Rystad Predicts Global Emissions Peak by 2026 as Clean Power Surges

- Clean electricity’s share of global energy has risen from 9% in 2015 to over 14% in 2025, marking the fastest energy shift in modern history.

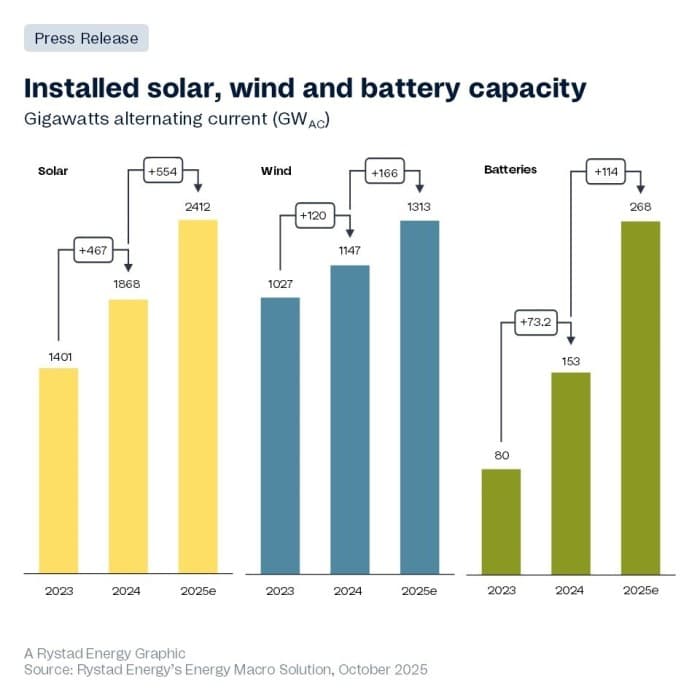

- Renewables are on track for record additions of more than 700 GW in 2024–2025, pushing the world toward a 1.9°C scenario by 2040.

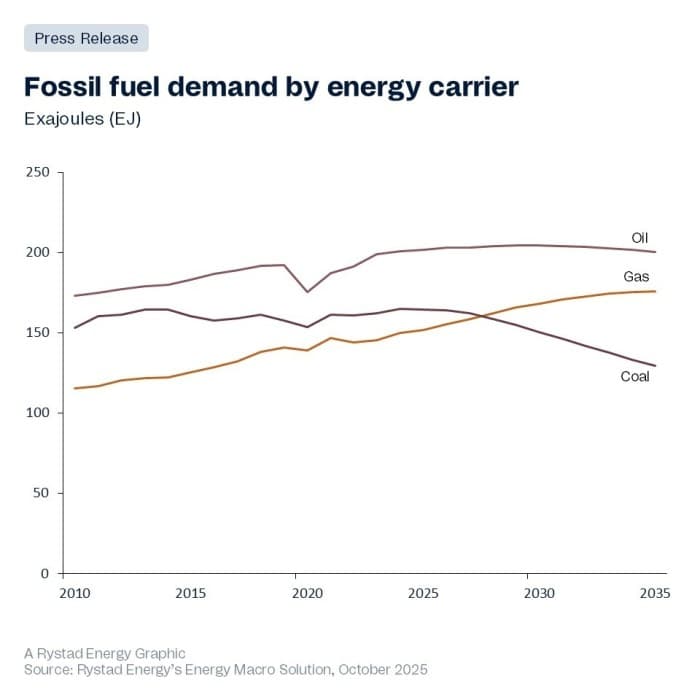

- Oil and gas remain resilient through the 2030s, but low-carbon investments are set to dominate global capital flows by the end of the decade.

