Bloomberg News | May 22, 2024 |

Javier Milei. Credit: Vox España | Wikimedia Commons

Global mining heavyweights including Lundin Mining Corp., Glencore Plc and First Quantum Minerals Ltd. are piling into Argentina as a new government intent on luring foreign investment propels the companies closer than ever to opening up vast copper deposits in the red-hued Andes.

It’s part of a colossal wave of spending needed worldwide to prevent a supply crunch for the metal, a critical component of the electrification push to slow climate change.

Argentina stands to get a good share of that money if President Javier Milei can convince companies based in Toronto, Melbourne and London that their projects are safe from the country’s notoriously volatile politics and rules for doing business — and if those companies can convince Argentines that the economic benefits outweigh the environmental risks.

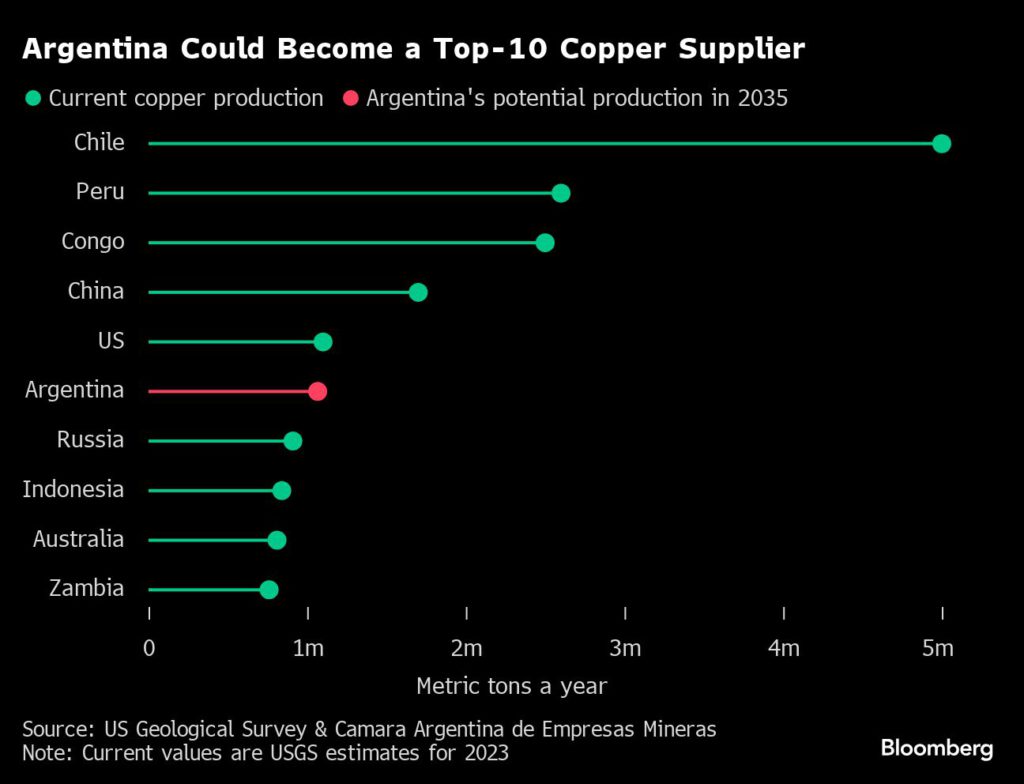

As it stands, Argentina produces next to no copper despite sharing geology with its neighbor Chile, the world’s top exporter.

But should just six of the two-dozen-or-so copper projects being contemplated in Argentina come to pass, the nation could be a major supplier by 2035, churning out more than 1 million metric tons a year. Annual exports could top $8 billion, according to local mining group Caem.

“With the change of government, I think Argentina will now become a huge rival to Chile,” said Marcelo Awad, who was the chief executive of Antofagasta Plc from 2004 to 2012 when the Chilean miner tried and failed to start operations in Argentina. “The pro-business policies clearly make it a big competitor for attracting capital flows to copper projects.”

Milei, a libertarian in his first year in office, is trying to flip the fortunes of a country that’s on course for its sixth recession in a decade by curtailing government influence and freeing business from a slew of controls to — in theory, at least — tee up private-led growth. Former President Mauricio Macri tried something similar from 2015 to 2019, but the efforts didn’t make much progress and he was swiftly voted out.

