CRIMINAL CAPITALI$M

INDIA

Minority Shareholders Accuse Baidyanath Group of Embezzlement, Company Denies

Image Courtesy: Justdial

Which Indian hasn’t heard of Chyawanprash? Who hasn’t tasted Churan before or after a meal? The first is an ancient dietary supplement that is a mixture of sugar, honey, ghee, amla, sesame oil, and various berries, herbs, and spices. Churan is a sweet and tangy blend of natural ingredients that helps digestion.

The pioneer in making and selling these two products is Shree Baidyanath Ayurved Bhawan Private Limited, the flagship company of the Baidyanath Group. Baidyanath is the oldest name in the market for ayurvedic medicines in India. The original company was founded in 1917 by two brothers, Pandit Ram Dayal Joshi, and Ram Narayan Vaidya, who were considered scholars of traditional Indian medicine.

The firm started as a small shop in Kolkata. It was then a proprietary concern. In May 1947, just before India became politically independent, it was converted into a private limited company under the Companies Act of 1913. Over the decades, the Baidyanath group expanded its operations to become one of the biggest manufacturers and sellers of ayurvedic medicines not only in India but across the world. The group later diversified its operations into unrelated sectors, such as coal mining and power generation, that landed it into controversies.

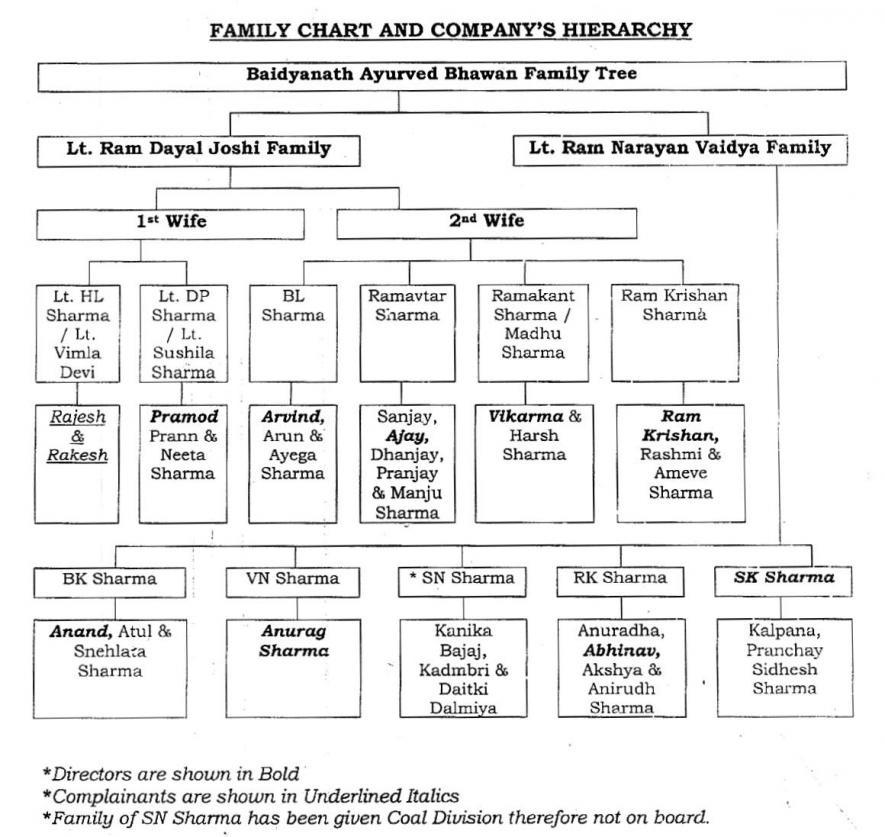

Like many family-owned businesses, the ownership rights and managerial control over the flagship firm, Shree Baidyanath Ayurved Bhawan Private Limited (henceforth Baidyanath) and other companies in the Baidyanath Group passed down through generations after the demise of the two founders (see family tree below).

Source: Submission to the Serious Fraud Investigation Office (SFIO), Ministry of Corporate Affairs, Government of India

The group is now effectively controlled and run by a member of the third generation of the extended family, Anurag Sharma, who is designated as Joint Managing Director. His writ is being challenged by other family members who have accused his section of the family of financial misdemeanours and fraudulent transactions in shares. These allegations have been denied.

Booming Business Dominated By A Few

The market for ayurvedic products in India touched Rs 62,600 crore in 2022, according to one estimate. The Baidyanath Group is among the handful of corporate conglomerates that dominate this market. Controversies have dogged the group over the years. It was recently accused of putting out false and misleading advertisements. The United States Food and Drug Administration (USFDA) has alleged that Baidyanath used harmful ingredients in its products.

