By Henry Lazenby in Tonopah, Nevada | July 6, 2023

PHOTOS: Henry Lazenby

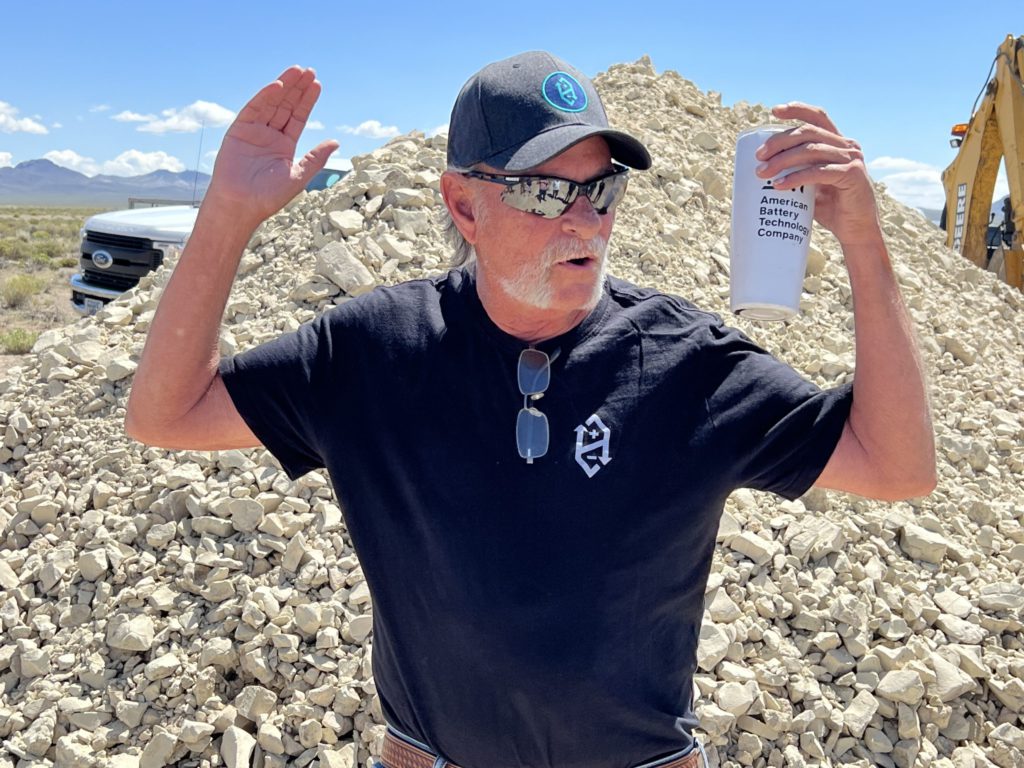

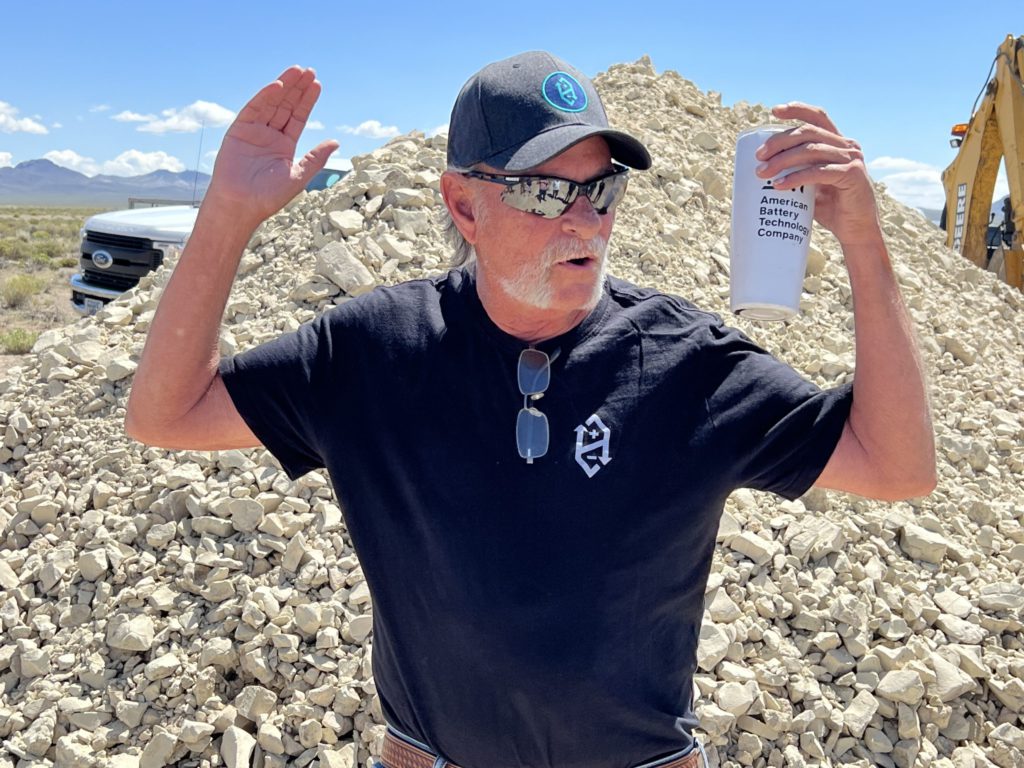

Ross Leisinger head of resources at American Battery Technology Company, stand at the company’s Tonopah Flats project with a stockpile of lithium clay ore ready for processing.

While precious metals-focused juniors are working to revive Nevada’s tired Tonopah Silver District, lithium discoveries to the north, west and south of the desert town’s doorstep could again kick the boom-bust local economy into high gear.

Among a handful of prospectors jumping to capitalize on the battery metal’s EV potential are American Lithium (TSXV: LI), Tearlach Lithium (TSXV: TEA), American Battery Technology Company (OTC: ABML) and Century Lithium (TSXV: LCE), all emerging as critical players in the region’s nascent lithium mining industry. They want to exploit lithium’s potential while emphasizing sustainability and community engagement, The Northern Miner learnt on a recent tour of the district’s lithium exploration plays.

Industry experts agree that in the next five years, there will be a structural lithium deficit, and one of the contributing factors is the lack of technical know-how in the industry while it attempts to scale up and become more global.

Suppose the Comstock Lode is credited for funding the war that created Nevada, and the Tonopah Silver District is credited for paying to keep Nevada an independent state. In that case, undoubtedly, lithium stands to chart a new course for the historical mining town a three-hour drive north of Las Vegas.

“The Heller Tuff is mainly a geological formation located in the southern caldera of the Tonopah District, but the Oddie rhyolite, which is where it says ‘Tonopah Mining Park,’ that’s the rhyolite and the Siebert Tuff; that’s what everybody’s excited about because it’s full of lithium. So much lithium people don’t know what to do with it all,” said Blackrock Silver CEO Bill Howard, orienting the tour group while pointing his finger to a prominent feature on a hillside overlooking Tonopah under the searing desert sun.