To help avoid a repeat scenario, Milei needs to generate a surge in economic activity. Mining, one of just a handful of sectors with the muscle to stimulate business up and down Argentina, provides an obvious opportunity.

That’s why Milei has made a sweeping package of tax, currency and customs benefits for big-time investors — known locally by its Spanish acronym, RIGI — a hallmark of his proposed reforms. They’re being debated by lawmakers.

“The RIGI will be a jumper cable for infrastructure projects,” said Michael Meding, the general manager of Los Azules, a copper site run by Canada’s McEwen Copper Inc. Company officials estimate it will take $2.5 billion to build the mine, with construction slated to start midway through Milei’s four-year term if it can win the needed permits.

Prices of copper, a wiring metal, have surged in recent months, driven in part by concerns that demand from clean power, military equipment and data centers will outstrip supply. Miners need to spend about $130 billion over the next decade to avoid a projected annual shortfall in 2034 of some 7.7 million tons, according to the CRU Group, a research firm focused on mining and commodities.

While there’s plenty of copper still in the ground, deposits are getting pricier and trickier to develop at a time of heightened scrutiny of social and environmental issues. In Argentina, those issues have been a bigger hurdle than elsewhere — but the record prices and Milei’s pivot to a friendlier business climate are suddenly making it more feasible to unearth the nation’s resources.

Argentina has already had success with lithium, a mineral that’s key to making batteries for electric cars. Copper projects, though, tend to be bigger, more expensive and more destructive. And Argentina is a particularly precarious destination for prospectors since it is largely focused on farming and oil, not metals like regional peers Chile and Peru.

A scene last month offered a peek into this dilemma. In the mountain village of Calingasta, in San Juan province, Meding and other officials from McEwen Copper were pitching investors about their plans to dig the Los Azules pit, measuring 2.3 miles long and more than half as wide, just up the road in a pristine stretch of the Andes.

Company founder Rob McEwen, seated in the audience, didn’t like the rosy picture he was hearing from his underlings about the impact the mine would have on wetlands, oases at 12,000 feet called vegas in Spanish. They were suggesting that water could be rerouted to recreate the marshes elsewhere.

“Those vegas are disappearing,” McEwen, 74, interjected from across the room, taking the men aback. “They’re gone forever. Don’t try to coat it, as people will see through it.”

In addition to securing environmental permits, miners operating in remote corners of the developing world like Calingasta must win “social licenses” from communities and other groups. It’s a difficult task in a place like Argentina that hasn’t fully embraced the metals industry, but McEwen says it’s vital to avoid protests and disruptions down the line.

San Juan, a relatively poor province with an economy based on agriculture and solar power, has been opening its arms to miners in a way that others — unwilling to compromise on ecological issues — haven’t.

Beyond the wetlands, glaciers are another concern. A federal inventory lists 16,000 sites to protect in the Argentine Andes, many in San Juan. Glencore has tried to get one — an ice-rich rock glacier — struck off the list so it can proceed with its El Pachon copper project.

Earthquakes are another major threat: A big quake might damage a mine and release chemicals into river systems.

Already, leaders of a small anti-mining group from Jachal, a San Juan county close to Calingasta, have been warning people not to give their blessing to Los Azules. At community meetings hosted by McEwen Copper, they’ve highlighted the negative impacts of nearby gold mine Veladero, which suffered three cyanide leaks from 2015 to 2017, leading a federal judge to recommend it be shuttered. After making improvements, today Veladero operates normally.

“We went to Calingasta with our own truth — to tell them that because of the sheer scale of mines it’s impossible for them not to pollute,” said Faustino Esquivel, one of the leaders of the non-governmental organization called Don’t Touch Jachal.

Bill Shaver, chief operating officer of McEwen Copper’s parent company, said he’s heard similar arguments before during a career spanning 50 years. His strategy is to bring in outside specialists who are comfortable with the project, say professors from the provincial university, and get them to meet with locals to address their concerns.

“You have to work with the communities,” Shaver said. “Otherwise these NGOs could come in and you get in a p—ing match that lasts years.”

