Lithium’s next big risk is grand supply plans falling short

Bloomberg News | January 16, 2023

Brines in the middle of Chile’s Salar de Atacama contain the world’s highest known concentrations of lithium and potassium. (Image courtesy of SQM.)

Electric-vehicle makers are hoping that an imminent wave of lithium supply will bring relief for their expansion plans after a two-year squeeze, but the battery metal’s die-hard bulls warn of more pain to come if producers fail to deliver.

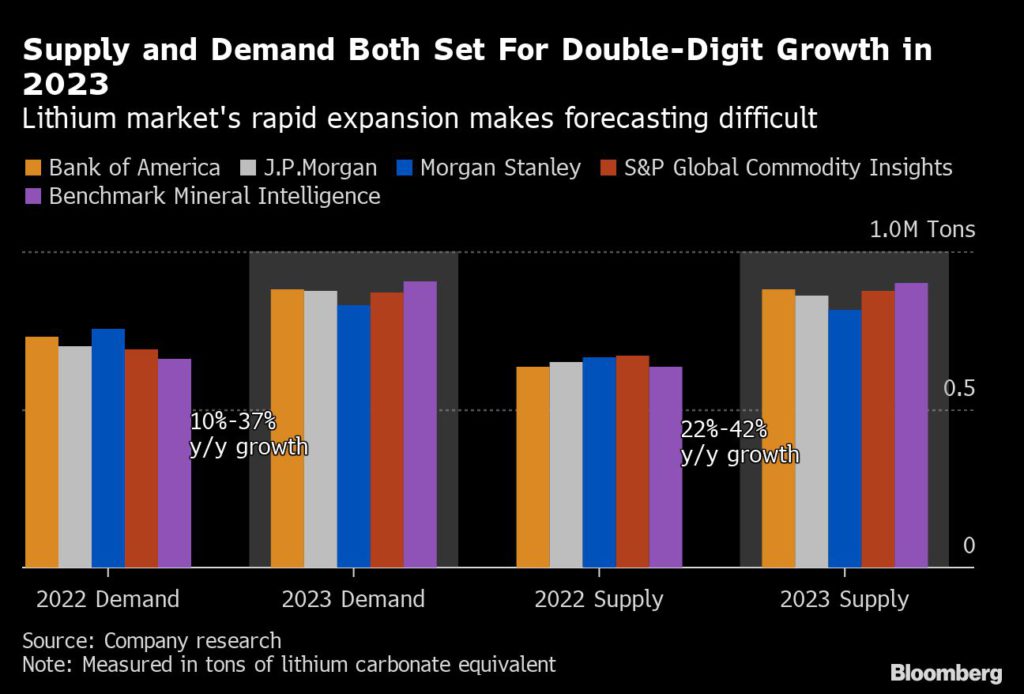

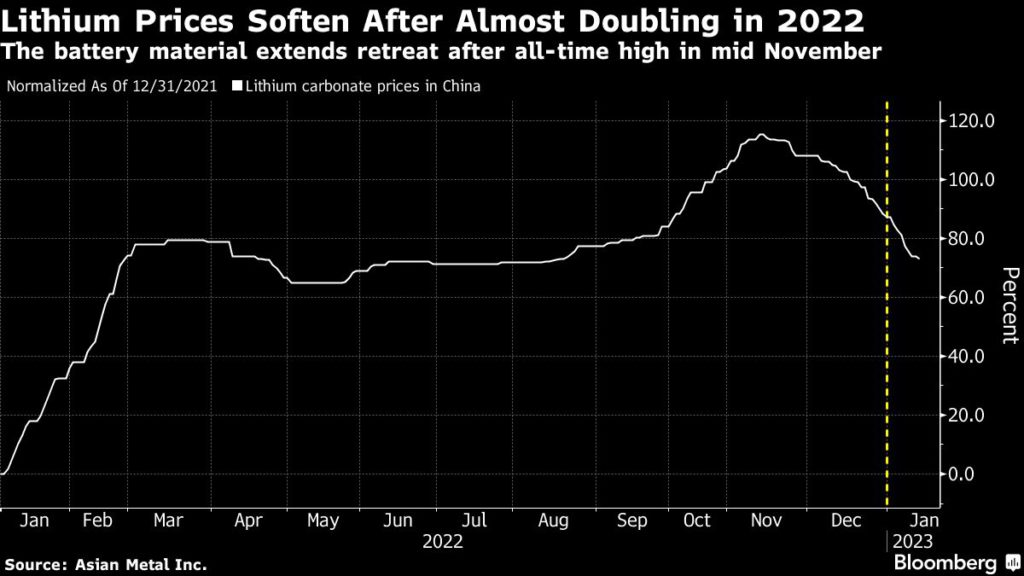

Rampant lithium demand has caught many forecasters by surprise, with booming global EV sales causing consumption to double over the past two years. With suppliers unable to keep pace, a blistering price rally sent the total spot value of lithium consumption rocketing to about $35 billion in 2022, up from $3 billion in 2020, according to Bloomberg calculations.

