Canadian government announces nuclear investments

The Government of Canada is to lend AtkinsRéalis up to CAD304 million (USD212 million) over four years to support the development of next-generation Candu reactor technology, and has also announced millions of dollars in new funding commitments and support for nuclear projects in Saskatchewan, Alberta and Ontario.

_69620_82640.jpg)

Minister of Energy and Natural Resources Jonathan Wilkinson announced that the government had entered into a preliminary agreement with AtkinsRéalis to finance up to half of the design costs of a "new, large-scale, natural uranium-fuelled Canadium deuterium nuclear reactor (e.g. Monark)" to a maximum of CAD304 million, through a loan over four years. This is to be matched by AtkinsRéalis. Atomic Energy of Canada Ltd (AECL), plant operators and the broader Canadian supply chain will also be included in the work to modernise the Candu design.

The Candu pressurised heavy water reactor design was developed from the 1950s onwards by federal Crown corporation AECL. AECL sold its reactor division to SNC-Lavalin's Candu Energy subsidiary in 2011 - along with an intellectual property licensing agreement - but still owns the intellectual property rights for the technology. AtkinsRéalis is the original equipment manufacturer of Candu technology (SNC-Lavalin Group Inc rebranded to AtkinsRéalis in 2023).

AtkinsRéalis unveiled its plans for the 1000 MW Candu Monark, a Generation III+ reactor with the highest output of any Candu technology, in November 2023. It completed the conceptual design phase in September 2024, and is in the planning stage of a vendor design review with the Canadian nuclear regulator.

Candu reactors currently operate in seven countries, and Wilkinson noted that, with their "almost entirely Canadian-made, Canadian-designed supply chain", they provide "good-paying, long-lasting, and sustainable jobs in manufacturing for Canadians" as well as being fuelled by uranium mined in Saskatchewan. "The Government of Canada is acting now to modernise Canadian-owned Candu technology, which will provide a viable, cost-effective design in support of the expansion of nuclear energy capacity in Canada and internationally,” he said.

AtkinsRéalis President and CEO Ian Edwards said the company has been the "proud steward" of Candu technology for more than a decade, and with its Candu supply chain partners has serviced, life-extended and refurbished Candu nuclear reactors on time and on budget as well as advancing the prospects for new Candu reactors. "The federal government’s decision today, to invest in the further development of Candu technology, an evolution of the proven Darlington reactor model, will enable us to continue this important work already underway with our utility partners," he said.

Jonathan Wilkinson announced the Canadian government's latest investment in Candu technology during a visit to BWXT Tecnhologies Inc's facility in Cambridge, Ontario (Image: X/@JonathanWNV)

SMR collaborations

Wilkinson also announced further funding for nuclear projects under Environment and Climate Change Canada’s Future Electricity Fund, on behalf of Minister of Environment and Climate Change Steven Guilbeault, plus a total of CAD52.4 million for various projects supporting the development and deployment of SMRs and Candu reactors and decarbonisation efforts in Saskatchewan, Alberta and Ontario under two Natural Resources Canada programmes.

The Future Electricity Fund mainly consists of proceeds collected from electricity-generating facilities which are being returned through funding agreements with provincial or territorial governments for which the federal carbon pollution pricing system for industry currently applies, or has applied in the past, to support clean electricity initiatives.

CAD55 million from the fund has been awarded to Ontario Power Generation (OPG) to support pre-development work for the Darlington New Nuclear Project, where the company plans to build up to four GE Hitachi BWRX-300 small modular reactors. Specifically, these funds are to be used for planning, site preparation, various procurements and regulatory approvals for units 2, 3 and 4 at the site. OPG signed a commercial contract for the first of the four SMR units in January 2023.

He also announced an increase to Future Electricity Fund programme funding to the Saskatchewan Government’s Crown Investments Corporation by CAD54 million to CAD80 million, to support of SMR pre-development work by SaskPower. The funding will support pre-engineering work and technical studies, environmental assessments, regulatory studies and community and Indigenous engagement.

