From Food Aid To Free Trade: Europe Courts India — With Caveats – Analysis

India's PM Narendra Modi meets the President of the European Commission,

Ms. Ursula Von Der Leyen. Photo Credit: India Prime Minister Office

October 17, 2025

By Ramesh Jaura

Since the 1960s, India has prioritised strategic autonomy in its foreign policy, consistently avoiding alliances that could compromise its sovereignty. Western partners often overestimate their influence, overlooking India’s strong commitment to independence. For India, autonomy is not a tactic but a core principle.

In September 2025, European Commission President Ursula von der Leyen unveiled an ambitious India Strategic Roadmap, which includes the world’s largest free trade agreement, a startup corridor, deeper ties to Horizon Europe, and broad security and defence cooperation.

However, the agreement included caveats. The EU warned that India’s continued purchases of discounted Russian oil and joint military exercises with Moscow would impede closer ties.

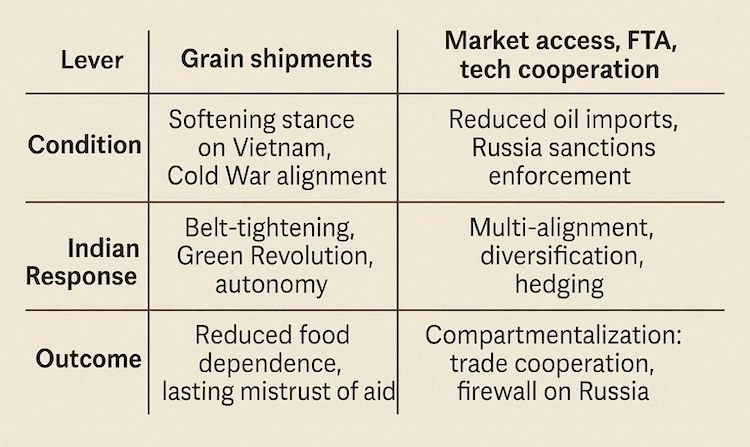

Indian leaders anticipated this response and maintained their position. The legacy of the 1960s remains relevant, when the United States used the PL-480 “Food for Peace” program to influence India during the Cold War.

The core challenge remains: India consistently defends its autonomy, while Western partners often seek alignment as a condition for partnership.

PL-480: Food as Foreign Policy

The 1954 Agricultural Trade Development and Assistance Act, commonly referred to as PL-480, was designed to dispose of surplus U.S. grain and foster goodwill. For India, this aid was essential.

By the late 1950s, India faced recurring droughts, rapid population growth, and stagnant farm output. U.S. wheat imports through PL-480 soared, reaching nearly 10 million tonnes annually by 1965.

Though touted as humanitarian, PL-480 quickly became a foreign policy toolUnder President Lyndon Johnson, the U.S. enforced a “short-tether” policy, authorising aid in small, conditional tranches.

Continued aid depended on India’s support for U.S.-Vietnam actions and alignment with Washington.

When Prime Minister Lal Bahadur Shastri condemned the bombing of Hanoi in 1965, U.S. shipments slowed mid-drought.

The message was clear: food aid was contingent on political alignment.

India’s Response: Tightening Belts, Guarding Sovereignty

The PL-480 experience exposed the risks of dependence and reinforced India’s commitment to the non-aligned path envisioned by Nehru.

Non-alignment was an active assertion of independence. India engaged with major powers but consistently set its own terms.

Prime Minister Shastri made it plain: “We have to tighten our belts, but we will never sacrifice our freedom.”

This stance had significant consequences:

1. The Green Revolution

The crisis led to a domestic agricultural revolution. By the 1970s, India no longer relied on foreign grain.

2. Strategic Skepticism of Conditional Aid

PL-480 demonstrated that Western aid often includes conditions. This caution continues to influence India’s foreign policy today.

Brussels in 2025: A Familiar Tune, New Instruments

The EU’s 2025 Strategic Roadmap echoes the PL-480 era. While the focus is now on market access, technology, and supply chains rather than wheat, conditionality remains central.

Economic Leverage

The EU promises the “largest FTA in the world,” but links it to compliance with Russia sanctions, oil import curbs, and a crackdown on “shadow fleets.”

