In a First, NRC Approves Restart of Mothballed Nuclear Facility

The U.S. Nuclear Regulatory Commission on Thursday granted multiple licensing and regulatory approvals necessary for the 800-MW Palisades nuclear plant in Michigan to restart operations later this year.

Palisades is now authorized to receive new fuel and formally transition licensed reactor operators to on-shift status, Holtec International said in a statement. The company is leading the effort to restart the plant.

“The NRC’s approval to transition Palisades back to an operating license represents an unprecedented milestone in U.S. nuclear energy,” Holtec President Kelly Trice said. Palisades would be the first U.S. plant to be brought back online after decommissioning.

NRC noted that there are still several licensing actions under review “and additional requirements that need to be met before the plant can start up under the original operating license, which would expire March 24, 2031.”

The nuclear regulator also said it has approved the transfer of operating authority for the plant and its independent spent fuel storage facility from Holtec Decommissioning International to Palisades Energy. And, it approved Holtec’s request to reinstate various documents and programs that were in place prior to shut down.

In May, NRC concluded Holtec’s efforts to restart the plant pose “no significant impact” to the human environment, a key finding in the effort to restart the facility.

Entergy, the former owner of Palisades, shuttered the plant in May 2022 and sold it to Holtec the following month. Holtec made the first public moves toward restarting the plant in late 2023. As electricity demand has begun to rise, owners of two other recently-shuttered U.S. nuclear power plants have since moved to restart them.

Backed by a 20-year power purchase agreement with Microsoft, Constellation Energy said in September it will restart the undamaged 835-MW reactor at Three Mile Island — now called the Crane Clean Energy Center — by 2028. And NextEra Energy has taken preliminary steps to restart the 600-MW reactor at its Duane Arnold nuclear plant in Iowa, which shuttered in 2020.

By Robert Walton of Utility Dive

Are Small Modular Reactors Worthy of the Hype?

- Small modular reactors represent a significant advance in nuclear technology, promising cheaper, safer, and more efficient nuclear capacity expansion.

- Despite widespread anticipation and significant investment, SMRs face challenges related to high costs and regulatory hurdles.

- Continued policy support and streamlined regulations are crucial for SMRs to achieve their full potential.

Nuclear energy is experiencing a political and technical renaissance. Around the world, nuclear fission is gaining traction as a critical piece of the puzzle for maintaining energy security while also slashing greenhouse gas emissions. Much of the renewed excitement over nuclear power comes from advances in nuclear technologies, particularly small modular reactors (SMRs), which are supposed to make nuclear capacity expansion cheaper, safer, and more efficient.

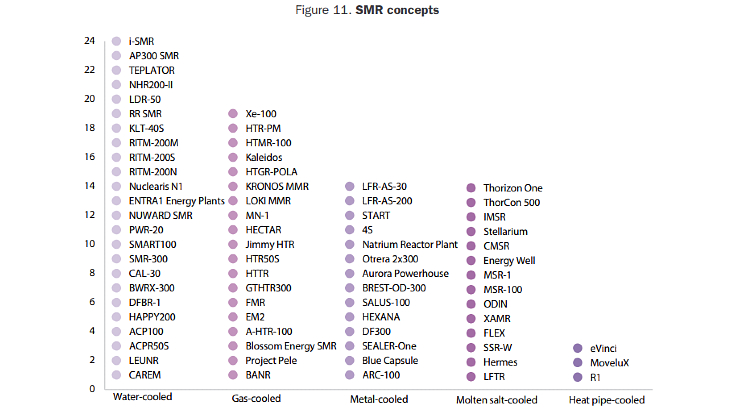

SMR is still a broad term, encompassing models with capacities ranging from 1 megawatt to several hundred megawatts. Currently, there are 74 SMR designs under development on a global scale, and there is a lot of variation in their design. But generally speaking, SMRs are much smaller versions of nuclear reactors that are standardized for mass production in factories. They can then be installed on-site. In contrast, traditional nuclear plants are necessarily one-of-a-kind and built according to the specifications of their environment, which leads to massive upfront costs and long project times.

