CU

Glencore cuts 2026 copper target but sets up for long-term surge

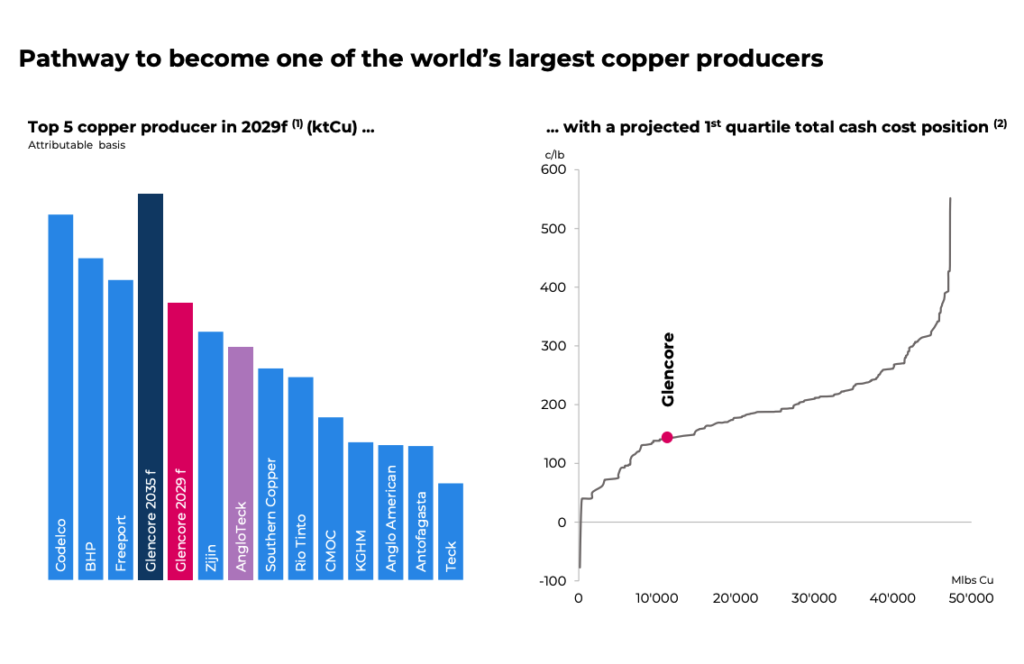

Mining and commodities giant Glencore (LON: GLEN) plans to expand annual copper production to about 1.6 million tonnes by 2035 as it seeks to reverse a multi-year slump in output.

Chief executive Gary Nagle told investors in London that the company expects its base copper business to exceed 1 million tonnes a year by the end of 2028, positioning Glencore among the world’s five largest producers.

The push comes as global miners race to increase supply, even as Glencore’s own copper output is set to fall for a fourth straight year and sit about 40% below 2018 levels.

The Swiss miner has faced pressure after its shares hit their lowest since 2020 and investors complained about repeated production cuts and operational underperformance. In response, Glencore has launched a sweeping operational review, which will see it cut about 1,000 jobs. It targets roughly $1 billion in recurring cost savings by the end of 2025, the miner announced at its first investor day in London in three years.

Copper prices hit a fresh record above $11,400 a tonne on Wednesday, extending a 30% gain this year on the back of supply disruptions and strong investor demand tied to electrification and the energy transition.

Eyes in South America

Despite outlining long-term growth plans, Glencore cut its 2026 copper guidance to 810,000–870,000 tonnes from a previous 930,000-tonne target after setbacks at Chile’s Collahuasi mine, which it jointly owns with Anglo American (LON: AAL). The company also lowered its zinc and cobalt forecasts for next year.

The Swiss firm reiterated that copper output should reach 1 million tonnes by 2028 and said the restart of its Alumbrera mine, in the Catamarca Province of Argentina, will support that ramp-up.

The operation is expected to restart in Q4 2026, with first production in the first half of 2028. Once fully operational, it is expected to produce about 75,000 tonnes of copper, 317,000 ounces of gold and 1,000 tonnes of molybdenum over four years.

“These projects are mostly brownfield and expected to be highly capital efficient,” Nagle said. He added that Glencore would be looking for partnerships to “reduce financial and operations risks” in certain projects.

Glencore noted the restart offers strong stand-alone economics and serves as a natural enabler for the Minera Agua Rica–Alumbrera (MARA) project by reducing ramp-up risk for the concentrator and downstream logistics, maintaining and retraining the workforce ahead of first ore, and keeping critical infrastructure active for shared use, generating operational synergies.