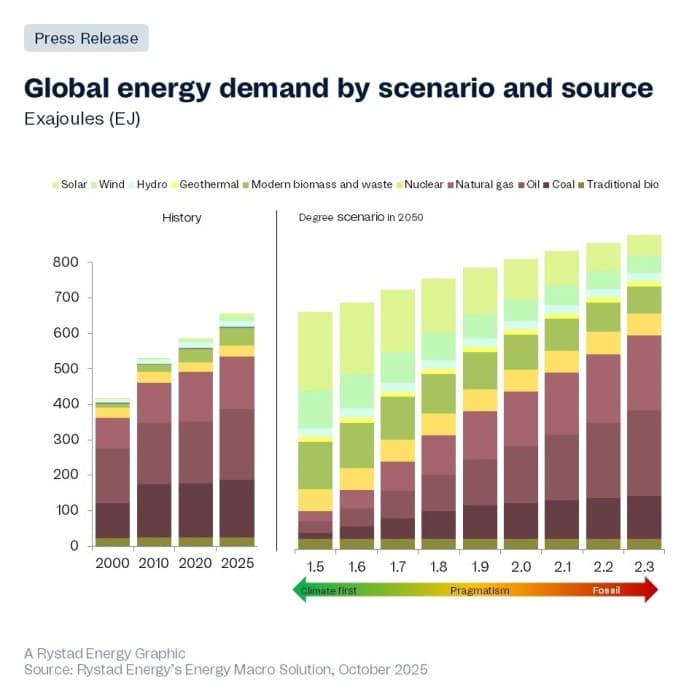

The global energy system is witnessing the next greatest transition, standing on the cusp of a new energy era championed by clean electricity and the increased adoption of electrification across the board. Rystad Energy is pleased to announce the release of its flagship annual report, Global Energy Scenarios (GES) 2025, which provides in-depth degree scenarios toward 2100 and a newly developed nationally determined contribution (NDC) scenario to 2035. Clean electricity and electrification are expanding faster than any shift in modern history, with energy sources of the next era growing from around 9% in 2015 to more than 14% this year as a share of primary energy.

While nations grapple with the dual challenge of addressing climate change and strengthening energy security, renewables are expanding faster than any previous energy technology, with total wind and solar capacity additions for 2024–2025 set to exceed 700 gigawatts (GW). Because of this, our research indicates that a 1.9-degree Celsius trajectory – referring to an average global temperature rise above pre-industrial levels – is more likely toward 2040, as a hybrid energy ecosystem is now in place.

As these scenarios play out, the transformation of the global energy system requires three clear steps:

Task 1: Clean up and grow the power sector

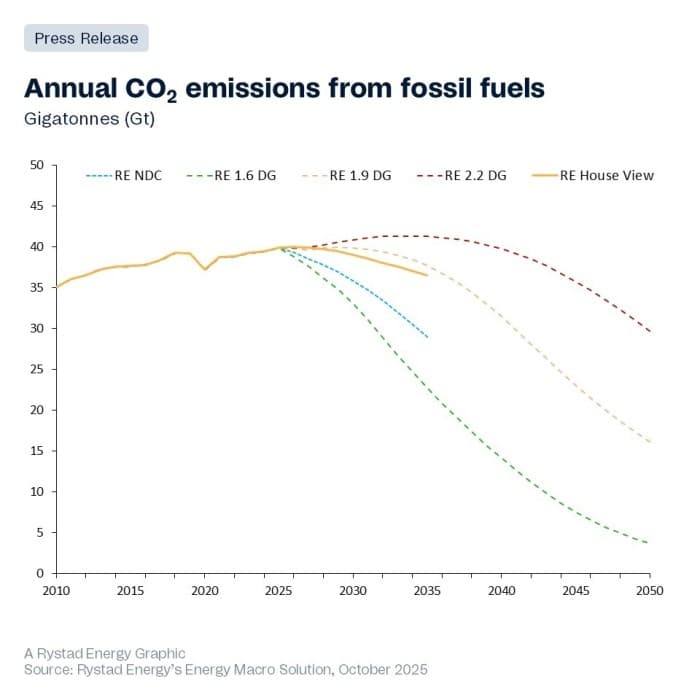

Cleaning up and expanding the power sector plays a dominant role in reducing emissions through 2050. Our analysis indicates that achieving a global warming scenario more ambitious than 1.9 degrees Celsius will require at least 90% of the identified opportunities for a reduction in emissions to be realized.

