Bill Ackman and Elon Musk called DEI 'racist' but companies need it to succeed, experts say

Tim Paradis,Josée Rose

Sat, 6 January 2024

Bill Ackman and Elon Musk.David A. Grogan, Slaven Vlasic/Getty Images

Billionaires and business leaders are arguing over whether DEI efforts should exist.

Investor Bill Ackman and Elon Musk say diversity, equity, and inclusion programs are "racist."

Corporate DEI efforts might evolve, experts told BI, but they're not likely to go away.

It's the abbreviation that has some billionaire bigwigs pretty worked up — and it's not AI.

The talk about DEI — diversity, equity, and inclusion — isn't about how to jumpstart efforts that once seemed almost universally lauded. It's about what's next for these programs following attacks on DEI by several high-wattage names in business.

Billionaire investor Bill Ackman, who became a vocal critic of how Harvard handled antisemitic rhetoric on campus, is now targeting DEI. In a post on X this week following the resignation of Harvard President Claudine Gay, Ackman said he believes DEI is "the root cause of antisemitism at Harvard," his alma mater.

The debate didn't end there. Elon Musk went after fellow billionaire Mark Cuban for his support of DEI efforts. Cuban, in a post on X, wrote that "there are people of various races, ethnicities, orientation, etc that are regularly excluded from hiring consideration." Musk replied that DEI was "just another word for racism."

The billionaire brawls over DEI signal that a focus on diversity — from academia to the corporate world — will further shift gears in 2024: Many of the efforts will stick around though some might evolve, experts told Business Insider.

"I don't think the work is going to stop," Joelle Emerson, cofounder and CEO of the DEI advisory firm Paradigm, told BI. "When I'm talking with boards and C-suite teams, I'm not hearing conversations around 'Oh, should we/shouldn't we.' I'm hearing conversations around how do we navigate the distraction that is this external kind of conversation?"

Part of the reason DEI efforts might change is practical. There are fewer people to carry out the work following layoffs in DEI departments over the past year or so. More than one in three people who started a role related to diversity following the 2020 killing of George Floyd, which touched off widespread social-justice protests and drew attention to DEI work, have left the field, according to research by data provider Live Data Technologies.

Another reason why changes to companies' DEI programs are likely is because the business world goes through cycles of enthusiasm for various topics, Jeffrey Sonnenfeld, senior associate dean for leadership studies at Yale School of Management, told BI. The current focus is artificial intelligence, so it's little surprise, he said, that there's less attention on DEI at many companies.

And, in the case of the attacks on Harvard, Sonnenfeld said communication failures by the university's governing board left an opening for critics of Gay to make the issue about DEI rather than her testimony before Congress over hate speech on campus and on subsequent accusations of plagiarism in some of her work.

"They left a vacuum there for people to fill with this stuff — with this DEI explanation. And what does that do?" Sonnenfeld said. "It horribly discredits some of the finest educators this country has."

DEI backlash grew after the Supreme Court's ruling

The latest attacks on DEI follow the Supreme Court's decision in June that effectively struck down the use of affirmative action in college admissions. Some schools had relied on affirmative action to consider race when deciding whom to admit.

That decision, which appeared to embolden conservative critics of the practice, also left some in the corporate world undeterred when it comes to diversity. In a survey of 400 C-suite and HR leaders in the weeks after the court's decision, the executive search firm Bridge Partners found that 96% of business leaders described DEI programs as being "very or somewhat important" to their organization.

Sonnenfeld, who's also the founder of Yale's Chief Executive Leadership Institute, said companies have been implementing DEI programs because they believe they're good for the bottom line. Research from McKinsey, for example, shows diverse and inclusive companies tend to be more profitable. They also file more patents and show greater innovation, research has shown.

"Having a better representation in your leadership of your workforce, and having a better representation of your owners, your customers, and your communities in your leadership is seen as a huge plus by 95% of corporate America," Sonnenfeld said.

DEI can be good for business

Sonnenfeld said it's unlikely CEOs will retreat from their efforts around diversity even if some of the work becomes the target of critics. "I don't know of any CEOs that are shrinking for fear of being called out," he said.

Kedra Newsom Reeves, a managing director and partner at Boston Consulting Group, told BI that equity and inclusion efforts can drive tangible results for a business. These include boosting innovation, increasing access to customer markets, and improving employee performance.

She explained BCG advises companies to think about using "an equitable, inclusive strategy to drive your own competitive advantage and performance in a way that's beneficial to you as an organization because you do have a fiduciary duty to your shareholders and beneficial from a social perspective as well," she said.

That idea of fiduciary duty is one some critics of DEI efforts are exploring as they make the case that companies' considerations of workers' backgrounds have meant talented workers were excluded. That, they argue, could sideline the best and therefore put shareholders at risk.

And there are signs that some companies are pulling back from their work around diversity, in some cases because there are indicators it's not been all that effective.

Emerson said some of the corporate conversations around DEI early on were performative because leaders didn't want to be called out for not addressing the issues. Having separate teams of DEI experts might not have been as effective when other teams were left to make decisions around things like hiring. Instead, she said, the work of ensuring various voices are included needs to be handled across teams.