Keeping Chile footprint

In neighbouring Chile, Glencore plans to keep an equal share in its copper joint venture with Anglo American should the partners eventually merge the Collahuasi operation with Teck Resources’ (TSX: TECK.A TECK.B, NYSE: TECK) nearby Quebrada Blanca mine once Anglo acquires Teck. “We won’t be a junior partner,” Nagle said, adding Glencore could inject cash to keep its stake level in any future combination.

Teck and Anglo shareholders will vote next week on the deal to create a copper-rich mining giant, with the two Chilean assets seen as a central motivation. The expectation that Collahuasi and Quebrada Blanca could be integrated to unlock major cost savings has circulated for years.

Nagle said any combination must reflect Collahuasi’s improved relative value after recent setbacks at Quebrada Blanca. “We’re not ignorant to some adjacent potential synergies,” he said. “At a minimum, the value attributed to the two properties, the value has materially moved towards Collahuasi.”

Rio Tinto’s Nuton tech makes first-ever copper cathode at Gunnison mine

Rio Tinto (NYSE, LSE, ASX: RIO) venture partner Nuton has produced the first copper using new technology at Gunnison Copper’s (TSX: GCU) Johnson Camp Mine (JCM) in Arizona.

The Nuton-made copper cathode, produced last month with a unique sulphide bioleaching technology, is part of a four-year demonstration period at JCM using its heap leach pad for the production of about 30,000 tonnes of refined copper, Gunnison said Thursday. JCM is about 105 km east of Tucson.

“This is a breakthrough achievement for our Nuton technology, which is proving that cleaner, faster, and more efficient copper production is possible at an industrial scale,” Rio Tinto Copper CEO Katie Jackson said in a release. “In an industry where projects typically take about 18 years to move from concept to production, Nuton has now proven its ability to do this in just 18 months.”

Trio of milestones

The milestone comes three months after Gunnison produced its first copper cathode at JCM, making the mine the United States’ newest red metal producer. The first Nuton-produced cathode is the result of more than 30 years of research and development, Gunnison said. Nuton began its collaboration with Gunnison’s predecessor Excelsior Mining at the site in 2023.

Gunnison shares gained 2.7% to C$0.38 apiece on Thursday morning in Toronto for a market capitalization of C$146.4 million ($105 million).

Microbes aid processing

The technology uses natural microorganisms grown in Nuton’s proprietary bioreactors to extract copper from sulphide ores, which tend to be difficult to process. The microbes speed up the oxidation of minerals in the heap leach pad, generating heat and allowing the red metal to dissolve into a leach solution. It’s then processed into 99.99% pure cathode.

Nuton achieves recovery rates of up to 85% and cuts out milling, tailings, smelting and refining, thus shortening supply chains and delivering copper cathode right at the mine, Gunnison said. The technology could reduce water usage by up to 80% and carbon emissions by as much as 60% compared to traditional copper concentration. It can also extend mine life by extracting metals from waste material.

‘Low-carbon copper’

The achievement at JCM in such a short time frame shows the possibilities of innovation, strong operational performance and a shared vision coming together, Gunnison CEO Stephen Twyerould said.

“With Nuton copper now entering the US supply chain, this milestone underscores the critical role we can play in strengthening domestic access to cleaner, low-carbon copper,” he said.

The next stage at JCM is to focus on validating Nuton’s long-term technical performance, Gunnison said. That would comprise multi-year testing, independent third-party verification and an internal review by Rio Tinto to ensure recovery consistency and environmental performance.

Nuton has invested $100 million in technology deployment and construction at JCM, while Gunnison holds ownership and operational control. The two-stage partnership is to last for four or five years during which copper output would pay down Nuton’s investment.

In the second stage, and after full-scale commercial production using Nuton technology is underway, the companies would form a joint venture, with Gunnison holding 51% and Nuton 49%.

15-to-20-year life

The JCM open pit and heap leach mine has an annual capacity of 25 million lb. of copper over a 15 to 20-year life, according to a 2023 preliminary economic assessment prepared for Excelsior.

It hosts about 108 million measured and indicated tons grading 0.31% copper and 51 million inferred tons at 0.32% copper.

In a base case, JCM has a post-tax internal rate of return of 30% with a payback period of about four years, and a net present value of $180 million, at a 7.5% discount rate. Initial capital costs are pegged at $58.9 million.

Anglo Asian completes first copper concentrate sale to Trafigura

Anglo Asian Mining (LON: AAZ) has begun copper concentrate sales from its new Demirli mine as part of a recently signed agreement with commodities trading group Trafigura.

On Nov. 3, the London-listed miner, which operates mines in Azerbaijan, contracted to sell copper concentrates produced at Demirli in Karabakh to Trafigura, with the latter agreeing to a $25 million prepayment.

In the second half of November, Anglo Asian made its first sale to Trafigura — totalling 2,055 wet tonnes of copper concentrate containing 351 tonnes of metal. This is expected to generate a revenue (before the government of Azerbaijan’s share) of $3.6 million, it said.