Task 2: Electrify almost everything

Electrification becomes particularly impactful in pathways that limit warming at or below 1.6 degrees. The greatest contribution comes from the adoption of electric vehicles (EV), alongside widespread energy efficiency improvements across buildings, industry, and transport.

Task 3: Address residual emissions

Addressing residual fossil fuel use through CO? capture or substitution with low-carbon fuels contributes little to a net reduction in emissions before mid-century in pathways exceeding the 2.2-degree scenario. This limited impact reflects its later-stage deployment and higher costs.

Download your copy of Global Energy Scenarios 2025.

Already today, we’re seeing the energy system shift to a hybrid model of renewable and fossil energy. With half of global power generation capacity now renewable and one in four new cars sold being electric, the energy system is transforming rapidly. There are already clear signs of change across investments, new capacity additions, and technological adoption curves that indicate we will witness a genuine transition over the next two to four decades.

Jarand Rystad, founder and CEO, Rystad Energy

Although the transition to renewable energy is gaining momentum, oil and gas are expected to remain resilient in the near term. Oil demand is projected to peak by the early 2030s, and gas growth will likely slow down towards the end of this decade; however, neither fuel experiences a sharp contraction. The energy transition is fast enough to alter the growth profile of fossil fuels, but not fast enough to deeply disrupt their dominance by 2040. Oil and gas remain the backbone of the system, tied to transport, petrochemicals and energy services, where alternatives are not yet cost-competitive or scalable. This transition will have significant implications for costs and investments, as fossil fuel growth slows down and they are outpaced by renewables, ultimately leading to lower costs for consumers over time.

Looking ahead, we can clearly outline five pathways that will shape the global energy outlook, which include the Rystad Energy NDC, 1.6 degrees Celsius, 1.9 degrees Celsius, 2.2 degrees Celsius, and the Rystad Energy House View scenarios. Global CO? emissions are expected to peak around 2026 before starting a gradual decline, driven by rapid renewable deployment in power and EV adoption in transport. This marks a turning point, showing that the world is moving from growth to decline in emissions. However, current NDCs remain far from sufficient to limit warming to 1.5 degrees. Even if fully implemented, they would not achieve the substantial reductions necessary for achieving the lower range of the Paris Agreement.

Our prediction of a 1.9-degree Celsius scenario is heavily predicated on renewable energy installations setting all-time high records and serving as the backbone of new power growth, with solar leading the pack. Solar is forecast to rise from 1,868 GW in 2024 to 2,412 GW in 2025 – a 544 GW increase that cements its position as the leader of new global power generation. Record manufacturing output, sustained cost declines, and accelerating deployment in China, India, and the US drive the expansion.

Fueling this exponential growth in renewable energy development is a global increase in low-carbon investments. Currently, low-carbon technologies attract over $900 billion annually, compared to $735 billion for oil and gas. This $181 billion delta widens to an estimated $391 billion by 2030, reflecting a complete shift in growth dynamics. The installed base changes slowly, but investment is a leading indicator: today's capital flows determine the 2040 energy system. By 2030, low-carbon sources are set to capture 46% of all energy investment, compared to 30% for fossil fuels, with grids accounting for 24%.

By Jon Ødegård Hansen, Lars Nitter Havro, and Katie Keenan at Rystad Energy.

Too Much of a Good Thing: Solar Overloads Europe’s Electricity System

- The rapid expansion of weather-dependent generation has made Europe’s power grids vulnerable to voltage surges.

- After four record years, EU solar additions are now set to decline for the first time in a decade, as negative wholesale prices and frequent curtailments erode profitability and deter new investment.

- Experts warn Europe’s infrastructure is not built for a decarbonized system; massive upgrades in transmission, flexibility, and cross-border links are needed.

When the official report on the Spain and Portugal blackout from April came out, it described a grid made vulnerable to excess voltage as a result of the fast growth of weather-dependent generators. But this excess voltage problem is not just reserved for the Iberian Peninsula. The whole of Europe has become vulnerable.