The International Energy Agency (IEA) has identified SMRs as one of the key catalysts for what is shaping up to be “a new era for nuclear energy.” A recent IEA report says that SMRs are increasingly becoming private sector darlings as they are quicker to build and offer many more opportunities for cutting costs than traditional reactors, which could provide a pathway to lower financing costs. The report contends that “with the right support, SMR installations could reach 80 GW by 2040, accounting for 10% of overall nuclear capacity globally.”

This idea of “the right support” is pivotal. We’ve been talking about the massive disruptive potential of SMRs for years now, but they have yet to make the waves that the public and private sectors have been eagerly and vocally anticipating. As a recent Canary Media Report asks: “Small modular reactors are gaining steam globally. Will any get built?”

Experts say that one of the primary hangups is simple economics. Costs are still too high to be genuinely competitive with other clean alternatives like large-scale hydropower and offshore wind projects. “A key argument from SMR proponents is that the new reactors will be economically competitive,” says David Schlissel, IEEFA director of resource planning analysis. “But the on-the-ground experience with the initial SMRs that have been built or that are currently under construction shows that this simply is not true.”

Moreover, even though there is an estimated $15 billion in public and private dollars flowing into the SMR sector, the dynamic and varied nature of the nascent technology is causing confusion for investors. “This is both an opportunity and a challenge,” Diane Cameron, leader of NEA’s division of nuclear technology development and economics, told Canary Media ?“There’s a lot going on, and sometimes financiers or regulators and policymakers are wondering where to focus their efforts first.”

This diversity also makes SMRs harder to regulate, causing a major hurdle for streamlining nuclear policy in this “new nuclear era.” And streamlined policy is one of the critical enabling factors for SMR's long-awaited success. According to the IEA’s January report, “In a scenario in which tailored policy support for nuclear and streamlined regulations for SMRs align with robust industry delivery on new projects and designs, SMR capacity is three times higher by mid-century, reaching 120 GW, with more than one thousand SMRs in operation by then.”

Even though there is excitement from investors and policymakers alike, getting SMR models approved is taking much longer than anticipated. Only one model has been approved in the United States, and it is not yet operational. But many, many more designs are waiting in the wings. And as the technologies evolve and begin to be deployed at scale, the economics will change – as will regulatory structures. So, despite the years of delays, we’ll say it again – the SMR revolution is right around the corner.

By Haley Zaremba for Oilprice.com

ENEC signs collaboration deals with Korea, USA

_12727.jpg)

During a visit to Seoul, South Korea, by ENEC management, a memorandum of understanding was signed with Hyundai E&C, which was the lead contractor in the construction of the UAE's four-unit Barakah nuclear power plant. It was signed by Hyundai E&C CEO Lee Han-woo and ENEC Managing Director and CEO Mohamed Al Hammadi.

The MoU provides a comprehensive framework for knowledge sharing, collaborative evaluation of project participation, and assessment of strategic investment opportunities. It also includes the formation of a joint working group to identify areas of mutual interest and support the development of future nuclear energy initiatives.

"The collaboration between ENEC and Hyundai E&C builds on the longstanding strategic partnership between the UAE and the Republic of Korea in the nuclear sector and supports both countries' shared goals to advancing peaceful nuclear energy in line with International Energy Agency and International Atomic Energy Agency projections for a significant global scale-up of nuclear capacity by 2030 and 2050 respectively," ENEC said.

"This MoU is very meaningful in that it provides a practical foundation for seeking cooperation opportunities with ENEC on global nuclear power projects," said a spokesperson from Hyundai E&C. "We will continue to discover new nuclear power plant projects in various regions, including the Middle East, North America, Asia, and Europe, and strengthen our global competitiveness in the future."

ENEC said the MoU with Hyundai E&C demonstrates its "expanding role in international nuclear partnerships to sustaining momentum in nuclear energy development and shaping the future of nuclear energy by enabling faster, safer and more cost-effective deployment of new nuclear technologies in the UAE and globally".

It noted that the signing of the MoU follows a series of recent agreements between ENEC and leading global operators, technology developers, and energy companies.