Three projects will receive a total of CAD11.4 million under Natural Resources Canada's Enabling SMRs programme: the University of Western Ontario is to receive nearly CAD5 million to conduct a detailed study of TRISO-based used fuel properties and characteristics; Canadian Nuclear Laboratories will receive just over CAD3.5 million for a project on developing guidelines, strategies and standards for SMR deployment to support the Canadian nuclear industry; and the Saskatchewan Industrial and Mining Suppliers Association will receive CAD2.8 million for a project to evaluate the capabilities of the existing supply chain in Saskatchewan to support SMRs.

Under Natural Resources Canada's Electricity Predevelopment Program, four projects in Alberta will receive funding totalling CAD41 million, including CAD13 million to develop an assessment of the potential suitability of three locations in Alberta as potential host locations for SMR deployment and increase public and Indigenous community understanding and awareness of SMRs and nuclear power generation.

“Nuclear is an integral part of Canada’s resilient and independent energy future, and Candu technology is helping us get there - while creating good domestic jobs and supporting international Canadian energy exports," Wilkinson said.

"By advancing innovative projects like Monark reactors, this government is reinforcing our commitment to domestically sourced and processed uranium, which is creating good-paying jobs in Ontario and throughout the country. And through investments in the Darlington New Nuclear project and SMRs in Alberta, we are providing a powerful example of how public and private sectors can work together to enhance energy security; advance cutting-edge, made-in-Canada nuclear technologies; and deliver a clean and reliable energy future."

Chernobyl: Emergency work completed after drone strike on shelter

The State Emergency Service of Ukraine has said that work to tackle the smouldering fires in the insulation layers of Chernobyl's giant shelter has been completed, three weeks after it was struck by a drone. The International Atomic Energy Agency says radiation levels have remained at normal levels.

According to the State Agency of Ukraine for Exclusion Zone Management, thermal image monitoring will continue and emergency workers, including climbers, will remain on site in case they are required. It said that the next step will be analysis of the damage to the arch-shaped New Safe Confinement.

The Chernobyl nuclear power plant operators say that the drone caused a 15 square metre hole in the external cladding of the arch, with defects affecting an area of 200 square metres, with some joints and bolts also damaged.

In its most recent update, on Wednesday, the International Atomic Energy Agency said that no smouldering fires had been detected that day and that its experts had undertaken its own radiation monitoring - "to date, all monitoring results have shown that there has not been any increase in the normal range of radiation levels measured at the site nor any abnormal readings detected".

It said the IAEA team at Chernobyl had reported multiple air raid alarms over the past week.

What is the New Safe Confinement?

Chernobyl Nuclear Power Plant's unit 4 was destroyed in the April 1986 accident (you can read more about it in the World Nuclear Association's Chernobyl Accident information paper) with a shelter constructed in a matter of months to encase the damaged unit, which allowed the other units at the plant to continue operating. It still contains the molten core of the reactor and an estimated 200 tonnes of highly radioactive material.

However it was not designed for the very long-term, and so the New Safe Confinement - the largest moveable land-based structure ever built - was constructed to cover a much larger area including the original shelter. The New Safe Confinement has a span of 257 metres, a length of 162 metres, a height of 108 metres and a total weight of 36,000 tonnes and was designed for a lifetime of about 100 years. It was built nearby in two halves which were moved on specially constructed rail tracks to the current position, where it was completed in 2019.

It has two layers of internal and external cladding around the main steel structure - about 12 metres apart - with the IAEA confirming that both had been breached in the incident. The NSC was designed to allow for the eventual dismantling of the ageing makeshift shelter from 1986 and the management of radioactive waste. It is also designed to withstand temperatures ranging from -43°C to +45°C, a class-three tornado, and an earthquake with a magnitude of 6 on the Richter scale.

According to World Nuclear Association, the hermetically-sealed New Safe Confinement allows "engineers to remotely dismantle the 1986 structure that has shielded the remains of the reactor from the weather since the weeks after the accident. It will enable the eventual removal of the fuel-containing materials in the bottom of the reactor building and accommodate their characterisation, compaction, and packing for disposal. This task represents the most important step in eliminating nuclear hazard at the site - and the real start of dismantling".

The wider context

The Chernobyl nuclear power plant lies about 130 kilometres north of Ukraine's capital Kyiv, and about 20 kilometres south of the border with Belarus. A 30-kilometre exclusion zone remains around the plant, although some areas have been progressively resettled. Three other reactors at the site, which was built during Soviet times, continued to operate after the accident, with unit 3 the last one operating, until December 2000.

