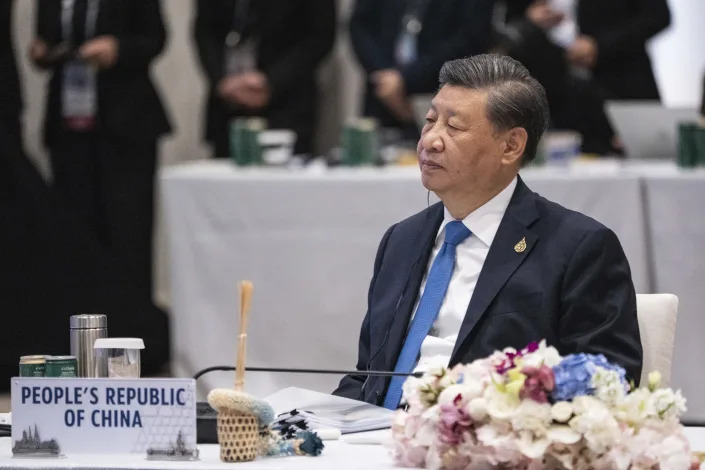

In this Nov. 6, 2015 file photo, TC Energy's Keystone pipeline facility is seen in Hardisty, Alberta. The U.S. government took a step toward approving expanding the capacity of a natural gas pipeline in the Pacific Northwest — a move opposed by environmentalists and the attorneys general of Oregon, California and Washington state. The Federal Energy Regulatory Commission, or FERC, announced Friday, Nov. 18, 2022 that it has completed an environmental impact statement that concluded the project "would result in limited adverse impacts on the environment.”

SALEM, Ore. (AP) — The U.S. government has taken a step toward approving the expansion of a natural gas pipeline in the Pacific Northwest — a move opposed by environmentalists and the attorneys general of Oregon, California and Washington state.

The Federal Energy Regulatory Commission, or FERC, announced Friday it has completed an environmental impact statement that concluded the project "would result in limited adverse impacts on the environment.”

“Most adverse environmental impacts would be temporary or short-term,” the federal agency said.

A grassroots coalition of environmental groups said the analysis conflicts with climate goals of Pacific Northwest states and fails "to address upstream methane emissions from the harmful practice of fracking.”

The Gas Transmission Northwest pipeline belongs to TC Energy of Calgary, Canada - the same company behind the now-abandoned Keystone XL crude oil pipeline.

Gas Transmission Northwest proposes to modify three existing compressor stations along the pipeline — in Kootenai County, Idaho; Walla Walla County, Washington; and Sherman County, Oregon — to boost capacity by about 150 million cubic feet per day of natural gas. The company says the project is necessary to meet consumer demand.

The 1,377-mile (2,216-kilomter) pipeline runs from the Canadian border, through a corner of Idaho, and into Washington state and Oregon, connecting with a pipeline going into California.

In August, the attorneys general of Oregon, Washington state and California asked the FERC to deny the proposal, saying the expansion is expected to result in more than 3.24 million metric tons of greenhouse gas emissions per year, including methane and carbon dioxide.

“This project undermines Washington state’s efforts to fight climate change,” Washington state Attorney General Ferguson said back then. “This pipeline is bad for the environment and bad for consumers.”

The grassroots coalition said the federal study didn’t adequately address harmful impacts on the climate caused by the project, including by fracking to obtain the natural gas. The energy industry uses the technique to extract oil and gas from rock by injecting high-pressure mixtures of water, sand or gravel and chemicals. But the technique increases emissions of methane, an extraordinarily potent greenhouse gas.

“FERC’s approach will worsen the climate crisis, downplaying the impacts of a proposal that will pollute our communities, impact health and safety, and create millions of tons of climate-changing pollution each year,” said Lauren Goldberg, executive director of Columbia Riverkeeper, an environmental group based in Hood River, Oregon.

The regulatory commission’s study noted that its staff was unable to assess the project’s contribution to greenhouse gases “through any objective analysis.”

“Climate change is a global concern,” the federal study said. “However, for this analysis, we will focus on the existing and potential cumulative climate change impacts in the project area.”

TC Energy said Saturday that it is reviewing the environmental impact statement, which recommended a few mitigation measures.

The company has “secured long-term agreements with customers for 100% of the project capacity,” TC Energy said in an email. “This further demonstrates the need for secure energy to supplement renewables as we work toward a cleaner energy future.”

FERC is expected to make its final decision on the proposal on Feb. 16, the environmental coalition said.