Op-Ed: To Save Bangladesh's Ship Recycling Industry, Phase In the HKC

Bangladesh ratified the International Convention for the Safe and Environmentally Sound Recycling of Ships, known as the Hong Kong Convention (HKC), on 26 June 2023. The Convention will come into force globally on 26 June 2025. As one of the world’s largest ship recycling nations, Bangladesh now stands at a pivotal juncture in implementing its international obligations. On one hand, there is the challenge of meeting commitments to enhance environmental protection and worker safety; on the other, the urgent need to safeguard a critical sector of the national economy. This situation raises a vital question: after the Convention’s global entry into force, can ship recycling facilities that are not yet fully compliant with HKC standards continue to import end-of-life vessels for recycling after 26 June 2025?

At present, the Government of Bangladesh, amid uncertainty regarding the Convention’s implications, has suspended the issuance of permissions for ship imports intended for recycling. This suspension has caused significant disruption and embarrassment within the ship recycling industry, which has been operating for over 30 years and, since 2011, under formal authorization granted by the Ship Breaking and Recycling Rules, 2011. Globally, nearly 95% of end-of-life ships are dismantled in just four countries — Bangladesh, India, Pakistan, and Turkey. Bangladesh is crucial to international shipping, providing cost-effective ship recycling at a time of global facility shortages. Meeting nearly half of the world's recycling needs, Bangladesh remains vital for sustaining maritime trade.

The current state of Bangladesh’s ship recycling industry, however, is increasingly precarious. For several decades, India has been Bangladesh’s closest competitor in this sector. Today, approximately 82% of India’s ship recycling yards have already achieved compliance with the standards prescribed by the Hong Kong Convention (HKC). In stark contrast, nearly 90% of Bangladesh’s yards remain not fully compliant with the HKC requirements. Through strategic policymaking and substantial investment, India has successfully modernized its ship recycling facilities to meet international benchmarks. Crucially, India did not treat ship recycling merely as an environmental liability; instead, it recognized the sector’s immense potential as a global business opportunity and positioned itself accordingly from an early stage. Bangladesh, by contrast, has lagged behind — due to gaps in information dissemination, a lack of sustained political commitment, and inadequate government support.

Nonetheless, all is not lost. International law still offers Bangladesh a lawful pathway for phased implementation of the HKC. The pressing question now is whether Bangladesh will seize this opportunity — or whether it will constrain itself unnecessarily and risk driving a vital national industry toward collapse. International law does not require developing countries to meet developed-world environmental standards overnight. Article 26 of the Vienna Convention on the Law of Treaties establishes the principle of pacta sunt servanda, meaning that every treaty is legally binding on the countries that sign it, and must be carried out in good faith. This means a country cannot avoid its obligations or act dishonestly after agreeing to a treaty. It must make sincere and genuine efforts to fulfill the treaty's objectives, considering its own capacities and circumstances meaning states must make sincere efforts considering their capacities. The principle has become a widely accepted customary international law. Similarly, Principle 11 of the Rio Declaration emphasizes that environmental standards must reflect each country’s socio-economic conditions. Thus, phased implementation — or "progressive realization" — is a lawful approach for countries like Bangladesh.

By adopting structured development plans, maintaining oversight, and demonstrating genuine progress, Bangladesh can lawfully continue ship imports under a conditional authorization system. This would uphold the Hong Kong Convention’s core objectives without crippling the industry. Although the Ship Breaking and Recycling Rules, 2011 are not fully HKC-compliant, they provide a legal foundation for conditional authorizations through administrative action. Comprehensive reforms are expected with the new 2025 Rules currently being prepared by the government.

India’s enactment of the Recycling of Ships Act, 2019, and Pakistan’s gradual reforms offer clear precedents. Both show that demonstrating progress, even if full compliance is pending, keeps a country aligned with international law. Furthermore, ICJ rulings, such as in the Gabcikovo–Nagymaros Project case, and Articles 202 and 203 of UNCLOS, recognize the legitimacy of phased treaty implementation for developing nations. Bangladesh, therefore, can confidently adopt a phased, supervised transition path consistent with international law.

A coherent and carefully considered decision is now essential within Bangladesh’s administrative framework. Responsibility for ship recycling lies with the Ministry of Industries and the Ship Recycling Board. Suspending the issuance of No Objection Certificates (NOCs) solely due to incomplete HKC implementation could be unconstitutional and unlawful. Articles 31 and 40 of the Constitution guarantee the right to conduct lawful business and protection under the law. Arbitrarily withholding NOCs from licensed yards authorized under the 2011 Rules could prompt legal action before the higher judiciary. Moreover, the principle of "legitimate expectation" applies. Stakeholders who invested based on government assurances of phased HKC implementation have a right to expect policy consistency. A sudden reversal would be open to legal challenge. The Supreme Court’s decision in Rabeya Basri Erin v. Bangladesh Biman strongly upheld this principle.