When Russia launched its invasion of Ukraine in February 2022 it rapidly took control of the Chernobyl plant. Its forces remained there until withdrawing on 31 March 2022 and control returned to Ukrainian personnel. The IAEA has had experts stationed at the site as the war has continued, seeking to help ensure the safety and security of the site.

IAEA teams are also in place at Ukraine's three operating nuclear power plants and the Zaporizhzhia nuclear power plant, which has been under the control of Russian forces since early March 2022.

Ukraine has blamed Russia for the drone strike, while Russia denied it was responsible and blamed Ukraine. The IAEA has not attributed blame to either side during the war, with Director General Grossi explaining in a press conference at the United Nations in April last year that this was particularly the case with drones, saying "we are not commentators. We are not political speculators or analysts, we are an international agency of inspectors. And in order to say something like that, we must have proof, indisputable evidence, that an attack, or remnants of ammunition or any other weapon, is coming from a certain place. And in this case it is simply impossible".

Orano and Energoatom sign enrichment services agreement

France's Orano has signed an agreement to supply enrichment services for Ukraine's Energoatom through to 2040.

The agreement, which guarantees a diversified supply of enrichment services for fuel for Ukraine's nuclear power plants, was signed by Nicolas Maes, CEO of Orano, pictured above left, and Petro Kotin, acting CEO of Energoatom, above right.

Maes said: "We are proud to accompany Energoatom in its development to reinforce Ukraine's energy independence. This agreement reflects our commitment to provide our customer with support and thus contribute to European energy security."

Kotin said: "Energoatom continues to strengthen Ukraine's energy security. Uranium enrichment is one of the important stages in the process of nuclear fuel production, and the agreement signed allows our state to plan a stable, bright future, relying on the operation of nuclear power plants."

Orano is in the process of extending the production capacity at its Georges Besse 2 uranium enrichment plant in France by 30% to meet growing international demand.

Ukraine has 15 reactors - including the six at Zaporizhzhia which have been under Russian military control since early March 2022 - whose combined capacity generates about half of its electricity. The country is planning expansion of its nuclear fleet and no longer uses Russian fuel.

KHNP to collaborate with Kazakhstan on uranium research

Korea Hydro & Nuclear Power has signed two agreements to collaborate with Kazakhstan on the utilisation of uranium resources dissolved in seawater and groundwater.

_19147.jpg)

The company signed memorandums of understanding with Al-Farabi National University on 3 March, and with the Institute of High Technologies (IHT) on 4 March. IHT is the research arm of Kazatomprom.

The MOUs aim to facilitate technological exchange and joint research between the two countries to identify promising water resources for uranium extraction, KHNP said. Under the agreements, Korea Hydro & Nuclear Power (KHNP), Al-Farabi University, and IHT will jointly investigate uranium concentrations and distribution in Kazakhstan’s seawater and groundwater. They will also conduct performance evaluations of uranium adsorbents, a key technology currently under development by KHNP.

The signing of the MoU with IHT was on 4 March (Image: KHNP)

KHNP said it is actively researching efficient uranium extraction from seawater and is developing adsorbents as one of the key methods for this process. If these collaborations confirm the feasibility of utilising Kazakhstan’s water resources for uranium extraction, further technological cooperation between the two countries is expected to expand significantly, it added.

"This agreement will further strengthen technological cooperation between our two nations in the field of seawater uranium resource utilisation," Shin Ho-cheol, director of KHNP's Central Research Institute, said.

WANO looks to build on achievements as nuclear capacity grows

As José Gago succeeds Tom Mitchell after a six-year term as chairman, the two talk to World Nuclear News about the role of the World Association of Nuclear Operators, its achievements and its future role with numbers of nuclear energy plants set to rise sharply in the years ahead.

The association, best known as WANO, is a not-for-profit international organisation established in 1989 by the world's nuclear power operators to exchange safety knowledge and operating experience among organisations operating commercial nuclear power reactors. Its primary mission is to "maximise the safety and reliability of nuclear power plants worldwide, independent of geopolitical and national boundaries". It currently has 460 nuclear units as members, with 60 under construction.

