CU

Polish copper miner KGHM dismisses CEO

Image courtesy of KGHM

Polish copper miner KGHM dismissed CEO Andrzej Szydlo and deputy CEO Piotr Stryczek on Friday, the company said in a statement, without providing a reason.

As of 11:22 GMT, shares of the company were down 7.5%, as the leadership overhaul coincided with a sharp correction in copper and precious metal prices.

Analyst Jakub Szkopek from Erste Group said the CEO dismissal was unexpected.

“It will certainly not help KGHM’s share price,” Szkopek said, noting that the change creates uncertainty just as the company was preparing to update its strategy.

Szydlo had led the state-controlled miner since March 2024.

The supervisory board has delegated its member Remigiusz Paszkiewicz to temporarily perform the CEO duties for up to three months until a permanent appointment is made, KGHM said.

(By Rafal Nowak; Editing by Milla Nissi-Prussak)

Copper rally boosts 2026 earnings outlook for miners: report

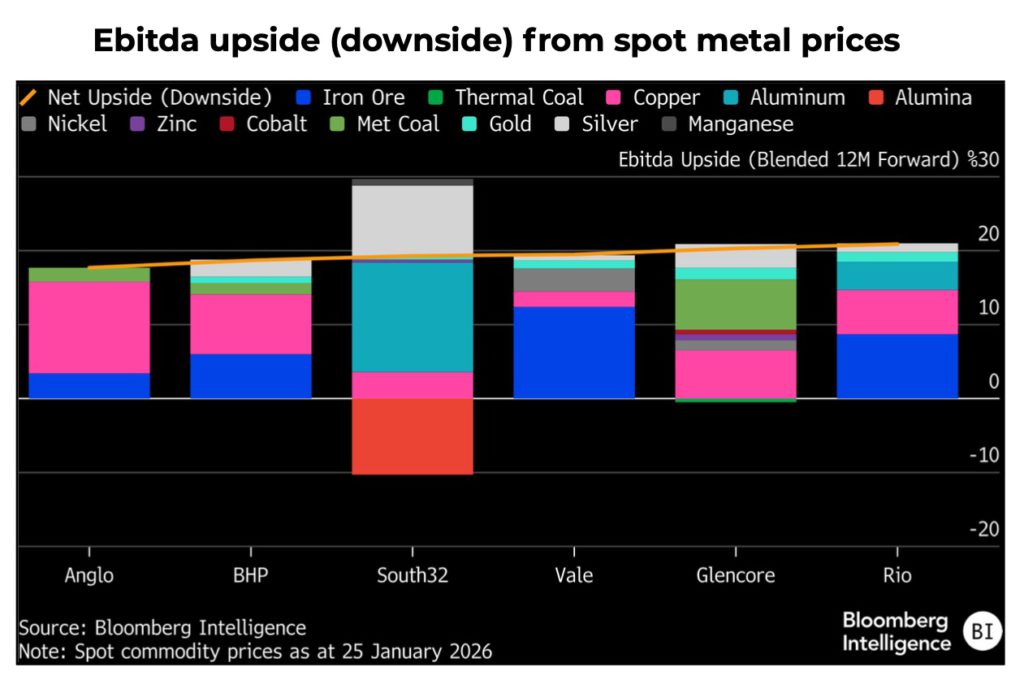

Rising spot metal prices are setting up one of the strongest earnings years in recent memory for diversified miners, with Rio Tinto (ASX: RIO, LON: RIO) and Glencore (LON: GLEN) leading on upside potential, according to a report by Bloomberg Intelligence.

Spot prices imply 18%–21% upside to one-year forward consensus Ebitda across major diversified miners if current levels hold, marking the largest earnings upside since early 2025. Bloomberg Intelligence says Rio Tinto and Glencore screen best, with roughly 20%–21% upside implied.

“Major miners’ consensus Ebitda upgrades should accelerate, led by Rio Tinto and Glencore,” said Alon Olsha, senior industry analyst at Bloomberg Intelligence, adding that stronger earnings revisions could support more scrip-funded M&A but also raise execution risk, particularly for Rio.

Quality matters

The composition of earnings growth matters as much as its size, with investors likely to place a higher value on upside driven by copper and precious metals than by iron ore, where consensus still assumes softer pricing.

For Glencore, strong metallurgical coal and copper prices account for about two-thirds of its spot-implied Ebitda upside, while gold and silver add more than 4% despite not being core earnings drivers.

