RARE EARTHS

China lifts export ban on gallium, germanium and antimony to US

China has lifted a nearly year-long ban on exports of gallium, germanium and antimony to the US, in a further de-escalation of trade tensions between the world’s two largest economies.

In a statement issued on Sunday, China’s commerce ministry said it will pause its export ban on these minerals and related end-use items for about one year. The ban was first imposed in December 2024 in retaliation for US export controls on high-bandwidth memory chips into China towards the end of the Biden administration.

The US considers all three minerals to be critical to its national security and economy. Gallium and germanium are both essential for semiconductors, with the former also used in advanced radar technology and the latter in infrared technology, fiber optic cables and solar cells. Antimony is widely used in military applications such as flame retardants and primers for ammunition.

According to the consultancy Project Blue, China accounted for almost half of the world’s mined antimony in 2023, as well as nearly 60% of global refined germanium production and 99% of refined gallium output.

The US Geological Survey estimates that the ban on gallium and germanium alone could result in a $3.4 billion hit to the US economy. Around half of the decrease would come from the semiconductor sector, a key battleground between China and the US.

In its statement, the Chinese commerce ministry said the suspension of its 2024 export curbs will take place until Nov. 27, 2026, without providing further details.

The announcement comes just days after China agreed to suspend the additional export controls introduced in early October on rare earths and other battery minerals for one year.

China starts work on easing rare earth export rules but short of Trump hopes

China has begun designing a new rare earth licensing regime that could speed up shipments, but it is unlikely to amount to a complete rollback of restrictions as hoped by Washington, industry insiders said.

The Ministry of Commerce told some rare earth exporters they will be able to apply for new streamlined permits in the future and in industry briefings outlined the documents that will be required, two sources familiar with the matter said.

The export curbs have become Beijing’s most potent source of leverage in its trade rivalry with Washington, as China produces over 90% of the world’s processed rare earths and rare earth magnets, vital in products ranging from cars to missiles.

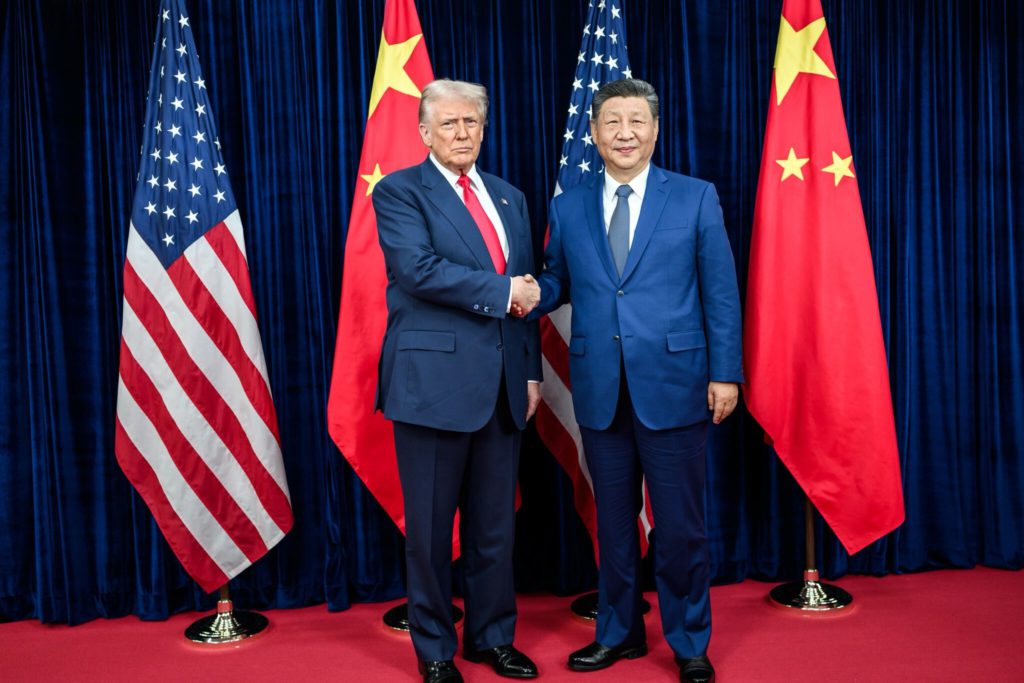

Following the agreement reached between Presidents Donald Trump and Xi Jinping, China said last week it would pause for one year the restrictions it imposed in October.

