Gold smuggling surges in India as price spikes before festivals

Gold smuggling into India has spiked ahead of key festivals, government and industry officials told Reuters, in response to record-high prices and a supply crunch.

Smuggling of gold into the world’s second biggest buyer of the precious metal had fallen after the government slashed import taxes on it to 6% from 15% last year.

However, Customs and Directorate of Revenue Intelligence (DRI) officials said smuggling has increased in recent weeks, with several attempts foiled at several Indian airports.

Bringing gold into India and liquidating it used to be time-consuming and risky, but with strong festival demand and limited supply smugglers can now convert it in just a few hours, said a Chennai-based bullion dealer.

Indians will celebrate the Dhanteras and Diwali festivals this month, occasions when buying gold is considered auspicious and among the busiest days for purchases of the precious metal.

Gold prices in India hit a record 128,395 rupees per 10 grams on Thursday, marking a 67% rise so far this year.

At this price smuggling a kilogram of gold is very lucrative for grey market operators, with margins exceeding 1.15 million rupees from dodging the 6% import duty and a 3% local sales tax.

“As gold prices keep climbing, smugglers are making bigger bucks. The payoff is now super tempting for them,” said a Mumbai-based senior bullion dealer, who declined to be named.

After import duties were cut in July, the margin for smugglers had fallen to 630,000 rupees per kilogram.

Investors are now chasing gold, creating supply tightness and pushing up premiums, the bullion dealer said.

Meanwhile, banks are unable to meet the full demand and are charging very high premiums on the available stock, said a Kolkata-based jeweller.

Indian dealers were this week quoting a premium of up to $25 per ounce over official domestic prices, the highest in more than a decade.

In the 2024/25 fiscal year ended in March, government agencies registered 3,005 cases of gold smuggling and seized 2.6 metric tons of the metal.

(By Rajendra Jadhav; Editing by Alexander Smith)

India central bank’s gold pile tops $100 billion on surging bullion prices

India’s gold reserves crossed the $100 billion mark for the first time, according to the Reserve Bank of India’s latest foreign exchange reserves data, buoyed by a global price rally even as the central bank’s purchases slowed sharply this year.

India’s gold holdings rose by $3.595 billion to $102.365 billion in the week through October 10, RBI data showed on Friday, while overall foreign exchange reserves declined $2.18 billion to $697.784 billion.

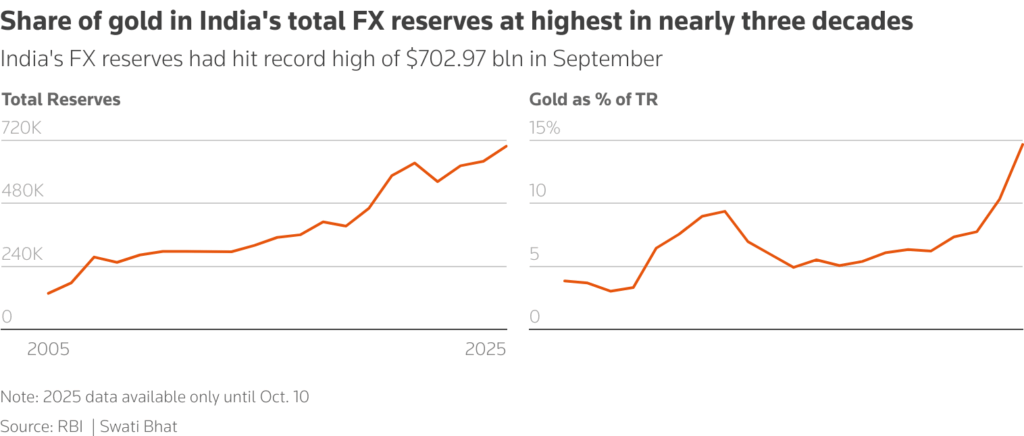

The share of gold in India’s total reserves climbed to 14.7%, the highest since 1996-97, according to traders.

Gold’s share in India’s foreign exchange reserves has almost doubled over the past decade — from below 7% to nearly 15% — reflecting both steady central bank accumulation and a surge in global bullion prices.

That’s led to the $100 billion milestone being hit despite a marked slowdown in the RBI’s gold purchases this year.

The central bank bought gold in only four of the first nine months of 2025, compared with near-monthly additions in 2024, according to World Gold Council data.

Cumulative buying from January to September stood at just 4 tons, sharply lower than 50 tons in the same period a year earlier.

The share of gold in India’s foreign exchange reserves has increased significantly, largely driven by valuation gains from the rising gold price, said Kavita Chacko, research head for India at the World Gold Council.

Gold has surged about 65% in 2025, powered by a potent mix of macroeconomic, institutional and psychological drivers.

Global central banks continue to accumulate gold as part of reserve diversification away from the US dollar — a trend spurred by heightened geopolitical risks, sanctions pressures and de-dollarization.

India is the world’s second-largest consumer of gold and relies on imports to meet demand. Buying gold is deeply rooted in Indian culture, driven by tradition and its role as both an investment and a status symbol.

(By Nimesh Vora and Rajendra Jadhav; Editing by Ronojoy Mazumdar)

No comments:

Post a Comment