"I hope we're going to move away from the trend of this being sort of a flashy topic that sits on its own as sort of a check-the-box," Emerson said.

Newsom Reeves said BCG encourages its clients to think less about organizational diversity targets and focus on outcomes.

Despite the rhetorical heat on DEI, she said, many companies that are still pursuing their diversity initiatives are looking at metrics like how to boost employee retention and drive revenue. "It is not simply DEI for DEI's sake," Newsom Reeves said. "It's really about how do we drive impact as companies."

The debates about DEI following the fights at Harvard are regrettable, Sonnenfeld said, because they miss the point over why Gay was forced to resign — the handling of her Congressional testimony and the allegations of plagiarism.

"Making her a poster child of DEI issues — that's exploiting her. This poor person, this professional who had some tragic missteps, should not become an ideological political football for people on different sides of the political spectrum. That wasn't the issue here," he said.

Royal Navy advertises on LinkedIn to hire nuclear Rear-Admiral

Danielle Sheridan

Fri, 5 January 2024

Defence sources told The Telegraph they hoped to attract a retired officer who commanded a submarine during their naval career - DFID/Alamy Stock Photo

The Royal Navy has been forced to use LinkedIn to advertise for a Rear-Admiral to be responsible for the nation’s nuclear deterrent amid a growing recruitment crisis.

No serving sailors are suitable to replace Rear-Admiral Simon Asquith, the current Director of Submarines, and the Navy has turned to the professional networking site to find his successor.

Defence sources told The Telegraph they hoped to attract a retired officer who commanded a submarine during their naval career to the £150,000-a-year, two-star position.

The advertisement says candidates must be a member of the reserves or have previously served in the regular forces and, if chosen, will be responsible for “highly classified stealth, elite operations and Trident, our nuclear deterrent”.

It comes a day after The Telegraph revealed that the Navy has so few sailors that it has to decommission two warships to man its its new class of frigates.

HMS Westminster and HMS Argyll will be decommissioned this year so crews can be transferred to new Type 26 frigates expected to come into service from 2028.

Grant Shapps, the Defence Secretary, has also put forward plans to scale back the use of two amphibious assault ships, HMS Albion and HMS Bulwark, so that they remain at a state of extended readiness. The Telegraph understands that neither assault ship will be decommissioned and that crew will remain on board.

While it is not unusual for the Navy to recruit through Linkedin, the role is its highest ranking position to have been advertised on the platform.

The Rear-Admiral position is the sixth promotion an officer can reach – two away from being made Admiral, the highest rank in the Navy.

“It’s an initiative we are introducing across all ranks,” a source said of the advert, which was first reported by The Times. “It gives people the flexibility and allows us to take advantage of skills acquired in the civilian sector.”

Last year, Rishi Sunak announced plans to make it easier for military personnel to “zigzag” between the Armed Forces and the Civil Service in order to retain top talent.

It comes as the Armed Forces experience a significant recruitment crisis, with the Navy having suffered a collapse in the flow of new recruits into the service.

In the 12 months to March, MoD figures showed that the Navy, which has 29,000 full-time recruits, performed the worst out of the three services for recruitment.

Tom Sharpe, a former Navy commander, said: “In an ideal world, the Royal Navy would select from within – but we’re not in one, so throwing the net a little wider for this role makes some sense to me.”

A Royal Navy spokesman said: “It would be inappropriate to comment ahead of any appointment being made.”

Asked about plans to mothball HMS Albion and HMS Bulwark, a Royal Navy spokesman said: “The Ministry of Defence is committed to ensuring that the Navy has the capabilities it needs to meet current and future operational requirements.”

Calling all guitar heroes, The Smashing Pumpkins are hiring

AFP

Fri, 5 January 2024

Billy Corgan and James Iha of The Smashing Pumpkins perform at Irving Plaza in September 2022 in New York (Theo Wargo)

Could you be the next member of The Smashing Pumpkins?

The influential alt rockers who achieved 1990s fame with hits including "Cherub Rock" and "Tonight, Tonight" are seeking an additional guitarist -- and welcoming resumes.

"The application process is open to anyone who might be interested," the band wrote on X Friday, inviting potential candidates to send their CVs and "related material."

Jeff Schroeder had played with the band's most recent iteration from 2007 until 2023, when he announced his departure.

Originally formed in the late 1980s in Chicago, The Smashing Pumpkins gained acclaim for their brand of metal fused with dreamier pop sounds, catapulting to commercial success and becoming a Gen X touchstone band until their breakup in 2000.

Founding member, primary songwriter and front man Billy Corgan rebooted the band in 2006.

Along with Corgan two of the original members, guitarist James Iha and drummer Jimmy Chamberlin, rejoined over the past decade.

And now, with the departure of Schroeder, the rockers are looking to round out their sound with a fourth ahead of a European tour with Weezer set to launch June 7 in Birmingham, England.

Later in the summer they -- and you? -- will join the Saviors stadium tour with Green Day, Rancid and Linda Lindas, which is slated to begin July 29.

mdo/bfm

UK

Fresh by-election nightmare for Rishi Sunak as Tory MP vows to quit over oil drilling law

Jacob Phillips

Fri, 5 January 2024

Former energy minister Chris Skidmore (PA Archive)

Rishi Sunak’s Government was plunged into fresh crisis on Friday as a Tory MP vowed to stand down "as soon as possible" over new legislation he argues “clearly promotes the production of new oil and gas”.

