US moves away from critical mineral price floors

The Trump administration is stepping back from plans to guarantee a minimum price for US critical minerals projects, a tacit acknowledgment of a lack of congressional funding and the complexity of setting market pricing, multiple sources told Reuters.

The shift, which comes as a US Senate committee is reviewing a price floor extended last year to MP Materials, marks a reversal from commitments made to industry and could set Washington apart from G7 partners discussing some form of joint price support or related measures to bolster production of critical minerals used in electric vehicles, semiconductors, defense systems and consumer electronics.

At a closed-door meeting earlier this month hosted by a Washington think tank, two senior Trump officials told US minerals executives that their projects would need to prove their financial independence without government price support, three attendees told Reuters.

“We’re not here to prop you guys up,” Audrey Robertson, assistant secretary of the US Department of Energy and head of its Office of Critical Minerals and Energy Innovation, told the executives. “Don’t come to us expecting that.”

The shift would guide future deals and does not affect MP’s price floor, which the government agreed to as part of an investment package last July.

Robertson was joined by Joshua Kroon, the deputy assistant secretary for textiles, consumer goods, materials, critical minerals and metals at the US Department of Commerce’s International Trade Administration.

Both Kroon and Robertson told the meeting that Washington is no longer in a position to offer price floors, according to the sources.

Kroon and Robertson did not respond to requests for comment.

The administration’s current stance is in contrast to a closed-door meeting held last July, where two separate officials told minerals executives that a floor price extended to MP Materials days prior was “not a one-off” and that the administration was working on price supports for other projects.

Since then, the administration has taken equity positions in Lithium Americas, Trilogy Metals, USA Rare Earth and others. None were offered price floors, sparking questions about the government’s commitment to that financial tool.

US mining and processing companies have pushed for price floors and other government backstops to help them compete with China. Industry executives argue China’s state-backed producers can slash prices to punish rivals, undercut projects and deter private investment.

The White House declined to say whether it plans to issue any new price floors, but said it will continue to pursue deregulation, tax cuts and targeted investments in the high-priority sector “while being good stewards of taxpayer dollars.”

Critics of price floors warn they could expose US taxpayers to significant financial risk by forcing the government to subsidize minerals when market prices fall, potentially locking in long-term liabilities if prices remain depressed.

Legal experts also caution that guaranteeing minimum prices could face challenges under US procurement, trade and budget laws, particularly if such support is seen as market distortion or lacks explicit congressional authorization.

Moving away from price floors does not preclude other steps Washington could take to bolster mineral projects and attempt to stabilize prices, including stockpiling, equity investments and local content stipulations.

Other countries, including Australia, have also considered price floors for critical minerals.

MP deal under spotlight

The MP Materials investment sparked concern from some administration officials and members of Congress that funding for a price floor of at least $110 per kilogram for two types of rare earths had not been authorized by Congress, two additional sources familiar with the discussions said.

The economics of mineral markets since the MP investment have shifted. USA Rare Earth said earlier this week it intends to buy those same types of rare earths for $125 per kilogram on the open market.

The MP investment, which included a guaranteed purchase agreement, fueled confusion over whether Washington would guarantee a price floor for others.

As the Trump administration considered other potential equity investments after MP, it recognized that it did not have the congressional authority to fund a price floor, the sources said.

That realization was fueled in part by an inquiry from members of the Senate Armed Services Committee, which asked Pentagon staff last year to meet to explain why MP Materials received price floor support and the administration’s strategy around minerals sector investment, according to the two sources.

A committee staffer confirmed the meeting request but declined further comment. MP Materials did not respond to a request for comment.

(By Ernest Scheyder and Jarrett Renshaw; Editing by Veronica Brown and Lisa Shumaker)

Australia’s Iluka flags impairment of minerals sands unit

Australia’s Iluka Resources said on Thursday it expects to recognize two exceptional items, including an impairment of its mineral sands business, putting its shares on course for their largest single-day decline in two months.

