kairos Power broke ground at the Hermes 1 site in Oak Ridge in July 2024 and began nuclear safety-related construction in May 2025. It will not produce electricity - Kairos's iterative development approach will see lessons learned from the project feeding into the Hermes 2 commercial-scale demonstration plant - a 50 MWe plant powered by a single commercial-scale reactor. Hermes 2 will include a power generation system.

HALEU - uranium enriched to contain between 5% and 20% uranium-235 - will be used to fuel many advanced reactors. The DOE's HALEU Availability Program was established in 2020 to secure a domestic supply of the material for civilian domestic research, development, demonstration, and commercial use. Allocating nuclear developers HALEU material from DOE sources, including material from the National Nuclear Security Administration, is a way of bridging a HALEU availability gap with existing material as the supply chain builds up.

“We are pleased to secure the HALEU we need to demonstrate our technology with Hermes 1,” said Kairos Power Chief Technology Officer and co-founder Edward Blandford. “The US Department of Energy has been a vital partner on the Hermes project, with its ongoing risk reduction investment through the Advanced Reactor Demonstration Program. The allocation of HALEU will enable continued progress on Kairos Power’s path to delivering affordable advanced reactors at scale.”

The DOE is investing up to USD303 million in the Hermes project through the Advanced Reactor Demonstration Program.

Bureau Veritas to aid Dutch deployment of Rolls-Royce SMR

The agreement was signed during the NExSMR conference, which was held from 14-16 January in The Hague.

"ULC-Energy is delighted with the collaboration with Bureau Veritas," said ULC-Energy CEO Dirk Rabelink. "Developing nuclear energy projects is a long-term process and stable, complementary and long-term collaborations are crucial to our success. Our collaboration with Bureau Veritas brings another highly capable and experienced party to our delivery model."

Pim Reuderink, Regional Technical Manager of Bureau Veritas, added: "Having a serious partner such as ULC‑Energy, the exclusive Dutch development partner for Rolls‑Royce SMR, as a key account will support our pathway to decarbonise the Netherlands and to roll out further nuclear services nationally. With 30+ years of experience in the nuclear field worldwide, supporting nuclear safety authorities, licensees, EPC, technology providers and supply chain, Bureau Veritas has gained a significant knowledge in nuclear safety and quality management. We are committed to leveraging our technical expertise to support ULC-Energy throughout all engineering and procurement phases of this SMR project."

The Rolls-Royce SMR is a 470 MWe design based on a small pressurised water reactor. It will provide consistent baseload generation for at least 60 years. Around 90% of the SMR will be built in factory conditions, limiting on-site activity primarily to assembly of pre-fabricated, pre-tested, modules which significantly reduces project risk and has the potential to drastically shorten build schedules.

In August 2022, Rolls-Royce SMR signed an exclusive agreement with ULC-Energy to collaborate on the deployment of Rolls-Royce SMR power plants in the Netherlands. ULC-Energy - established in 2021 and based in Amsterdam - aims to accelerate decarbonisation in the Netherlands by developing nuclear energy projects that efficiently integrate with residential and industrial energy networks in the country. It has also established cooperation agreements with other strategic partners including BAM Infra, Siemens Energy and Orano.

In December 2021, the Netherlands' new coalition government placed nuclear power at the heart of its climate and energy policy. In addition to keeping the Borssele plant in operation for longer, the government also called for the construction of new reactors. Based on preliminary plans, two new reactors will be completed around 2035 and each will have a capacity of 1000-1650 MWe. The government is also taking steps to prepare the Netherlands for the possible deployment of SMRs.

Civil construction of replacement Trino waste store completed

_93632.jpg)

Work on the 41-metre-long, 19-metre-wide, and 8.5-metre-high facility, which began in November 2024, involved demolishing the old storage facility and rebuilding it on the same site, with a volume equal to that of the dismantled building.

The new facility - referred to as the No 2 storage facility - will house both legacy waste, currently stored in storage facility No 1 and the "buffer test tank", as well as waste generated by upcoming decommissioning operations.

At the same time, the characterisation and disposal of materials resulting from the demolition work, consisting primarily of iron, concrete, and excavated soil, has been completed.

The next stage of the project involves the installation of electrical, fire-prevention, and radiological monitoring systems, which will be completed by the first half of this year. Commissioning, following testing, is scheduled for early 2027.

Societa Gestione Impianti Nucleari SpA (Sogin) - established in 1999 to take responsibility for decommissioning Italy's former nuclear power sites and locating a national waste store - said the new facility will bring the Trino plant (also referred to as the Enrico Fermi plant) "up to the latest regulatory safety standards".

Upon completion, Sogin will begin work to upgrade the other repository on the site, No 1, as part of the programme to optimise the storage space for radioactive waste generated by the plant's operation and the ongoing decommissioning work, with a view to its subsequent transfer to the national repository, once available.