Adding to its woes, now a section of shareholders of the flagship company who are members of the extended family, have complained to the Serious Fraud Investigation Office (SFIO) in the Union Ministry of Corporate Affairs alleging embezzlement of funds and “illegal” transfer of shares. The SFIO’s investigations are on at the time of writing.

According to the complaint made to the Additional Director, SFIO, that was marked to the Secretary, Corporate Affairs, and other senior officials in the Ministry, a copy of which is with the writers of this article, on November 7, 2022, Rajesh Sharma and his brother Rakesh Sharma alleged that the shares in the name of their father, late Hazari Lal Sharma, have been “diluted” in a “grossly arbitrary and capricious manner” from 8.14% to 4.20% and claimed that the transfer of shares violates Sections 108 and 109 of the old Companies Act of 1956 (that are now Sections 58 and 59 of the new Companies Act of 2013).

Sections 58 and 59 of the Companies Act of 2013 state that “any person that has ceased to be a member of the company, has to be reflected in the register.” Moreover, “if a private company limited by shares refuses to transfer securities (shares) or interest of a member in the company, it shall inform them with a reason within 30 days of the refusal.”

It has been claimed that after the death of their father H L Sharma, Rajesh and Rakesh have not been given a seat in the board of directors of the company, whereas all other branches of the family have been represented on it. It has also been alleged by the complainants that they were not served any notices before convening general body meetings of shareholders and that many of such meetings were conducted only “on paper.”

Baidyanath’s company secretary has refuted these allegations and claimed that Rajesh Sharma (holding 0.8% shares) and his brother Rakesh Sharma (holding 0.6% of the shares) are not eligible to hold positions on the company’s board of directors. But the minority shareholders have more serious allegations against the company.

Allegations of Financial Embezzlement and Incorporation of Bogus Entities

According to the complainant’s allegations, the audited financial statements provided to government authorities, like the Registrar of Companies (RoC), contain fraudulent information and numbers, created by manipulating financial records without following accounting standards. The complaint claims that Baidyanath’s management has informally split the business to suit their preferences. The company’s main business has five manufacturing units located at Kolkata, Patna, Allahabad, Jhansi, and Nagpur.

Rajesh Sharma and his brother Rakesh Sharma have claimed that auditors have expressed concerns about the finances of companies in the group and their boards of directors have “intentionally” misled the RoC. These claims, together with other allegations which will be subsequently detailed, have been denied.

Shree Baidyanath Ayurved Bhawan’ has reported an annual turnover of around Rs 500 crore in recent years. Rajesh and Rakesh Sharma have alleged that the company’s and the group’s turnover has been “manipulated” over a period of three decades and should have been four times higher. They further allege that turnover not less than Rs 1,500 crore has been concealed and the funds “laundered” through fictitious payments and expenses. In addition, the complainants claim that 72 “asset-less” entities were created at Baidyanath’s addresses, and funds were diverted in the name of payment of office rent, advertising expenses and “fraudulent” accounting entries in the name of affiliate companies.

They also allege that 30 individuals were paid artificially high salaries totalling over Rs 25 crore a year, while the complainants were deprived of their dues and entitlements worth more than Rs 80 crore.

A particular director of the flagship company had reportedly side-tracked other members of the extended Sharma family to control its coal mining division. It may be noted that Baidyanath was booked by the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED) for its involvement in the infamous coal block allocation scandal (popularly called “Coalgate”) that took place 2015 onwards. In October 2023, a Delhi court acquitted the accused in the case.

The final set of allegations against Baidyanath relate to a school, Shri Shiv Narayan Joshi High School, that was located at Kotputli near Behror, mid-way between Delhi and Jaipur. The educational institution was registered as a society with the RoC in 1961 but has now ceased operations. According to the complainants, the society holds more shares in Baidyanath than individual members of the extended Sharma family. The complainants claim they are unaware of how Baidyanath’s dividends accrue to the society that used to run the school.

Baidyanath’s Response to the Allegations

Following the receipt of the November 2022 letter from Rajesh and Rakesh Sharma, addressed to the Assistant Registrar of Companies, Ministry of Corporate Affairs, Baidyanath’s company secretary Uma Shankar Gutgutia responded stating that there was no supporting evidence for the complainants’ allegations. He deemed the letter “vexatious” and an attempt to pressure the company’s management into conceding to unsubstantiated claims. Gutgutia said no shares had been transferred in violation of the provisions of the Companies Act of 1956 and that the company had not received requests or reminders for transfer of shares by the complainants.

Regarding auditing practices, Gutgutia said Baidyanath has a robust three-tier auditing system, adding that any claims of auditing malpractices are baseless. The company denied allegations of an “unofficial demerger” and said there was no such legal term in the country’s corporate laws. He disputed the claim of the complainants that revenue figures had been artificially suppressed, and added that Baidyanath’s annual turnover ranged between Rs 500 crore and Rs 700 crore in recent years. For instance, in the year ended March 31, 2021, the company recorded a turnover of Rs 689.79 crore.