However, China’s commerce ministry has said nothing publicly about a broader round of controls introduced in April that rattled global supply chains.

The White House said on Saturday that China had agreed to introduce general licenses and characterized such permits as the de facto end of China’s rare earth export controls.

In private, Chinese officials have said they are working on the licenses, three other sources briefed on discussions said, although one said it could take months.

However, other industry insiders said the new licenses do not mean China’s wide-ranging rare earth export controls introduced in April have been removed.

China’s Ministry of Commerce did not immediately respond to questions from Reuters.

One year, potentially higher volumes

The new licenses would be valid for a year and probably allow larger export volumes, the first two sources said. Companies are preparing documents, which will require more information from customers, they said.

The sources said they expect more clarity by the end of the year.

Some Chinese rare earth companies said they have not yet been informed of the change.

General licenses will likely be harder to acquire for users associated with defence or other sensitive areas, some industry sources said.

All sources spoke on condition of anonymity given the sensitivity of the matter.

Introduced in April and expanded in October, Beijing’s rare earth rules require exporters to obtain licenses for every cargo, an onerous and lengthy process customers complain is holding up exports. The restrictions created shortages in May which brought parts of the auto industry to a halt.

Of the 2,000 applications submitted by European Union firms since April, just over half have been approved.

(Editing by Sonali Paul)

China approves registration of platinum and palladium futures

China has approved registration of platinum and palladium futures and options, moving a step closer to the launch of the derivatives trading of the metals used by automakers and other industrial sectors.

The China Securities Regulatory Commission said on Friday that it would supervise the Guangzhou Futures Exchange to ensure a smooth launch of platinum and palladium futures and options. The regulator did not disclose a date for the launch.

The Guangzhou bourse, which was established in 2021 and mainly focuses on products related to green energy, announced the plans in July last year, seeking to provide a domestic price-hedging mechanism for the metals.

The exchange had been communicating with futures companies, producers and traders on the design of the proposed contracts, industry insiders said.

Prices of platinum and palladium have spiked this year, driven by tight supply.

Analysts have raised price forecasts for platinum and palladium in 2026, citing tight mine supply, tariff uncertainty and rotation from investment demand for gold.

(By Amy Lv, Xiuhao Chen and Ryan Woo; Editing by David Goodman)

CATL sees progress in bid to restart key China lithium mine

Contemporary Amperex Technology Co. Ltd. has been told how much it should pay for the rights to its key lithium mine in China, another sign of progress in the battery maker’s bid to restart the operation that’s been halted since August.

The Chinese company is required to pay 247 million yuan ($35 million) for the lithium mining rights at its Jianxiawo project in Yichun city, according to the website of Jiangxi province’s Department of Natural Resources, which shows a valuation report submitted by a government-appointed asset appraisal company.

The levy is necessary for CATL to get its mining license approved and is a precondition for Jianxiawo to restart, analysts at UBS Group said in a note.

CATL didn’t immediately respond to a request for comment.

Production at the mine has been suspended since CATL failed to get an extension on a permit that expired Aug. 9, creating uncertainty in the lithium market at a time when Chinese authorities are scrutinizing supply chains for the battery ingredient. CATL is the world’s biggest battery supplier for electric vehicles, with Jianxiawo forecast to account for about 3% of global lithium production.

The mining right transferral from the government was evaluated in 2022 based on kaolinite deposits, without considering other minerals including lithium, according to the valuation report on Jianxiawo dated Nov. 6. Previously, eight mines in the region were asked to submit reports on reserves, following an audit that uncovered administrative shortcomings.

CATL shares fell as much as 1.5% in Shenzhen on Friday, tracking broader weakness across Asian equity markets.

(By Annie Lee and Charlotte Yang)

No comments:

Post a Comment