Rio Tinto has seen particularly strong earnings momentum, with consensus forecasts lifting its 2026 Ebitda by 18% over the past six months, well ahead of peers, while spot prices still imply a further 21% upside. That strengthens Rio’s relative position but raises the bar for any large, scrip-funded acquisition as earnings upgrades increasingly reflect self-help and copper exposure.

By contrast, Glencore’s 2026 Ebitda has risen just 5% over the same period, suggesting greater scope for positive revisions if spot prices persist.

From Dr. to King

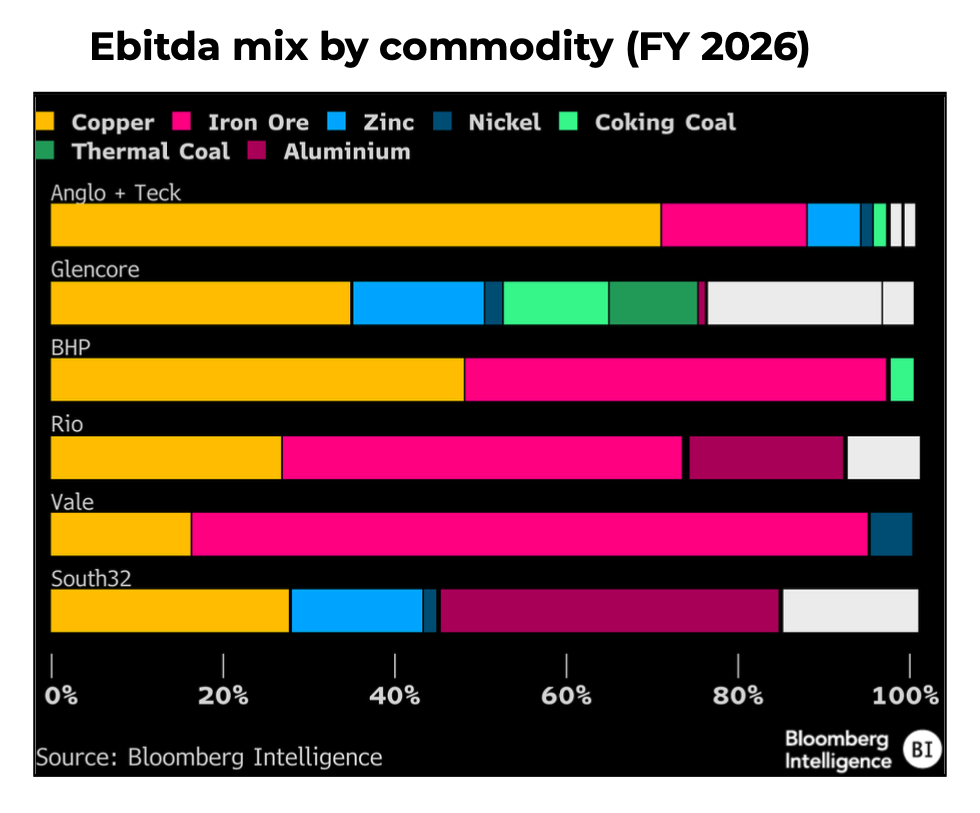

Copper’s growing dominance is reshaping the sector’s earnings mix, transforming the former “Dr. Copper” into what Bloomberg Intelligence now calls the king of commodities. Copper is set to account for more than 35% of diversified miners’ Ebitda in 2026, up about 14% from eight years ago, driven largely by higher prices and portfolio simplification rather than volume growth.

Rio Tinto stands out on production, having lifted copper output by 54% since 2019 with the ramp-up of Oyu Tolgoi, compared with an 11% increase at BHP (ASX: BHP, LON: BHP). The race to secure copper-heavy pipelines has intensified, pushing miners toward organic growth and M&A before assets are fully de-risked and rerated.

Anglo American’s (LON: AAL) transaction with Teck has accelerated its shift toward copper, with pro-forma earnings set to exceed 70% from the metal, followed by BHP at nearly 50% and Glencore at about 35%. Rio’s copper exposure has risen through sustained investment but still trails peers at roughly 26%, with iron ore dominating at 47%.

Bloomberg Intelligence expects diversified miners’ Ebitda to rise across the board in 2026, led by Glencore and Anglo at 24–28% growth.

Copper remains the key lever, with prices seen rising 25% versus 2025 under Bloomberg Intelligence’s scenario, or about 16% on consensus, while Glencore’s marketing division adds upside if volatility stays high.

Higher prices also bring cost risks, particularly labour, but for miners with precious metals by-products, stronger gold and silver prices should more than offset those pressures.

