Iran Strengthens Strait of Hormuz Defenses as Nuclear Talks Move Ahead

Reports from the continuing Omani-mediated talks between the United States and Iran suggest that after four rounds, negotiations are reaching a critical point, with progress now being dependent on either side giving way on redline positions.

The United States is said to be demanding that Iran must give up all uranium enrichment (whether for civil or military needs), and disperse current stocks of processed uranium. U.S. negotiators are also seeking an end to Iranian long-range ballistic missile development and a scaling back of its decades-old regional expansionism program.

Iran, for its part, seems willing to accept oversight of its nuclear program and to keep uranium enrichment to the 3.67% level needed for civil purposes. The International Atomic Energy Agency believes that Iran already has a 275-kilogram stockpile of 60% enriched uranium. Iran also recognizes that following the reverses suffered by its Axis of Resistance allies in Lebanon, Syria and Iraq, its regional expansionism program needs to be scaled back for now - but probably hopes it can continue its efforts in a more covert manner. More than anything else, Iran seeks sanctions relief, without which its economy cannot recover - threatening internal unrest. Nothing motivates the clerical leadership in Iran more than threats to its grip on power.

The scene is set for a major negotiating stand-off. Within the Iranian political leadership, this impasse is being approached differently by the hardliners surrounding the Supreme Leader and by mainstream political opinion. The hardcore faction, heavily invested in the infallibility of the Supreme Leader Ali Khamenei, is trumpeting robustness and the strength of Iran’s position - despite recent setbacks.

Mainstream politicians are taking a less aggressive line, with commanders of the regular armed forces stressing the effectiveness of Iran’s defenses. In a speech made at the Bandar Abbas Naval Base on May 12, Major General Mohammad Bagheri, the Armed Forces Chief of Staff, outlined this essentially reactive posture, saying that all operational plans in southern Iran had been reviewed to ensure “full readiness to confront any potential attack.”

General Bagheri warned that US bases in the region used to mount any US strikes on Iran would be targeted. This would include Al Udeid (Qatar), Al Dhafra (UAE), Naval Base Bahrain, Dimona (Israel), Muwaffaq Salti (Jordan), Camp Arifjan (Kuwait), Ain al-Assad (Iraq), and also the Naval Support Facility on Diego Garcia.

This threat was also extended generally to the countries in the region that host the US bases, and to Israel should it join in such attacks. If Operation True Promise-3 were to be launched against Israel, Bagheri said it could involve a barrage “from a thousand to thousands” of missiles, which could cripple Israel’s “military, economic, and technical infrastructure all at once.” Even a limited attack mounted against a GCC country would have a devastating impact on economic confidence. Iran has at least 24 identified missile and drone sites in the western half of the country, spread from north to south. All feature underground storage bunkers, from which both drone and missile mobile launchers can be driven out, ready to go into action within minutes.

Bagheri has also sought to bolster the credibility of Iran’s missile and drone fleet. IRGC missile sites are being retro-fitted with upgraded Qassem Basir missiles, which have a maneuverable warhead with passive terminal guidance. It is likely this warhead was fitted to the Houthi Palestine-2 missile, which penetrated Israel’s Arrow-2/3 air defense system on May 4, impacting on waste ground within Ben Gurion International Airport. On this occasion the Qassem Basir likewise defeated the US THAAD system, and did so again several days later. The IRGC missile fleet is also being bolstered with Emad and Khorramshahr-4 liquid fuel missiles, both also with separable warheads and longer ranges.

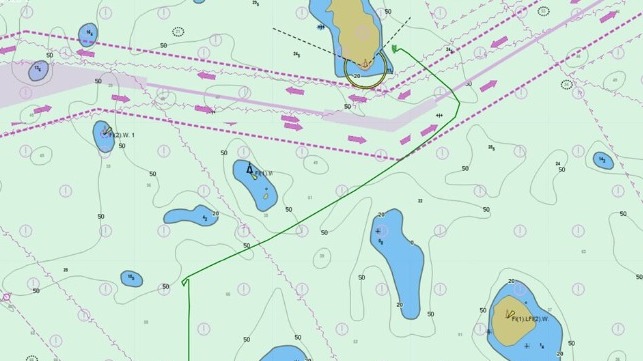

Such threats have been heard before. However, there was a new emphasis: the general’s revival of the threat to international shipping in the Gulf and Straits of Hormuz, specifically to foreign warships and oil tankers. The general thought such attacks, which by implication would close the Straits of Hormuz, could lead to oil prices rising to “$150 to $200” per barrel. Ignoring the fact that the United States as the world’s largest oil producer is now self-sufficient, he thought this would “be a major shock to the global economy.” He also ignored the likelihood that the biggest victim from any closure of the Straits of Hormuz could be Iran itself, rendered unable to export any of its own oil.