Ross Leisinger head of resources at American Battery Technology Company, stand at the company’s Tonopah Flats project with a stockpile of lithium clay ore ready for processing.

While precious metals-focused juniors are working to revive Nevada’s tired Tonopah Silver District, lithium discoveries to the north, west and south of the desert town’s doorstep could again kick the boom-bust local economy into high gear.

Among a handful of prospectors jumping to capitalize on the battery metal’s EV potential are American Lithium (TSXV: LI), Tearlach Lithium (TSXV: TEA), American Battery Technology Company (OTC: ABML) and Century Lithium (TSXV: LCE), all emerging as critical players in the region’s nascent lithium mining industry. They want to exploit lithium’s potential while emphasizing sustainability and community engagement, The Northern Miner learnt on a recent tour of the district’s lithium exploration plays.

Industry experts agree that in the next five years, there will be a structural lithium deficit, and one of the contributing factors is the lack of technical know-how in the industry while it attempts to scale up and become more global.

Suppose the Comstock Lode is credited for funding the war that created Nevada, and the Tonopah Silver District is credited for paying to keep Nevada an independent state. In that case, undoubtedly, lithium stands to chart a new course for the historical mining town a three-hour drive north of Las Vegas.

“The Heller Tuff is mainly a geological formation located in the southern caldera of the Tonopah District, but the Oddie rhyolite, which is where it says ‘Tonopah Mining Park,’ that’s the rhyolite and the Siebert Tuff; that’s what everybody’s excited about because it’s full of lithium. So much lithium people don’t know what to do with it all,” said Blackrock Silver CEO Bill Howard, orienting the tour group while pointing his finger to a prominent feature on a hillside overlooking Tonopah under the searing desert sun.

