Indian Coast Guard Busts Three Iran-Linked Shadow Fleet Tankers

On Friday, the Indian Coast Guard busted three sanctioned tankers allegedly engaged in a "smuggling racket" in the Arabian Sea.

The agency identified and followed the three ships using surveillance and data analysis. Based on this information, it launched a coordinated raid and interdicted the three ships at a position about 100 nautical miles to the west of Mumbai - outside of Indian territorial seas and the ICG's coastal-state jurisdiction.

ICG personnel boarded the three ships on the high seas and conducted "sustained rummaging" to look for evidence. Further examination of electronic data and interrogation of the crew produced clues on the ship's "modus operandi and a global handler network," the ICG said.

The vessels in question are all under U.S. sanctions, according to TankerTrackers.com. The consultancy identified them as Al Jafzia (IMO 9171498; ex name Chiltern, broadcasting a Nicaraguan flag, formerly false-flagged in Guyana), Asphalt Star (IMO 9463528; falsely broadcasting a Malian flag, formerly false-flagged in Aruba) and Stellar Ruby (IMO 9555199; flagged in Iran).

AIS data provided by Pole Star Global shows the vessels performed an intricate pattern of voyages and meet-ups that connected known transfer regions for Iranian petroleum - the anchorage areas off Basrah and Khor Fakkan - with ports on India's west coast. Widespread AIS spoofing in the Iranian oil trade allows vessels to engage in Iran-linked activity while appearing to be on ordinary commercial voyages to other nearby nations.

All three ships are on the Treasury OFAC Iran sanctions list under EO 13902, and are believed to be linked to the network of sanctioned Indian national Jugwinder Singh Brar. According to the Treasury, Brar is a captain and shipowner who has a fleet of about 30 vessels, many operating in the Iran-linked shadow fleet. These ships engage in STS transfers to move Iranian petroleum from the Mideast to foreign buyers, concealing and falsifying its origins.

“The Iranian regime relies on its network of unscrupulous shippers and brokers like Brar and his companies to enable its oil sales and finance its destabilizing activities,” said Secretary of the Treasury Scott Bessent. “The United States remains focused on disrupting all elements of Iran’s oil exports, particularly those who seek to profit from this trade.”

As of Sunday, AIS data showed all three seized vessels in convoy and moving together towards a port on India's west coast.

Op-Ed: Iran Plays for Time, But U.S. Response Options Are Ready

Iran has a standard playbook when dealing with a foreign policy crisis, a playbook that used to work well until its adversaries figured it out. The playbook involves portraying the political leadership in Tehran as split between hardliners adopting a maximalist, no-concession position and ‘reformists’ who say that they are in favor of negotiations and talk vaguely of possible compromises.

The trick is to lure the other side into negotiations, and string them out as long as possible, keeping alive the idea that an agreement could be possible. By prolonging the process, the Iranians hope the other side will grow weary and soften their demands – with the Iranian side making only marginal concessions and banking on the crisis dissipating as the world’s attention moves on.

These Iranian tactics are fully on display in the latest crisis, although the ‘reformist’ mask slipped recently when the supposedly reasonable President Masoud Pezeshkian re-appointed extreme hardliner retired Admiral Ali Shamkhani to the position of National Security Adviser. The IRGC hardliners have been threatening to use their ballistic missile fleet in retaliation, including to attack infrastructure targets in neighboring countries. The ‘reformists’ suggest Iran might make concessions on nuclear materials, but on nothing else, and want a complete lifting of sanctions in return. Domestically, the hardline rhetoric is played up, the ‘reformist’ messaging packaged primarily for foreign consumption.

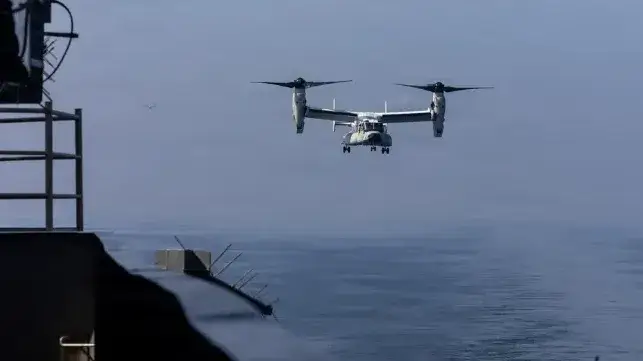

After the first round of negotiations in Muscat last week, the Americans made it clear that they wanted a comprehensive deal, covering regional expansionism, the ballistic missile fleet, and an end to repression, regarding nuclear material almost as an irrelevant side issue now that most of Iran’s stock has already been neutralized. The American delegation reinforced the point by visiting the USS Abraham Lincoln off Duqm once the negotiations had closed, to emphasize that the military option was still very much on the table.

US discussions with Israel, with President Trump meeting Prime Minister Netanyahu at the White House on February 11, further reinforce the feasibility and possibility of military options.

The rash recently of Iranian-associated dark fleet tanker seizures, both by the United States and allies, is another indicator of robust and coordinated intent.

Iranian threats of ‘massive retaliation’, made by a series of retired generals, do not appear credible. Iranian defenses were severely degraded last year, and neither Russia nor China are rushing to help rebuild and replace. Moreover, any Iranian attack on the Gulf states, given that they have forbidden US attacks from bases on their territory, would invite a very substantial Emirati-Saudi response. Both have powerful, well-equipped and battle-tested air forces.

Pundits have looked at the current American force posture in the region. It is still small in comparison with last year. But this forgets the long-range capability that the United States can deploy. What the United States has done is enhance defensive measures within the region, both in terms of dispersal of assets and air defenses, which gives breathing space for whatever strike assets are needed for a scale-up of offensive capability flying in from US bases, should the need arise.

Not too busy: a US Navy P-8 and 2 x C-130s on the South Pan at Diego Garcia, February 4 (Sentinel-2)

The move of the USS Abraham Lincoln carrier strike group and other US assets into theater is a small but powerful reinforcement, sufficient for a number of offensive options. Interestingly, the United Kingdom has moved both additional air defense and strike aircraft into the region, broadening the profile of the offensive options. On January 31, the Astute Class attack submarine HMS Anson (S124) passed south through the Suez Canal en route to Australia, having loaded Tomahawk missiles in Gibraltar, and could now be somewhere in a vast area of the Indian Ocean from which any target in Iran could be attacked.

All options are very much on the table, without any further indicators or warnings.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

No comments:

Post a Comment