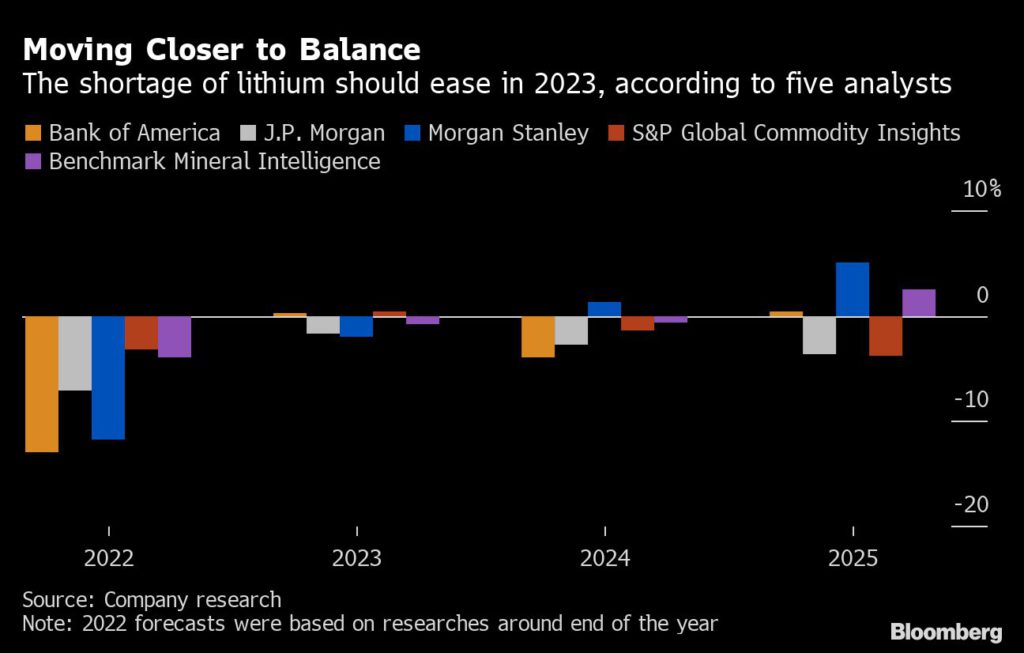

Some bearish lithium-watchers say fast-growing supply, rather than dizzying demand, will be the decisive factor in 2023. Five analyst forecasts reviewed by Bloomberg point to a much more balanced global market after clear shortages in 2022, while BYD Co., China’s top EV seller, is counting on a lithium surplus.

But there are many skeptics who warn of fresh tightness if miners from Chile to China and Australia hit hurdles in launching daunting volumes of new supply. The reviewed forecasts peg production increases of between 22% and 42% in 2023: a breakneck pace for any complex extractive industry.

“I really don’t think there’s any reason to believe that so many tons can magically appear this year to return the market to balance,” Claire Blanchelande, a lithium trader at Trafigura Group, said by phone from Geneva. “The pain is not over yet.”

At stake is the pace at which the world’s vehicle fleet adopts battery power. Lithium-ion battery costs rose last year for the first time in the EV era, according to BloombergNEF. Elon Musk bemoaned lithium’s “insane” rally and said high raw material costs were among Tesla Inc.’s biggest headwinds.

Not matched

There’s broad agreement that lithium supply is heading for a major increase in 2023 as a wave of expansions or new projects get up and running. The more bearish voices say that supply wave will hit the market just as China’s withdrawal of generous EV subsidies causes demand to cool, creating a mismatch that could trigger a sharper fall in prices.

Average prices this year are likely to fall about 8% from average 2022 levels, according to the mean of five forecasts reviewed by Bloomberg.

The divisive issue is whether less-established producers will be able to deliver in full, defying a range of regulatory, technical and commercial challenges. The extraordinary pace of lithium’s expansions – across both demand and supply – has made forecasting the market a contentious pursuit.

“2023 is when lithium becomes what I call a volume game,” said Chris Berry, president of House Mountain Partners, a consultant to the battery-materials sector. “We need to see a supply response from both existing producers and near-term producers who will need to execute flawlessly in the face of sustained lithium demand.”

Softer market

Lithium prices have already come down about 20% from an eye-popping record in November, in an early sign of respite for buyers. Lithium carbonate in China fell to 480,500 yuan a ton ($71,500) on Jan. 13, the lowest since August.

“I think you’re going to see a short dip in spot prices in 2023 but I don’t see that as a problem,” Joe Lowry, founder of advisory firm Global Lithium. “If we were talking five years ago today, the biggest issue that lithium industry had was lack of investment. Now the most significant problems are permitting and project execution.”

A cause for optimism on supply is that the largest increases will be coming from veteran top producers like Albemarle Corp. and Chile’s SQM that are considered more likely to succeed. But they only account for about a third of anticipated increases in 2023, according to data from BMO Capital Markets.