"ENEC is pursuing a new phase of investing in, collaborating with and consulting on both large nuclear reactors in addition to advancing new nuclear technologies both locally and internationally," the company said. "With the Barakah Nuclear Energy Plant fully operational, ENEC is now focused on working with global partners to support the acceleration of nuclear deployment and committed to working with all responsible nations looking to deploy new nuclear or expand their existing fleets, and MoUs with companies such as Hyundai E&C are a clear demonstration of this approach."

Westinghouse agreement

Last week, ENEC announced it had signed an MoU with Westinghouse to explore collaboration opportunities for the deployment of advanced nuclear energy solutions in the USA.

(Image: Westinghouse)

Westinghouse said the collaboration will "leverage ENEC's world-class expertise in large-scale nuclear development and operations and Westinghouse's industry leading nuclear technologies".

Under the MoU, the companies will explore ways to accelerate the deployment of the AP1000 reactor in the USA. In addition, ENEC and Westinghouse will look at ways to collaborate across a broad range of opportunities, including new build and restart projects in the USA, development of commercial and operational deployment models for AP1000 reactors, and fuel supply chains, operations and maintenance services.

"With ENEC's proven track record in developing one of the world's most advanced nuclear energy programmes, our collaboration with Westinghouse brings together two leaders in our fields," Al Hammadi said. "This marks a significant step in supporting the United States' bold ambitions to rapidly expand its nuclear fleet, reinforcing the deep and long-standing energy partnership between the UAE and the United States."

Assembly of Taipingling 3 containment vessel begins

_78834.jpg)

The HPR1000 (Hualong One) reactor design features a double-layered containment structure. The main function of the containment building is to ensure the integrity and leak tightness of the reactor building, and it plays a key role in the containment of radioactive substances.

The 36 steel sub-modules of the bottom head module were prefabricated off-site, transported to the construction site and welded together. The completed module - measuring about 43 metres in diameter, 6 metres in height and weighing more than 130 tonnes - was hoisted into place using a 2,000-tonne crawler crane.

China General Nuclear (CGN) said installation of the first containment module at Taipingling unit 3 "marks the steady advancement of the modular construction technology of nuclear island civil engineering in the Taipingling Nuclear Power Project, and lays a solid foundation for the high-quality construction of subsequent nuclear island civil engineering projects".

The Taipingling plant in Guangdong province will eventually have six Hualong One reactors. The construction of the first and second units began in 2019 and 2020, respectively. Unit 1 is scheduled to start up later this year, with unit 2 following in 2026.

Construction of the second phase of the plant - units 3 and 4 - was approved by China's State Council on 29 December 2023. The first safety-related concrete was poured for the reactor building of Taipingling unit 3 last month.

Slovakia and Urenco sign enriched uranium supply contract

It follows an international tender launched last year aimed at diversifying Slovakia's supplies and strengthening its energy security.

Branislav Strýček, Chairman and CEO of Slovenské elektrárne, said: "We are pleased that through future cooperation with Urenco Group, we can diversify our business relationships. It will significantly help us continue maintaining the stable and secure operation of our nuclear power plants."

Urenco’s Chief Commercial Officer Laurent Odeh, said: "We are very proud at Urenco to be entering into a new market with a new customer, and I’d like to pay tribute to Slovenské elektrárne for placing their trust in us.

"Urenco is committed to supporting countries’ energy security by providing enrichment services to fuel clean, reliable nuclear energy. We are also deeply committed to helping our customers progress their net zero goals."

Background: A guide: Uranium and the nuclear fuel cycle

Slovakia has five operable nuclear reactors with a capacity of 2.3 GW, generating about half of its electricity. It has a fourth unit at the Mochovce nuclear power plant under construction.

Slovenske elektrárne said that in the nuclear fuel cycle uranium enrichment "is technologically and financially the most demanding phase ... therefore, access to reliable and diversified enrichment services is a strategic priority for every nuclear power plant operator".

Urenco, which is headquartered in the UK, has enrichment facilities in Germany, the Netherlands, the UK and the USA. It is one-third owned by the UK government, one-third by the Dutch government and one-third by the German utilities EOn and RWE AG. It was founded in 1970 following the signing of the Treaty of Almelo by the governments of Germany, the Netherlands and the UK.