Security Incentives with Strings

Offers of defense cooperation and intelligence sharing depend on India aligning with Europe’s Russia policy and reducing its ties to Moscow.

Regulatory Conditionality

EU norms on data privacy, green standards, and due diligence act as informal pressure tools that shape India’s policies.

India no longer relies on foreign aid, yet the EU continues to use economic leverage to influence political decisions.

India’s Modern Doctrine: Multi-Alignment, Not Non-Alignment

India’s strategy still channels the instincts forged in the 1960s, now reinvented for a world of shifting power centres.

This approach represents multi-alignment rather than neutrality:Oil from Russia

Weapons from France

Chips from Taiwan

Markets in the EU

Capital from the U.S.Connectivity via the Gulf

India partners modularly:QUAD for Indo-Pacific security

BRICS for financial coordination

SCO for regional dialogue

This is a deliberate risk-management strategy. As the Green Revolution ended food dependency, multi-alignment now protects India from geopolitical challenges.

The EU’s Blind Spot

The EU’s sanctions-first approach defines post-Ukraine cohesion. Urging partners to follow supports a rules-based order.

However, this approach overlooks India’s realities:Energy Needs

Discounted Russian oil is vital for India’s energy security and inflation control.

Defense Interoperability

Over 60% of India’s military hardware comes from Russia. Transitioning will take time.

Global South Optics

India’s approach resonates in the Global South, where many see sanctions as unilateral rather than universal.

The EU’s use of conditional tactics risks repeating the mistakes of the PL-480 era by overestimating its leverage and underestimating India’s commitment to autonomy.Three Lessons Europe Hasn’t Learned

1. Autonomy Is Existential

India is willing to weather any storm to safeguard its independence.

2. Compartmentalisation Works

When interests converge—in mobility, technology, climate, or maritime security—progress follows. But when partners try to force connections where they do not fit, the effort backfires.

3. Respect Builds Trust

India seeks partnerships built on mutual respect, not on condescension or demands for subordination. France’s defence engagement has been successful without requiring India’s ideological alignment.

Toward a Smarter EU Strategy

If Brussels seeks a meaningful strategic partnership, it should:De-link trade from sanctions politics

Negotiate the FTA on economic merit.

Pursue modular wins

Talent mobility, green tech, maritime awareness, and startups offer quick progress.

Embrace India’s multi-alignment

Multi-alignment strengthens Europe’s China de-risking strategy.

Engage in quiet diplomacy.

Sensitive issues such as shadow fleets should be addressed discreetly, not through public pressure.

The Continuity of Autonomy

From the grain crises of the 1960s to today’s energy crunch, India has weathered wave after wave of Western economic pressure, emerging each time more resilient than before.

This pattern continues: India resists external pressure, adapts, and becomes increasingly self-reliant.

PL-480 unintentionally birthed the Green Revolution.

Today, EU conditionality could spark fresh breakthroughs in homegrown defence, clean energy, and financial innovation in India.

Europe must recognise that a genuine partnership can succeed only when India’s autonomy is respected and protected, without exception. Any attempt to pressure India will only strengthen its independence, the very quality others seek to influence.

Ramesh Jaura is a journalist with 60 years of experience as a freelancer, head of Inter Press Service, and founder-editor of IDN-InDepthNews. His work draws on field reporting and coverage of international conferences and events.

Since the 1960s, India has prioritised strategic autonomy in its foreign policy, consistently avoiding alliances that could compromise its sovereignty. Western partners often overestimate their influence, overlooking India’s strong commitment to independence. For India, autonomy is not a tactic but a core principle.

In September 2025, European Commission President Ursula von der Leyen unveiled an ambitious India Strategic Roadmap, which includes the world’s largest free trade agreement, a startup corridor, deeper ties to Horizon Europe, and broad security and defence cooperation.

However, the agreement included caveats. The EU warned that India’s continued purchases of discounted Russian oil and joint military exercises with Moscow would impede closer ties.

Indian leaders anticipated this response and maintained their position. The legacy of the 1960s remains relevant, when the United States used the PL-480 “Food for Peace” program to influence India during the Cold War.

