Nicholas LePan - Mining Intelligence | March 22, 2023 |

The mining industry faces increasingly complex challenges from the weather, climate change, and a global push to become more sustainable. But mining is complicated, restricting operations can cost millions of dollars and needed supply of metals.

Weather and changing climatic conditions will affect mining operations and supporting infrastructure. As severe weather events continue to rise, companies and investors must consider the impact on equipment, employee safety, the availability of transportation routes, along with the price of water and energy supplies.

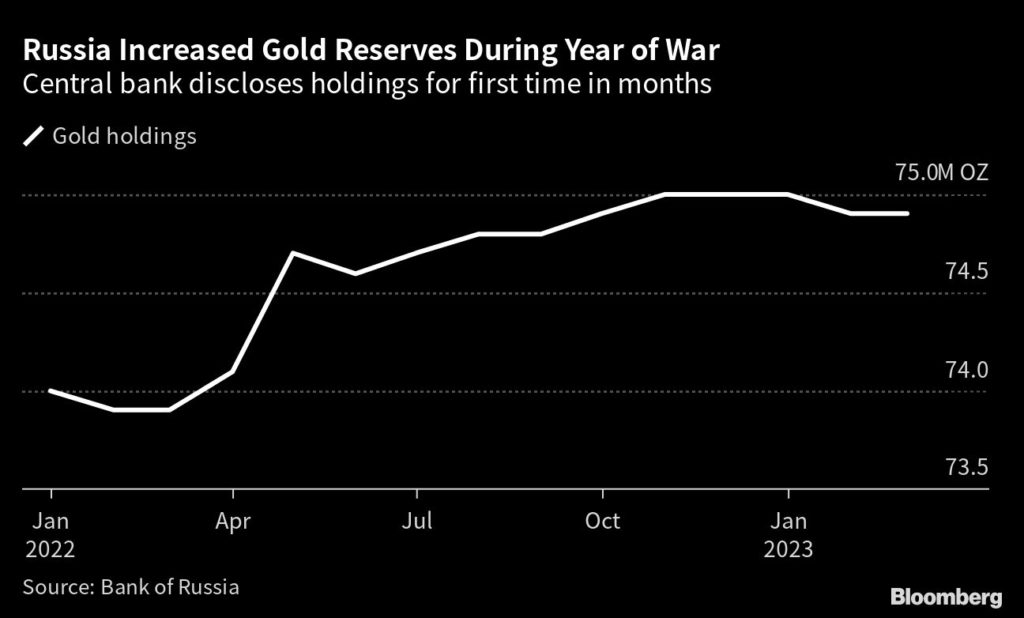

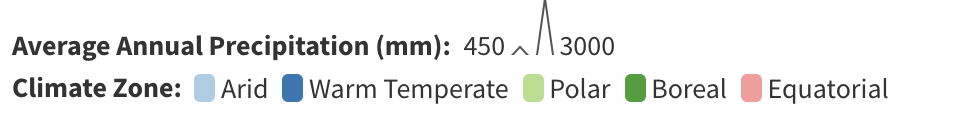

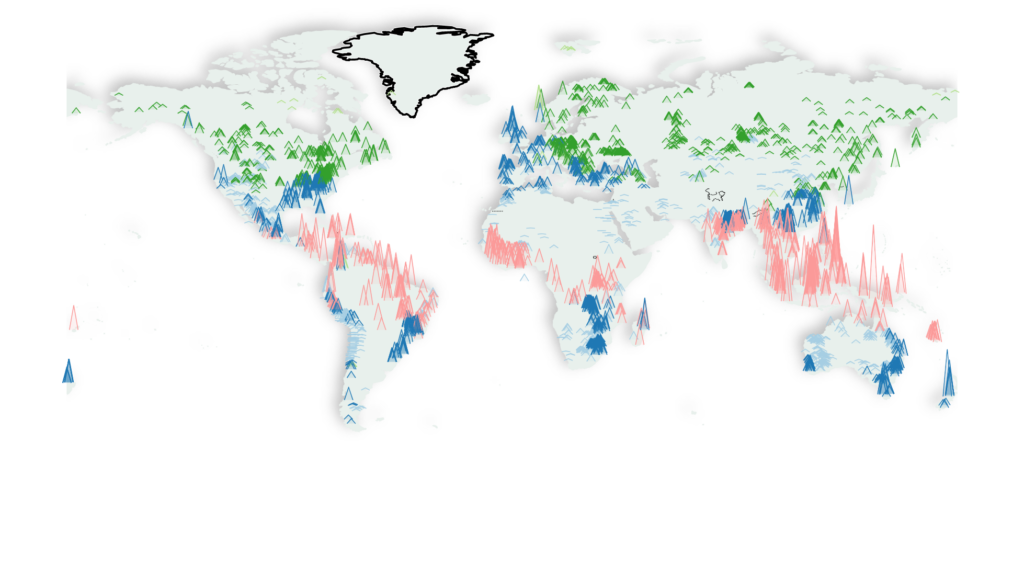

Mining Intelligence looked at the annual average precipitation from over 3500 in operation mine sites around the world to reveal the world’s wettest mines.

Making it rain: The world’s wettest mines

Average Annual Rain Fall at Mine Sites:

Source: Mining Intelligence

This data is for mine sites that are currently in production, including open, open-pit/underground, surface and underground operations.

This data is for mine sites that are currently in production, including open, open-pit/underground, surface and underground operations.

Source: Mining Intelligence

Rain and Mining Operations

Mines and mining infrastructure are large and irreversible industrial projects with heavy capital expenditures, which are designed to operate for decades in challenging environments. Investors, engineers, and company management face an almost infinite variety of considerations and must balance the trade-offs between constructing lower risk designs and declining economic returns.

As a result, this means that planning is very important to secure the long-term technical and economic sustainability of mining investments. Mine plans and investment decisions should capture the type and kind of uncertainty that surrounds a mining project, and understand the precipitation of a mine location is one such risk.

The risks of heavy precipitation include:

Land transportation route disruption

Degradation of roads

Disruption in delivery of input materials such as steel, timber, cement, hydrochloric acid, and cyanide, or consumables such as diesel, tires, and reagents

Tailings dam failures

Release of contaminated water into surrounding areas

Remediation costs

Increases in environmental liability

Impacts on community health and safety

If heavy rainfall leads to flooding, then this can lead to operational disruptions, which include mine closure, washed-out roads, and unsafe water levels in tailing dams. Experts observed 10 percent annual production losses from wet weather at an open-pit coal mine.

Extreme weather also affects different commodities in different ways. For example, iron and zinc are the most exposed to flood occurrences, at 50% and 40% of global volume at risk, respectively.

Without this knowledge or data, many investors and those who make decisions are making decisions blind.

More data is here.