Last year, a total of 65.5 GW of solar generation capacity was installed across the European Union. It was a record high, and the fourth record-high year of installations in a row, as reported by the EU’s solar power industry association. However, the annual growth rate in additions was markedly lower than in previous years, at just 4.4%, Solar Power Europe noted. Since the start of this year, things have only got worse, with total new installations expected to be a decline on 2024 rather than an increase. It would be the first decline in ten years.

Solar is one of the pillars on which the European Union’s transition plans are built. Solar, along with wind, is instrumental for what Brussels strategists call a decarbonisation of the European grid. However, there have been unforeseen circumstances that have interfered with these plans and are going to interfere with them increasingly frequently because of the nature of solar, affecting growth plans.

Related: U.S. Nuclear Output Forecast to Surge 27% After 2035

One obvious problem that was not anticipated is negative prices. The phenomenon, sometimes called a cannibalization effect, refers to periods of excessive generation from wind and/or solar that plunges electricity prices on the wholesale market below zero because supply exceeds demand by a very wide margin.

In Europe, the problem has become especially pronounced in the past couple of years, thanks to all those record solar capacity additions—and it has started affecting investment decisions for further capacity because negative prices affect the profitability of existing installations. Some governments have considered support for solar operators forced to switch off their installations when there is excess generation, but not all.

Switching off a solar installation is what grid operators order whenever generation threatens to become excessive. This is also problematic for solar operators, because when their installations do not generate electricity, the operators do not make money. Sure, they can be paid to not generate, like wind turbine operators in the UK, but that does not necessarily guarantee profits—government handouts never do.

Finally, there is the voltage surge problem that caused the Spain and Portugal blackout, and that Bloomberg this week reported is getting more serious across Europe. The solution proposed: change the grid.

The argument that Europe’s grid is not fit for a decarbonized energy system has been put forward repeatedly by transition advocates who claim we need a more flexible electricity supply and distribution network that would reduce—and maybe even eliminate—the waste of electricity generated by wind and solar installations during periods of low demand. Flexibility, including on the demand side, is being made a top priority. The problem is that solar is not very flexible. When the sun shines, the panels generate, regardless of demand. When the sun stops shining, the panels stop generating, also regardless of demand.

According to one Dutch grid expert who Bloomberg interviewed, the problem is one of scale. There are simply way too many solar installations to control all at the same time and make sure the grid does not get overloaded on sunny days. “The speed of the change is extreme,” Jan Vorrink, who was in charge of the control room of the Netherland’s grid, told Bloomberg. “The strong increase in solar is pushing the boundaries of the system.”

Obviously, the simplest solution would be to put caps on solar capacity additions to make the grid more manageable. Yet this is not the preferred solution in Europe. The preferred solution is to continue building more installations and transform the grid to be better able to incorporate these installations productively.

The transformation would essentially involve building a lot more transmission lines to bring electricity from generators to demand hotspots to reduce curtailment. This would include better interconnectivity between EU member states to tap into cross-border electricity demand. However, this would not do much about the voltage surge risk. Demand patterns tend to be pretty consistent across countries—and they do not always coincide with peak solar generation, which is what creates the voltage surge risk.

Last year, there were 8,645 voltage surges in Europe, per data from ENTSO-E, the EU grid operators’ association. The figure represents a 2,000% increase from 2015, when there were 34 surges. This is not going to change in a safer direction anytime soon, even if the EU stays on its chosen grid transformation path. Such a transformation takes a lot of time—and money—and in the meantime, the grid will remain highly vulnerable to power outages resulting from voltage surges caused by excess solar generation that cannot be brought down fast enough when demand dips. Maybe exercises in flexibility need to touch on the generation part of the electricity equation.

By Irina Slav for Oilprice.com

- The rapid expansion of weather-dependent generation has made Europe’s power grids vulnerable to voltage surges.

- After four record years, EU solar additions are now set to decline for the first time in a decade, as negative wholesale prices and frequent curtailments erode profitability and deter new investment.

- Experts warn Europe’s infrastructure is not built for a decarbonized system; massive upgrades in transmission, flexibility, and cross-border links are needed.

