Teck’s founder sought merger with Anglo before it was too late

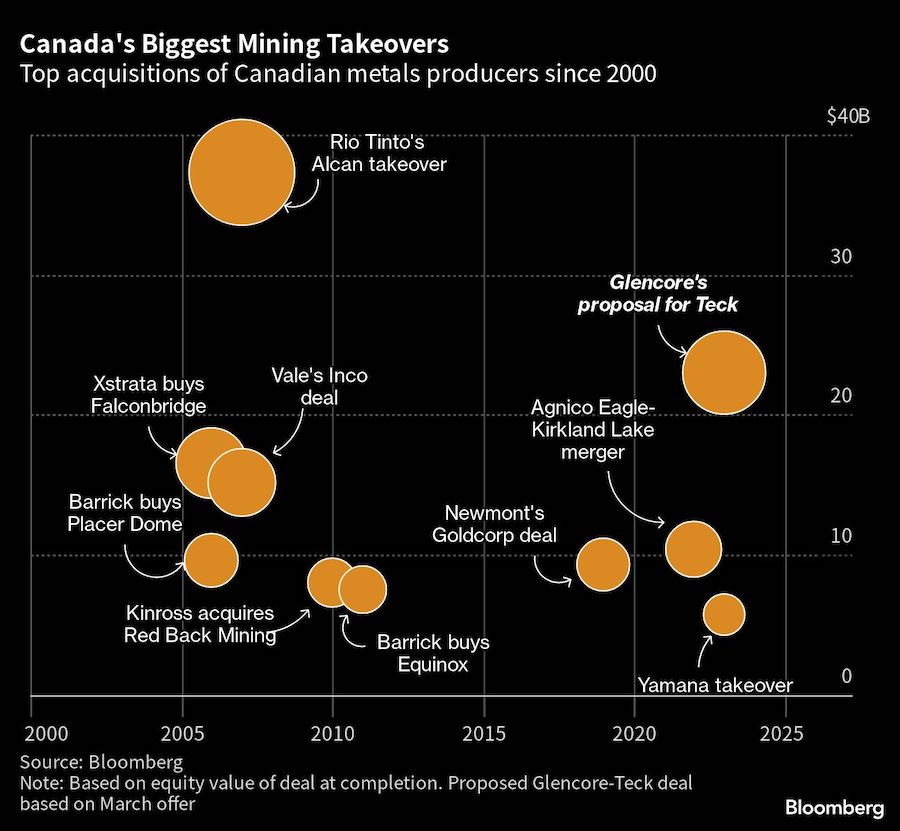

Two years ago, when Glencore Plc proposed an unsolicited, $23 billion takeover of Teck Resources Ltd., the Canadian miner’s founder decisively rejected the idea. “Now is not the time,” Norman Keevil Jr. said back then.