A review of the Hong Kong Convention shows that Articles 6 and 7, along with Regulation 9, directly govern ship recycling. Parties must authorize and register facilities, considering infrastructure, safety, and environmental standards, and ensure each ship has an approved Ship Recycling Plan (SRP) before recycling begins. Crucially, the Convention does not demand immediate full compliance, but promotes a balance between "progress" and "protection." IMO guidelines MEPC 210(63), MEPC 211(63) and MEPC 222(64) confirm that phased compliance is acceptable for developing countries, allowing continued operations under strict monitoring. A zero-tolerance approach would devastate Bangladesh’s ship recycling industry, causing massive job losses and economic disruption. A lawful solution remains: issuing conditional NOCs to support a progressive, supervised transition.

Given the current situation, it is imperative that Bangladesh urgently announces a Transition Plan. The government could adopt a framework that first defines minimum conditions for granting authorization of ship recycling facility subject to conditions such as immediate infrastructure upgrades, enhanced worker safety measures, and improved hazardous waste management. Yards could be categorized into three groups: A (fully compliant), B (progressing), and C (non-compliant). B-category yards could receive conditional NOCs tied to clear development milestones and regular third-party audits, while facilities failing to meet conditions would face suspension or revocation.

By following this approach, Bangladesh could fulfill its international obligations while protecting its vital ship recycling industry. International bodies like the IMO, financial institutions, and investors support phased implementation strategies, and Bangladesh could leverage this momentum to secure further technical assistance, including through programs like SENSREC Phase III. Demonstrating credible progress would also help maintain trust among global shipowners seeking HKC-compliant options.

It is now clear that Bangladesh now faces a choice between two paths: rigid inaction that risks industry collapse, or pragmatic, lawful transition that keeps the sector operational while advancing toward full compliance. The second path offers a stronger, safer, and more sustainable future. Immediate action, grounded in strategic foresight and innovation, is essential to preserving not just the industry, but also Bangladesh’s environmental, economic, and international standing.

Dr. Ishtiaque Ahmed is the Chairman and an Associate Professor in the Department of Law at North South University, Bangladesh. He holds a Doctor of Juridical Science (J.S.D.) degree from the Center for Oceans and Coastal Law at the University of Maine School of Law, USA, specializing in ship recycling law and policy. A qualified Barrister of Lincoln’s Inn, London, Dr. Ahmed has served as a legal consultant to the International Maritime Organization (IMO), where he contributed to drafting amendments to Bangladesh’s Ship Recycling Act and revising the Bangladesh Ship Recycling Rules. His academic and professional work focuses on maritime law, environmental regulation, and sustainable ship recycling practices.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

The Wawi Indigenous territory borders a soybean plantation in the state of Mato Grosso, Brazil. Agricultural expansion has long put pressure on the Amazon forest and its traditional communities (Image: Flávia Milhorance / Dialogue Earth)

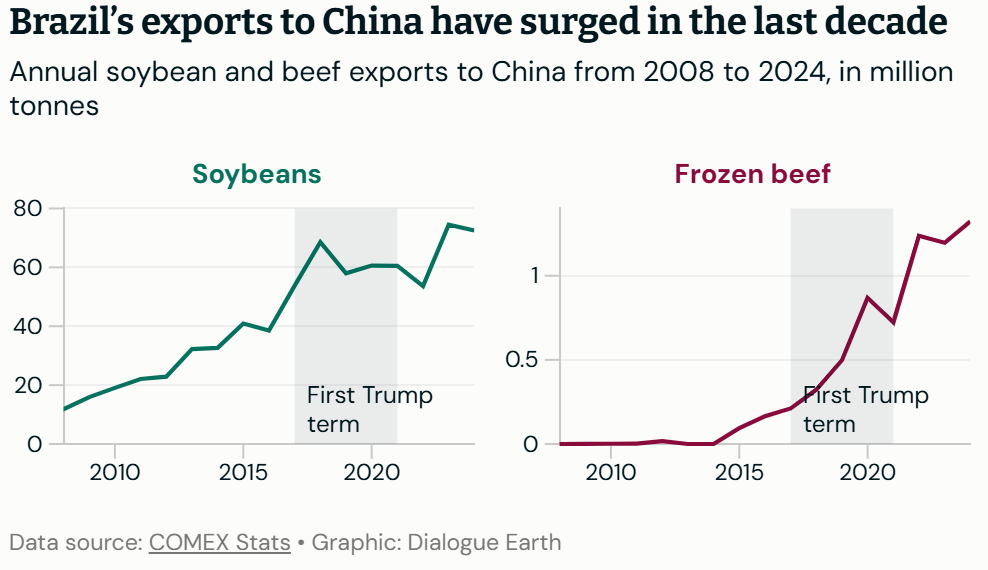

The Wawi Indigenous territory borders a soybean plantation in the state of Mato Grosso, Brazil. Agricultural expansion has long put pressure on the Amazon forest and its traditional communities (Image: Flávia Milhorance / Dialogue Earth) Analysts believe the tariffs will cause Brazilian exports to grow less this time around, due to Brazil’s already consolidated position in the Chinese market. “The impact of this trade war on Brazil will not be as great as under the first Trump administration,” says Camila Amigo.

Analysts believe the tariffs will cause Brazilian exports to grow less this time around, due to Brazil’s already consolidated position in the Chinese market. “The impact of this trade war on Brazil will not be as great as under the first Trump administration,” says Camila Amigo.