The core challenge remains: India consistently defends its autonomy, while Western partners often seek alignment as a condition for partnership.

PL-480: Food as Foreign Policy

The 1954 Agricultural Trade Development and Assistance Act, commonly referred to as PL-480, was designed to dispose of surplus U.S. grain and foster goodwill. For India, this aid was essential.

By the late 1950s, India faced recurring droughts, rapid population growth, and stagnant farm output. U.S. wheat imports through PL-480 soared, reaching nearly 10 million tonnes annually by 1965.

Though touted as humanitarian, PL-480 quickly became a foreign policy tool

Continued aid depended on India’s support for U.S.-Vietnam actions and alignment with Washington.

When Prime Minister Lal Bahadur Shastri condemned the bombing of Hanoi in 1965, U.S. shipments slowed mid-drought.

The message was clear: food aid was contingent on political alignment.

India’s Response: Tightening Belts, Guarding Sovereignty

The PL-480 experience exposed the risks of dependence and reinforced India’s commitment to the non-aligned path envisioned by Nehru.

Non-alignment was an active assertion of independence. India engaged with major powers but consistently set its own terms.

Prime Minister Shastri made it plain: “We have to tighten our belts, but we will never sacrifice our freedom.”

This stance had significant consequences:

1. The Green Revolution

The crisis led to a domestic agricultural revolution. By the 1970s, India no longer relied on foreign grain.

2. Strategic Skepticism of Conditional Aid

PL-480 demonstrated that Western aid often includes conditions. This caution continues to influence India’s foreign policy today.

Brussels in 2025: A Familiar Tune, New Instruments

The EU’s 2025 Strategic Roadmap echoes the PL-480 era. While the focus is now on market access, technology, and supply chains rather than wheat, conditionality remains central.

Economic Leverage

The EU promises the “largest FTA in the world,” but links it to compliance with Russia sanctions, oil import curbs, and a crackdown on “shadow fleets.”

Security Incentives with Strings

Offers of defense cooperation and intelligence sharing depend on India aligning with Europe’s Russia policy and reducing its ties to Moscow.

Regulatory Conditionality

EU norms on data privacy, green standards, and due diligence act as informal pressure tools that shape India’s policies.

India no longer relies on foreign aid, yet the EU continues to use economic leverage to influence political decisions.

India’s Modern Doctrine: Multi-Alignment, Not Non-Alignment

India’s strategy still channels the instincts forged in the 1960s, now reinvented for a world of shifting power centres.

This approach represents multi-alignment rather than neutrality:

Weapons from France

Chips from Taiwan

Markets in the EU

Capital from the U.S.

India partners modularly:QUAD for Indo-Pacific security

BRICS for financial coordination

SCO for regional dialogue

This is a deliberate risk-management strategy. As the Green Revolution ended food dependency, multi-alignment now protects India from geopolitical challenges.

The EU’s Blind Spot

The EU’s sanctions-first approach defines post-Ukraine cohesion. Urging partners to follow supports a rules-based order.

However, this approach overlooks India’s realities:Energy Needs

Discounted Russian oil is vital for India’s energy security and inflation control.

Defense Interoperability

Over 60% of India’s military hardware comes from Russia. Transitioning will take time.

Global South Optics

India’s approach resonates in the Global South, where many see sanctions as unilateral rather than universal.

The EU’s use of conditional tactics risks repeating the mistakes of the PL-480 era by overestimating its leverage and underestimating India’s commitment to autonomy.

1. Autonomy Is Existential

India is willing to weather any storm to safeguard its independence.

2. Compartmentalisation Works

When interests converge—in mobility, technology, climate, or maritime security—progress follows. But when partners try to force connections where they do not fit, the effort backfires.

3. Respect Builds Trust

India seeks partnerships built on mutual respect, not on condescension or demands for subordination. France’s defence engagement has been successful without requiring India’s ideological alignment.

Toward a Smarter EU Strategy

If Brussels seeks a meaningful strategic partnership, it should:De-link trade from sanctions politics

Negotiate the FTA on economic merit.

Pursue modular wins

Talent mobility, green tech, maritime awareness, and startups offer quick progress.