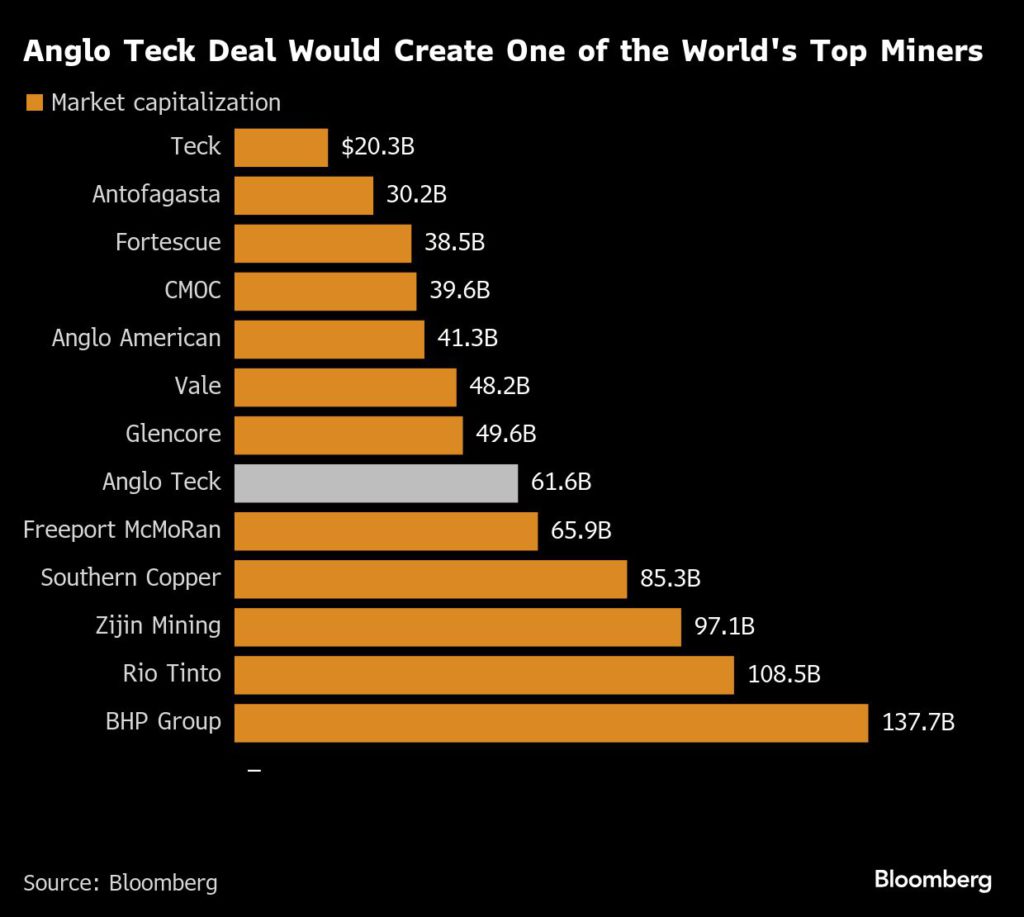

Fast forward to 2025, and the 87-year-old Keevil is one of the chief proponents of a mammoth deal to combine Teck with London-based Anglo American Plc. The merger would create a roughly $60 billion company and one of the world’s top copper producers. But both companies describe it as a zero premium deal, in contrast to Glencore’s proposal, which initially offered a 20% takeover premium.

Leaving that money on the table was the price Keevil was willing to pay to keep the company headquartered in Canada. The industry veteran, who built Teck with his father about six decades ago, is also the controlling shareholder, giving him significant sway over Canada’s largest diversified mining company. He played a crucial role in negotiating the merger with Anglo, according to people familiar with the matter.

While the structure of the deal was largely decided among the firms’ bankers and corporate development teams, the negotiators were careful not to run afoul of Keevil, knowing his aversion to a takeover that would erase the Teck brand and allow it to be swallowed by a bigger, foreign company. Certain key concessions were made at Keevil’s behest, including the agreement to headquarter the company in Canada, said the people, who asked not to be identified discussing internal debates.

Keevil wanted to get a deal done sooner rather than later because his grip on the company was weakening, according to the people. In 2023, amid Glencore’s takeover attempt, Teck shareholders approved an arrangement that would see Keevil’s controlling stake wind down by 2029, after which he’d lose any ability to sink a takeover that other investors favored.

With that expiration date looming, Keevil was eager to protect his legacy and Teck’s status as a Canadian company.

“The longer Norm waited to make a deal, the less ability he would have to shape it,” said Pierre Gratton, president of the Mining Association of Canada.

Teck and Anglo didn’t respond to requests for comment. In an email to Bloomberg News, Keevil said the deal was “the right thing to do.”

“It merges two mid-level, international copper miners into a single top-tier one, stronger than either alone, and with its global operating headquarters and top management based right here in Canada,” Keevil wrote. “Before, Canada had never had that. Now we will.”

The accord included a promise for at least C$4.5 billion ($3.3 billion) of investment in Canada over five years.