San Juan — which has the power to issue environmental permits for building mines, rather than federal authorities — wants the windfall of investment, jobs and tax revenue that copper can bring. Yet officials are only too aware that they must tread carefully when it comes to social and environmental considerations.

“Mining in San Juan is state policy,” Governor Marcelo Orrego said in an interview. “But we also know that we can’t make a mistake on environmental issues.”

There are risks at the national level, too: Milei’s proposed RIGI tax benefits for miners — part of his broader deregulation push — come after a similarly sweet deal recently fueled protests and the downfall of a huge copper pit in Panama.

For now, McEwen, like most wealthy investors, is fawning over the policies.

“Argentina has been a case of ‘nice deposit but wrong country,’” he said. “Milei is Prince Charming who’s given it the wake-up kiss.”

(By Jonathan Gilbert and James Attwood)

- Argentina Is Positioning Itself as a Mining Giant

- Irina Slav - May 21, 2024

- Argentina has large reserves of copper and lithium, key minerals for electric vehicles and renewable energy.

- The government is removing regulations and attracting investment to develop these resources.

- Argentina could become a major supplier of transition metals if demand from the energy transition continues to grow.

In commodity circles, Argentina is known for its agricultural produce and for the Vaca Muerta shale play. But the country has recently started drawing attention to other kinds of natural resources: copper and lithium. According to some, it has a bright future as one of the world’s biggest transition minerals suppliers.

Two weeks ago, a local investment company, Integra Capital, struck a deal with Glencore to acquire its stake in a company called Volcan Compania Minera. According to Bloomberg, this is the second Glencore project the company has acquired in recent years. It is part of a strategy: building a metals and minerals portfolio in Argentina in anticipation of a mining boom driven by transition efforts.

Integra Capital is an investment vehicle owned by Jose Luis Manzano, who told Bloomberg in an interview, “We believe we are positioning ourselves in things that will be necessary for the next 50 to 100 years.”

In that, the Argentinian commodity investor echoes a sentiment that has become rather popular in investment circles. Copper and lithium are the focus of much forecasting attention as key transition minerals, alongside elements such as nickel and cobalt, used in batteries for EVs and storage.

Argentina’s political circles have also been paying attention to the forecasts. Last year, Reuters reported that Argentina’s government had plans for copper mining projects that could produce 793,000 tons of the metal annually by the end of the decade. That would be quite something given that there is no copper production in Argentina at the moment—it would turn the country into one of the ten biggest copper producers in the world.

There are several copper projects in various, though early, development stages as miners stake their claims in the resource-rich country. Manzano’s buying spree now suggests there may well be something to it—as long as the forecasts materialize.

There are seven copper projects in progress in Argentina at the moment. According to BNAmericas, these could generate some $5 billion annually for the country’s budget once they start producing. The total output of the seven is seen at 1.2 million tons annually, per that report, which is considerably more than the estimate reported by Reuters. In total, Argentina’s copper reserves are estimated to be 44 million tons.

Yet copper is not the country’s only transition metal available in abundance. Argentina is also part of the so-called Lithium Triangle and is home to a third of the global reserves of the battery metal. Along with the other two “points” of the Triangle—Chile and Bolivia—Argentina accounts for as much as 70% of the world’s lithium, per Mining.com.

There are already a slew of companies developing Argentina’s lithium resources, with production last year hitting 9,600 tonnes. This appears set to grow in response to forecasts for growing demand, even though lately, these forecasts have become much less certain as demand for EVs weakens in many key markets. Even so, more lithium hopefuls are going to Argentina. Earlier this month, Reuters reported that an Emirati company planned to start producing battery-grade lithium at a rate of 5,000 tons in the country from 2027, raising this to 10,000 tons by the next year.

All these companies betting on Argentina’s mineral wealth got lucky last year when President Javier Milei came into power. The outspoken libertarian has eagerly promoted the country’s mineral wealth, and his policies should make it easier for miners to do business in the country by removing regulatory hurdles and establishing an investment-friendly environment. As long as demand lives up to forecast, Argentina could indeed become a major supplier for the energy transition.

By Irina Slav for Oilprice.com

No comments:

Post a Comment