The non-cash impairment charge for the segment is expected to be around A$350 million ($246.02 million) before tax and will be accounted for in its final 2025 results, Iluka added.

Shares of the critical minerals miner fell as much as 8.4% to A$5.92, set for their weakest session since late November 2025. The stock is the worst performer on the broader ASX 200 index, which was down 0.4% as of 23:23 GMT.

The impairment comes after Iluka in September disclosed the suspension of production activities at its Cataby mine and Synthetic Rutile Kiln 2 (SR2) processing facility in Western Australia.

The decision had been taken due to subdued demand for mineral sands and their associated downstream products, with lower levels of global economic activity further weighing on purchasing behaviour of their customers, the company said in its September statement.

Rio Tinto is also looking to exit its minerals sands business, with the world’s largest iron ore miner last year flagging that its titanium and borates divisions were up for sale.

Iluka added in its Thursday announcement that it would also recognize a reduction for some of its inventory as price expectations have prompted a decrease in realized value for its items.

The company is expected to include exceptional charges totalling A$565 million pre-tax in its financial statement for the year ended December 31.

In its quarterly production report, Iluka flagged that development of its Eneabba rare earths facility, which is being built via a partnership with the Australian government, has progressed, with commissioning slated for 2027.

($1 = 1.4227 Australian dollars)

(By Nikita Maria Jino; Editing by Alan Barona)

Volta Intersects High-Grade Gallium Mineralization at the Springer REE Project in Ontario, Canada

HIGHLIGHTS

- Broad, continuous gallium mineralization confirmed in Borehole SL25-23 with 117m assayed to date:

- 77g/t Ga2O3 over 117m (from 59.0m to 175.8m)

- Including 120 g/t Ga2O3 over 11.1m (from 153.0m to 164.1 m)

- Up to 211.0 g/t Ga2O3 over 1.5m (from 156.0m to 157.5m)

- Results rank among the highest-grade gallium assays reported in North America to date, based on publicly available data

- Gallium is on the critical mineral list for Canada, Europe, Australia and the US, and the gallium market is expected to grow significantly from US$2.5B in 2024 to US$21.5B by 2034