As the Prime Minister tried to kick start a Tory New Year recovery, he was hit by a bombshell announcement from former energy minister Chris Skidmore.

It means the Tories will have to defend two seats which could easily swing to Labour in upcoming by-elections.

Mr Skidmore, who said he will resign the Conservative whip, launched a scathing attack on Mr Sunak’s green credentials which have already been heavily criticised by former environment minister Lord Goldsmith.

A by-election will be held in his Kingswood constituency in Gloucestershire, providing another headache for Rishi Sunak.

The Tories are already gearing up for a by-election in Wellingborough after disgraced MP Peter Bone was unseated by voters in a recall petition.

Mr Skidmore, who led a Government review of net zero, said the "future will judge harshly" anyone who backs the Offshore Petroleum Licensing Bill due before the Commons on Monday.

In a lengthy statement posted on X, formerly Twitter, he said the bill "would in effect allow more frequent new oil and gas licences and the increased production of new fossil fuels in the North Sea".

The politician has previously opposed the bill and said he did not vote in the King's Speech debate to protest it being in the Government's legislative programme.

The former minister said: "As the former energy minister who signed the UK's net zero commitment by 2050 into law, I cannot vote for a Bill that clearly promotes the production of new oil and gas."

He went on: "To fail to act, rather than merely speak out, is to tolerate a status quo that cannot be sustained. I am therefore resigning my party whip and instead intend to be free from any party-political allegiance."

Mr Skidmore added that his decision to resign the whip meant his constituents "deserve the right to elect a new Member of Parliament".

He said: "I therefore will be standing down from Parliament as soon as possible."

He confirmed to the PA news agency that he would quit "next week when Parliament is back", with the Commons still on its Christmas recess until Monday.

Responding to Mr Skidmore's post Lord Goldsmith wrote on X: "Well said Chris Skidmore the party will need to regroup after Sunak has crashed it against the rocks.

"Those who see themselves as part of that future should think very carefully about backing this nonsense policy."

Reacting to the news about Mr Skidmore's resignation Green Party co-leader Carla Denyer said: "As the world burns, the Tories turn in on themselves.

"The Government's green credentials are truly in tatters. The climate crisis is here and now and being experienced by people across the country, but the Prime Minister can't hold on to anyone who has any good intentions toward the environment."

Tory MP Chris Skidmore to quit over bill 'that promotes production of new oil and gas'

Sky News

Updated Fri, 5 January 2024

A former energy minister has said he will quit as a Conservative MP over new legislation "that promotes the production of new oil and gas".

Chris Skidmore has said he will resign when parliament returns next week over the Offshore Petroleum Licensing Bill.

The senior Tory had already announced his intention to stand down at the next general election, but bringing this forward will trigger a by-election in his Kingswood constituency in Gloucestershire.

That seat is being abolished at the election in constituency boundary changes, meaning whoever takes his place could be an MP only for a matter of months, with Rishi Sunak expected to go to the polls in the second half of this year.

Announcing his decision on social media, Mr Skidmore said: "The bill would in effect allow more frequent new oil and gas licences and the increased production of new fossil fuels in the North Sea.

"I can no longer stand by. The climate crisis that we face is too important to politicise or to ignore."

The Offshore Petroleum Licensing Bill will allow oil and gas companies to bid for new licences to drill for fossil fuels every year.

The government argues it is important for domestic energy production but it has been widely criticised by climate groups.

Mr Skidmore, who has been critical of his party's green record before, warned MPs who vote for the legislation that the future will judge them "harshly".

He said: "It is a tragedy that the UK has been allowed to lose its climate leadership, at a time when our businesses, industries, universities and civil society organisations are providing first-class leadership and expertise to so many across the world, inspiring change for the better.

"I cannot vote for the bill next week. The future will judge harshly those that do.

Read More:

When could the next general election be - and what factors will influence Rishi Sunak's decision?

"At a time when we should be committing to more climate action, we simply do not have any more time to waste promoting the future production of fossil fuels that is the ultimate cause of the environmental crisis that we are facing."

Mr Skidmore said he would resign the Conservative whip to make him an independent and quit as an MP "as soon as possible".

He confirmed to the PA news agency that he would quit "next week when Parliament is back", with the Commons still on its Christmas recess until Monday.

By-election headache

Mr Skidmore has been an MP since the Conservatives came to power in 2010. He has been a leading voice in the Tory party on climate issues and as energy minister under Boris Johnson, led the government's review into Net Zero.

He has held Kingswood since 2010, beating second-placed Labour by 11,220 votes at the last general election.

That margin is far smaller than in the last two by-election upsets Labour handed to the Tories, when a 24,664-vote majority was overturned in Mid Bedfordshire and 19,634 in Tamworth.

Sunak faces new by-election nightmare as senior Tory MP Chris Skidmore quits in net zero row

Adam Forrest

Fri, 5 January 2024

Rishi Sunak has been hit with another by-election as a senior Tory MP quits the party and his seat in protest over the PM’s climate failures.