Rio Tinto to publish site-by-site water usage data

Staff Writer | March 22, 2023

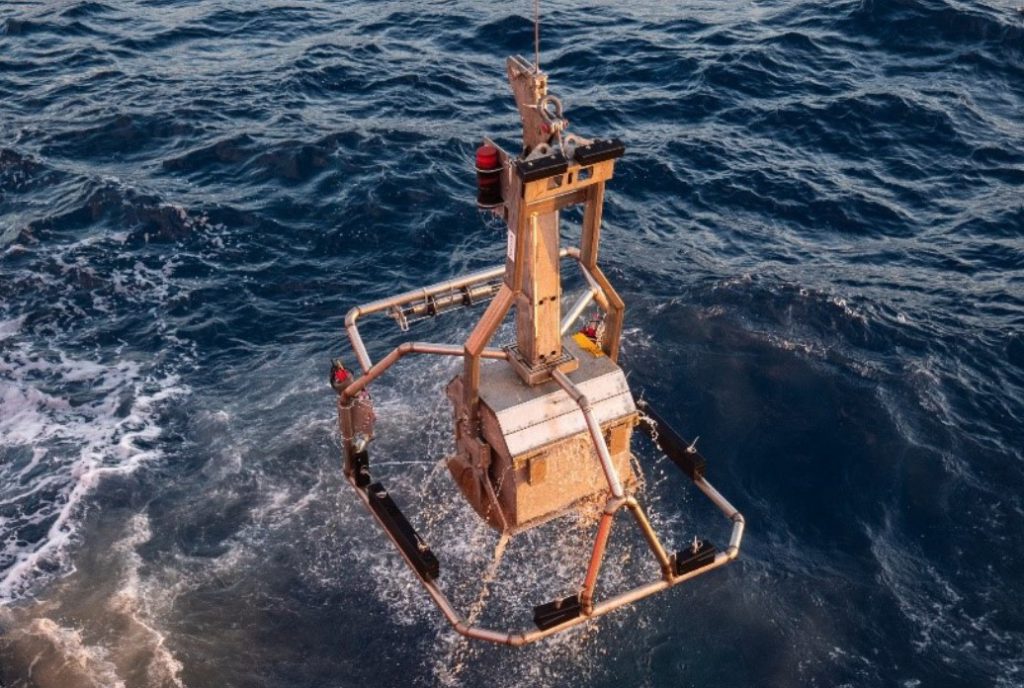

Image from Rio Tinto.

In an effort to mark World Water Day 2023 on Wednesday, Rio Tinto (NYSE: RIO; ASX: RIO) is making public detailed information about annual surface water usage across its various sites in over 35 countries. The information is displayed through an interactive map on the company’s website.

The interactive database details permitted surface water allocation volumes, the site’s annual allocation usage, and the associated catchment runoff from average annual rainfall estimate. This five-year historic comparative data will be updated annually.

In 2019, Rio Tinto made a commitment to drive good water stewardship and improve disclosure to stakeholders by publishing site-by-site surface water usage data for all managed sites by the end of 2023.

This commitment is in line with the water reporting guidelines of the International Council on Mining and Metals (ICMM) Water Stewardship Position Statement, which sets out ICMM members’ approach to water stewardship, Rio said.

It includes commitments requiring members to apply strong and transparent water governance, manage water at operations effectively, and collaborate to achieve responsible and sustainable water use.

“Water is an essential resource, critical to sustaining biodiversity, people, and economic prosperity. It is also a resource we share with the communities and nature surrounding our operations, so it is essential that we carefully manage our use and hold ourselves accountable to our stakeholders,” Rio Tinto CEO Jakob Stausholm said in a media statement.

“This interactive database brings a new level of transparency and will enable us to engage more deeply with our stakeholders, seek their feedback on our disclosure and continue to focus our efforts on becoming better water stewards for today and future generations,” Stausholm said.

Use the interactive platform here.

Image from Rio Tinto.

In an effort to mark World Water Day 2023 on Wednesday, Rio Tinto (NYSE: RIO; ASX: RIO) is making public detailed information about annual surface water usage across its various sites in over 35 countries. The information is displayed through an interactive map on the company’s website.

The interactive database details permitted surface water allocation volumes, the site’s annual allocation usage, and the associated catchment runoff from average annual rainfall estimate. This five-year historic comparative data will be updated annually.

In 2019, Rio Tinto made a commitment to drive good water stewardship and improve disclosure to stakeholders by publishing site-by-site surface water usage data for all managed sites by the end of 2023.

This commitment is in line with the water reporting guidelines of the International Council on Mining and Metals (ICMM) Water Stewardship Position Statement, which sets out ICMM members’ approach to water stewardship, Rio said.

It includes commitments requiring members to apply strong and transparent water governance, manage water at operations effectively, and collaborate to achieve responsible and sustainable water use.

“Water is an essential resource, critical to sustaining biodiversity, people, and economic prosperity. It is also a resource we share with the communities and nature surrounding our operations, so it is essential that we carefully manage our use and hold ourselves accountable to our stakeholders,” Rio Tinto CEO Jakob Stausholm said in a media statement.

“This interactive database brings a new level of transparency and will enable us to engage more deeply with our stakeholders, seek their feedback on our disclosure and continue to focus our efforts on becoming better water stewards for today and future generations,” Stausholm said.

Use the interactive platform here.