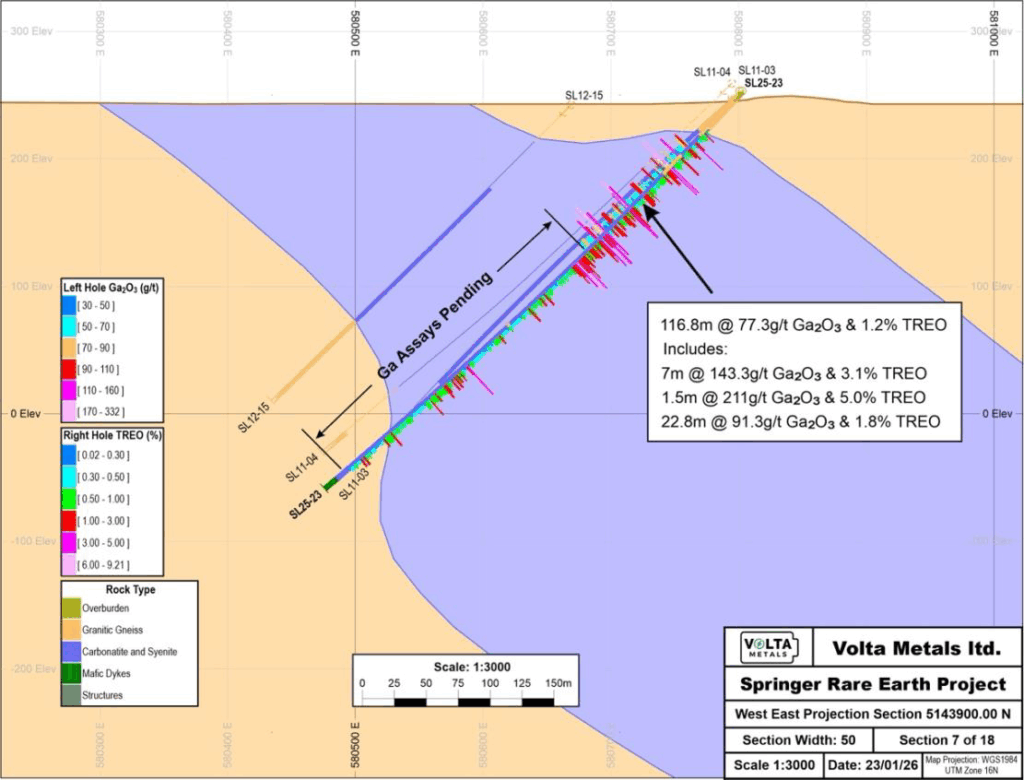

Volta Metals Ltd. (CSE: VLTA) (FSE: D0W) (OTC Pink: VOLMF) (“Volta” or the “Company”) is pleased to report initial gallium assay results from its Springer Rare Earth Project near Sudbury, Ontario, Canada. The newly received assays from drill hole SL25-23 confirm thick, continuous gallium mineralization over a 116.8m interval grading 77 g/t Ga2O3, including multiple high-grade zones exceeding 100 g/t Ga2O3 (Figure 1).

These initial Springer results show gallium mineralization within the high-grade range, reinforcing the project’s potential to emerge as a leading North American gallium-bearing REE system (Table 1).

Table 1. Select Ga2O3 Assays from Drill hole SL25-23

| Ga2O3 g/t | Interval (m) | From (m) | To (m) |

| 77.3 | 116.8 | 59.0 | 175.8 |

| 143.3 | 7.0 | 81.0 | 88.0 |

| 332.0 | 1.0 | 82.0 | 83.0 |

| 172.7 | 3.0 | 126.0 | 129.0 |

| 194.9 | 1.5 | 127.5 | 129.0 |

| 211.0 | 1.5 | 156.0 | 157.5 |

| 119.8 | 11.1 | 153.0 | 164.1 |

| 91.3 | 22.8 | 153.0 | 175.8 |

Globally, gallium is primarily produced as a secondary by-product of aluminum and zinc refining, making primary natural gallium occurrences uncommon. Industry benchmarks generally classify gallium grades as:

- Low grade: <35 g/t Ga2O3

- Moderate-grade: 35-60 g/t Ga2O3

- High grade: >60 g/t Ga2O3

The sampled interval (58.0m to 175.8m) from hole SL25-23 ended in 118.3 g/t Ga2O3, with the remainder of the hole (to 372m) currently undergoing gallium assay.

These results represent the widest and most consistent high-grade gallium intercept identified at Springer to date and demonstrates the project’s multi-commodity critical minerals potential in addition to its high-grade Rare Earth Element (“REE”) mineralization.

CEO Kerem Usenmez commented, “These gallium assays further reinforce Springer’s position as one of North America’s most advanced and strategically important critical minerals projects. The presence of long, continuous intervals with consistently high gallium grades is rare in North America.”

Gallium is on the critical mineral list for Canada, Europe, Australia and the US, with the gallium market expected to grow significantly from approximately US$2.5B in 2024 to US$21.5B by 2034. Subject to ongoing metallurgical testwork, Springer could produce notable by-product Ga alongside Light and Heavy Rare Earth Elements.

The Global Gallium Market

The gallium market is overwhelmingly dominated by China, which controls 98% of global gallium production.

Expanding Demand Across Multiple Sectors

Demand for gallium has expanded dramatically across a range of high-tech sectors, placing sustained upward pressure on prices. The global gallium market is projected to grow from approximately US$2.32 billion in 2024 to US$2.91 billion in 2025, representing a compound annual growth rate (“CAGR”) of 25.4%. More aggressive forecasts suggest the market could reach US$17.0 billion by 2032, expanding at a CAGR of 24.5%. Continued demand growth across the semiconductor, telecommunications, defense, and renewable energy sectors is expected to support ongoing price strength.

