Gold and uranium boost Namibia’s tax revenue after diamond prices plunge

Namibia’s diamond revenue has been surpassed by income from other minerals for the first time, the country’s mining chamber said, with record gold prices and higher uranium output helping to offset the impact of weak gem prices.

Diamond income has traditionally boosted Namibia’s state coffers, accounting for about 30% of export earnings. But the natural diamond industry has faced a price decline since mid-2022, largely owing to growing popularity of lab-grown gems.

Tax revenue from diamonds in the six months to September was down 79% year on year, after falling 49% in the previous financial year, according to the country’s tax collector.

“As a result, non-diamond mineral revenues have surpassed diamond revenues for the first time, reinforcing a structural shift towards a more diversified and resilient mining revenue base,” the Chamber of Mines of Namibia said in its report for October, published late on Tuesday.

Tax revenue from other minerals, mainly uranium and gold, rose to 2.87 billion Namibian dollars ($171.09 million) in the past financial year, almost double the original budget estimate. It is expected to rise further to N$3.54 billion in the current financial year.

Non-diamond royalty income also surpassed expectations, rising from a budgeted N$747.8 million to N$1.03 billion in the past financial year and maintaining that trend in the current year.

Namibia’s two gold mines, Navachab and B2Gold’s Otjikoto mine, benefited from the bullion price rally that sent spot prices as high as $4,380 an ounce in October, up about 60% from a year earlier.

Production of uranium, which is used in nuclear technologies, was up 22% year on year in the first 10 months of 2025. Namibia is the world’s third-largest uranium producer behind Kazakhstan and Canada.

($1 = 16.7745 Namibian dollars)

(By Nyasha Nyaungwa; Editing by Nelson Banya and David Goodman)

Zimbabwe scraps gold royalty hike, sets higher threshold for windfall tax

Zimbabwe has reversed plans to double its gold royalty rate to 10%, a new 2026 budget bill showed on Wednesday, following protests by miners and industry groups.

A royalty rate of 5% would continue to apply for gold prices between $1,200 and $5,000 per ounce, according to the revised budget bill, which was approved by Zimbabwe’s lower parliament chamber in the early hours of Wednesday following lengthy debate.

In his budget speech last month, Finance Minister Mthuli Ncube had proposed doubling the gold royalty rate to 10% for gold sold above $2,501 an ounce.

During the late-night budget debate, however, he told lawmakers that a 10% royalty rate would now only apply if the bullion price topped $5,000 an ounce.

Small-scale miners would continue to pay lower royalty rates of up to 2%, he added.

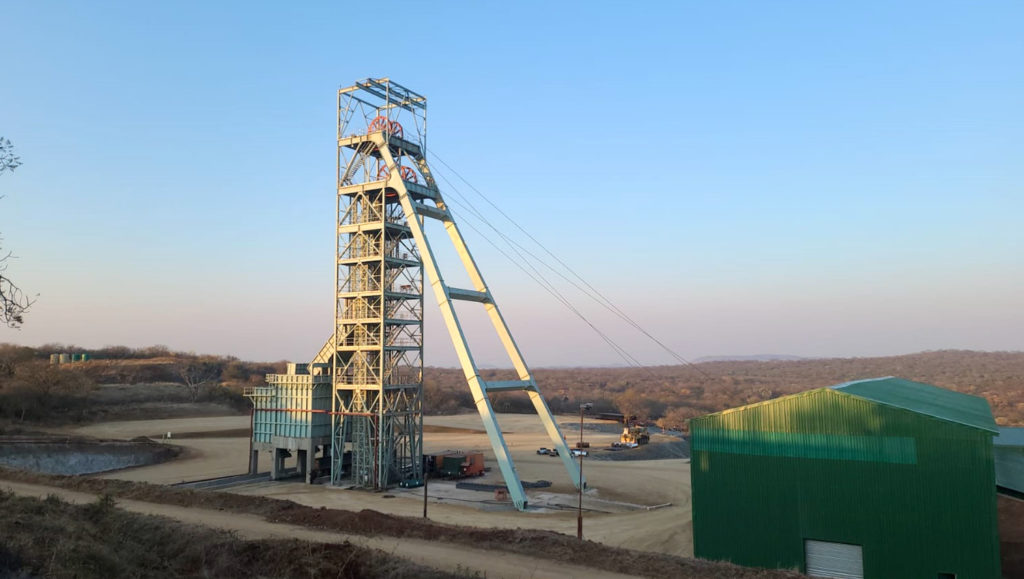

Large-scale miners such as Caledonia Mining Plc have warned that the proposed royalty hike would impact profitability at its 80,000 ounce-per-year Blanket mine in southern Zimbabwe.

Caledonia said the royalty increase and other changes to Zimbabwe’s fiscal regime would also undermine plans to develop its $500 million Bilboes project, which is set to be Zimbabwe’s biggest gold mine.

The southern African nation produced 42 metric tons of gold in the 11 months to November 2025, a new peak, outpacing the previous record of 37 metric tons in 2024.

Industry groups had warned that the government’s royalty hike would hurt efforts to attract investment and reposition Zimbabwe among Africa’s top gold producers.

(By Nelson Banya; Editing by Joe Bavier)

No comments:

Post a Comment