Baidyanath’s company secretary argued that the 72 operating entities named in the complaint were all legitimate and that their transactions have been included in the audited financial reports. Gutgutia dismissed the accusation by the complainants that they had not been paid Rs 80 crore, as false and unsubstantiated. He emphasised that Rajesh and Rakesh Sharma had no inherent right to representation on the board of directors and that they were regularly receiving dividends.

Countering Baidyanath’s Reply

In response to Baidyanath’s counter statement, the complainants provided further details to the SFIO. Of the 72 alleged bogus entities, it has been claimed that a group entity, Baidyanath Finance and Leasing Limited, had a rental income of Rs 45.69 lakh in 2020-21 that was higher than its total receipts of Rs 30.67 lakh in 2021.

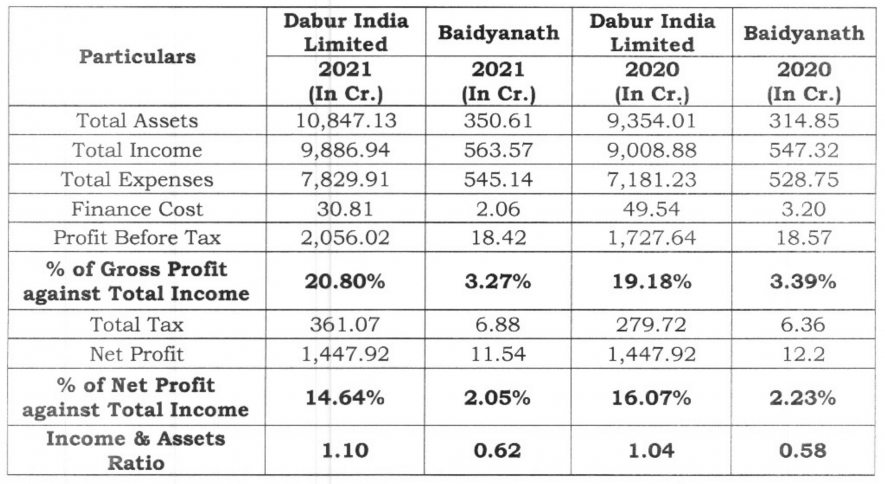

In 2017, Ameve Sharma, the then president of Baidyanath, had said in an interview with the Financial Express that “Baidyanath’s market share is higher than that of Dabur. With 15-20% of market share in the Indian Ayurvedic market of Rs 6,000 crore in 2017 (Rs 62,600 crore according to 2022 estimates), and 2-3% of market share in Herbal market space of estimated Rs 20,000 crore.”

If the above estimates are correct, Baidyanath’s claim that the company’s annual turnover has been between Rs 500 crore and Rs 700 crore, does not seem to tally. Our questions to the company secretary of Baidyanath as well as the minority shareholders Rajesh and Rakesh Sharma were not responded to.

The chart below is being reproduced from the complaint made to the SFIO.

Finally, there have been allegations that Baidyanath is marketing its products through undisclosed channels not reflected in the company's revenue reports. Baidyanath, in response, refuted these claims by asserting that the only official platform for product sales is “Baidyanath.co.in.” A simple online search, however, reveals the existence of several websites bearing Baidyanath’s name and official logo that are apparently involved in the distribution of the company’s products – these include “baidyanath.com,” “baidyanath.net.in,” and “baidyanathayurved.com.”

It is understood that the complainants have filed first information reports (FIRs) against the representatives of Baidyanath with the Rajasthan Police.

Detailed questionnaires were sent to one of the complainants, Rajesh Sharma, and Uma Shankar Gutgutia, company secretary of Shree Baidyanath Ayurved Bhawan Private Limited to their email addresses, on the afternoon of October 19.

Yadvendra Sharma, who is the son and nephew of the two complainants, Rajesh and Rakesh Sharma, in the case against Baidyanath, replied to their questionnaires and revealed that they had lodged an FIR in Jaipur against Umashankar Gutgutia. The F.I.R dated 28/06/2023, a copy of which has been provided to the writers of this report, mentions charges, such as cheating and criminal conspiracy.

Yadavendra also wrote in his reply, “Mr Gutgutia said that our complaint was a civil dispute and that we had no inheritable rights based on the board meetings’ minutes. The minutes showed that Late Mr Hazari Lal Sharma (our father) was owed a huge sum by the company, which was deleted from the records after he passed away and his legal heirs were not paid. This was a criminal offence and not a civil dispute.”

The writers have not received any reply from Gutgutia or any other Baidyanath representatives. The article will be updated if they get any responses.

The writers are independent journalists.

No comments:

Post a Comment