Trino - comprising a single 270 MWe pressurised water reactor - was Italy's first commercial nuclear power plant. Its construction began in 1961 and the plant started generating electricity in 1964. As a result of a referendum held in 1987 in the wake of the Chernobyl accident, Italy decided to shut down its four nuclear power plants. Trino was subsequently permanently shut down in 1990. Sogin took over ownership of the plant from utility Enel in 1999 and is responsible for its decommissioning.

EnergySolutions sets date for Kewaunee licence application

_19544_40999.jpg)

In May 2025, EnergySolutions and WEC Energy Group announced their plans to explore new nuclear energy generation at Kewaunee, where a 566 MWe (net) pressurised water reactor operated from 1974 to 2013. EnergySolutions acquired the plant - which is undergoing decommissioning - from Dominion Energy in 2022.

EnergySolutions said the submittal of its Notice of Intent to the US Nuclear Regulatory Commission earlier this month was an important next step as the companies continue to explore new nuclear generation at the Kewaunee site. Applications for an Early Site Permit, Construction Permit, or Combined Licence are currently being evaluated, it said, adding that the decommissioning and decontamination activities at the site will be "closely coordinated with the application and associated support activities".

An early site permit certifies that a site is suitable for the construction of a nuclear power plant from the point of view of site safety, environmental impact and emergency planning, but does not specify the choice of technology. The permit is valid for 10 to 20 years, renewable for an additional 10 to 20 years.

The company said it is carrying out a structured, multi-phase project that includes initial planning and scoping activities. In-depth studies will support the application to demonstrate the site's suitability for new nuclear construction. This is a prerequisite to the development and securing of NRC approvals for this project, it added.

"This is an important milestone in moving towards the next generation of nuclear power in Wisconsin in partnership with WEC Energy Group," EnergySolutions President and CEO Ken Robuck said. "As communicated when we announced this initiative in May of 2025, the need for reliable, carbon-free power has never been greater. We have assembled an experienced team that brings environmental compliance, nuclear licensing and project management expertise to this project at a time new nuclear generation in Wisconsin is essential."

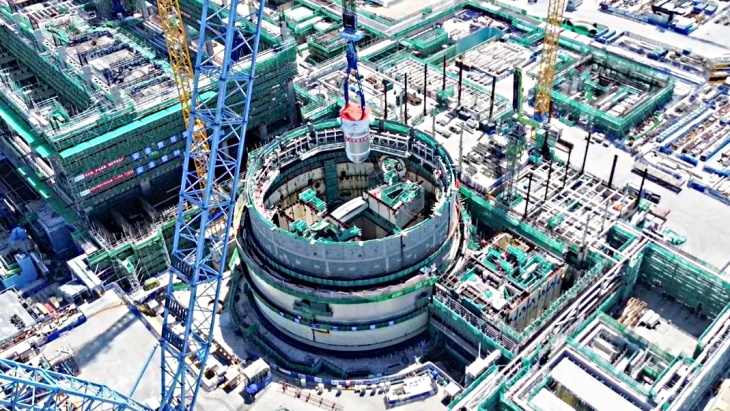

Reactor internals delivered for Xudabao unit 1

The main functions of the reactor internals are to provide support for fuel assemblies and other components in the reactor pressure vessel, and to guide the control rod drive mechanism.

China National Nuclear Corporation (CNNC) said there had been "a systematic review and meticulous planning of past project experience, all parties involved in the Liaoning Nuclear Power Joint Project scientifically organised and meticulously arranged the process, conducting a process simulation exercise covering the entire manufacturing process of reactor internals to identify and address potential risks in advance".

(Image: CNNC)

It said that "during implementation, the team closely monitored key aspects, actively coordinated resources, and ultimately ensured the accurate delivery of equipment, laying a solid foundation for the smooth progress of subsequent milestones and the implementation of the main installation work".

The reactor pressure vessel was installed in July (Image: CNNC)

Background

The Ministry of Ecology and Environment announced in November 2023 that the National Nuclear Safety Administration had decided to issue a construction licence for Xudabao units 1 and 2, which will both feature 1250 MWe CAP1000 reactors - the Chinese version of the Westinghouse AP1000. A ceremony was held later that month at the Xudabao site near Xingcheng City, Huludao, to mark the start of construction of unit 1.

The Xudabao project (also known as Xudapu) was originally expected to comprise six CAP1000 reactors, with units 1 and 2 in the first phase. Site preparation began in November 2010. The National Development and Reform Commission gave its approval for the project in January 2011. CNNC noted that the total investment in units 1 and 2 exceeds CNY48 billion (USD6.6 billion).

However, with a change in plans, construction of two Russian-supplied VVER-1200 reactors as Xudabao units 3 and 4 began in July 2021 and May 2022, respectively.

The Xudabao plant is owned by Liaoning Nuclear Power Company Ltd, in which CNNC holds a 70% stake with Datang International Power Generation Company holding 20% and State Development and Investment Corporation owning 10%. The general contractor is China Nuclear Power Engineering Company Ltd, a subsidiary of CNNC.

Two further CAP1000 reactors are proposed for units 5 and 6 at the Xudabao plant.

No comments:

Post a Comment