Price Increase and Market Dynamics

Gallium prices have experienced significant volatility in recent years, with a clear upward trend driven by tightening supply and accelerating demand. In December 2024, gallium price surged to US$575 per kilogram, representing a 17% increase over previous levels and the highest price since 2011. The most significant factor driving recent price increases has been China’s strategic export restrictions. Initial export controls introduced in August 2023 disrupted global supply chains and pushed prices higher. By December 2024, China had escalated these measures, announcing a comprehensive ban on gallium exports to the US, further intensifying market pressures. With China accounting for approximately 98% of global gallium production, these export restrictions have had a disproportionate impact on global supply and pricing. China’s production advantage stems from its integration of gallium recovery with its massive aluminum industry, as gallium is typically extracted from the alumina processing stream.

Gallium Applications

Semiconductor Applications and Integrated Circuits: The semiconductor industry represents the largest demand driver for gallium, with approximately 74% of gallium imported into the United States in 2023 used in integrated circuits. Gallium arsenide (GaAs) and gallium nitride (GaN) have become critical semiconductor materials across a wide range of industries, including high-tech, automotive, aerospace, healthcare, and telecommunications. Gallium nitride semiconductors are particularly valuable due to their superior power density and heat resistance properties. Traditionally used primarily in military applications, GaN is now finding increased adoption in commercial applications, including 5G networks, wireless infrastructure, power electronics, satellites, electric vehicles, and consumer electronics. As one manufacturer noted, “GaN offers higher power density, more reliable operation and improved efficiency over traditional silicon-only based solutions”.

Optoelectric Devices: Approximately 25% of gallium consumption goes toward optoelectronic devices such as laser diodes, light-emitting diodes LEDs, photodetectors, and solar cells. Continued growth in consumer electronics devices – such as mobile phones, laptops, televisions, and advanced lighting applications continues to drive demand in this segment. These applications are particularly important for fibre optic communications and high-speed data transmission technologies, both of which represent key long-term growth areas.

Renewable Energy Applications: The renewable energy sector represents an emerging but potentially significant source of future gallium demand. Thin-film solar panels rely heavily on gallium for their high efficiency, and as renewable energy adoption accelerates globally, gallium requirements are expected to grow substantially. Europe alone is projected to consume up to 26 times more gallium by 2030 compared to current levels, according to the Fraunhofer Institute*. The scale of potential demand is staggering — Austria’s planned renewable energy projects, despite serving a population of only 9 million, would require approximately 4.5 times the current global gallium production. This statistic underscores the looming supply-demand imbalance as gallium becomes increasingly integral to both energy independence and environmental commitments worldwide.

About the Springer Rare Earth Deposit

The 2012 mineral resource estimate presented for the Springer Rare Earth Project is historical in nature. Volta’s Qualified Person has not completed sufficient work to confirm the results of the historical resource. Volta does not treat this as a current mineral resource but considers it relevant as a guide to future exploration and includes it for reference purposes only. The historical resource was estimated by Tetra Tech Wardrop in 2012. The gallium was not included in this initial mineral resource estimate.

The block model and mineral resource for the Springer Rare Earth Project is classified as having both Indicated and Inferred Mineral Resources based on the number of boreholes, borehole spacing and sample data populations used in the estimation of the blocks. The mineral resource estimate for the deposit, at a 0.9% Total Rare Earth Oxide (“TREO”) cut-off, is an Indicated Resource of 4.2 Mt at 1.14% TREO, 0.02% ThO2, with approximately 6% of the TREO being made up of HREO; and an Inferred Resource of 12.7 Mt at 1.17% TREO, 0.01% ThO2, with approximately 4% of the TREO being made up of HREOs.

The 2012 mineral resource, based on 22 diamond boreholes, was estimated by Ordinary Kriging interpolation on uncapped grades for all 15 REOs and thorium dioxide. The TREO% is a sum of the 15 individual interpolations of the REOs. No recoveries have been applied to the interpolated estimates.

