After 10 Years, Iran Opens Naval Base at Jask

For some time, the Iranian authorities have sought to build up their maritime access to the open seas by developing port infrastructure outside the Gulf, acknowledging the vulnerability of dependency on free and uninterrupted access through the Straits of Hormuz.

This objective can be seen in the construction of the 1,000-km 42-inch pipe bringing oil from the crude collection point at Goreh in Bushehr Province to a new oil export terminal at Jask Mobarak, a project which was supposed to support three single-point moorings and a throughput of one million barrels per day. Despite the huge investment and the inauguration of the pipeline on July 22, 2021, the oil terminal is hardly being used, with the last tanker spotted loading on September 19 last year.

It appears to be a similar tale of watered-down ambition in the naval domain, apparent when on January 16 the Armed Forces Chief of Staff Major General Mohammad Bagheri, Iranian Army Commander Major General Abdolrahim Mousavi and the Iranian Navy (Nedaja) Commander Rear Admiral Shahram Irani opened the first phase of the new naval base at Jask-Hojdan, in a quay-side ceremony (top).

Present at the opening ceremony was a visitor from Bandar Abbas, the Moudge Class frigate IRINS Dena (F75), along with other vessels usually seen alongside in the old port of Jask: the submarines IRINS Fateh (S920) and a Ghadir Class midget, tied up alongside Hendijan Class auxiliaries IRINS Hendijan (A1401) and Bamregan (A1406), two Kaman Class patrol boats (one probably IRINS Neyzeh (P231)) and two Kaivan Class patrol craft.

Previously, the Nedaja has used the northern harbor mole of the busy commercial and fishing port at Jask as the base for ships assigned to its 2nd Naval Region.

Nejada 2nd Naval Region base at Jask (September 15 – Sentinel-2 / Jonathan Campbell-James)

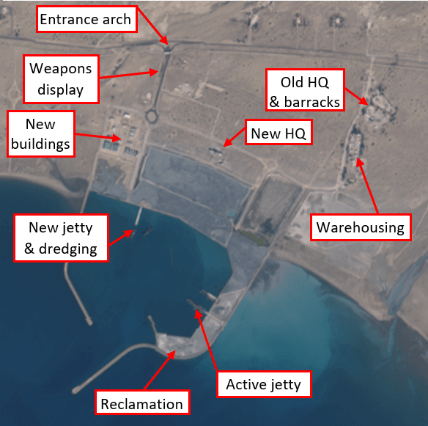

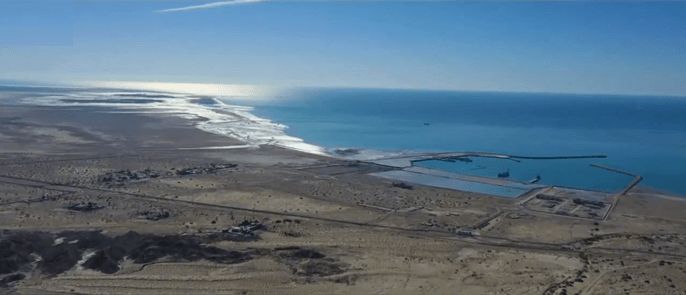

The new facility, still under construction after ten years, is 12 miles east of Jask, and is exclusively for naval use. At present only one jetty is active, but two others are under construction. Building work has progressed extremely slowly since the impressive main gate was completed in 2015, with only a small stretch of road within the base asphalted in the last few weeks, ahead of the opening ceremony. Work on a new Headquarters building appears to be stalled. The crews of the Jask-based vessels may have few creature comforts at the new out-of-town facility until further construction work is completed.

Sparse, underdeveloped infrastructure at the Jask naval base (Iranian MOD / Fars)

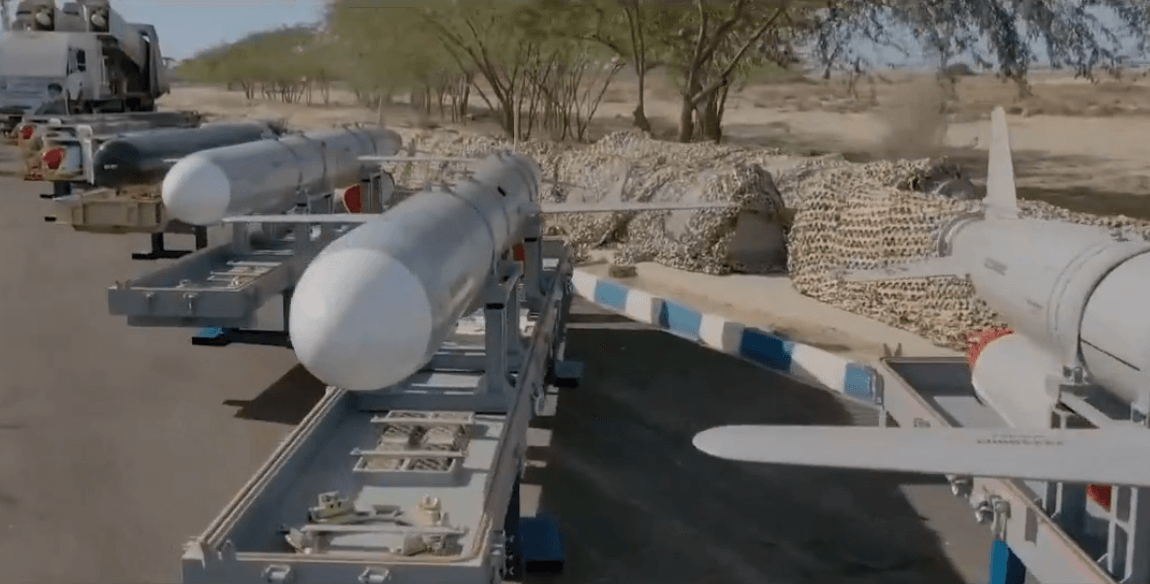

On display within the base was a selection of naval weaponry, including the short range/low altitude Azerakhsh air defense missile system, a 300-mile-range Ababil 5 reconnaissance and attack drone, and Valfajr heavy homing torpedoes.

Also paraded was a coastal defense battery of truck-mounted Talaiyeh anti-ship cruise missiles – a system derived from the Russian KH-55 system with a 650-mile range. Nejada is likely to be building protective underground garaging for these systems in the hills to the north of the base.

Main gate and equipment display, Jask Naval Base (Fars News/Iran MoD)

Equipment display, Jask base (Iranian MoD / Fars)

Strategically, it would make sense to have a larger naval footprint at this base, but the slow pace of development suggests that this is not likely to occur in the near term. However, a report carried by Press TV said that the newly-commissioned intelligence collection vessel IRINS Zagros (H313) is to be home-ported at the new base. But after the sinking of IRINS Kharg (A431) off Jask in June 2021, there may also be concerns that access to the open seas is a two-edged sword and a potential vulnerability.