Road ahead

Execution will define the year as miners push major projects forward. Glencore must deliver cleaner operating performance while advancing Coroccohuayco and the Alumbrera restart. Anglo faces a critical phase completing its Teck merger and simplifying its portfolio. BHP needs to steady Jansen, clarify its Australian copper strategy and deliver the Vicuna technical study in the first quarter. Rio Tinto will focus on lithium integration, advancing in-flight projects and concluding its minerals segment strategic review, while Vale (NYSE: VALE) continues work on its plan to double copper output by 2030.

Macro trends favour base metals over bulk commodities, with resilient demand from electrification, AI and defence spending, alongside supply constraints and expected interest rate cuts. Iron ore faces a tougher outlook as supply growth accelerates and Chinese steel exports encounter rising global trade barriers.

US copper tariffs less likely after critical minerals decision: Macquarie

US tariffs on copper look increasingly unlikely after Washington opted to prioritize supply negotiations over trade penalties for processed critical minerals, Macquarie said, a stance that could eventually unwind stockpiles built on fears of import restrictions.

Earlier this month, the White House concluded a Section 232 investigation into imports of processed critical minerals and their derivative products by directing the Commerce Department to pursue supply agreements, while keeping tariffs as a future option if talks fail.

This decision, according to Macquarie commodities strategists led by Alice Fox, “significantly weakens the case for copper tariffs,” although it cannot be ruled out entirely.

For the time being, the US is likely to maintain “status quo” and postpone its decision on copper tariffs, the analysts wrote in a note published last week.

Cautionary signal

While copper is subject to its own Section 232 review, Macquarie said the fallout from the broader critical minerals decision — and its impact on silver markets — offers a cautionary signal.

Last year, concerns over potential US tariffs led to a sharp build in Comex silver inventories, tightening liquidity on the London Bullion Market Association (LBMA) and pushing lease rates sharply higher. That dislocation drove metal flows from New York to London as price arbitrage between exchanges reversed.

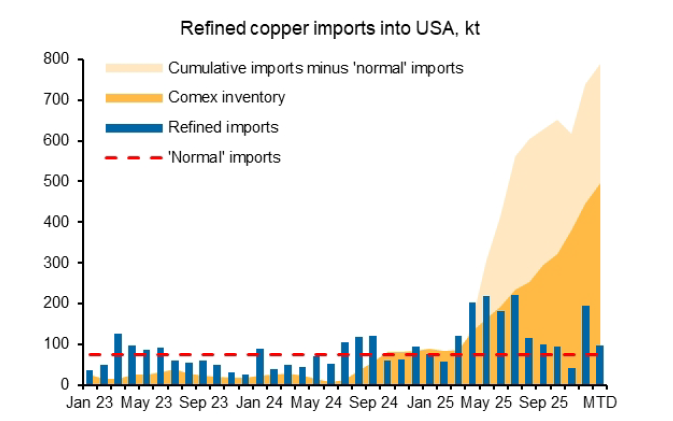

A similar dynamic is emerging in copper, Macquarie noted. Comex copper inventories have risen by about 412,000 tonnes since December 2024, with an estimated additional 375,000 tonnes held off-exchange. At the same time, the CME-LME arbitrage for January through March has fallen to zero or turned negative, reducing incentives for further US-bound arbitrage trades in the first quarter.

Instead, the negative arbitrage has begun to draw metal out of US warehouses, with London Metal Exchange stocks in New Orleans and Baltimore rising by 8,700 tonnes in the past week. Elevated premiums in Europe are also attracting contract metal that had been scheduled for delivery to the US, the Macquarie strategists said.

While copper already held in the US is not yet sufficiently incentivized to be re-exported, those stocks could become available if markets outside China tighten, as occurred in silver, the bank added.

Supply agreements

Despite minimal progress on rebuilding the US domestic copper production, Macquarie pointed to improvements in supply security through recent international agreements, such as the joint venture between the Democratic Republic and trading house Mercuria being backed by the US International Development Finance Corporation.

Under that deal, US end-users will have rights of first refusal on output, with Mercuria estimating annual sales of about 500,000 tonnes of copper and 40,000 tonnes of cobalt — equivalent to nearly 70% of US net refined copper imports in 2024.

Macquarie’s strategists concluded that the US could still delay a final tariff decision until the end of the year while negotiations continue, a scenario that would preserve the current market structure, with imports diverted and US-held stocks effectively sidelined.

However, if tariffs are ultimately ruled out, the copper arbitrage trade would likely reverse, releasing accumulated US inventories back into the market and potentially triggering a sharp correction in prices, they added.

No comments:

Post a Comment