UCL: Ammonia is the Cheapest Compliance Option for New IMO Carbon Rules

When the University College London's Energy Institute used detailed modeling to evaluate the IMO's highly complex new carbon price structure, they came to a surprising conclusion: if proven safe, dual-fuel ammonia propulsion will be the least-cost alternative for shipowners who want to comply with the rules in the 2030s and beyond - and it reduces the risk of fuel unavailability, too.

"Although there are significant complexities and uncertainties in what was agreed [at IMO MEPC 83] in April, even conservative projections of how remaining policy details will be finalised results in a ‘no brainer’ choice for shipowners in dual fuel ammonia," said Dr. Tristan Smith, Professor of Energy and Transport at the UCL Energy Institute.

UCL's 40-page study illustrates what owners are quickly finding out: a winning business strategy for carbon compliance is going to require a lot of math.

The IMO is not planning a simple flat tax on bunker fuel. Instead, ships will be expected to meet an emissions intensity standard, which gets more strict over time. If owners meet the standard, they pay the IMO nothing. If they emit too much, they can comply by paying a tax (remedial units) at prices that will rise at a yet-to-be-determined pace. Alternatively, they can overcomply and sell their emissions credits (surplus units) to other owners, and collect yet-to-be-determined subsidies (rewards) for using low-emission fuels.

The details for these factors change over time, so a business plan for the 25-year lifespan of a newbuild has to account for different compliance requirements and cost structures in the 2020s, 2030s and 2040s.

Initially, UCL found, LNG dual-fuel ships will have an edge on cost. But as the emissions intensity standard gets tougher in the mid-2030s, the cost of compliance for LNG will go up. Ammonia dual-fuel ships begin to win out because they can burn blue ammonia, made from cheap natural gas with the added bonus of onshore carbon capture. Running a ship on blue ammonia will generate a lot of IMO surplus units, which can be sold to other shipowners to offset the cost of the fuel.

"Blue ammonia, which also benefits from the low gas price outlook modelled, is the only fuel with an abatement cost lower than the initial [remedial unit] price and the only fuel capable of generating significant volumes of [surplus units] into the mid-2030s," UCL concluded.

This is enough to make the ammonia dual-fuel strategy the winning business case, even before taking expected IMO rewards for zero and near-zero fuels into account, according to UCL.

Optionality adds another bonus in an uncertain landscape. With a dual-fuel ammonia hull, the operator can burn fossil bunker fuel; biofuel; blue ammonia; or e-ammonia, made with green electricity. This means the operator can pick from the best available pricing in the markets for natural gas, oil, biofuel or green power, depending on how the energy market fluctuates.

The study's findings would put LNG in second place, and the authors included a warning that LNG bunkering infrastructure investments could prove unnecessary if ammonia takes hold (a cautionary note that UCL has sounded before). The authors also discounted the possibility of onboard carbon capture, noting cost and infrastructure requirements.

"Despite any early dominance LNG may achieve in the late 2020s, its prospects become more challenging by the early 2030s. LNG's relatively high emissions intensity presents a fundamental constraint—it cannot generate surplus units (SUs) without onboard carbon capture and storage technology," found UCL. "Consequently, LNG dual-fuel (DF) ships must rely on either lower-emission drop-in fuels (such as bio-LNG, bio-marine gas oil, or e-LNG) or accept penalty costs."

Yara is Ready for Ammonia-Powered Shipping

As the maritime industry scans the horizon for scalable zero-emission fuels, low emission ammonia is looming ever larger as a potential solution for deep sea operators. Here Hans Olav Raen, CEO of Yara Clean Ammonia, explains the universal appeal of the power source, while outlining why his company has the experience, knowledge and global vision to help fuel the future of sustainable shipping.

“No one is better positioned than Yara to capture value in the clean ammonia market,” states Hans Olav Raen, the man leading the charge for one of the longest established producers of this zero-to-near-zero emission fuel.

“We’re the world’s second-largest ammonia producer and operate the largest export and trading network. This gives us a unique platform to support maritime in the transition to a more sustainable future.”

Ammonia, as many readers will be aware, is often regarded as the closest thing to a ‘silver bullet’ shipping has in its voyage towards net zero by 2050. With no carbon dioxide released at combustion point, ammonia edges ahead of close cousin hydrogen (for some) with easier handling and higher energy density. It also liquefies at -33°C (versus hydrogen’s -253°C), making storage and transportation simpler and cheaper using existing technology and infrastructure.

“If you're serious about decarbonization, you want a fuel that doesn’t emit CO? in the first place. That’s the fundamental advantage of ammonia,” Raen underscores. “Handling requires obvious precautions (ammonia is a hazardous chemical that deserves respect, but should not be feared… and is very, very smelly), but we’ve been producing and transporting ammonia safely since the early 1900s. So this not new territory for us—it’s what we do.”

It is, however, new territory for shipping.

Accelerating adoption

Despite the appeal of ammonia, there are still a relatively small number of orders for ammonia vessels. That said, the pace has picked up over the past 12 months. According to the Ammonia Energy Association, as of 2024 there were 25 dual-fuel ships on the orderbook, but this had increased to 45 ammonia fuelled vessels, despite the fact that engines are still being developed and prepared for commercial sales.

