Rio Tinto targets $10B assets selloff as Trott resets the miner

Rio Tinto (ASX, LON: RIO) chief executive Simon Trott has outlined a plan to generate $5 billion to $10 billion through divestments and productivity growth, as he moves to simplify the structure of the world’s second largest miner.

Trott, speaking in his first major strategy briefing almost five months into the job, said he wants Rio to become the world’s “most valued” miner and that after executing his plan the company will be “stronger, sharper and simpler”.

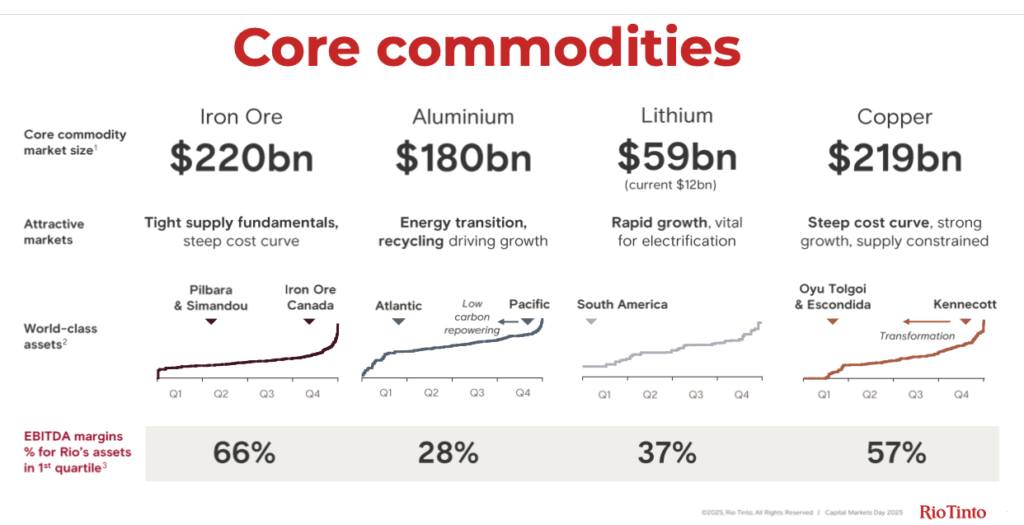

The strategy centres on narrowing Rio’s portfolio to iron ore, copper, aluminum and lithium while applying tighter capital discipline across the business. Rio shares jumped almost 4% on Thursday to a record $140.58, extending a 17% gain over the past year, although the stock still lags BHP on a price-to-earnings basis.

Trott aims to close that gap by selling non-core units, including titanium dioxide and borates, and by exploring commercial, partnership or ownership changes across land, infrastructure, mining and processing assets.

Investors have been waiting for specifics since August, when Rio announced it would streamline its structure to three core units and pursue only the most profitable operations. The company now joins global rivals in offloading non-core assets, cutting jobs and tightening capital amid shifting commodity cycles and pressure for stronger returns.

Rio will look to release cash from projects where third-party funding falls below its cost of capital and will review sales of smaller product lines.

Capital expenditure is projected to drop below $10 billion a year from 2028 as spending on large projects winds down and as the company scales back decarbonisation investments.

Decarbonization spending has been cut to $1 billion to $2 billion through 2030, down from an earlier target of $5 billion to $6 billion. Investment in new lithium projects will proceed only “when supported by markets and returns”, Trott told investors.

On the chopping block

In outlining the overhaul, Trott said assets the company “does not need to own” include titanium, borates, land, infrastructure and processing facilities. Rio is also reviewing partnership options and plans to cut unit costs by 4% from 2024 to 2030.

Rio’s top boss added the company is working with top shareholder Chinalco to resolve governance constraints that have limited share buybacks.

Trott has already trimmed leadership ranks and paused spending on projects such as BioIron and the Jadar lithium project in Serbia. Those moves are expected to deliver about $650 million in annualised productivity gains.

The world’s biggest miners have been cutting costs as volatile prices and uncertainty over long-term demand for key commodities press on valuations. Glencore (LON: GLEN) said this week it would cut 1,000 jobs to improve performance, and Vale (NYSE: VALE) downgraded its iron ore output guidance as new supply enters the market.

Many of Rio’s peers have been in consolidation mode, with Anglo American (LON: AAL) and Teck Resources (TSX: TECK.A TECK.B, NYSE: TECK) advancing a proposed $53 billion merger. Rio itself held preliminary talks with Glencore about a possible combination earlier this year, though Trott dismissed further large-scale consolidation unless it delivered clear “synergies” and “value to the table”.

BMO Capital Markets analysts offered a slightly positive first take on Rio’s update. “On the whole, guidance updates are in line with estimates, although higher copper in 2025 is offset by lower 2026 output,” analyst Alexander Pearce wrote.

Pearce added that a first look at 2026 plans for the giant Simandou iron ore project in Guinea points to a slower than expected ramp-up, though the return to less than $10 billion in annual group capex in the mid-term and the target of $5 billion to $10 billion in divestment proceeds are positives.

BMO noted Simandou’s flagged sales of 5 to 10 million tonnes of iron ore in 2026, on a 100% basis, fall short of its 19 million tonne estimate, suggesting a slower initial ramp-up.

Copper front and centre

Rio raised its 2025 copper production forecast on the back of stronger activity at Mongolia’s Oyu Tolgoi mine. It now expects 2025 copper output to be up to 3% higher than earlier estimates.

Copper production this year is projected at 860,000 to 875,000 tonnes, up from a prior range of 780,000 to 850,000 tonnes, followed by 800,000 to 870,000 tonnes in 2026.

Bauxite output is also set to beat expectations, while Canadian iron ore volume will fall short. Although Rio still earns most of its profits from iron ore, it is shifting toward copper with a target of producing 1 million tonnes annually by 2030.

Copper prices sit at record levels as global energy systems move toward greener technologies. Rio said copper output from Oyu Tolgoi should rise more than 50% this year and about 15% in 2026.

Homeland digging

Rio’s key division, Australian iron ore, is expected to deliver steady volume, with 2026 Pilbara production forecast between 323 million and 338 million tonnes.

The new Simandou mine in Guinea shipped its first ore this week and is expected to produce 5 million to 10 million tonnes in 2026.

Rio shares have climbed 36% since June 20, lifted by rising copper prices, resilient iron ore markets and expectations that Trott will boost cash flow through asset sales and cost cuts. Benchmark 62% iron ore was trading at $108 a tonne on December 3, up from less than $93 in mid-June.

No comments:

Post a Comment