Chris Skidmore – the former net zero tsar and former energy minister – has said he will resign the Conservative whip and stand down as an MP next week.

In a scathing exit statement he said he could no longer continue as a Tory or “condone” the government because the PM’s environmental stance is “wrong and will cause future harm”.

The MP for Kingswood, in Gloucestershire, said resigning the whip meant his constituents “deserve the right” to elect a new MP in a by-election. “I therefore will be standing down from parliament as soon as possible.”

Despite a Tory majority of 11,000, the struggle to hold off Labour will be a potentially demoralising struggle for Mr Sunak, as he seeks to build some momentum ahead of the 2024 general election.

Mr Skidmore later said that he would quit when the Commons returns from Christmas recess on Monday – setting up a contest in the blue wall seat in February or March.

While the area has been fertile ground for the Lib Dems, Labour came second in the seat in 2019 – so it would seem to provide Sir Keir Starmer’s party with an ideal opportunity to deliver a fresh blow to Mr Sunak.

The Conservatives lost a string of by-elections in 2023, with Labour overturning big majorities in Mid-Bedfordshire, Tamworth and Selby and Ainsty.

And the battle for Mr Skidmore’s seat is one of three by-elections the Tory party could lose in the early months of 2024.

Peter Bone’s Wellingborough seat will soon see a contest after the Tory MP was removed in a recall petition following his suspension for upheld sexual misconduct claims.

And Scott Benton’s Blackpool South seat could also be up for grabs after his 35-day suspension over a sting which exposed him offering to lobby for gambling investors.

Mr Sunak’s proposed energy bill – to be introduced in the Commons next week – will allow new fossil fuel extraction licences in the North Sea.

The bill would mandate that licences for oil and gas projects in the North Sea are awarded annually, and was seen as a challenge to Labour, which said it would ban new exploration licences to focus on renewables.

In a statement posted on X Mr Skidmore said: “As the former energy minister who signed the UK’s net zero commitment by 2050 into law, I cannot vote for a bill that clearly promotes the production of new oil and gas.

“To fail to act, rather than merely speak out, is to tolerate a status quo that cannot be sustained. I am therefore resigning my party whip and instead intend to be free from any party-political allegiance.”

Labour’s campaign leader Pat McFadden said Mr Skidmore’s exit showed that Mr Sunak was “too weak” to lead his party or the country for much longer. The Lib Dems called his exit an “embarrassing mess” which showed a government in chaos.

Rishi Sunak with King Charles at the Cop28 summit in Dubai (PA)

The PM was heavily criticised by campaigners, opponents and green Tories over his July announcement of around 100 new oil and gas licences. Mr Skidmore said the move was the “wrong decision at precisely the wrong time”.

Mr Sunak also faced a backlash from Tory environmentalists after backtracking on more key government climate pledges to reach net zero in September.

In the wake of a surprise by-election victory in Uxbridge over the London mayor’s Ulez charging scheme, the Tory leader also attacked climate “zealots” and said he was on the side of motorists.

The PM then announced that the 2030 ban on the sale of petrol and diesel cars – and gas boilers – would be pushed back to 2035.

Former minister Zac Goldsmith – who quit in June with a swipe at Mr Sunak’s “apathy” toward climate change – said the moves were reprehensible and had “destroyed UK credibility on climate change”.

Boris Johnson also condemned his successor – warning that Mr Sunak was in danger of losing “ambition for this country”, and arguing that businesses were desperate for clear net zero commitments.

Mr Sunak was also accused of “shrinking and retreating” on the climate crisis at the Cop28 summit, as he was condemned for spending more time flying to Dubai than at the conference itself.

The PM insisted that the UK government can still “stand tall” and remain a leader on climate change – despite his own rollback of net zero ambitions at home.