Work starts on Pele microreactor core

_93023.jpg)

Project Pele was launched in 2019 with the objective of designing, building, and demonstrating a prototype mobile nuclear reactor within five years. The initiative is led by the Department of Defense's Strategic Capabilities Office, which is working in collaboration with the US Department of Energy (DOE), the Nuclear Regulatory Commission and the US Army Corps of Engineers, as well as with industry partners.

BWXT Advanced Technologies and X-energy LLC were subsequently selected to develop a final design for a prototype mobile high-temperature gas reactor using high-assay low-enriched uranium (HALEU) tristructural isotropic (TRISO) fuel under the Project Pele initiative. BWXT was contracted in June 2022 to build a prototype 1.5 MWe microreactor. The contractor team also includes critical roles played by Northrop Grumman, Rolls Royce Liberty Works, and Torch Technologies. The fuel for the reactor will be produced at BWXT's facilities using material from the DOE's highly-enriched uranium inventory.

BWXT has now announced the start of work on the reactor core.

A rendering of the Pele microreactor (Image: BWXT)

"We are proud to develop and deliver the Pele microreactor for the benefit of our armed forces," said BWXT Advanced Technologies President Kate Kelly. "This is a tremendous achievement for the BWXT team and for the advancement of groundbreaking nuclear energy technology as a reliable, resilient source of electricity and heat for multiple applications."

The prototype reactor facility is designed to be transported within four 20-foot shipping containers, and tested at Idaho National Laboratory's (INL's) Critical Infrastructure Test Range Complex. The technology is expected to begin producing electricity in 2028.

BWXT said it has completed fabricating the TRISO nuclear fuel for the reactor and will ship it to INL in the months ahead.

Northrop Grumman is providing the control module for the reactor, while Rolls-Royce is developing the power conversion module at its Liberty Works facility in Indianapolis, Indiana.

Regulatory approvals pave way for Palisades restart

The US Nuclear Regulatory Commission has approved a series of licensing and regulatory actions that will allow fuel loading at Holtec's plant.

_37878.jpg)

Palisades, a single-unit pressurised water reactor in Covert, Michigan, ceased operations in May 2022 and was defuelled the following month, although it was licensed to operate until March 2031. The unit's licence was transferred from previous operator Entergy Nuclear Operations to Holtec Decommissioning International, LLC and Holtec Palisades, LLC, for decommissioning, but in late 2023, Holtec began the process of obtaining the licensing approvals needed to return the plant to operational status for the remainder of its licensing term.

Following the completion of technical reviews, the Nuclear Regulatory Commission (NRC) has now approved the transfer of operating authority for the plant and its independent spent fuel storage facility from Holtec Decommissioning International LLC to Palisades Energy LLC. It has also approved the reinstatement of various documents and programmes that were in place prior to the shutdown, including the technical specifications, emergency plan, emergency action levels, and physical security plan, as well as programmes for quality assurance, maintenance, and in-service inspections.

"The NRC staff is issuing its approval of these actions concurrently with its approval of this exemption to reauthorise power operations at PNP. The effectiveness of this exemption will occur on August 25, 2025, Holtec's planned date to transition to the power operations licensing basis," the NRC told Holtec Vice President, Licensing, Regulatory Affairs Jean Fleming in a letter dated 24 July.

There are still several licensing actions under NRC review and additional requirements that need to be met before the plant can start up.

The approval means that Palisades is authorised to receive new fuel and formally transition licensed reactor operators to on-shift status, Holtec said.

"The NRC's approval to transition Palisades back to an operating licence represents an unprecedented milestone in US nuclear energy," Holtec International President Kelly Trice said. "Our mission remains clear: to restart Palisades safely, securely, reliably, and in support of America's energy future - while supporting local jobs and economic growth for decades to come."

DeepGeo and Allweld partner for nuclear energy in Africa

US-based Deep Geo Inc and South Africa-based Allweld Nuclear and Industrial have signed a memorandum of understanding to support the development of new nuclear power capacity in Africa.

DeepGeo is best known for its proposals to develop multinational repositories in Ghana, Somaliland and potentially Finland and Canada. Allweld is an Engineering Solutions company which has been serving the nuclear and other sectors in South Africa and beyond since the early 1960s.

