Shipping out. Stock Image

December’s raw materials bill topped $2 billion for the first time since August 2023 and surging lithium, nickel prices going into 2026 puts battery metals slump definitively in the rearview mirror.

The global passenger EV market, including plug-in and conventional hybrids, likely exceeded 30 million units last year, a 20% increase over 2024. In combined battery capacity deployed – a better indicator of battery materials demand than unit sales alone – the electric car market expanded by an even more robust 25%.

According to data from Toronto-based EV supply chain advisory Adamas Intelligence, 2025 is shaping up to be the first calendar year battery capacity deployment tops 1 TWh (and may yet go well beyond that level once detailed data for December is tallied).

To put that in perspective, for calendar 2021, the total was 286 GWh, meaning the global market measured in GWh has nearly quadrupled in just four years and is ten times larger than in 2019 – powering through the pandemic.

Turnaround

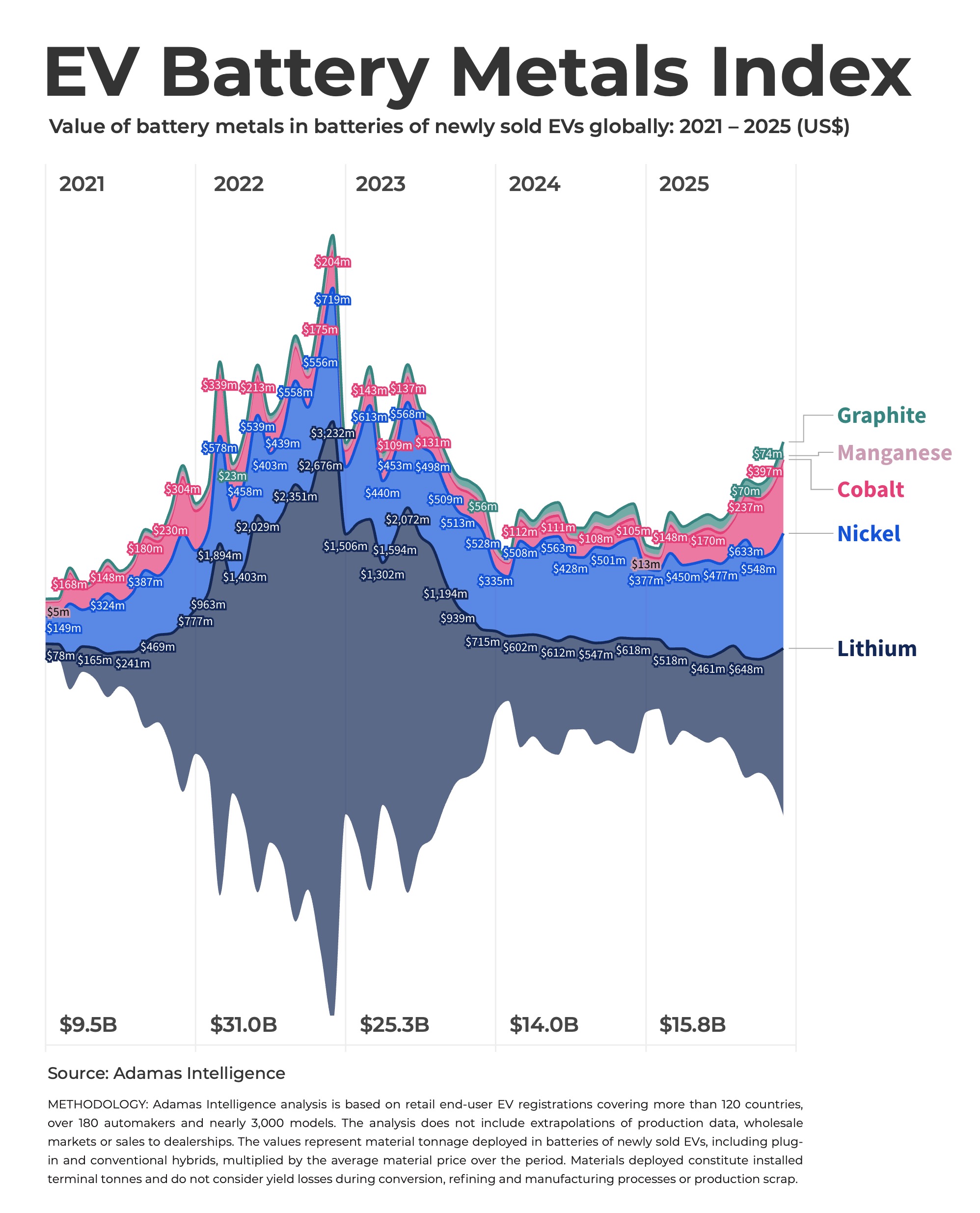

The EV Metal Index pairs metals demand with prices in the EV battery supply chain. That paints a very different picture of the battery metals market and shows just how deep the slump of the last few years has been for raw material suppliers to the industry.