Buyers Shun Argentina Reconstruction Bonds for Second-Straight Week

Ignacio Olivera Doll and Kevin Simauchi

Thu, January 4, 2024

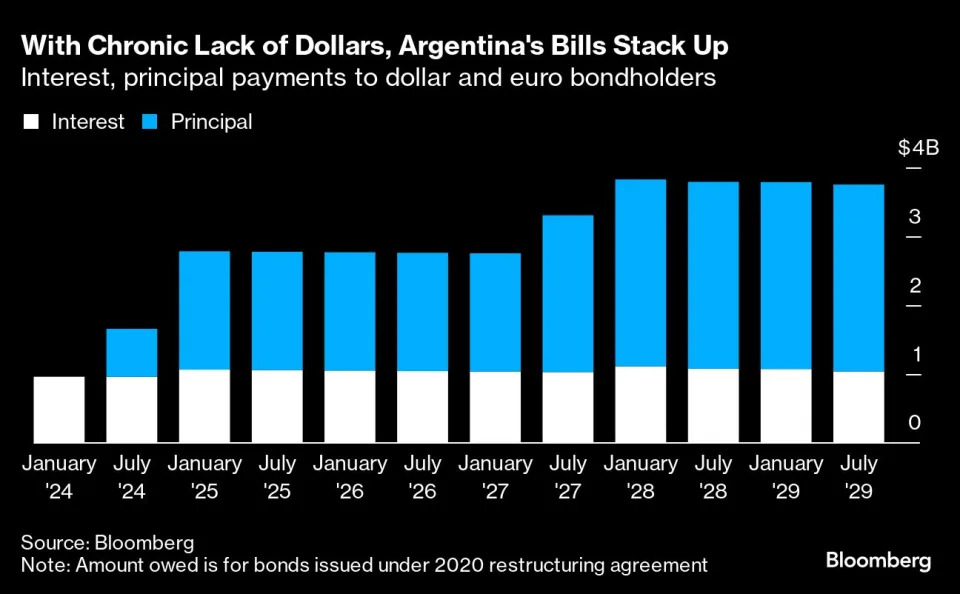

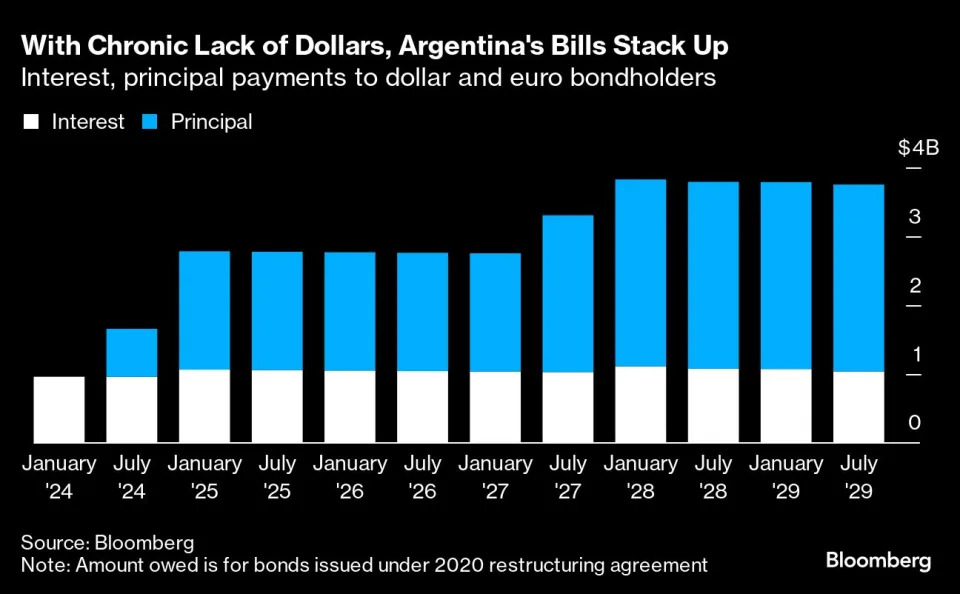

(Bloomberg) -- The Argentine Central Bank’s second auction to pay down importers’ debts owed to suppliers abroad saw another batch of disappointing results on Thursday.

The bank said it sold just $57 million out of a maximum of $750 million of notes available. The fresh setback for the government of Javier Milei — reported by Bloomberg earlier on Thursday — follows a similar flop last week, when the auction saw sales of just $68 million of the $750 million offered.

The bonds — which importers can buy and resell in the secondary market to other investors in exchange for US dollars — are key to helping importers settle some $30 billion owed to suppliers abroad and improving the central bank’s balance sheet. The sales are also meant to help Milei wrestle a chronic dollar shortage and strict capital controls, both of which have bottlenecked trade.

Since taking office in December, Milei has announced a swath of measures to pull Argentina’s economy back from the brink of its sixth recession in a decade. The “shock therapy” package included devaluing the peso by more than 50%, along with massive cuts to government spending.

The sales — which are seen as key for Argentina to eventually unify its different exchange rates — also come as the government has about $1 billion in interest payments to bondholders due next week.

The dollar-denominated importer notes are called “Bopreal” — which stands for “bonds for the reconstruction of a free Argentina” — and offer a 5% annual interest rate. They can be bought in local currency, which in turn would help the central bank absorb some pesos in the economy in a bid to ease annual inflation expected to exceed 220% in December.

Bloomberg Businessweek

WORKERS CAPITAL

Calstrs Seeks to Borrow More Than $30 Billion to Manage Cash

Eliyahu Kamisher

Thu, January 4, 2024

(Bloomberg) -- The California State Teachers’ Retirement System, the country’s second-largest pension fund, may borrow more than $30 billion to help it maintain liquidity without having to sell assets at fire-sale prices, according to a new policy its investment committee will consider this month

If approved, the policy will allow staff to borrow as much as 10% of the roughly $318 billion portfolio. The proposal calls for leverage to be used “on a temporary basis to fulfill cash flow needs in circumstances when it is disadvantageous to sell assets,” a Calstrs policy document said.

Calstrs board members will review a first draft of the policy at its Jan. 11 meeting. A representative for the pension declined to comment.

The California Public Employees’ Retirement System board approved adding 5% leverage in 2021, adopting an investment strategy that could enhance returns but potentially increases the risk of losses during market downturns.