When the official report on the Spain and Portugal blackout from April came out, it described a grid made vulnerable to excess voltage as a result of the fast growth of weather-dependent generators. But this excess voltage problem is not just reserved for the Iberian Peninsula. The whole of Europe has become vulnerable.

Last year, a total of 65.5 GW of solar generation capacity was installed across the European Union. It was a record high, and the fourth record-high year of installations in a row, as reported by the EU’s solar power industry association. However, the annual growth rate in additions was markedly lower than in previous years, at just 4.4%, Solar Power Europe noted. Since the start of this year, things have only got worse, with total new installations expected to be a decline on 2024 rather than an increase. It would be the first decline in ten years.

Solar is one of the pillars on which the European Union’s transition plans are built. Solar, along with wind, is instrumental for what Brussels strategists call a decarbonisation of the European grid. However, there have been unforeseen circumstances that have interfered with these plans and are going to interfere with them increasingly frequently because of the nature of solar, affecting growth plans.

Related: U.S. Nuclear Output Forecast to Surge 27% After 2035

One obvious problem that was not anticipated is negative prices. The phenomenon, sometimes called a cannibalization effect, refers to periods of excessive generation from wind and/or solar that plunges electricity prices on the wholesale market below zero because supply exceeds demand by a very wide margin.

In Europe, the problem has become especially pronounced in the past couple of years, thanks to all those record solar capacity additions—and it has started affecting investment decisions for further capacity because negative prices affect the profitability of existing installations. Some governments have considered support for solar operators forced to switch off their installations when there is excess generation, but not all.

Switching off a solar installation is what grid operators order whenever generation threatens to become excessive. This is also problematic for solar operators, because when their installations do not generate electricity, the operators do not make money. Sure, they can be paid to not generate, like wind turbine operators in the UK, but that does not necessarily guarantee profits—government handouts never do.

Finally, there is the voltage surge problem that caused the Spain and Portugal blackout, and that Bloomberg this week reported is getting more serious across Europe. The solution proposed: change the grid.

The argument that Europe’s grid is not fit for a decarbonized energy system has been put forward repeatedly by transition advocates who claim we need a more flexible electricity supply and distribution network that would reduce—and maybe even eliminate—the waste of electricity generated by wind and solar installations during periods of low demand. Flexibility, including on the demand side, is being made a top priority. The problem is that solar is not very flexible. When the sun shines, the panels generate, regardless of demand. When the sun stops shining, the panels stop generating, also regardless of demand.

According to one Dutch grid expert who Bloomberg interviewed, the problem is one of scale. There are simply way too many solar installations to control all at the same time and make sure the grid does not get overloaded on sunny days. “The speed of the change is extreme,” Jan Vorrink, who was in charge of the control room of the Netherland’s grid, told Bloomberg. “The strong increase in solar is pushing the boundaries of the system.”

Obviously, the simplest solution would be to put caps on solar capacity additions to make the grid more manageable. Yet this is not the preferred solution in Europe. The preferred solution is to continue building more installations and transform the grid to be better able to incorporate these installations productively.

The transformation would essentially involve building a lot more transmission lines to bring electricity from generators to demand hotspots to reduce curtailment. This would include better interconnectivity between EU member states to tap into cross-border electricity demand. However, this would not do much about the voltage surge risk. Demand patterns tend to be pretty consistent across countries—and they do not always coincide with peak solar generation, which is what creates the voltage surge risk.

Last year, there were 8,645 voltage surges in Europe, per data from ENTSO-E, the EU grid operators’ association. The figure represents a 2,000% increase from 2015, when there were 34 surges. This is not going to change in a safer direction anytime soon, even if the EU stays on its chosen grid transformation path. Such a transformation takes a lot of time—and money—and in the meantime, the grid will remain highly vulnerable to power outages resulting from voltage surges caused by excess solar generation that cannot be brought down fast enough when demand dips. Maybe exercises in flexibility need to touch on the generation part of the electricity equation.

By Irina Slav for Oilprice.com

No comments:

Post a Comment