To facilitate the shipment, the company said it established a dedicated logistics centre for storage and delivery near Ganja, close to the main highway between Azerbaijan and Georgia. The location would allow Trafigura trucks to receive concentrates without obtaining permission to enter Karabakh, which has restricted access.

“We are continuing to make great progress at the Demirli mine, which was brought into production on time and on budget, and we have now completed our first copper concentrate sales to Trafigura,” Reza Vaziri, CEO of Anglo Asian, stated in a press release.

“We continue to invest in this relationship, which is strategically important for Anglo Asian, by establishing our new logistics centre which will drive significant efficiencies.”

In July, the company announced the successful commissioning of the Demirli mine. According to its forecasts, the operation is expected to deliver 4,000 tonnes of copper concentrates this year, then rising to 15,000 tonnes from 2026 onwards.

A new kind of copper from the research reactor

Cu-64 is a copper isotope needed for medical applications — but it is very difficult to produce. At TU Wien, researchers have now developed an alternative production method.

Vienna University of Technology

image:

Veronika Rosecker in the reactor hall at TU Wien

view moreCredit: TU Wien

The copper isotope Cu-64 plays an important role in medicine: it is used in imaging processes and also shows potential for cancer therapy. However, it does not occur naturally and must be produced artificially — a complex and costly process. Until now, Cu-64 has been generated by bombarding nickel atoms with protons. When a nickel nucleus absorbs a proton, it is transformed into copper. At TU Wien, however, a different pathway has now been demonstrated: Cu-63 can be converted into Cu-64 by neutron irradiation in a research reactor. This works thanks to a special trick — so-called “recoil chemistry.”

From Nickel to Copper

Copper atoms contain 29 protons, while the number of neutrons can vary. The most common naturally occurring variant is Cu-63, which has 34 neutrons and is stable. Cu-64, by contrast, contains one additional neutron and is radioactive, decaying with a half-life of about 13 hours. This makes Cu-64 attractive for medical use: it remains stable long enough to be transported to its target location inside the body, but decays quickly enough to keep the patient’s radiation exposure low.

“Today, Cu-64 is typically produced in a cyclotron,” explains Veronika Rosecker of TU Wien. “You can produce Cu-64 by taking Ni-64 and bombarding it with protons. The nickel nucleus absorbs the proton, ejects a neutron, and is thereby transformed into copper-64.” This method works very well, but it is expensive — and it requires access to both a cyclotron and enriched Ni-64, itself a rare isotope.

Copper with One Extra Neutron

It is therefore natural to consider a simpler alternative: producing Cu-64 from Cu-63 directly. All that is needed is to add a single neutron — something a research reactor can provide. But this approach comes with a challenge: “When Cu-63 is irradiated with neutrons, Cu-64 nuclei are indeed produced, but it is almost impossible to separate them chemically from the ordinary copper atoms,” says Martin Pressler. “You end up with a mixture that consists mostly of ordinary copper, with only tiny traces of the desired Cu-64.”

Now, however, this problem has been solved using recoil chemistry. This effect has been known for nearly a century, but has not previously been used for the production of medically relevant radioisotopes. Before irradiation, the copper atoms are built into specially designed molecules. “When a Cu-63 atom within such a molecule absorbs a neutron and becomes Cu-64, it briefly holds a large amount of excess energy, which it releases as gamma radiation,” says Veronika Rosecker. The emission of this high-energy photon gives the atom a recoil — much like a rocket recoils when expelling exhaust. This recoil is strong enough to eject the copper atom from the molecule.

“This means that Cu-63 and Cu-64 can now be cleanly separated,” says Veronika Rosecker. “The Cu-63 atoms remain bound within the molecules, while the newly formed Cu-64 atoms are released. This makes it easy to separate the two isotopes chemically.”

Finding the Right Molecule

A key challenge was identifying a suitable molecule. It needed to be stable enough to withstand conditions inside a nuclear reactor, yet soluble enough to allow efficient chemical processing afterward.

“We achieved this using a metal–organic complex that resembles heme — the molecule found in human blood,” explains Martin Pressler. Similar substances had been studied before, but were not soluble. The new complex was chemically modified to make it soluble, enabling straightforward recovery of the Cu-64 after neutron irradiation.

The method can be automated, the molecules can be reused without loss, and — instead of requiring a cyclotron — it only needs a research reactor such as the one at TU Wien.

Journal

Dalton Transactions

Method of Research

Experimental study

Subject of Research

Not applicable

Article Title

Fast and easy reactor-based production of copper-64 with high molar activities using recoil chemistry

No comments:

Post a Comment