The next tier down is a small army of nascent lithium producers who will need to prove they can get up and running. And beyond those, there’s unconventional new sources like lepidolite — a lithium-bearing mineral that’s emerging in China as a serious option. JPMorgan Chase & Co. called it “one of the largest threats” to prices.

But it’s also a controversial topic, with some specialists saying it’s costly and environmentally harmful to convert in large volumes for battery use.

“We will see more lepidolite be brought online in China in 2023,” Cameron Perks, analyst at Benchmark Mineral Intelligence said. “But we won’t see as much as being predicted by others. Give it five or 10 years, and it will increasingly become an important part of the market.”

All of this means the path to supply and cost relief for carmakers is fraught, even before considering the demand side of the ledger.

No collapse

For now, China’s withdrawal of EV credits, as well as uncertainties over the pandemic and global economy, are weighing on the outlook. But a faster-than-expected reopening of China’s economy, and the rest of the world escaping a deep slump, could yet deliver an upside surprise.

“The market consensus and the consensus that I would agree with is that in 2023 pricing is likely to plateau, with perhaps some potential for downside but by no means do I see any sort of a pricing collapse,” said Berry of House Mountain Partners.

(By Annie Lee and Mark Burton)

U.S. Lithium Production Is Set To Explode

- The Inflation Reduction Act, which has been described as “the most significant climate legislation in U.S. history”, is an attempt to kickstart the U.S. renewable energy and EV industries.

- In order for the U.S. energy transition plans to work, it will need a significant and secure supply of lithium, a resource that is currently dominated by China, Australia, and Chile.

- To secure this supply, the U.S. government is now throwing money at lithium producers, with lithium facilities planned in Nevada, North Carolina, and Tennessee.

For years, the United States has been falling behind in the clean energy race. While other energy producers around the world have been investing heavily into transitioning away from fossil fuels, a flood of cheap oil and gas from the West Texas Permian Basin over the last decades – on top of enormous inertia and petro-protectionism built into the nation’s economy and culture – has left the U.S. renewable energy sector in a state of arrested development.

Now, the Biden administration is making a bid to bring the country up to speed and become competitive with renewable energy powerhouses like China and Europe. Last year’s Inflation Reduction Act has been described as “the most significant climate legislation in U.S. history” according to the United States Environmental Protection Agency (EPA). The Act, which is actually a slimmed-down version of the Build Back Better Act, includes massive financial support for the domestic renewable energy sector. According to the Biden administration, the Act provides an estimated $370 billion in subsidies for solar, wind, and electric vehicle subsidies. These and other provisions are part of the government’s current goal to lower greenhouse gas emissions to a level 40% below 2005 levels by 2030.

Trying to kickstart growth in these sectors faces several major hurdles. One of these is finding enough labor in a historically tight job market. The other is lithium. The batteries that power electric vehicles and store energy created by variable renewable sources such as wind and solar depend on lithium and other non-renewable rare Earth minerals to function. This poses new challenges for geopolitics, as just a few countries – most notably Australia, Chile, and China – control the majority of the global supply.

The United States does have some of its own proven lithium reserves. But at present, there is just one operating lithium plant in the entire country – the Silver Peak facility on the western edge of Nevada. If the United States has any hope of boosting its EV and renewable energy production without relying on China for lithium, developing more domestic lithium production will be crucial, not to mention urgent.

As such, the federal government is throwing money at lithium producers to develop lithium supply chains fast enough to support the rapid renewable sector growth targeted by the Inflation Reduction Act. Just last week, Australian lithium company Ioneer said that the U.S. Department of Energy gave them a conditional commitment of a loan of up to USD $700 million. The company’s main project will be in Nevada, at the Rhyolite Ridge Lithium-Boron Project in Esmeralda County. “When fully operational, the site will produce enough lithium for 400,000 electric vehicles,” CNBC reports, “while also producing boron.” The Rhyolite Ridge project is just the latest in a series of lithium companies to introduce new or expanded plants in the U.S. since the unveiling of the Inflation Reduction Act. In addition to more Nevada facilities, plans have also been announced for lithium production centers in North Carolina and Tennessee.

The Rhyolite Ridge plant hasn’t even become operational, and already EV producers including Ford and Toyota have already inked offtake agreements with Ioneer, underscoring the growing anxiety that there might not be enough lithium to go around once EVs and short-term renewable energy storage take off in earnest. That anxiety is understandable. If all the gas-powered cars in the world were replaced with electric cars overnight, projections show that the global supply of lithium would be completely depleted in just fifty years. Of course, this is just a thought experiment, but it is an important reminder that even “renewable” technologies rely on finite resources. Currently, just 1% of cars on U.S. roads are electric, but the number of electric cars in the world is projected to skyrocket over the next decade, reaching a global fleet of approximately 125 million by 2030.

By Haley Zaremba for Oilprice.com

No comments:

Post a Comment