Pledges by the companies to have Vancouver as the global head office and to invest further in Canadian projects constitute a “home run,” British Columbia Premier David Eby said in an interview last week. “It’s an incredible opportunity for British Columbia and Canada and I’ll be delivering that message directly to the federal government as they do their assessment of this bid.”

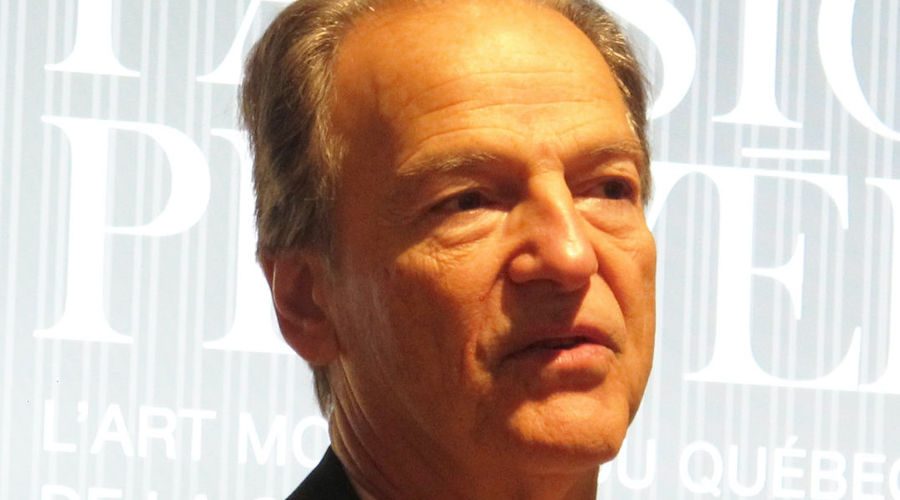

Keevil is rarely in the office, and he keeps well away from day-to-day decision making. But major corporate moves only get done with his approval.