Lithium fever is running high in Nye and Esmerelda Counties, Nevada.

Credit: Tearlach Resources

While Albemarle (NYSE: ALB) has been producing lithium at the Silver Peak lithium brines mine in the nearby Clayton Valley, discovering high-grade lithium clays in neighbouring basins opens opportunities for new players.

The first stop on the whirlwind tour is American Lithium’s TLC project. Under the leadership of executive vice president Ted O’Connor, American Lithium has made noteworthy progress in its lithium endeavours.

The TLC project boasts a distinct freshwater lithium system and easily extractable lithium deposits between Tonopah and a solar power plant. “Our system is an incredibly low energy system. The lithium is more weakly bound in our magnesium smectite,” O’Conner says.

He explains that through extensive drilling and exploration, American Lithium aims to mine for 20 years, process and stockpile lithium for another 20 years, and gradually rehabilitate the pit. The TLC project is forecast to yield 24,000 tons of lithium carbonate yearly, with plans to double production to 48,000 tons within four years.

On Dec. 1, 2022, the company announced an updated resource estimate that increased the contained lithium resources for the TLC project. This estimate was completed in early December as part of compiling the initial preliminary economic assessment (PEA). It was incorporated into the mine plan within the first PEA , released on Feb. 1.

TLC currently hosts 8.8 million tonnes of lithium carbonate equivalent (LCE) grading 809 parts per million (ppm) lithium in two million tonnes measured and indicated resources and 1.9 million tonnes LCE at 713 ppm lithium in 486 million tonnes inferred.

The PEA calculated a net present value of $3.3 billion, using an 8% discount rate with an internal rate of return of 27.5%, giving a 3.5-year capital payback period.

The company has prioritized positive community relationships, engaging with local tribes and fostering a balance between development and preservation. O’Conner says the near-surface deposit is above the water table, and there are no threatened or protected plants or wildlife on the 50-sq.-km property.

Following the example

Next door and just to the west of Tonopah, Blackrock Silver (TSXV: BRC) and Tearlach Lithium’s 30-70%-owned Gabriel project partnership follows in American Lithium’s footsteps. They are also working to explore claystone lithium mineralization.

Led by CEO Chuck Ross, Tearlach brings its expertise in lithium exploration and development, while Blackrock contributes valuable insights and assets gained from previous lithium exploration efforts.

Tearlach Lithium’s geological team, headed by Dr. Julie Selway, oversees multiple projects in Ontario and has now set its focus on Nevada exploration. The partnership’s exploration program has yielded promising results, with significant mineralization intersected in drill holes on the 16-sq.-km property.

The team has drilled over 1,200 metres across 11 holes, returning grades as high as 550 ppm lithium to 1,460 ppm. Ross also points out some wide intercepts of up to 44 metres.

Blackrock Silver’s initial discovery of lithium during their search for high-grade silver veins has paved the way for their partnership with Tearlach.

While Albemarle (NYSE: ALB) has been producing lithium at the Silver Peak lithium brines mine in the nearby Clayton Valley, discovering high-grade lithium clays in neighbouring basins opens opportunities for new players.

The first stop on the whirlwind tour is American Lithium’s TLC project. Under the leadership of executive vice president Ted O’Connor, American Lithium has made noteworthy progress in its lithium endeavours.

The TLC project boasts a distinct freshwater lithium system and easily extractable lithium deposits between Tonopah and a solar power plant. “Our system is an incredibly low energy system. The lithium is more weakly bound in our magnesium smectite,” O’Conner says.

He explains that through extensive drilling and exploration, American Lithium aims to mine for 20 years, process and stockpile lithium for another 20 years, and gradually rehabilitate the pit. The TLC project is forecast to yield 24,000 tons of lithium carbonate yearly, with plans to double production to 48,000 tons within four years.

On Dec. 1, 2022, the company announced an updated resource estimate that increased the contained lithium resources for the TLC project. This estimate was completed in early December as part of compiling the initial preliminary economic assessment (PEA). It was incorporated into the mine plan within the first PEA , released on Feb. 1.

TLC currently hosts 8.8 million tonnes of lithium carbonate equivalent (LCE) grading 809 parts per million (ppm) lithium in two million tonnes measured and indicated resources and 1.9 million tonnes LCE at 713 ppm lithium in 486 million tonnes inferred.

