Copper is closing in on the $12,000 a metric ton mark as expectations of soaring demand from data centres that power artificial intelligence and tight supplies collide with shortages outside the United States.

Valued for its exceptional electrical conductivity, copper wiring is vital in power grids that feed data centres, electric vehicles and the infrastructure needed for the energy transition.

Copper prices are up 35% so far this year and heading for their largest gain since 2009, due to mining disruptions and stockpiling in the US. On Friday, they touched $11,952 a ton.

“Investors who want a broad basket of AI interests will also buy into financial products which include hard assets that feed into data centres,” said Benchmark Mineral Intelligence analyst Daan de Jonge. “Investors will buy copper-related assets such as ETFs.”

Canada’s Sprott Asset Management launched the world’s first physically backed exchange-traded copper fund in mid-2024. The fund, which holds nearly 10,000 tons of physical copper, has shot up by almost 46% this year to nearly 14 Canadian dollars per unit.

A recent Reuters survey of analysts’ forecasts shows the copper market will see a deficit of 124,000 tons this year and 150,000 tons next year.

Copper demand growth is being driven by billions of dollars being invested worldwide to modernize and expand power grids. Data centres and clean energy require vast amounts of electricity.

The energy transition, which includes renewable energy technology such as wind and solar, is also expected to boost copper demand.

Macquarie expects global copper demand at 27 million tons this year, up 2.7% from 2024, with demand in top metals consumer China rising 3.7%. It forecasts global demand growth outside China at 3% next year.

“Bullish sentiment is being driven by the narrative around tight supply, supported by macro news flows,” said Macquarie analyst Alice Fox.

A magnet for traders

Supply disruptions include an accident at Freeport McMoRan’s giant Grasberg mine in Indonesia in September, while miners such as Glencore have cut production guidance for 2026, reinforcing expectations of tight supplies.

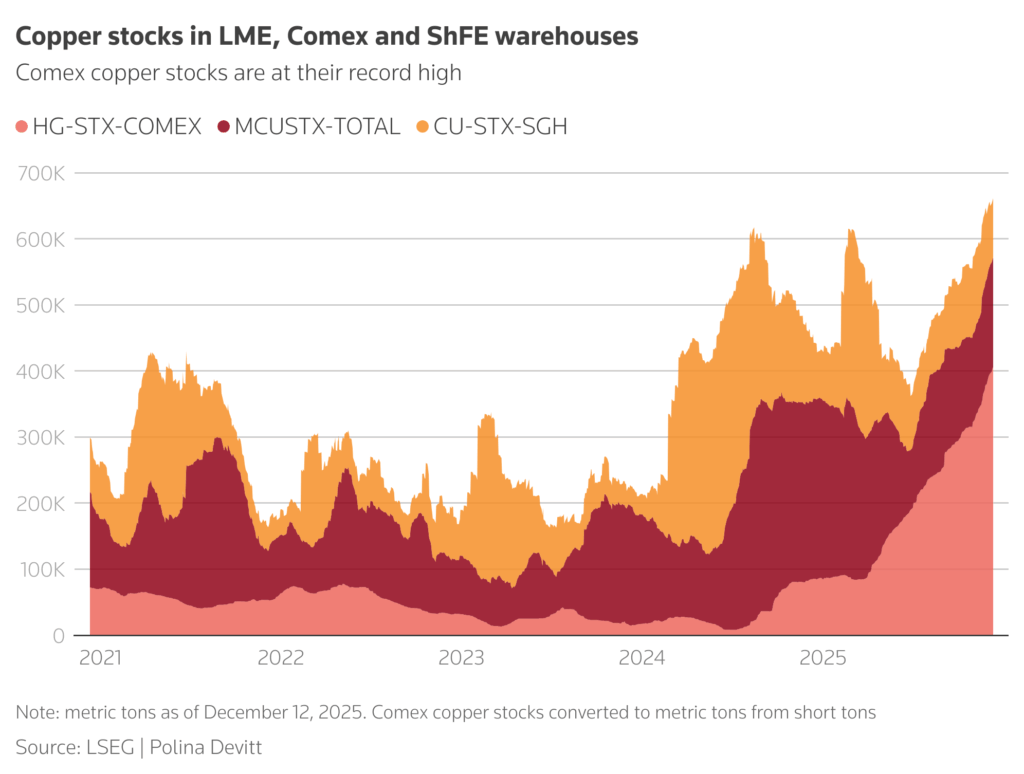

The overall amount of copper stored in exchange warehouses – the London Metal Exchange, US-based Comex and the Shanghai Futures Exchange – is up 54% so far this year at 661,021 tons.

Traders have been shipping copper to the United States since March due to higher prices on Comex ahead of US President Donald Trump’s planned import tariffs. Higher prices are needed to cover the import tariff.

Stocks on Comex at a record high of 405,782 tons amount to 61% of total exchange stocks versus 20% at the start of 2025.

“It feels incredibly tight because all of this material is going to the US,” said BMI’s de Jonge.

Refined copper was given an exemption from the 50% import tariffs that came into force on August 1, but US levies on the metal remain under review with an update due by June.

(By Polina Devitt, Pratima Desai and Tom Daly; Editing by Nia Williams)