Meketa Investment Group, a Calstrs consultant, said increased leverage poses minimal risk to the fund. Calstrs already leverages 4% of its portfolio, and the new policy would not create a new asset allocation policy. Instead leverage would be used to smooth cash flow and as an “intermittent tool” to manage the portfolio, Meketa said in a board document.

Calstrs is also planning to open a satellite investment office in San Francisco to help attract and retain talent outside of its West Sacramento headquarters. The 5,000-square-foot office will initially house 12 members of the investment team and could accommodate as many as 35 people over the next five years.

“A San Francisco office will not only help to recruit new talent, but it will also help retain current talent by shortening long commute times for staff residing in the greater Bay Area,” Calstrs said.

The pension fund has an annualized return of 7.2% over the past five years, exceeding its 7% return target. In the 2022-2023 fiscal year Calstrs posted a 6.3% net return.

Most Read from Bloomberg Businessweek

Distressed Builder Puts Korea on Edge Again as Risk Mounts

Finbarr Flynn, Heejin Kim and Whanwoong Choi

Fri, January 5, 2024

(Bloomberg) -- South Korea is again in damage control mode, seeking to contain fallout from a construction firm’s debt woes that risk replicating replicating a recent credit crunch.

In the cross-hairs this time is Taeyoung Engineering & Construction, which shocked markets late last month with a request to reschedule payment terms for project financing loans. These securities were also the source of two earlier episodes of stress, including one triggered by the default of the developer of the Legoland theme park in 2022 that snowballed into the worst meltdown in the country’s credit market since the global financial crisis.

The proposal of Taeyoung, whose projects include a baseball stadium, amusement parks and buildings in Seoul, caused a selloff in bank and developer stocks. Its won-denominated bond due in July plunged to about 62% of its par value from 97% on Dec. 26, according to Bloomberg-compiled data.

Investors’ unease came even as Korean officials pledged to step up a $66 billion program to stabilize markets if needed, with the country’s finance minister vowing authorities “will make every effort” to limit the spillover. On Friday, Taeyoung’s creditors expressed disappointment after a meeting to discuss its restructuring request and characterized its leverage as excessive.

Taeyoung’s payment struggle is the latest example of the side effects of global central banks’ aggressive monetary tightening that has worsened a housing slump in countries including Korea. It’s also a reminder of the risk from some local lenders’ undue reliance on property-related loans as a source of profit.

Founded in 1973, Taeyoung secured 400 billion won ($304 million) of fresh funds when its holding company sold bonds in a deal with KKR & Co. last year and then in December, it said it would sell a stake in Pocheon Power Co. for 42 billion won to secure liquidity. A spokesperson for KKR declined to comment.

The construction firm is more exposed than others in the sector to project financing liabilities. With the company in the throes of a liquidity crisis, the 90-year-old founder Yoon Se-Young has returned to try to save the company, meeting with creditors earlier this week.

Taeyoung should submit a self-rescue plan this week and creditors will decide by Jan. 11 whether to begin restructuring procedures, Lee Bokhyun, governor of the Financial Supervisory Service, a market watchdog, said at a briefing Thursday. The FSS has a contingency plan to stabilize financial markets, if needed, he said.

“The incident will dent market sentiment in the short-term capital market and the real-estate financing market,” Lee Kyoung-rok, an analyst at Shinyoung Securities Co., wrote in a note. While the worst-case scenario would be the “spreading of a crisis in Taeyoung into other builders and causing a liquidity risk at banks,” Lee expects regulators to stop that from occurring.

Taeyoung’s top creditor Korea Development Bank has urged the builder to present a way forward so as to win enough support for rescheduling its debt. As the construction firm applies for a debt workout, all of its liabilities will be frozen, KDB said in a statement. Once the restructuring begins, creditors should negotiate with each other on how individual loans should be handled, it added.

The construction firm’s debt woes are reminiscent of the financial stress caused by a theme-park developer’s default in late 2022 on the same type of short-term loan, which later snowballed into the worst meltdown in the country’s credit market since the global financial crisis. The chaos at that time forced the government to unleash an array of rescue measures to calm markets.

Policymakers had to step in again last year when the branch of one of Korea’s biggest credit unions was shut after reporting a 60 billion won loss on such loans, prompting authorities to set aside more than $100 billion worth of rescue funds.

--With assistance from Daedo Kim, Shinhye Kang and Abhishek Vishnoi.

Bloomberg Businessweek

Bayer Investor Harris Sees Potential in Breakup of German Conglomerate

Tim Loh

Fri, January 5, 2024

(Bloomberg) -- Bayer AG is facing renewed calls for a breakup, with a top investor urging Chief Executive Officer Bill Anderson to reshape the unwieldy German conglomerate and unlock “huge potential” from its three main units.

Bayer’s three divisions — dedicated to crop science, pharma and consumer health — are all “good businesses,” but they probably don’t belong under one roof, according to David Herro, portfolio manager at Harris Associates LP, which owns a roughly 4% stake. Anderson needs to lay out a better ownership plan by Bayer’s capital markets day in early March, Herro said.

“Do I believe that the current structure is anywhere near where it should be? Absolutely not,” Herro said in an interview Friday. “I’m sure there is a way to extract value, and large sums of it, by corporate rearranging — both on the micro and the macro.”