Embrace India’s multi-alignment

Multi-alignment strengthens Europe’s China de-risking strategy.

Engage in quiet diplomacy.

Sensitive issues such as shadow fleets should be addressed discreetly, not through public pressure.

The Continuity of Autonomy

From the grain crises of the 1960s to today’s energy crunch, India has weathered wave after wave of Western economic pressure, emerging each time more resilient than before.

This pattern continues: India resists external pressure, adapts, and becomes increasingly self-reliant.

PL-480 unintentionally birthed the Green Revolution.

Today, EU conditionality could spark fresh breakthroughs in homegrown defence, clean energy, and financial innovation in India.

Europe must recognise that a genuine partnership can succeed only when India’s autonomy is respected and protected, without exception. Any attempt to pressure India will only strengthen its independence, the very quality others seek to influence.

Ramesh Jaura is a journalist with 60 years of experience as a freelancer, head of Inter Press Service, and founder-editor of IDN-InDepthNews. His work draws on field reporting and coverage of international conferences and events.

India’s retail payment revolution

India’s payments landscape has reached a pivotal stage, with digital transactions now accounting for 99.8% of all retail payments, according to a new report by CareEdge Advisory. Despite this near-total digitisation, cash continues to hold a 50% share in private consumption expenditure (PFCE) as of the first quarter of FY26, reflecting the coexistence of traditional and digital modes in the economy.

The study traces how the country’s payment ecosystem has been reshaped by policy reforms, technology adoption, and the rapid expansion of internet and smartphone use. It concludes that India has built a “hybrid payments economy” - digital for convenience, but cash for certainty.

UPI remains the growth engine

The Unified Payments Interface (UPI) continues to drive the country’s digital transformation. UPI transactions rose to 54.9bn in Q1FY26 and 185.9bn in FY25, growing at a compound annual rate of 49% between FY23 and FY25. Digital payments accounted for 92.6% of total retail payment value in Q1FY26, up from 89.1% in FY23, with UPI alone contributing over 90% of total transaction volume.

The average UPI transaction value declined from INR1,662 ($18.72) in FY23 to INR1,330 in Q1FY26, showing that consumers increasingly use the platform for small-value, everyday purchases such as groceries, transit fares, and utilities. CareEdge said this trend indicates growing trust and adoption in smaller towns and semi-urban areas, where digital payment usage has accelerated significantly.

The RBI’s Digital Payments Index (DPI) rose from 445.5 in March 2024 to 493.2 in March 2025, reinforcing the rapid pace of digitisation across all demographic segments.

Financial inclusion and infrastructure expansion

The growth of digital payments is closely tied to rising internet access and financial inclusion. Internet penetration in India increased from 60.7% in March 2021 to 70.9% in June 2025, while the Financial Inclusion Index improved from 53.9 to 67 during the same period. Wider smartphone ownership and affordable data have brought millions of users into the formal digital economy.

Government programmes such as the Payments Infrastructure Development Fund (PIDF) have supported the rollout of acceptance infrastructure in smaller towns and rural areas. New tools like UPI Lite for offline payments and UPI123Pay for feature phones have made digital transactions more inclusive by enabling users without smartphones or stable internet connections to participate in the system.

According to CareEdge, UPI now serves 491mn users and 65mn merchants, and powers nearly half of all global real-time digital payments. The system’s recent expansion into France signals India’s growing influence in the international fintech ecosystem.

Cards and NEFT retain relevance as PPIs decline

While UPI dominates in both volume and value, traditional systems such as NEFT and IMPS remain critical for higher-value transfers. NEFT, with an average transaction size of about INR48,000 in Q1FY26, continues to handle large business and interbank payments. IMPS remains significant for instant transfers, though some activity has shifted to UPI.

Credit card usage continues to expand, driven by e-commerce growth and flexible EMI options, but debit card transactions have declined sharply as users migrate to UPI for smaller purchases. Prepaid payment instruments (PPIs), once popular for mobile recharges and transit payments, have fallen out of favour due to tighter regulations and wallet integration with UPI.