The two will work together to promote DeepGeo's Ubuntu Nuclear Energy, a nuclear project company aiming "to lead the development of standardised fleets of nuclear power plants across Africa and beyond", pursuing a "commercial, regional approach" working with one or two technology partners so it can realise standardisation across projects and "progressively localise the supply chain so that more benefits can be realised by the building countries".

Link Murray, President of DeepGEO, said: "Allweld has a stellar international reputation for quality workmanship, reliability, and employee development. It is a natural partner for supporting our regional and cooperative approach to nuclear energy development in Africa - Ubuntu Nuclear Energy. Allweld’s inspired and innovative leadership is helping us to break open Africa’s nuclear gridlock."

Mervyn Fischer, Allweld CEO, said: "DeepGEO is a vibrant and active nuclear company that is clearly deeply committed to the expansion and sustainability of nuclear energy. If the nuclear industry expects to make rapid progress, it can’t continue to do things the same way they have been done before. We need to embrace innovative solutions. African countries, especially, have the clear potential to leapfrog their European and American peers by adopting regional and harmonised approaches."

Ubuntu Nuclear Energy says it is currently working towards establishing its initial projects and is seeking early-stage investment and looking to finalise its technology and supply chain partners.

The MoU says "DeepGEO intends to preferentially partner with Allweld to support the construction, operation and maintenance of its nuclear project opportunities in Africa, and potentially globally … Allweld agrees to lend its support to DeepGEO/Ubuntu Nuclear Energyas a technical expert and business partner to support its sales and investment".

And it says the two companies "seek to advance the goal of Africa reaching full independence in the peaceful uses of nuclear sciences and technologies"

France and Belgium agree to enhance nuclear cooperation

_54664.jpg)

The declaration was signed in Paris on 23 July by Belgium's Federal Minister of Energy Mathieu Bihet and France's Minister responsible for Industry and Energy Marc Ferracci.

The declaration aims to strengthen exchanges between the two governments in key areas, including: the extended operation of existing reactors; the development of new projects, including small modular reactors (SMRs); research and innovation; strategic supply chains; training and skills.

These thematic cooperation areas will be the subject of individual projects and specific working groups, Bihet said in a statement.

"After opening up the field of possibilities with the repeal of the 2003 law, we are now moving on to a new stage, that of the concrete construction of cooperation," he said. "With this declaration, we are sitting down with France, a friendly country, a major industrial partner, and a pioneer in civil nuclear power in Europe.

"The partnership is based on a shared ambition: to make nuclear power a strategic lever for a more sustainable, competitive, and resilient Europe. It demonstrates a desire to make nuclear power not only a tool for transition, but also an industrial and scientific pillar for future generations."

"This declaration demonstrates our shared commitment to developing our nuclear industries and launching ambitious energy programmes to secure our future," Ferracci said in a post on X. "I also commend Belgium's recent commitment to the European Nuclear Alliance, alongside France. Together, we advocate for a European energy strategy based on technological neutrality, energy sovereignty, and decarbonisation."

The European Nuclear Alliance currently comprises Bulgaria, Croatia, the Czech Republic, Finland, France, Hungary, the Netherlands, Poland, Romania, Slovakia, Slovenia and Sweden, plus Belgium and Italy as observers. The alliance's members have committed to expanding their use of nuclear energy.

In May, Belgium's federal parliament voted by a large majority to repeal a 2003 law for the phase-out of nuclear power and banning the construction of new nuclear generating capacity. Under the phase-out policy, unit 1 of the Tihange plant was set to shut in October this year, with Doel 2 following in December. Belgium's last two reactors - Doel 4 and Tihange 3 - were scheduled to close in November 2025, but a final agreement was reached in December for the two units to continue operating for a further 10 years.

"This declaration is in line with the ongoing revival of the nuclear industry in Belgium, as confirmed by the amendment of the 2003 law and the announcement of the return of nuclear power to our energy mix," Bihet said. "It demonstrates our country's commitment to working hand in hand with its European partners on long-term strategic issues: security of supply, energy sovereignty, decarbonisation, and innovation."