The out-going chairman Mitchell, whose previous roles included six years as CEO at Ontario Power Generation and who was on the WANO governing board before taking up the chairman role in 2019, said that he was proud of the way the organisation, and the industry as a whole, had "remained united, remained focused on our nuclear safety mission" during his years in the role. Those years, of course, saw the massive global disruption of the COVID-19 pandemic and also a war in Ukraine which included the military occupation of a nuclear power plant.

He says that even during the enforced restrictions of the pandemic there was the opportunity and time for WANO to work on a new strategic plan - "I wouldn't want to go through that period again, but I would also say I think as an organisation we effectively used the time to get ready to move on to a new operational model."

That new model has seen the "evolutionary change" to more regular interactions with members rather than mainly focusing on a full WANO peer review mission every few years. New processes are being introduced and it is planned to be totally in place by the end of the year, says Mitchell. Work is also progressing on establishing a fifth regional centre in Shanghai - to go alongside those in Atlanta, Moscow, Paris and Tokyo.

WANO's new chairman Gago, who spent 10 years as director general of Spain's Asociacion Nuclear Asco-Vandellos (ANAV), has been ANAV's governor at the WANO Paris centre since 2012. He has also been president of the Spanish Nuclear Society and a member of the Foro Nuclear board of directors.

He paid tribute to the work of his predecessor in developing the new strategy which he will be overseeing in the coming years with CEO Naoki Chigusa (who was travelling on WANO work on the day of our interview). Gago says that he would continue Mitchell's emphasis on ensuring there is no complacency among existing operators, while also increasing focus on new entrants to the nuclear sector.

The large numbers of small modular reactors being proposed suggests an obvious growth area for WANO, with the promise of novel challenges in terms of new technology or new nations entering the nuclear energy 'club'. The organisation has developed new membership categories and outreach programmes - and worked with a variety of other organisations such as the International Atomic Energy Agency - and combined with a growing programme of pre-start-up peer reviews, it aims to help ensure that any new entrants will make the switch from construction to operation of nuclear units as smoothly and safely as possible.

They both also highlight the workforce requirements of new nuclear projects, as well as the benefits of leadership programmes such as World Nuclear University, which has WANO as one of the founding partners. The WANO process of peer review visits to share good practice and advice is seen by many members as a crucial staff development opportunity, alongside secondments to WANO, Mitchell says.

The way that WANO operates - with peers from different nuclear power plants visiting other companies' plants and sharing experience and knowledge - means that discretion and trust is vital, and it tends not to have a high profile outside the industry. Mitchell says there are other organisations that advocate on behalf of the industry - who WANO has worked with on subjects like safety culture - but "we've learned that we are best if the operators have the ability to have really open, direct, conversations with each other". The question of whether to have a higher profile is one that has been had a few times during its 30-plus year history and Gago says that although he does not see a change in the future, he is sure that it is a debate which will be raised again.

Another growth area has been that relating to life extension programmes which are rolling out at a growing number of existing plants. Mitchell gives the example of there being "a huge amount of information available these days about steam generator replacements ... so some plants that have started up later are now getting to that point where it's time to do that as well" and that is where members could get in touch with their WANO regional centre who can "put you in contact with someone else who's done it to see what were the lessons learned, what worked and maybe what could have been done better".

After six years as chairman, and an involvement with WANO going back a lot further, what are Mitchell's reflections as he leaves the London-headquartered organisation? "There will always be challenges, and I don't have a crystal ball so I don't know what the next one will be, but what I can tell you is that my view is that when we have a challenge as an industry we pull together. We stay focused on nuclear safety. I think if the founders came back today they would be very proud that we have stayed focused on that and helped us deal with whatever the issue is, and quite frankly we emerge as a stronger and more united and resilient industry."

Gago also makes a point of talking about the need to focus on the safety mission and ensuring that workers in the industry do not find their crucial work being affected by what is happening outside the plant. "One of the key messages is, for the sake of nuclear safety, to protect people from the political noise so they can focus on safely and reliably operating the plants," he says.