The PEA calculated a net present value of $3.3 billion, using an 8% discount rate with an internal rate of return of 27.5%, giving a 3.5-year capital payback period.

The company has prioritized positive community relationships, engaging with local tribes and fostering a balance between development and preservation. O’Conner says the near-surface deposit is above the water table, and there are no threatened or protected plants or wildlife on the 50-sq.-km property.

Following the example

Next door and just to the west of Tonopah, Blackrock Silver (TSXV: BRC) and Tearlach Lithium’s 30-70%-owned Gabriel project partnership follows in American Lithium’s footsteps. They are also working to explore claystone lithium mineralization.

Led by CEO Chuck Ross, Tearlach brings its expertise in lithium exploration and development, while Blackrock contributes valuable insights and assets gained from previous lithium exploration efforts.

Tearlach Lithium’s geological team, headed by Dr. Julie Selway, oversees multiple projects in Ontario and has now set its focus on Nevada exploration. The partnership’s exploration program has yielded promising results, with significant mineralization intersected in drill holes on the 16-sq.-km property.

The team has drilled over 1,200 metres across 11 holes, returning grades as high as 550 ppm lithium to 1,460 ppm. Ross also points out some wide intercepts of up to 44 metres.

Blackrock Silver’s initial discovery of lithium during their search for high-grade silver veins has paved the way for their partnership with Tearlach.

American Lithium technical advisor and director Ted O’Connor at the TLC project, host to the states biggest lithium resource.

Ross explains the Blackrock Silver historic drilling intersected claystone intervals within the Miocene Siebert Formation that are lithium-mineralized, most likely in the form of lithium-bearing clays similar to other lithium deposits in the district. The Siebert Formation comprises mostly tuffaceous, pelitic, calcareous, and locally dolomitic lacustrine sediments. The bulk of the lithium mineralization is flat-lying in nature and is initially interpreted to be present in two separate claystone layers.

The partnership aims to gain deeper insights into lithium mineralization patterns and accurately estimate resource variability.

“We appreciate hearing where American lithium is; we can see where we need to go,” Ross said.

A little further west towards the centre of the basin, American Battery Technology Company head of resources Ross Leisinger says the discovery of significant lithium deposits on the Tonopah Flats of Nevada has garnered attention from the Department of Energy (DOE) and the Biden administration. “The Biden administration and DOE have selected us… to build the first of its kind lithium extraction plant in the state of Nevada,” Leisinger says.

The company plans to build a pilot plant in Fernley, Nev., with a nearly 30,000-sq.-metre lithium-ion battery recycling facility.

Leisinger stood in front of a large stockpile of lithium claystone above the projected economic grade for production, earmarked to be fed through the pilot plant once it’s ready.

Ross explains the Blackrock Silver historic drilling intersected claystone intervals within the Miocene Siebert Formation that are lithium-mineralized, most likely in the form of lithium-bearing clays similar to other lithium deposits in the district. The Siebert Formation comprises mostly tuffaceous, pelitic, calcareous, and locally dolomitic lacustrine sediments. The bulk of the lithium mineralization is flat-lying in nature and is initially interpreted to be present in two separate claystone layers.

The partnership aims to gain deeper insights into lithium mineralization patterns and accurately estimate resource variability.

“We appreciate hearing where American lithium is; we can see where we need to go,” Ross said.

A little further west towards the centre of the basin, American Battery Technology Company head of resources Ross Leisinger says the discovery of significant lithium deposits on the Tonopah Flats of Nevada has garnered attention from the Department of Energy (DOE) and the Biden administration. “The Biden administration and DOE have selected us… to build the first of its kind lithium extraction plant in the state of Nevada,” Leisinger says.

The company plans to build a pilot plant in Fernley, Nev., with a nearly 30,000-sq.-metre lithium-ion battery recycling facility.

Leisinger stood in front of a large stockpile of lithium claystone above the projected economic grade for production, earmarked to be fed through the pilot plant once it’s ready.

Salt crystalizes under the Nevada desert sun at Albemarle’s Silver Peak lithium mine in the Clayton Valley.

“The real icing on the cake is for people that haven’t seen what lithium claystone looks like. This is what it looks like… worth more than gold right now in Nevada,” he said, holding a piece of rock that resembles brittle dried mud, with the attending geologists — curious folks that they are – giving the rocks the old lick test for the presence of salinity.