Ocean-Power to consider deployment of Danish SMRs

The MoU initiates a strategic collaboration between the two companies, combining Ocean-Power's expertise in project development and energy conversion with Copenhagen Atomics' advanced reactor technology.

The joint study will assess the technical and regulatory conditions for deploying thorium reactors in Norway. It will include evaluations of power and heat demands, site selection, dialogue with Norwegian stakeholders, and conceptual design of a complete energy plant based on Copenhagen Atomics' reactor modules.

The study will provide a basis for potential further collaboration on project development and deployment.

"Our modular reactor technology is designed to be scalable, cost-efficient, and flexible," said Copenhagen Atomics CEO Thomas Jam Pedersen. "We are excited about this collaboration with Ocean-Power and view Norway as a promising market for the next generation of nuclear energy."

Ocean-Power's current concept is to develop floating power plants featuring combined cycle power plants (gas turbines and steam turbines). The 200-250 MW floating plants would be used to supply power to nearby platforms for the offshore version and to the grid inshore. CO2 from the exhaust gases will be captured and would then be either injected directly into a nearby geological formation, into a pipeline or liquefied and transported by vessel for usage or permanent storage.

"This is an important step in our mission to provide sustainable and reliable power for Norwegian industry," said Ocean-Power CEO Erling Ronglan. "We see great potential in Copenhagen Atomics' technology and look forward to exploring how it can be integrated with our capabilities to deliver clean, firm power to the grid."

Copenhagen Atomics is developing a containerised molten salt reactor. Moderated with unpressurised heavy water, the reactor consumes nuclear waste while breeding new fuel from thorium. Small enough to allow for mass manufacturing and assembly line production, the reactor has an output of 100 MWt. Copenhagen Atomics' goal is to deliver energy at a levelised cost of just EUR20 (USD23.5) per MWh.

The company's thorium reactors are expected to consume the transuranic elements in used nuclear fuel from conventional nuclear reactors, which radically reduces the amount of long-lived radioactive waste. To achieve this, Copenhagen Atomics intends to separate used nuclear fuel from light water reactors into four streams: zircaloy, uranium, fission products and transuranics. Its reactor designs can make use of plutonium (a transuranic) to 'kickstart' the use of thorium.

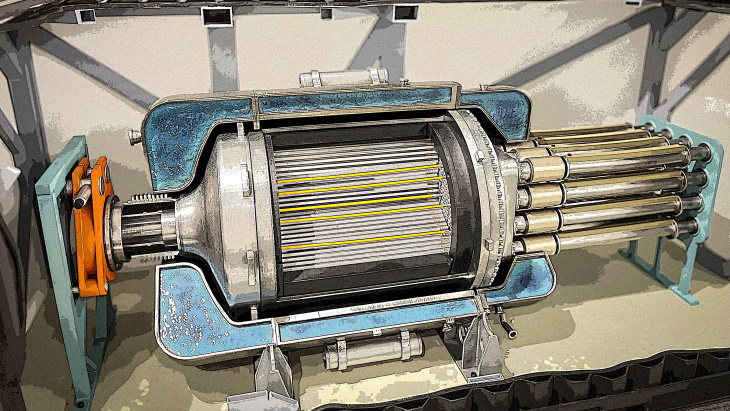

First steam generator lowered into place at Hinkley Point C

The carefully planned installation involved lifting the generator on to a special section of railtrack to be brought into the building.

(Image: Screengrab from EDF/Youtube)

It then had to be lifted and rotated into place where it will use the 295°C heat from the EPR reactor to turn water into steam to turn the turbine, to generate electricity.

(Image: EDF)

The installation brings an end to the journey for the 25-metre steam generator, which was manufactured by Framatome in France. The first of the eight steam generators that the two-unit plant will feature was delivered to the site in southwest England in May 2024 after a journey by sea and road.

The first steam generator was delivered to the site last year (Image: EDF)

Construction of the first of two 1630 MWe EPR reactors at Hinkley Point C began in December 2018, with construction of unit two beginning a year later. The dome of unit 1 was put in place in December 2023. The dome was lifted into place on the second unit's containment building last week.

Last year, EDF announced that the "base case" was now for unit 1 being operational in 2030, with the cost revised from GBP26 billion (USD32.8 billion) to between GBP31-34 billion, in 2015 prices.