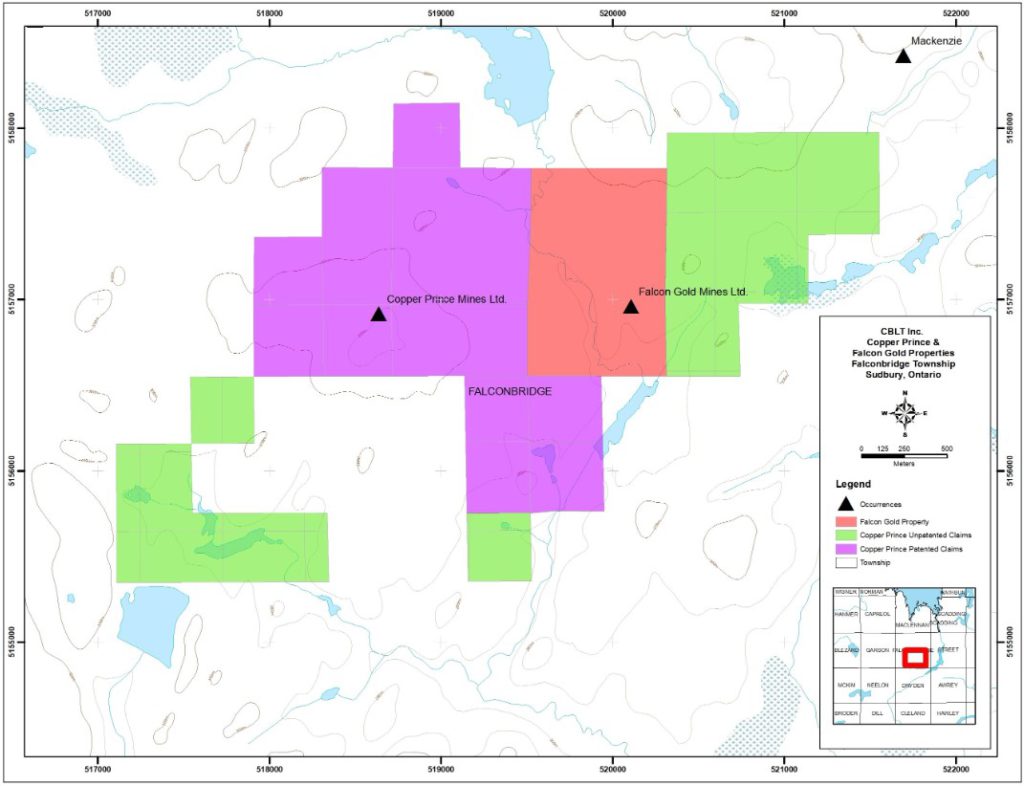

Born in Cambridge, Massachusetts, the mining veteran spent much of his upbringing in Canada’s wilderness. His father, an outdoorsman and prospector, worked at Harvard University before abandoning academia in the 1950s to search for copper and gold in Ontario’s outback. In the 1960s, Keevil Sr. bought a controlling interest in a small copper deposit near a remote settlement called Teck Township, 375 miles (600 kilometers) north of Toronto, and set out to develop it into a mine.

While the elder Keevil had a penchant for bushwhacking and prospecting — he liked to paddle a canoe across Canada’s northern lakes in search of lucrative ore bodies — the younger Keevil was more interested in dealmaking and corporate expansion. He joined his father in the mining business after obtaining a Ph.D. from the University of California at Berkeley and became Teck’s chief executive officer in 1981.

Atop the company, he oversaw a flurry of acquisitions that dramatically expanded the firm’s portfolio into other metals, as well as oil and gas. In 2001, he engineered a transformative merger with Cominco Ltd. that gave Teck one of the world’s largest zinc mines as well as its downstream processing operations. He later bet big on steelmaking coal with the $13.8 billion acquisition of Fording Canadian Coal Trust, making Teck a major supplier to Asia’s industrial boom.

Friends and counterparts have described the mining veteran as soft-spoken and reclusive. “When we’re together, I sometimes have trouble hearing him because he’ll talk so quietly,” Edward Thompson, one of Teck’s first executives, previously told Bloomberg News.

But Keevil has long been vocal about his support for Canada’s storied mining industry — funding explorers, prospectors and Canadian academic institutions that specialize in geology and engineering.

He was also careful to protect the company from circling competitors. Early on, the family sought to insulate Teck from takeovers through a dual-class share structure that gave the Keevils disproportionate voting power. This helped Teck survive a flurry of dealmaking in the 2000s, when Canada’s top mining companies including Inco Ltd. and Falconbridge Ltd. were enveloped by foreign firms.

“He was quite upset with how the big Canadian mining companies got swallowed up by others,” Gratton said. “He never wanted that to happen to Teck.”

In 2023, Keevil expressed outrage at the prospect of Glencore’s unsolicited takeover. “It’s not a matter of price, Canada is not for sale,” he reportedly told the Globe and Mail at the time.

But Teck has been under pressure to make a deal ever since. The Canadian miner has drawn attention from the industry’s biggest names for its attractive copper assets, as firms like Glencore, Rio Tinto Plc and BHP Group Ltd. scramble for a metal that’s supposed to soar in demand in the coming years. The sale of Teck’s coal assets in 2024, combined with the wind-down of Keevil’s controlling shares, made the Canadian company a prime takeover target.

In talks with Anglo, Keevil was said to be insistent that any transaction be structured as a merger rather than a takeover, preserving Teck’s name and top personnel. He was also adamant that the headquarters stay in Vancouver, where Teck occupies a sleek, 35-story downtown office building. Talks repeatedly broke down between the companies, in part over those demands, according to people familiar with the matter, but eventually the London-based mining giant acquiesced.

“He’s trying to secure his legacy,” Gratton said. “Part of that means leaving behind a company that stays Canadian.”

(By Jacob Lorinc)