When a nuclear power plant is scheduled to be shut down there is, unlike some industries, no room to lower safety standards, and yet there will be the same challenges of retaining crucial staff. This challenge is not helped when, as seen in some countries recently, politicians announce a plant closure and then U-turn on that decision later. Mitchell, agreeing with Gago's point, says "it's actually essential that you don't get distracted, from a human behaviour point of view, and stay focused on the fundamentals - when I was a senior executive I saw it as my job to manage the external issues" so that people operating the plant could concentrate on their jobs.

After the last six years, who knows what the next six might bring, but, as Gago puts it: "This is an amazing association, unique in the world, based on the confidentiality and self-confidence of its members, which is needed to create the openness and transparency to help each other. WANO’s mission - to maximise the safety and reliability of nuclear power plants worldwide - is as relevant today as ever."

Commissioning milestone for WIPP ventilation facility

The new, state-of-the-art, large-scale ventilation system at the USA's repository for the disposal of transuranic waste has now been fully commissioned and is expected to be fully operational later this year.

_10914.jpg)

The Safety Significant Confinement Ventilation System (SSCVS) is part of the US Department of Energy Office of Environmental Management's major project to significantly increase airflow underground in the Waste Isolation Pilot Plant (WIPP) in New Mexico. Increased airflow will mean that activities to emplace sealed waste drums in underground rooms mined out of the ancient salt formation can take place at the same time as facility mining and maintenance operations.

The ventilation system will work in tandem with a new utility shaft, and will pull air through the repository, remove salt when required and send the air through HEPA filtration units before releasing it to the environment. (HEPA - for High Efficiency Particulate Air - filters are mechanical air filters that can remove at least 99.97% of dust, pollen, mold, bacteria, and any airborne particles down to a size of 0.3 microns.) The SSCVS includes two primary buildings: the Salt Reduction Building, which pre-filters salt-laden air from the underground repository; and the New Filter Building, which houses fans and 22 HEPA filtration units. The new system will increase underground airflow from 170,000 cubic feet (4814 cubic metres) per minute to a maximum of 540,000 cubic feet per minute.

HEPA filters inside the SSCVS facility (Image: DOE EM)

Construction of the SSCVS was completed in June. During the commissioning phase, WIPP management and operations contractor Salado Isolation Mining Contractors have tested each system individually and then the SSCVS as a whole to demonstrate complete functionality. Following commissioning, the SSCVS has now been turned over to the operations team members so they can gain proficiency in running the highly efficient system.

Assessments will now be carried out to show the SSCVS is fully integrated into other WIPP site systems, demonstrating that all primary and backup systems are functional and operating as expected, and that operators are proficient and fully understand the ventilation system. When all the reviews have been completed and approved by the US Department of Energy Office of Environmental Management, the SSCVS will be connected to the repository's underground ventilation system.

Construction of the SSCVS began in 2018, when it was estimated that the system would cost USD288 million with completion envisaged for November 2022. Progress was impacted when WIPP, like most of the Office of Environmental Management's field sites, focused on essential mission-critical operations during the COVID-19 pandemic. According to a report released last year by the US Government Accountability Office, by 2024 the cost estimate had risen to USD494 million.

WIPP is the USA's only repository for the disposal of transuranic, or TRU, waste which includes clothing, tools, rags, residues, debris, soil and other items contaminated with small amounts of plutonium and other man-made radioactive elements from the US military programme. The repository is excavated out of a natural rock salt layer 650 metres below ground, and has been operational since 1999.

UKAEA, Eni partner for tritium fuel cycle facility

The United Kingdom Atomic Energy Authority and Italian multinational energy company Eni SpA have entered into a collaboration agreement to jointly conduct research and development activities in the field of fusion energy. The collaboration primarily starts with the construction of the world's largest and most advanced tritium fuel cycle facility.

_34320.jpg)

Tritium recovery and re-use will play a fundamental role in the supply and generation of the fuel in future fusion power plants and will be crucial in making the technology increasingly efficient.

The UKAEA-Eni H3AT Tritium Loop Facility, located at Culham Campus in Oxfordshire, England, will be complete in 2028. It is designed to serve as a world-class facility providing industry and academia with the opportunity to study how to process, store and recycle tritium.