When complete, the two EPR reactors will produce enough carbon-free electricity for six million homes, and are expected to operate for as long as 80 years.

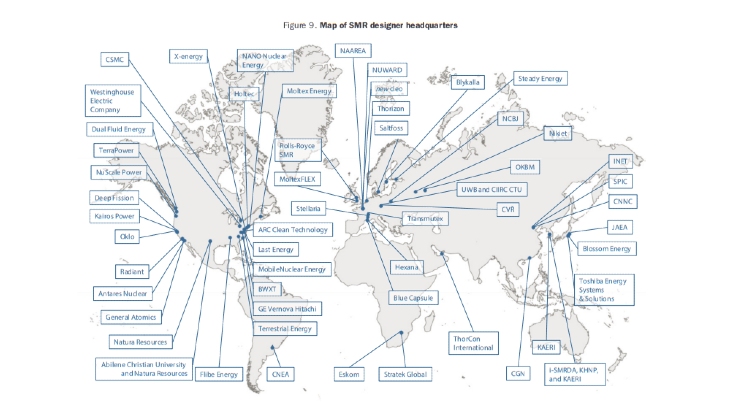

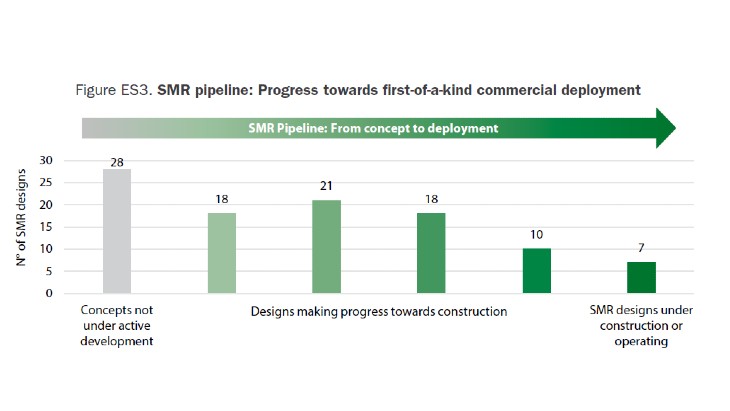

There are now 127 different SMR designs, finds NEA report

The NEA Small Modular Reactor (SMR) Dashboard identifies 127 SMR designs, which is up from 98 in its previous edition. It also reports that since that 2024 edition there has been an 81% increase in the number of SMR designs to have secured at least one source of funding, or funding commitment.

It says there are seven designs operating or under construction with a "strong pipeline of projects progressing toward first-of-a-kind deployment".

(Image: NEA SMR Dashboard)

NEA Director-General William Magwood, said: "The overarching developments reflected in the NEA SMR Dashboard are clear: the strategic drivers for SMR deployment - rising electricity demand, including from data centres and expanding digital services, energy security imperatives and national goals set by many countries to reduce carbon emissions - are intensifying. SMRs are now a core part of the energy strategies in an increasing number of countries in all parts of the world."

The dashboard is now available as a digital interactive platform, which is searchable by country, by technology and by readiness.

(Image: NEA SMR Dashboard)

For the new report, 74 of the 127 designs identified were analysed. Of the other 53 designs, 25 asked not to be included in this year's edition, with the other ones including SMR designs not under active development or cancelled or paused.

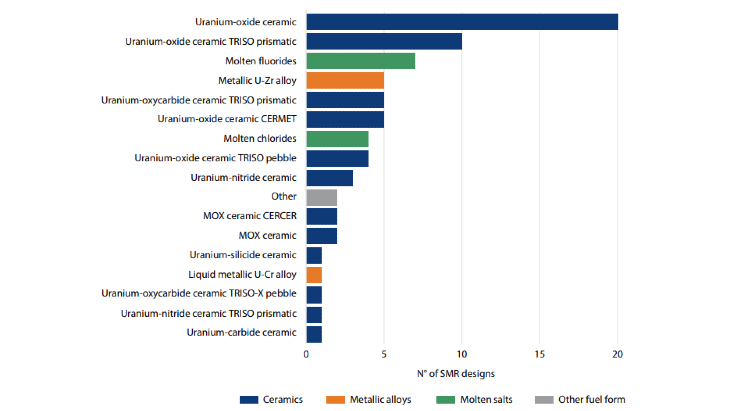

Favoured fuel

(Image: NEA SMR Dashboard)

Thirty of the SMR designs reviewed require high-assay low-enriched uranium (HALEU) fuel enriched between 10% and 20% and nine plan to use HALEU fuel enriched between 5% and 10%.