Through strategic exploration efforts on the 42-sq.-km property, the team has identified a measured and indicated resource of 15.6 million tonnes of LCE grading 300 ppm in 5.3 million inferred tons.

The geologist says the team has demonstrated its determination to expedite the permitting process and move toward full-scale production. “We’re moving rapidly on permitting… let’s get this into production.”

Leisinger advocates for collaboration among the region’s lithium explorers, aiming to reduce costs and maximize efficiency.

In the shadow of a giant

Meanwhile, the Century Lithium Angel Island project in the Clayton Valley will also make its mark when in production. Around 2017, a company called Cyprus Development Corp consolidated some groups of lithium claims in the valley.

The company’s Angel Island project sits next to Albemarle’s Silver Peak brine evaporation mine, essentially one valley over from California’s Death Valley, where the world’s hottest temperature of 56.7 degrees Celsius was recorded in 1913.

The project encompasses about 2,185 sq. km of claims, mainly claystone, hosting impressive lithium grades ranging from 500 ppm to 3,500 ppm.

“So far, we’ve drilled 42 holes in our model. That doesn’t sound like a lot, but given the low spatial variability in the drill holes regarding grade, the geostatistics say that 42 holes are enough to constrain a resource.”

A 2021 resource update disclosed probable reserves of 213 million tonnes grading 1,129 ppm lithium for 1.28 million tonnes LCE. The reserve sits in a larger indicated resource of 1.3 billion tonnes grading 905 ppm lithium for 6.3 million tonnes LCE.

Century Lithium’s Angel Island project in Nevada.

The project benefits from a rare 170-acre foot water right, enabling eco-friendly operations utilizing hydrochloric acid as the leaching reagent. “Most of the operators don’t have that kind of access to water rights,” project manager Adam Knight says.

The company is launching a pilot plant in the Amargosa Valley to the south to validate the new extraction process, ensuring continuous operation and refinement for optimized lithium extraction.

“We’ve been running tests for over a year. The total recovery right now is about 80%, but we believe it has the potential to go higher,” Knight said. He added that the planned feed rate right now is 15,000 tons a day, which should reach 27,000-28,000 tonnes per year production of lithium hydroxide.

A modest drilling program will define the starting area and help develop an ore control model this fall.

In the background further south is visible progress on construction of Pure Energy Minerals’ (TSXV: PE) direct lithium extraction (DLE) pilot plant at its Clayton Valley lithium brine project in Esmeralda County.

The final permit required to operate the DLE pilot plant became effective on Mar. 17, the company said, adding the pilot plant’s construction and operation at the Clayton Valley site are both now permitted.

The Vancouver-based miner is exploring and developing the 94.5-sq.-km Clayton Valley project, the largest mineral land holdings in the area, which adjoins and surrounds on three sides the Silver Peak lithium brine mine operated by Albemarle.

Pure Energy’s partner, SLB (formerly Schlumberger), through its New Energy business, is responsible for the design, construction and operation of the pilot plant to produce lithium compounds.

The company is launching a pilot plant in the Amargosa Valley to the south to validate the new extraction process, ensuring continuous operation and refinement for optimized lithium extraction.

“We’ve been running tests for over a year. The total recovery right now is about 80%, but we believe it has the potential to go higher,” Knight said. He added that the planned feed rate right now is 15,000 tons a day, which should reach 27,000-28,000 tonnes per year production of lithium hydroxide.

A modest drilling program will define the starting area and help develop an ore control model this fall.

In the background further south is visible progress on construction of Pure Energy Minerals’ (TSXV: PE) direct lithium extraction (DLE) pilot plant at its Clayton Valley lithium brine project in Esmeralda County.

The final permit required to operate the DLE pilot plant became effective on Mar. 17, the company said, adding the pilot plant’s construction and operation at the Clayton Valley site are both now permitted.

The Vancouver-based miner is exploring and developing the 94.5-sq.-km Clayton Valley project, the largest mineral land holdings in the area, which adjoins and surrounds on three sides the Silver Peak lithium brine mine operated by Albemarle.

Pure Energy’s partner, SLB (formerly Schlumberger), through its New Energy business, is responsible for the design, construction and operation of the pilot plant to produce lithium compounds.

No comments:

Post a Comment