UKAEA and Eni will collaborate to develop advanced technological solutions in fusion energy and related technologies, including skills transfer initiatives. Eni will contribute to the H3AT project with its expertise in managing and developing large-scale projects, helping to de-risk its roadmap. The partnership combines UKAEA's extensive expertise in fusion research and development with Eni's established industrial-scale capabilities in plant engineering, commissioning, and operations.

"We are delighted to be working with Eni who have shown great commitment to fusion," said UKAEA CEO Ian Chapman. "We believe that fusion energy can contribute to a net-zero future, including going beyond the decarbonisation of electricity. The H3AT demonstration plant will set a new benchmark as the largest and most advanced tritium fuel cycle facility in the world, paving the way for innovative offerings in fusion fuel and demonstrating the UK's leadership in this crucial area of research and development."

Eni CEO Claudio Descalzi added: "Fusion energy is meant to revolutionise the global energy transition path, accelerating the decarbonisation of our economic and industrial systems, helping to spread access to energy, and reducing energy dependency ties within a more equitable transition framework. Eni is strongly committed to various areas of research and development of this complex technology, in which it has always firmly believed.

"Today with our UK partners we are laying the foundations for further progress towards the goal of fusion which - if we consider its enormous scope of technological innovation - is increasingly concrete and not so far off in time. To continue this virtuous development, international system-level technological partnerships like this one are indispensable."

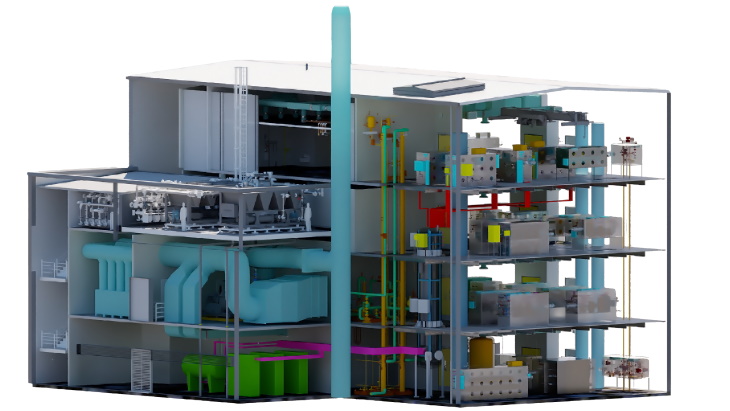

A cutaway of the H3AT Tritium Loop Facility Plant and Building (Image: UKAEA)

The H3AT facilities will comprise: advanced tritium infrastructure, to feed, recover, store and recycle tritium; a flexible suite of enclosures designed to enable a wide variety of experimental work, including pure tritium science, process development, component testing and waste detritiation; computational simulations and model validation; training facilities; and materials detritiation processes and facilities.

H3AT will include a prototype-scale process plant and experimental platform, which is a scaled version of the design for the International Thermonuclear Experimental Reactor.

In May last year, UKAEA appointed Canadian engineering firm AtkinsRéalis to deliver the detailed design of an isotope separation system to strengthen research into sustainable fusion delivery. The Isotope Separation System will form part of the H3AT facility.

The UKAEA carries out fusion energy research on behalf of the UK government, overseeing the country's fusion programme, including the MAST Upgrade (Mega Amp Spherical Tokamak) experiment as well as hosting the recently closed Joint European Torus (JET) at Culham, which operated for scientists from around Europe. It is also developing its own fusion power plant design with plans to build a prototype known as STEP (Spherical Tokamak for Energy Production) at West Burton in Nottinghamshire, which is due to begin operating by 2040.

In November 2022, the UK's First Light Fusion announced plans to build a 60 MW pilot power plant based on its unique projectile fusion technology to prove the integrated engineering for electricity generation and the production of tritium. It partnered with Canadian Nuclear Laboratories to design a system for extracting tritium from the reactor. The proposed pilot plant was expected to cost about USD570 million to develop and would produce about 2 kilograms of excess tritium per year.

However, earlier this month, First Light Fusion announced a change in strategy. The Oxfordshire-based company has dropped plans to develop a fusion power plant and will instead focus on commercial partnerships with other fusion companies who want to use its amplifier technology, as well as with non-fusion applications.