Glencore said to hold talks for sale of key Congo copper mine

Sanctioned Israeli billionaire Dan Gertler also receives a 2.5% royalty

Glencore Plc has been holding talks about selling a stake in its biggest African copper mine, in the clearest sign yet that the commodity trader is open to relinquishing control of one of its flagship assets.

The Kamoto Copper Co. controls a major copper and cobalt project in the Democratic Republic of Congo, which has long been touted by Glencore as one of its key drivers of growth. Yet the mines have been dogged by operational setbacks, a collapse in cobalt prices, and an ongoing dispute with the Congolese government over royalties.

Glencore is the only western miner operating major cobalt mines in Congo, with most of the country’s output coming from assets controlled by Chinese companies and Kazakhstan’s Eurasian Resources Group. While overproduction has weighed on prices for the battery metal, the US has been moving to lock in long-term supplies and build strategic reserves as a backstop for its defense industry.

KCC’s poor performance has frustrated some investors in recent years, but Glencore still sees potential in the asset as it looks to reverse a decline in copper output.

The mining and trading company has long said that all of its assets would be for sale at the right price, and at the end of last year it was approached by Orion Resource Partners with a proposal for the New York fund to buy the Congolese operation through its joint venture with Abu Dhabi’s ADQ, according to people familiar with the situation, who asked not to be identified because the talks are private.

Glencore said at the time it had rejected an unsolicited offer, without naming the buyer. But in recent months, it has stepped up its efforts to find a buyer for the mine and has held talks with potential bidders, including Orion, the people said. A potential sale has been discussed as part of ongoing talks over a minerals and infrastructure partnership between the US and Congo, according to the people.

While Glencore has not run an official sales process, it has informally let other companies — such as Rio Tinto Group — know that it’s open to selling a controlling stake, some of the people said. There is no guarantee the talks will result in a deal, they added.

Spokespeople for Glencore, Orion and Rio declined to comment.

Congo is the world’s second-biggest source of copper and accounts for about 75% of global production of cobalt, which is a key material in batteries, jet-engine alloys and high-strength magnets. The US is hoping a metals and infrastructure partnership with the central African nation will help secure key minerals and reduce China’s control over the industry.

The US International Development Finance Corp. is currently in discussions to establish a fund to invest in mining with New York-based Orion, Bloomberg reported Tuesday. The Trump administration has made it a priority to shore up access to critical minerals such as copper, cobalt and rare earths. The logic behind the potential collaboration between the DFC and Orion is widespread anxiety about supply.

The DFC could be involved in the KCC deal, possibly through the planned venture with Orion, according to three of the people.

A senior official in the US State Department declined to comment on any potential sale, but said it is committed to facilitating increased US investment in the DRC, and furthering strategic cooperation with African partners in the critical minerals sector.

Royalties dispute

KCC, which produced 191,000 tons of copper and 27,000 tons of cobalt in 2024, has struggled to reach full capacity and has been embroiled in a long-running dispute with Congolese authorities over billions of dollars in taxes and royalties. The future of the offtake contracts for the mine’s output — which currently help underpin Glencore’s trading operation — are a key point of discussion with prospective buyers, some of the people said.

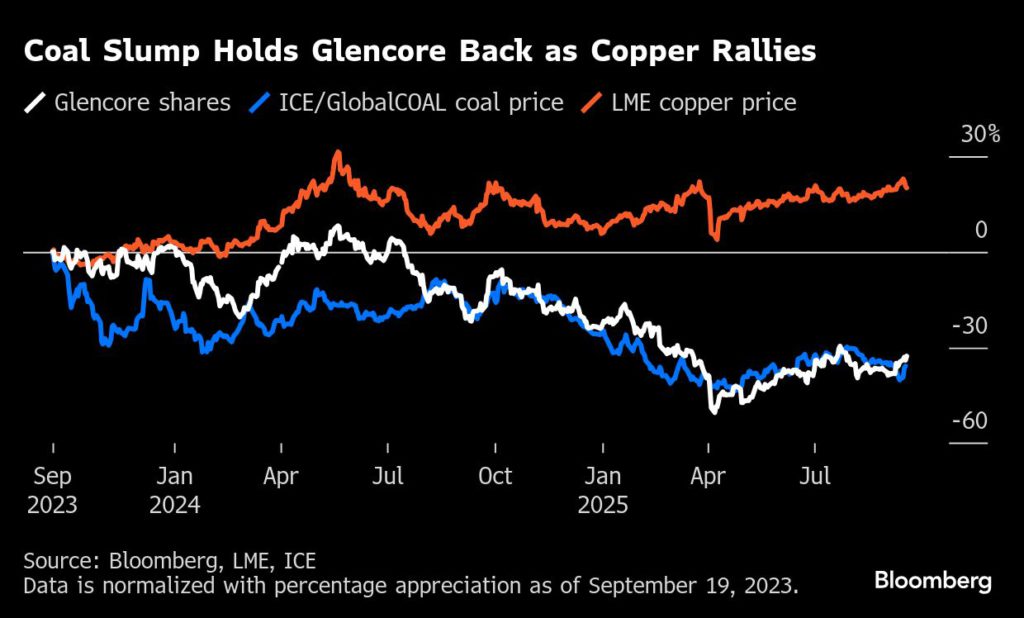

The talks come at a pivotal time for Glencore. Its high dependence on coal — which has slumped in value — along with falling copper production and a crisis in metal processing and refining has seen its shares fall almost 20% in the past year.

Swiss-based Glencore holds 70% of KCC, with the remaining shares belonging to Gecamines and the Congolese state. Sanctioned Israeli billionaire Dan Gertler also receives a 2.5% royalty on net revenues from KCC, which has complicated the US-Congo talks, according to the people.

Western investors have been reluctant to invest in Congo in part because of concerns about dealing with a sanctioned individual, they said. Gertler also collects a similar royalty from Glencore’s Mutanda mine and ERG’s Metalkol copper and cobalt projects.

He has in principle agreed to a plan — first formulated under the Biden administration — to sell the royalties, which could be worth hundreds of millions of dollars, divest from Congo, and participate in an audit. The US in turn would provide a license that would conditionally lift the sanctions, which were implemented in 2017 for allegedly amassing a “fortune through hundreds of millions of dollars’ worth of opaque and corrupt mining and oil deals” in Congo.

Gertler has never been charged with a crime and has always denied any wrongdoing.

It’s possible Glencore would keep a stake in KCC large enough to keep paying Gertler the royalties, so any buyer would not be paying a sanctioned individual directly, according to one of the people.

Another option would see Gertler paid a lump sum for his royalties, which would then likely revert to state-owned Gecamines. A third proposal would see Gertler hand over the royalties to Gecamines for nothing, according to two people with knowledge of the talks.

Representatives for Gertler and Congo’s mining ministry did not respond to requests for comment. Gecamines declined to comment.

(By Michael J. Kavanagh, Thomas Biesheuvel and Jack Farchy)

No comments:

Post a Comment