But even by this measure, the outlook has become much brighter.

The raw material bill for the contained lithium, graphite, nickel, cobalt and manganese in the batteries of EVs sold over the course of 2025 climbed to $15.8 billion, an almost 13% gain over the year before.

Granted, that’s still almost half of the extraordinary level reached in 2022, but 2026 is already shaping up to be another year of strong growth – and a much better pricing environment.

Indeed, December’s estimated total spend on EV battery raw materials hit the highest level since August 2023, exceeding $2 billion for the first time in 27 months as rising lithium and nickel prices began to work through the supply chain. Prices for both have only accelerated into the new year, much like cobalt did a year ago.

If $2 billion a month sounds modest, keep in mind that the installed tonnage does not take into account any losses during processing, chemical conversion or battery production scrap (where yield losses often go well into double digit percentages and at much higher rates during startup) so required tonnes and revenues are meaningfully higher at supply chain entry points.

Cobalt bolts

The revival of cobalt prices played a significant part in the better performance of the index in the early months of last year, with prevailing prices for cobalt sulphate up by over 200% year over year in December. From a low of under 6% in 2023, cobalt’s contribution to the overall index was more than 14% in 2025 at $2.4 billion, only slightly below 2022’s annual record.

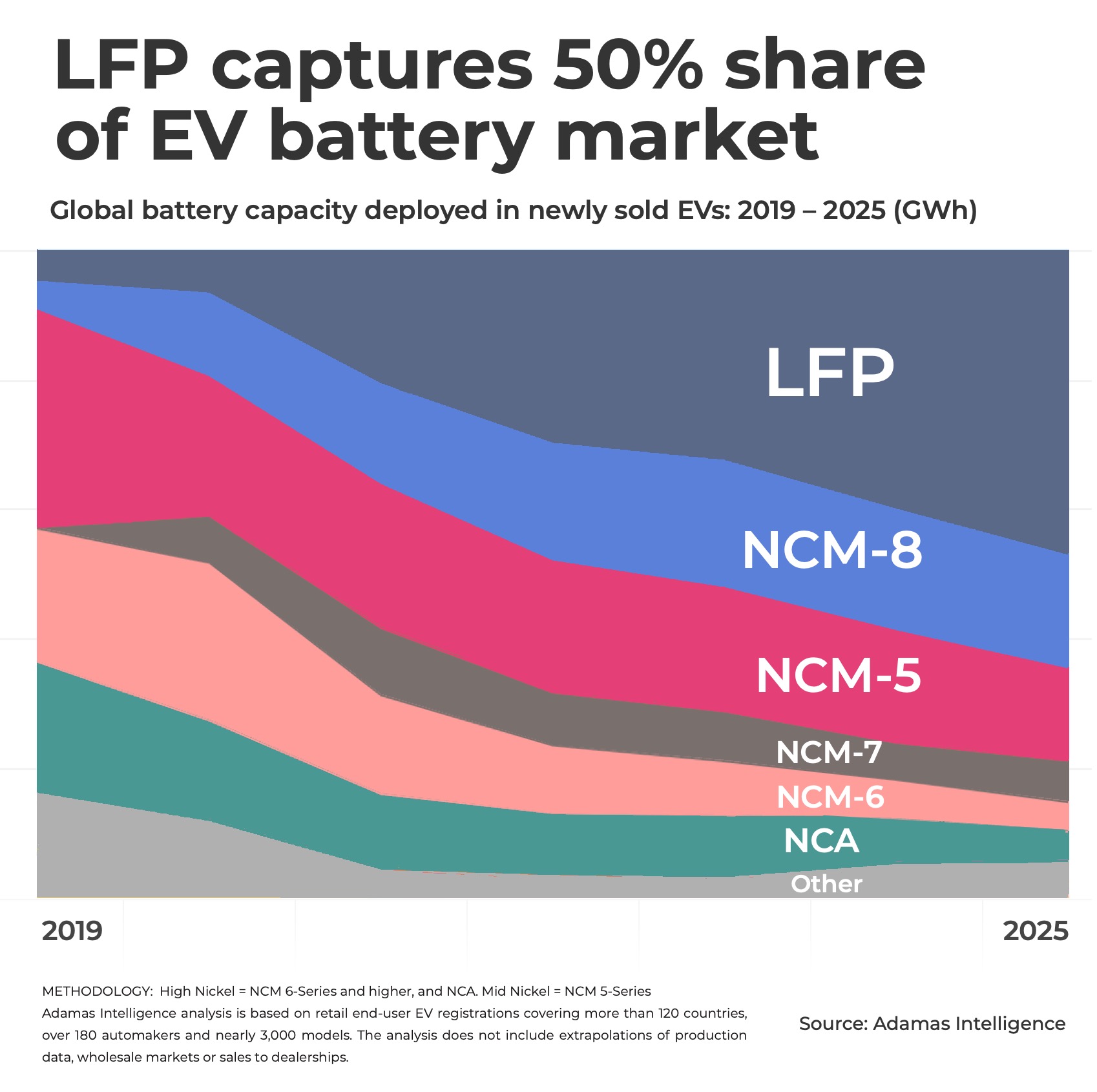

And that is despite ongoing thrifting of cobalt by automakers in NCM (nickel-cobalt-manganese) and NCA (nickel-cobalt-aluminum) batteries and ever faster adoption of LFP (lithium-iron-phosphate) cathode chemistries. In 2025 LFP packs accounted for nearly half of the total in battery capacity deployed terms, despite a limited presence outside China.