The 2012 mineral resource estimate categories are not compliant with the current CIM Definition Standards. No other resource estimates have been undertaken since the 2012 Tetra Tech Wardrop report. Further drilling will be required by Volta to verify the historical estimate as a current mineral resource.

QA/QC Protocol

All drilling was completed by a diamond drill rig producing NQ-size core. Volta implemented a strict QA/QC protocol in processing all rock samples collected from the diamond core samples obtained from the Springer REE property. The protocol included inserting reference materials, in this case, high-concentration and low-concentration certified rare earth elements standards, blanks, and drill core duplicates, to validate the accuracy and precision of the assay results. All collected rock core samples were cut in half by a rock saw, placed in sturdy plastic bags and zip-tied shut while under the supervision of a professional geologist. The remaining half core was returned to the core box, which is stored on the Property. Sample bags were then put in rice bags and kept secure before being sent by road transport to Activation Laboratories Ltd.’s preparation facility in North Bay, Ontario. Sample preparation (code RX1) consists of drying and crush (< 7 kg) up to 80% passing 2 mm, riffle split (250 g), and pulverize (mild steel) to 95% passing 105 µm. The samples from SL25-23 were subsequently analyzed at Saskatchewan Research Council (“SRC”) site in Saskatoon, Saskatchewan, using Code 8–REE Assay (lithium metaborate/tetraborate fusion with subsequent analysis by ICP and ICP/MS). Syenite standard SY-5 from Natural Resources Canada was inserted in the sample stream for every 20 drill core samples. Standard SY5 passed within two standard deviations for rare-earth elements (La to Lu) and Ga. The rare-earth elements assayed by SRC were similar to those previously assayed by Actlabs to further confirm the REE assays from the Springer Project.

Qualified Person

The technical content of this news release has been reviewed and approved by Dr. Julie Selway, P.Geo., who is an independent Qualified Person (“QP”) as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects. The QP and the Company have not completed sufficient work to verify the historical information on the Springer deposit, and it is considered as “historical”, particularly regarding historical exploration and government geological work.

For more information about the Company, view Volta’s website at www.voltametals.ca.

ABOUT VOLTA METALS LTD.

Volta Metals Ltd. (CSE: VLTA) (FSE: D0W) (OTC Pink: VOLMF) is a mineral exploration company focused on rare earths, gallium, lithium, cesium, and tantalum. It owns, has optioned and is currently exploring a critical minerals portfolio of rare earths, gallium, lithium, cesium, and tantalum projects in Ontario, one of the world’s most prolific and emerging hard-rock critical mineral districts. To learn more about Volta and its Springer and Aki Projects, please visit www.voltametals.ca.

ON BEHALF OF THE BOARD

For further information, contact:

Kerem Usenmez, President & CEO

Tel: 416.919.9060

Email: info@voltametals.ca

Website: www.voltametals.ca

Neither the CSE nor the Canadian Investment Regulatory Organization (CIRO) accepts responsibility for the adequacy or accuracy of this release. This news release contains forward-looking statements relating to product development, plans, strategies, and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects” and similar expressions. All statements other than statements of historical fact included in this news release are forward-looking statements that involve risks and uncertainties. Forward-looking information in this news release includes, but is not limited to, that the newly designed drill program will provide sufficient data for an updated mineral resource estimate, which is scheduled to be completed in the first quarter of 2026. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include: the risks detailed from time to time in the filings made by the Company with securities regulators; the fact that Volta’s interests in its mineral properties are options only and there are no guarantee that such interest, if earned, will be certain; the future prices and demand for lithium, rare earth elements, and gallium; and delays or the inability of the Company to obtain any necessary approvals, permits and authorizations required to carry out its business plans. The reader is cautioned that assumptions used in the preparation of any forward-looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking statements. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, other than as required by law.