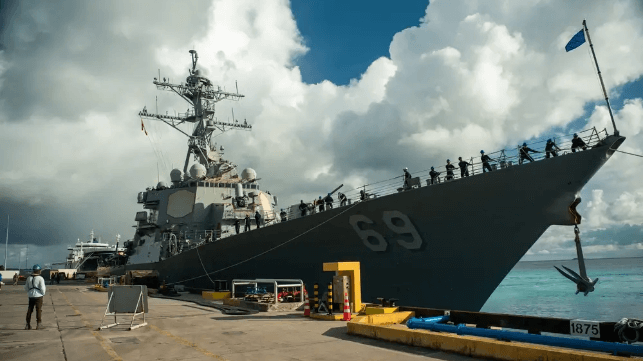

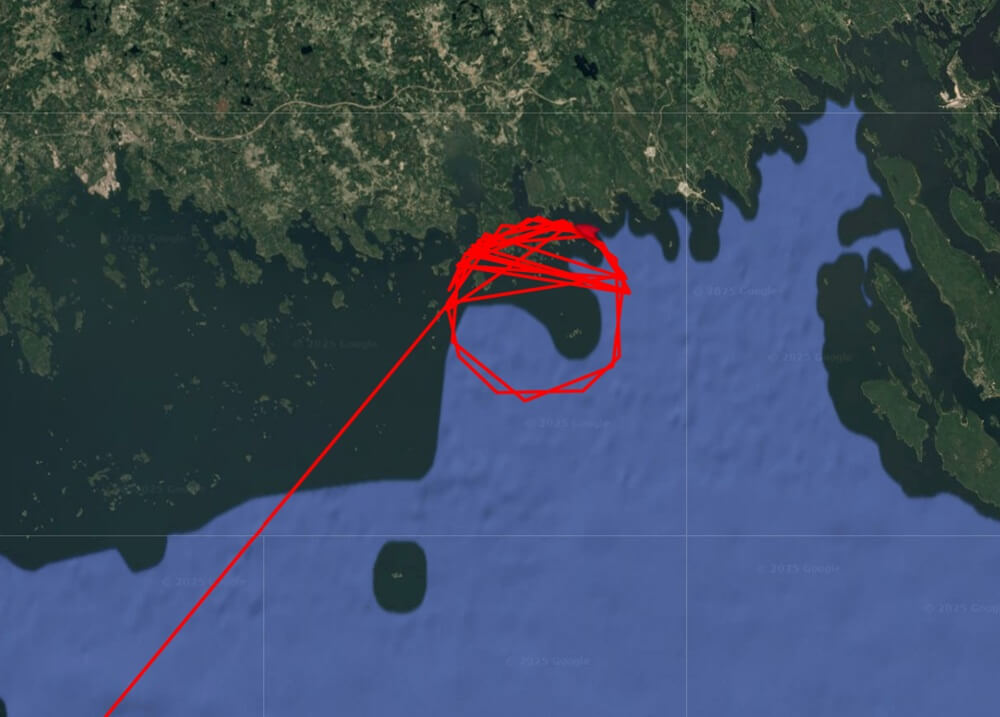

Evidence on the ground suggests that Iran’s armed forces are indeed focusing on defensive measures. Missile defenses on the Iranian-controlled islands in the Gulf have been strengthened, with extra missile boats deployed to reinforce coastal defenses. On May 18, most of the regular Navy’s replenishment ships, on which long-range deployments depend, were in port in Bandar Abbas, and the Navy’s Red Sea presence has been curtailed. Also present alongside in the Naval Harbor were all three Alvand Class frigates, IRINS Alvand (F71), IRINS Alborz (F72) and IRINS Sabalan (F73); the intelligence collector IRINS Zaghros (H313); and one of the two operational Moudge Class frigates. Taken together, this deployment pattern suggests a focus on home waters, covering the Straits of Hormuz and approaches.

The Iranian Air Force also seems similarly preoccupied with defense, with its commander Brigadier Amir Hamid Vahedi reporting that “all Air Force bases are 100 percent fully prepared, both in terms of manpower and equipment, to defend the skies of the country.”

The day after his address in Bandar Abbas Naval Harbour, General Bagheri visited the nearby Defense Industries Organization fabrication shed adjacent to the ISOICO Bostanu shipyard, where he inspected two half-completed submarines, construction of which appears to have stalled. The submarines look to be about 30 meters in length, and are probably of Iran’s light coastal Ghadir Class, of which Iran has about 15 currently in service.