China was responsible for a full 83% of LFP roll-out globally and inside the country the chemistry now commands a 70% and growing share. Global LFP deployment grew twice as fast as the overall market in GWh terms in 2025 – that’s 50% year on year.

As the graph shows, that was a rapid process kicked into high gear in 2020 when BYD, now the world’s top EV maker, switched its entire model line-up to LFP, and Tesla started production of LFP variants at its new factory in Shanghai.

Lithium lights up

Prices for lithium hydroxide and carbonate are also trending upwards, although the full effect of the spectacular rise in spodumene concentrate shipped from Australia is yet to be fully felt at Chinese factory gates.

At $6.5 billion for the year, the value of lithium contained in the batteries of newly sold EVs was only up slightly year on year and still a country mile behind the peak of $22.1 billion in 2022.

Going into 2026, lithium is likely to substantially increase its proportion of the overall index (at 41% last year versus a peak of 72% in 2022) thanks to rising prices and the aforementioned spread of LFP beyond China’s borders diminishing nickel’s contribution.

Niftier nickel

The value of nickel deployed increased 7% year on year in 2025, hitting a new high. It was the first time the value of contained nickel registered over $6 billion on an annual basis.

Average ex-factory nickel sulphate prices in China in December were up by double digit percentage points from the year before and continued to rise in 2026, but over the course of 2025 nickel sulphate prices moved sideways, showing that NCM batteries remain a significant source of underlying demand for the metal.

The nickel bill even exceeded that of lithium during a couple of months, boosted by furious buying in the US ahead of the expiry of EV retail incentives at the end of September. High-nickel cathodes dominate the US market and LFP only represents 6% of the total.

In Europe LFP’s share also remains modest at 12% in 2025 on a battery capacity basis despite an influx of made-in-China EVs. While US EV-buying has tanked post-subsidies, European growth last year even outpaced China’s and will likely stay on the boil thanks to the re-introduction of generous subsidies in countries like Germany boding well for NCM demand.

Some of the negative effects of LFP’s intrusion in markets in North America and Europe are being blunted by a parallel trend towards higher nickel content NCM batteries (60%-plus nickel content and more often 80% and above like NCM 8-Series battery chemistries shown on the graph) which remains the go-to chemistry outside China.

Tesla’s woes in 2025, however, further dented high-nickel NCA deployment, and apart from falling global sales, the EV pioneer’s use of LFP batteries manufactured in Germany and China now sits nearly 40% on a GWh basis.

Indonesian talk of export quotas (details remain scarce) caused a surge in nickel sulphate prices since the start of 2026 and at around 40% of the index in 2025, the devil’s copper will strongly contribute to overall growth for the remainder of the year.

Mid manganese

Nickel, and more so cobalt and manganese, usage are also supported by the lingering use of mid-nickel batteries by Chinese automakers pitching vehicles a step above entry level LFP models, and large installed cell manufacturing base in the country.

Mid-nickel packs (roughly 50% nickel, 20% cobalt and 30% manganese) feature in almost a fifth of EVs sold in China, with the world’s largest battery manufacturer, CATL, cornering more than half the market for these cathodes.

Manganese deployment grew by 7% year on year, but the metal’s value in the EV battery basket remains small. Commercial production and deployment of newer chemistries such as LMFP (lithium-manganese-iron-phosphate) which had been expected to eat into LFP’s market, has been disappointing.

NCMA (nickel-cobalt-manganese-aluminum) used by General Motors through a partnership with LG Energy Solution has seen uptake grow rapidly, but likewise only plays a tiny part in the mix.

With lacklustre prospects for manganese sulphate prices, 2026 is not likely to change the equation for the battery metal despite a number of automakers (including Volkswagen) working to bring high-manganese batteries to market.

The value of graphite, used in virtually all EV batteries, expanded by a healthy 16% last year to $686 million, hitting a new annual high. With graphite prices in the EV supply chain drifting lower and deployment growth for the anode active material closely tied to slowing EV global EV market, most of the attention will remain on lithium and nickel in 2026.

For a fuller analysis of the battery metals market check out the latest issue of the Northern Miner print and digital editions.

* Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, providing news and analysis based on Adamas Intelligence data.