“Adoption of any breakthrough solution starts slowly,” he comments, “but with ammonia engines essentially sharing technology with traditional combustion engines, and the strong sustainability/regulatory rewards, we expect to see rapid acceleration once the business case becomes clearer.”

And it’s here where Yara has decided to take some eye-catchingly proactive action.

“We’re putting our money where our mouth is,” says Raen with a smile.

Walking the talk

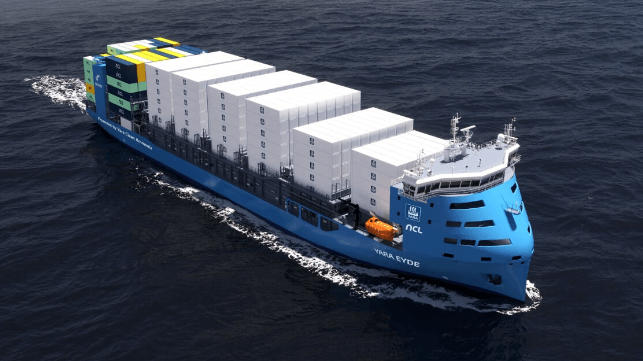

Yara Clean Ammonia has joined forces with shipowner Delphis, the container division of CMB.TECH, and logistics partner North Sea Container Line to place an order last year with China’s Qingdao Yangfan Shipbuilding for the world’s first ammonia-powered container ship.

Set to be delivered in 2026, the Yara Eyde will operate between the Oslofjord area and the European continent, transporting both Yara’s fertilizer products (accounting for between 40 and 60% of the 1,400 TEU capacity) and third party cargoes for businesses also looking to cut scope three emissions. The pioneering vessel will feature dual-fuel engines and offer reduced emissions for all parties in the value chain.

“This project is proof that the value chain can come together to make clean shipping happen,” says Raen. “From shipyards to fuel suppliers and cargo owners, everyone involved is taking a share of the risk because we all believe in the opportunity. Collectively, we are ‘walking the talk’ with Yara Eyde.”

He adds that, when in operation, the “real world business case” becomes much easier to demonstrate, which, he believes, can be another “persuasive catalyst” for wider adoption.

Scalable solution

Although the engine technology and awareness of ammonia as a zero emission power source are maturing, devil’s advocates would argue that the required infrastructure and availability remain stuck in their infancy.

Is this a concern for a maritime industry facing a future already seemingly defined by uncertainty?

Raen thinks not.

“Our message is simple,” he states. “When the ships are ready, the fuel will be too.” Yara is already producing low emission ammonia today and is scaling up production to meet growing maritime demand, with ambitious plans for global ‘hubs’ ready to roll.

“We’re looking to establish bunkering hubs in strategic locations for the industry – for example in Europe, Asia, and North America - where demand is expected to emerge first. We see no insurmountable barriers here in terms of scalability.”

With 15 ammonia carriers already in operation and 4 million tons transported annually, Raen stresses that Yara has the infrastructure and expertise to act as a reliable partner. “We’re ready to help shipowners transition - today and in the future.”

This also applies in terms of safety.

A call for clarity

“We never compromise on safety,” Raen affirms.

“Our ships, terminals, and people are already trained and equipped to handle ammonia, while we’ve also developed safety procedures with DNV, UN Global Compact and work closely with other partners to professionalise the entire value chain - from port to propulsion.”

This includes training seafarers and providing technical guidance to new entrants:

“We support our partners every step of the way to ensure ammonia is used and handled safely onboard ships.”

Although Raen is confident in this regard, he’s less effusive when it comes to regulatory and market clarity. A little more of this, he stresses, would help supercharge the transition.

“We always say going green can’t be achieved with red numbers. The economics must work for everyone involved,” he explains. “We need regulators to establish clear rules and rewards for using net zero fuels. If you do it right, you should benefit. An equal playing field for zero and net zero fuels is crucial to get the transition moving. That’s the only way to drive change at scale.”

Raen welcomes the emerging momentum from both IMO and the EU, with FuelEU Maritime offering tangible signs of progress: “There’s a real opportunity here for first movers. If you're building ammonia fuelled ships now, you can secure a competitive advantage - not just in compliance, but in customer value too.”

Next stop Nor-Shipping

Raen, as demonstrated by this interview, is eager for engagement industry wide.

He says a diverse array of stakeholders can benefit from ammonia’s advance and believes we need to take not just discussions but actions “to the next level.”

It’s a message he and his team will be keen to communicate at this year’s Nor-Shipping, taking place in Oslo and Lillestrøm 2-6 June. Yara Clean Ammonia is participating in the event week as a Partner for the always anticipated Blue Talks programme.

“Nor-Shipping offers an ideal platform for engaging with decision-makers across the global maritime value chain,” Raen concludes. “We want to collaborate - with shipbuilders, operators, port authorities, regulators, technology developers, and other key stakeholders.

“The advantages of clean ammonia for an industry in transition are huge. It may not be a silver bullet for everyone, but it’s an absolutely critical part of the global solution.

“And Yara Clean Ammonia is here to help lead the way.”

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

No comments:

Post a Comment