Harris is one of the top five investors in Bayer, which has lost more than 60% of its market value since its $63 billion takeover of herbicide and seeds maker Monsanto in 2018. Ex-Bayer CEO Werner Baumann spearheaded that deal just weeks into his own tenure.

Baumann overpaid for Monsanto and did a poor job of integrating the company, Herro said. The former CEO also should have found a better strategy early on to stanch a flood of litigation over the weedkiller Roundup, the portfolio manager said.

Roche Veteran

Harris probably would have sold its stake in Bayer by now if the company hadn’t replaced Baumann last year, Herro said. Now, he sees reason for optimism under Anderson, a Texas native who was previously head of Roche Holding AG’s pharma division and took over at Bayer in June. Since then, the new chief has pushed for cultural change within Bayer, looking to speed up decision making, cut layers of management and empower employees who are closest to customers.

Bayer declined to comment for this story.

Anderson has said he’s weighing a breakup of Bayer, a move that could undo much of the legacy of Baumann, as he looks to focus “only on what’s essential for our mission, and getting rid of everything else.” Anderson has laid out options including selling off the consumer health unit, listing it as a separate entity or spinning it off. He’s also considering separating the crop science division.

With his pharma background, Anderson has plenty of experience shepherding experimental medicines to market. He has told investors that despite a high-profile clinical trial setback in November, the company has a lot of promising early-stage therapies in the pipeline.

“Bill makes a very good point that with patience, patience, there’s a lot of good seeds in the ground,” Herro said.

‘Solid Lid’

Herro endorsed Bayer’s pitch that its crop division’s technology will be needed to feed a growing global population on the world’s shrinking acreage of arable land. Even so, he said, the company needs to find a way to put a “solid lid” on the money it’s been paying out to US plaintiffs who have sued over the safety of products like Roundup, which Bayer insists is safe.

When Bayer explored options during a simulation in the fall, it found that any divestiture of the consumer health business would likely trigger a massive tax hit potentially jeopardizing the benefits of a deal, Bloomberg reported in November.

“If there is a big tax bill, they have to think twice about it,” Herro said. “Everything is a cost and a benefit and I think we will trust them to find the route that has the least amount of leakage.”

To some extent, the Bayer situation reminds Herro of Daimler AG before it separated into Mercedes-Benz Group AG and Daimler Truck Holding AG a couple of years back. Harris has long invested in those companies, and Herro regards the two businesses today as healthier than their joint predecessor.

Before the split, there was “so much fat and so many layers and so much waste,” Herro said. “Being kind of a conglomerate, there’s so many low-hanging fruits.”

Bloomberg Businessweek

Telecom services still too expensive, industry minister says

CBC

Thu, January 4, 2024

Toronto-based Rogers Communications said Wednesday it would hike the cost of some of its wireless plans for non-contract customers. (Patrick Morrell/CBC - image credit)

Canadians are still paying too much for telecom services, the industry minister said Thursday, one day after Rogers Communications said it was raising the cost of some of its wireless phone plans.

Rogers said Wednesday it would hike the cost of some of its wireless plans for non-contract customers. Bell is also reportedly increasing some of its existing wireless phone plan prices in February, according to a report by MobileSyrup.

"Let's be clear, while some progress has been made to lower prices, Canadians still pay too much and see too little competition," Industry Minister François-Philippe Champagne said in a statement to CBC News.

"That is why, last year, I issued a policy direction to the CRTC to make sure that competition, affordability, and consumer rights would be at the core of CRTC decisions."

Nearly two dozen "enforceable" conditions were attached to Rogers's merger with Shaw Communications, including reducing costs for customers, when Champagne announced the deal's approval in 2023.

"While prices for some wireless plans have declined by more than 22 per cent over the past year, the planned price increases to certain month-to-month plans that have recently been announced go against the direction we set at a time when Canadians are struggling to make ends meet," Champagne said Thursday.

"I strongly urge companies and carriers to seriously consider customers over profits at this time."

The long-brewing deal, first announced in March 2021, was subject to a number of regulatory hurdles as opponents expressed concerns about decreased competition.

At the time, Rogers CEO Tony Staffieri pledged in an interview that prices would go down for customers.

Bell has not responded to a request for comment.

Shoppers in disbelief as man does a naked 'cannonball' dive into Bass Pro Shop aquariumMEN AND THEIR NEED TO GET NAKED IN PUBLICRebecca RommenSat, January 6, 2024  AP/Butch DillA 42-year old man got naked and dived into a Bass Pro Shop aquarium in Alabama.He spent about five minutes in the water before police intervened.The man was arrested on multiple charges, including public lewdness.A 42-year-old man was arrested in Leeds, Alabama after diving into a Bass Pro Shop aquarium naked, according to local police, WAFF 48 News reports.The man crashed his car, disrobed, and executed a daring plunge into the store's massive aquarium on Thursday night.Leeds Police Chief Paul Irwin said the incident left shoppers in the town just outside Birmingham in disbelief.Video taken by bystanders showed the man do a "cannonball" dive into the aquarium and later stand under the waterfall, reported AL.comIrwin noted that the man spent about five minutes in the water before officers arrived on the scene.He exited the water to confront two police officers, only to dive back into the aquarium.Evedntually, the man climbed over the side of the aquarium, falling to the concrete floor below, where he appeared unconscious, said AL.com. Law enforcement swiftly apprehended him and handcuffed the naked man, who, when he regained consciousness, started to struggle with officers.He was charged with public lewdness, disorderly conduct, resisting arrest, assault on police, two counts of criminal mischief, and two counts of reckless endangerment.Police Chief Irwin said the man suffered from mental health issues, according to his family, WAFF 48 News reported.Business Insider has contacted the Leeds Alabama Police Department for comment.

