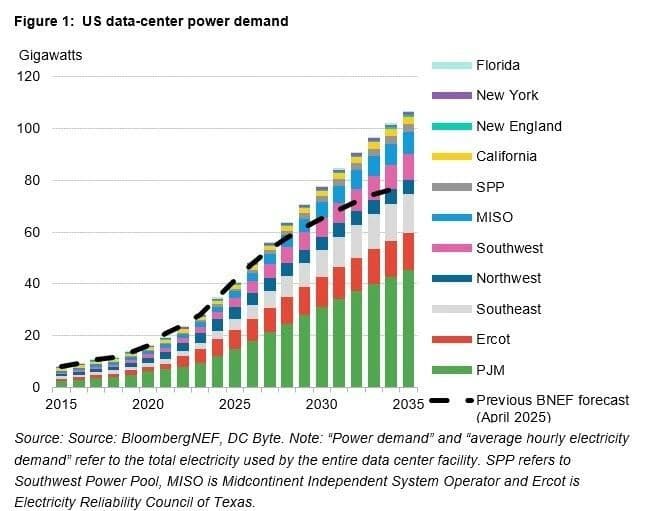

U.S. Data Center Demand Could Hit 106 GW by 2035

- BNEF estimates U.S. data center demand could reach 106 GW by 2035, far above other recent forecasts.

- Many analysts warn that speculative projects, chip constraints, and overlapping permits may deflate current projections.

- Major U.S. grid operators face rising reliability risks as data center proposals cluster across PJM, MISO, and ERCOT.

U.S. data center power demand could reach 106 GW in 2035, BloombergNEF said Monday in one of the more aggressive load growth estimates to date. The report comes as some energy industry analysts and executives warn that an artificial intelligence bubble or speculative data center proposals could be fueling excessive load growth projections.

A report from Grid Strategies released last month said utility forecasts of 90 GW additional data center load by 2030 were likely overstated; market analysis indicates load growth in that time frame is likely closer to 65 GW, it said.

A July report from the Department of Energy estimated an additional 100 GW of new peak capacity is needed by 2030, of which 50 GW is attributable to data centers. Those facilities could account for as much as 12% of peak demand by 2028, according to Lawrence Berkeley National Laboratory.

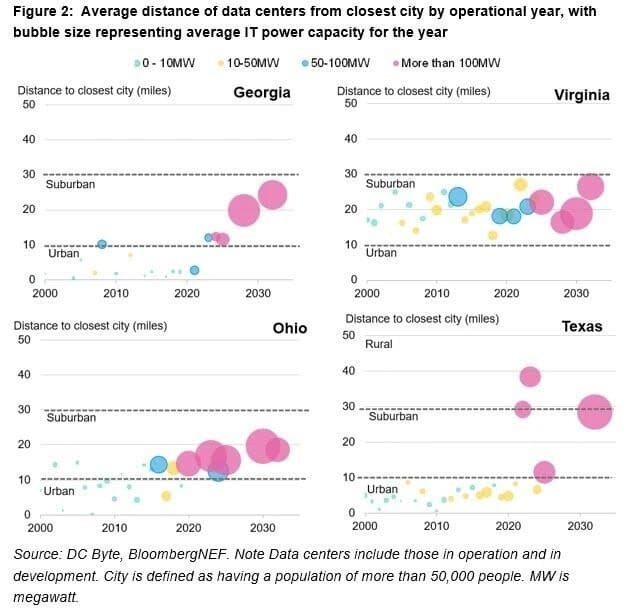

BNEF’s data center project tracker shows the industry diversifying beyond traditional data center hubs like Northern Virginia, metro Atlanta and central Ohio into exurban and rural regions served by existing fiber-optic trunk lines for data traffic.

A map of under-construction, committed and early-stage projects shows gigawatts of planned data center capacity spreading south through Virginia and the Carolinas, up through eastern Pennsylvania and outward from Chicago along the Lake Michigan shore. More data centers are also planned for Texas and the Gulf Coast states.

Much of the capacity is poised to materialize on grids overseen by the PJM Interconnection, the Midcontinent Independent System Operator and the Electric Reliability Council of Texas. BNEF predicts PJM alone could add 31 GW of data center load over the next five years, about 3 GW more than expected capacity additions from new generation.

With the expected surge, the North American Electric Reliability Corp. warned late last year of “elevated risk” of summer electricity shortfalls this year, in 2026 and onward in all three regions.

Some experts disputed NERC’s methodology, however. MISO’s independent market monitor said in June that the group’s analysis was flawed and that MISO was in a better position than grid regions not expected to see exponential data center growth, like ISO New England and the New York Independent System Operator.

Other technology and energy system analysts expect a significant amount of proposed data center capacity to dissipate in the coming years due to chip shortages, duplicative permit requests and other factors.

In July, London Economics International said in a report prepared for the Southern Environmental Law Center that meeting projections for U.S. data center load in 2030 would require 90% of global chip supply — a scenario it called “unrealistic.”

Patricia Taylor, director of policy and research at the American Public Power Association, told Utility Dive earlier this year that it’s common for data center developers to “shop around” the same project across neighboring jurisdictions.

Still, U.S. grid operators face an “inflection moment” as they balance the desire to accommodate large-scale data centers with the obligation to ensure reliable service for all customers, BNEF said.

By Brian Martucci of Utility Drive via Zerohedge

U.S. Eyes Warehouse Generators for Massive Grid Capacity Boost

- Energy Secretary Chris Wright has proposed an innovative plan to quickly expand US grid capacity by leveraging idled industrial diesel generators at commercial sites like data centers and big-box retailers.

- The plan aims to unleash approximately 35 gigawatts of electricity capacity, which is described as the equivalent of about 35 nuclear power plants, to serve as a short-term bridge until new natural-gas and nuclear generation is available.

- The proposal is a direct response to the explosive power demand from the data-center boom, offering a short-term solution for the missing power needed to support the massive buildout and mitigate the strain on regional power grids.

Energy Secretary Chris Wright has floated an unusual but very creative plan to quickly expand U.S. grid capacity: tapping the industrial diesel generators already sitting at data centers, big-box retailers, and other commercial sites. The proposal comes as multiple regional grids strain under the explosive power demand driven by the data-center boom. Leveraging these idled generators could serve as a short-term bridge until new generation comes online.

Bloomberg quoted Wright on Tuesday morning at the North American Gas Forum in Washington, where he said that tapping the nation's idled fleet of industrial diesel generators could add the equivalent of about 35 nuclear power plants' worth of electricity and help bridge the country until new natural-gas and nuclear generation comes online in the coming years.

Wright emphasized the scale of the opportunity, saying, "We're going to unleash that 35 gigawatts of capacity that sits there today," though he noted that pollution rules have historically limited generator use.

He argued that the massive data-center buildout over the next few years could be primarily supported by these existing generators, avoiding the need for dozens of new power plants.

These generators, he said, are already deployed at data centers and commercial sites nationwide. "They're all around the country. It's going to start with communicating to everyone that these assets exist."

Wright and the Trump administration understand that power grids are stretched thin in the era of data centers. The push for dispatchable backup generation is a short-term solution for all the missing power needed for the AI boom...

Perhaps by the time the 2030s arrive, new natural-gas generators and other reliable sources will finally add enough capacity to meet booming demand. Nuclear remains more of a next-decade story. And now, Wright may truly be onto something.

By Zerohedge

No comments:

Post a Comment