The report notes: "The availability of HALEU remains a significant barrier to the deployment of many SMR designs, though some developers have engaged early to secure supplies for their first-of-a-kind reactors. The data collected shows that as of early 2025, more than half of the SMRs planning to use HALEU had not yet progressed beyond non-binding agreements or collaborative studies with national laboratories related to fuel supply."

It adds: "SMR designs are based on an increasingly diverse range of fuel forms, most of which have not yet been licensed or qualified for use. Uranium oxide ceramics are the most common fuel in commercial reactors today. However, innovative SMR designs are introducing a wide range of novel fuels that require different manufacturing processes and technologies. Standard uranium oxide ceramic fuel is the most common fuel among the SMR technologies under active development, with 39 planning to use it as their fuel. Out of these 39 designs, 19 incorporate or plan to incorporate a composite fuel architecture, such as TRISO, distinguishing them from the conventional fuel used in today’s large-scale light-water reactors and potentially altering significantly fuel fabrication requirements and performance characteristics. More broadly, 47 SMR designs, over 60% of those included in this edition of the Dashboard, rely on fuel forms that are not currently available at commercial scale."

(Image: NEA SMR Dashboard)

Magwood, in his foreword to the third edition of the dashboard, said: "Private investment is surging, with an estimated USD5.4 billion of capital now flowing from venture and corporate sources. Major global corporations such as Google, Amazon, Meta and Dow Chemical have recently bolstered this wave of investment to meet energy needs consistent with their environmental goals. And now with three SMR companies publicly traded, we are witnessing growing confidence in capital markets. The recent announcement that the World Bank will now consider financing nuclear energy projects also sends a clear and powerful signal to other financial institutions.

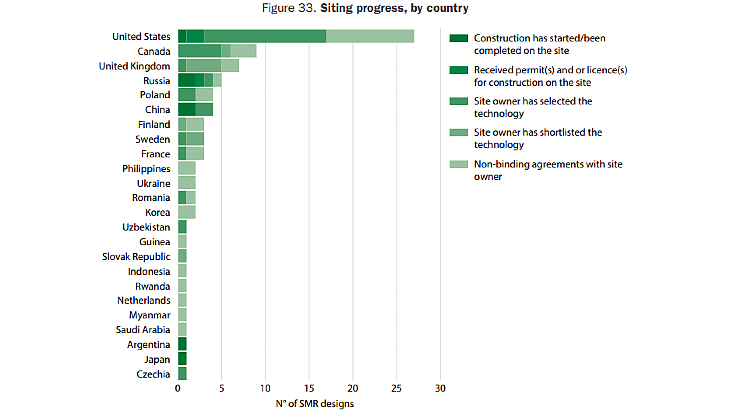

"Equally notable is the evolution on the regulatory front. In 2024, more than 33 SMR designs began pre-licensing activities with nuclear regulators - a 65% increase from the 2023 edition. ... the siting landscape has also evolved, with nearly 85 active discussions worldwide as of early 2025. As SMRs move from concept to construction, new markets are opening - not only for electricity, but also for non-electric applications like industrial heat and hydrogen production. The supply chain associated with SMR sector development is beginning to take shape, with universities, national laboratories and engineering firms contributing to capacity-building efforts."

He added that despite the growth in the sector there were still potential constraints to overcome, such as the supply of HALEU fuel, which "underscores the need for co-ordinated international action and support mechanisms to unlock fuel availability".

The latest edition, which covers the situation up to February 2025, coincides with the digital tracker, which offers "real-time access to global SMR developments. This marks a significant leap forward in transparency, accessibility and utility for the international nuclear policy community".

_51475.jpg)