AP/Butch DillA 42-year old man got naked and dived into a Bass Pro Shop aquarium in Alabama.He spent about five minutes in the water before police intervened.The man was arrested on multiple charges, including public lewdness.A 42-year-old man was arrested in Leeds, Alabama after diving into a Bass Pro Shop aquarium naked, according to local police, WAFF 48 News reports.The man crashed his car, disrobed, and executed a daring plunge into the store's massive aquarium on Thursday night.Leeds Police Chief Paul Irwin said the incident left shoppers in the town just outside Birmingham in disbelief.Video taken by bystanders showed the man do a "cannonball" dive into the aquarium and later stand under the waterfall, reported AL.comIrwin noted that the man spent about five minutes in the water before officers arrived on the scene.He exited the water to confront two police officers, only to dive back into the aquarium.Evedntually, the man climbed over the side of the aquarium, falling to the concrete floor below, where he appeared unconscious, said AL.com. Law enforcement swiftly apprehended him and handcuffed the naked man, who, when he regained consciousness, started to struggle with officers.He was charged with public lewdness, disorderly conduct, resisting arrest, assault on police, two counts of criminal mischief, and two counts of reckless endangerment.Police Chief Irwin said the man suffered from mental health issues, according to his family, WAFF 48 News reported.Business Insider has contacted the Leeds Alabama Police Department for comment.

Magnets, how do they work? Trump can't tell you.

Lloyd Lee

Sun, January 7, 2024

Violent J of Insane Clown Posse (left) and Donald Trump (right)John Lamparski/WireImage and Anna Moneymaker/Getty Images

Years ago, the Insane Clown Posse proposed a thought-provoking question: Magnets, how do they work?

Donald Trump's recent rant at an Iowa rally shows that he sadly won't be able to tell you.

Miracles, right?

"Fucking magnets, how do they work?"

The rock-rap duo Insane Clown Posse posed that very question in their "Miracles" single in 2009, as they took in the everyday wonders of life: the stars, the trees, childbirth, "long neck giraffes," and most importantly — magnets.

More than a decade later, the miracle of magnets still appears to stump some people, including Donald Trump.

At a recent rally in Mason City, Iowa, the former president went on a rant about the frailty of magnets while complaining about the Gerald R. Ford aircraft carrier.

Simply put: The ship has an electromagnetic aircraft launch system that relies on very large magnets.

"They had a $900 million cost over on these stupid electric catapults that didn't work. They had almost a billion dollar cost over on the magnetic elevators," he said. "Think of it, magnets. Now all I know about magnets is this: Give me a glass of water, let me drop it on the magnets, that's the end of the magnets."

That is, of course, not how magnets work. They work just fine underwater.

But what do scientists know?

"I don't wanna talk to a scientist. Y'all motherfuckers lying and getting me pissed," the Insane Clown Posse rap in "Miracles." Trump's comments during the pandemic and on the climate crisis suggest that he doesn't much care for scientists either.

"I don't think science knows, actually," Trump once said, refuting the idea that climate change is driving some of the wildfires in California.

The clowns and Trump may have a lot in common outside bad makeup. However, it's hard to say who's joking and who isn't.

ICP's "Miracle" and the accompanying music video became a viral internet meme in 2010 and was parodied by "Saturday Night Live."

In an interview with The New York Times, rapper Violent J clarified: "Yeah, we know how magnets work. But they're still incredible."

He later said in the interview that the "good reaction" to "Miracles," was all "planned out" for a tour.

The Insane Clown Posse did not immediately respond to a request for comment sent during the weekend.

Carrier catapult claims

But Trump has yet to say he's joking, too. The former president has repeatedly brought up his fixation with the carrier, its electromagnetic catapult system, and the bizarre claim that magnets don't function with water.

"They want to use magnets to lift up the elevators," Trump said in a July 2021 interview with a Princeton professor. "I said magnets will not work. Give me a cup of water, throw it on the magnets, you totally short out the system. They said, 'How did you know that?' I said, 'Because I know that.'"

It's unclear where Trump might have got the idea that magnets don't work underwater, but it is a common myth that results in numerous debunking articles after a simple Google search.

To his credit, however, Trump was right that the electromagnetic catapults on the aircraft carrier would be unreliable.

An oversight report released in 2019 by the Defense Department's operational test office showed that the catapult system repeatedly failed to launch and land an aircraft. In 2020, Navy officials said they were unsure what was causing the system to malfunction. And the Pentagon still appears to be working out its kinks, The Maritime Executive reported in February.

If the scientists can't figure it out, maybe magnets are a miracle after all.