Systems such as NACH and AePS remain relevant for recurring payments, government transfers, and financial inclusion. NETC continues to drive contactless toll and transit transactions. CareEdge’s analysis indicates that India’s payment architecture is now a multi-layered ecosystem — with each instrument serving a specific need, while UPI anchors overall growth.

Digital expansion, cash resilience

Despite the dominance of digital payments, cash remains a vital component of India’s payment ecosystem. Its share in private consumption has fallen from 70% in FY23 to 50% in Q1FY26, but it continues to play a stabilising role, particularly in rural and informal sectors.

The report attributes cash’s continued importance to its reliability, ease of use, and universal acceptance. It remains a preferred mode for small merchants and unbanked populations, and acts as a dependable fallback during network outages or system failures. The current 50:50 split between cash and digital payments marks what CareEdge calls a “tipping point”, suggesting that while digital modes will continue to expand, cash will remain entrenched in cultural and economic practices.

India’s payment evolution, the report observes, is no longer about replacing cash but integrating it into a hybrid, resilient model where both channels complement each other.

Challenges and sustainability of growth

CareEdge notes that UPI’s zero-merchant discount rate (MDR) framework has accelerated adoption but poses questions about the long-term sustainability of payment systems. The next phase of growth is expected to come from value-added services such as micro-credit, merchant analytics, insurance integration, and fintech collaborations that can ensure financial viability for service providers.

The surge in digital transactions has also heightened the importance of security, fraud prevention, and consumer protection. With billions of payments occurring in real time, regulators and payment companies face growing challenges in maintaining robust safeguards against cyber threats and misuse.

The next few years are expected to consolidate India’s position as one of the world’s leading digital payment markets. Internet penetration is projected to reach 85% by 2028, which will further widen the user base. Meanwhile, ongoing financial literacy initiatives and government-led digital inclusion schemes are likely to accelerate adoption across smaller cities and rural regions.

The report adds that affordable smartphones, low-cost data plans, and interoperable payment systems will remain the strongest growth enablers. As connectivity deepens, the diversity and frequency of digital payments are expected to rise, extending beyond peer-to-peer transfers to encompass retail, services, and investments.

To this end, CareEdge expects UPI transaction volumes to exceed 250bn by FY27, maintaining double-digit growth over the next three years. Digital payments are projected to expand further as regulatory innovations enhance accessibility and interoperability.

However, the report argues that cash will remain part of India’s consumption pattern, particularly in regions where digital penetration remains low. This coexistence of cash and digital modes provides flexibility and resilience, making the system less vulnerable to shocks.

India Rejects U.S. Claims of Halving Russian Oil Imports

India hasn’t requested refiners to cut imports of Russian crude oil and no cuts have been seen for the already placed nominations for loadings in November, Indian industry sources told Reuters on Friday, after the U.S. claimed refiners had stared to reduce Russian supply.

U.S.-Indian talks in Washington this week were productive and Indian refiners are already halving crude oil imports from Russia, a White House official told Reuters on Thursday.

U.S. President Donald Trump said on Wednesday that India had agreed to cut imports of Russian crude oil.

According to the U.S. President, India’s Prime Minister Narendra Modi had assured him that Indian refiners would stop buying Russian crude "within a short period of time".

Despite the U.S. claim that Indian refiners are already cutting imports from Russia by 50%, unspecified Indian industry sources told Reuters that any potential cuts could be shown in volumes for December and January crude imports as the refiners have already booked the cargo loadings for November and part of the loadings for December.

Russian oil imports account for about a third of all crude arrivals in India, which has significantly boosted Russian crude buying in the past three years.

Some refiners in India have started to prepare to reduce their purchases of Russian crude, Reuters reported on Thursday, citing unnamed sources in the know. The sources said the reduction would be gradual.

Officially, India on Thursday neither confirmed nor denied that it would indeed cut or halt imports of Russian crude.

In response to comments on India's energy sourcing, Randhir Jaiswal, an official spokesperson for the Foreign Ministry, said “India is a significant importer of oil and gas. It has been our consistent priority to safeguard the interests of the Indian consumer in a volatile energy scenario. Our import policies are guided entirely by this objective.”

By Charles Kennedy for Oilprice.com

No comments:

Post a Comment