CHARTS: Mining M&A surges as Canada deal values hit post-2009 high

Mining companies are rushing into mergers and acquisitions (M&A) as a core growth strategy, a shift that is helping drive Canada’s deal market to its highest level in more than a decade, a Bain & Company report shows.

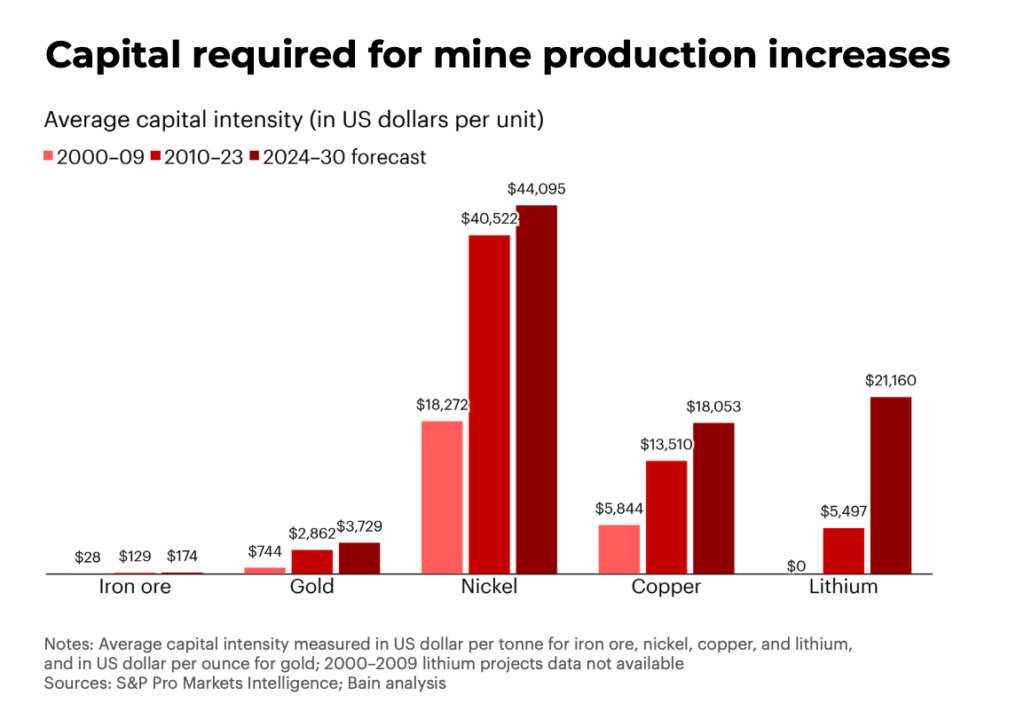

The shift reflects mounting pressure from rising capital costs, longer development timelines and intensifying competition for high-quality assets, which are the main forces reshaping how miners pursue growth and efficiency.

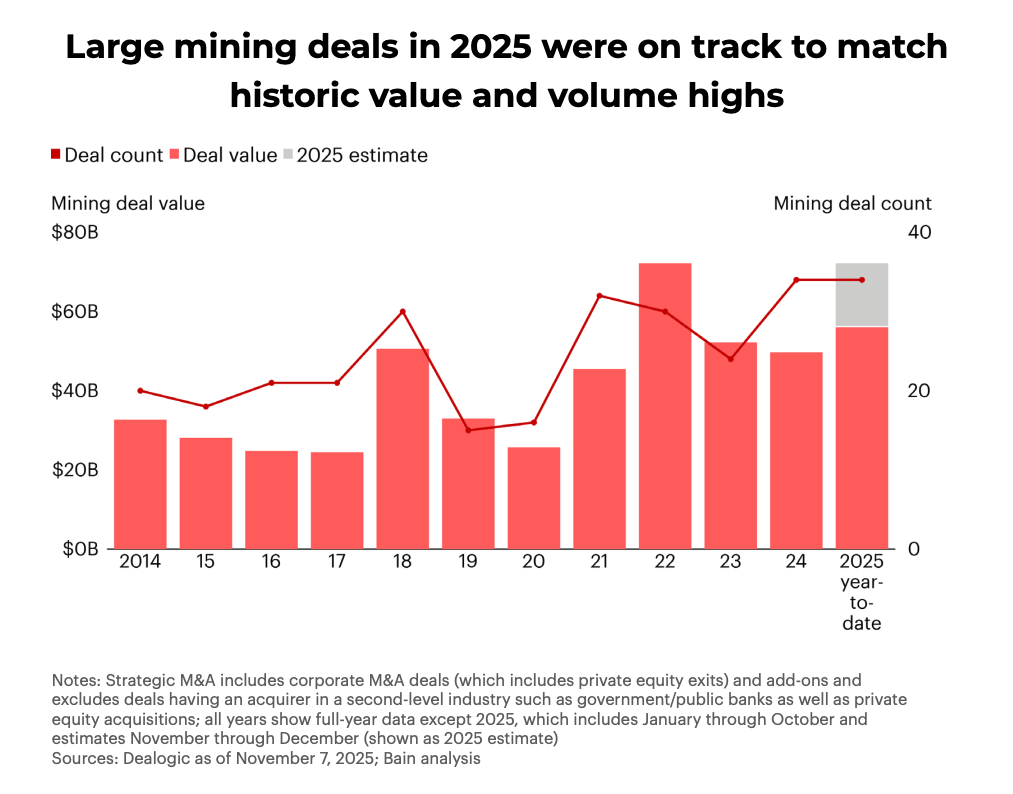

Bain estimates that global mining transactions valued above $500 million rose about 45% in 2025 compared with 2024, as companies looked to secure scale and resilience through acquisitions rather than greenfield development.

Recent large moves underscore the trend. Anglo American’s (LON: AAL) proposed merger with Teck (TSX: TECK.A TECK.B, NYSE: TECK), which values the Canadian miner at nearly $24 billion including debt, would create a combined entity with a market value of roughly $53 billion.

Bain says such transactions highlight how strategic M&A is becoming a critical tool for competitiveness and capital efficiency as the sector positions for a new commodity supercycle.

The next wave of mining dealmaking is expected to be larger, more complex and more decisive in determining long-term winners, the report finds.

Execution matters

While most large mining deals over the past decade have delivered neutral or positive shareholder outcomes, few have reached their full potential. Bain points to timing risk, peak-cycle valuations and execution challenges as the main constraints on value creation.

Successful examples show what is possible when execution is strong. Agnico Eagle’s $10.7 billion merger with Kirkland Lake Gold created the world’s second-largest gold producer, anchored in the Abitibi gold belt. The deal targeted between $800 million and $2 billion in synergies over five to 10 years, with only 15% to 20% tied to general and administrative costs and the bulk expected from operational and strategic integration.

By the second quarter of 2022, Agnico reported early “quick-win” synergies and signalled it could exceed the $2 billion target. Subsequent milestones—including commissioning the Macassa mine’s No. 4 shaft in 2023 and record gold production and free cash flow in 2024—point to growing momentum, though Bain notes it is still early to fully assess outcomes.

Canada focus

Canada’s total M&A deal value rose 30% to $178 billion last year, outperforming the US on strategic transactions even as it lagged the 40% increase globally. Strategic M&A value jumped 57% year over year in Canada, compared with 54% growth south of the border.

Energy and natural resources led Canadian strategic dealmaking, with deal value rising 133% in 2025, while advanced manufacturing and services declined 21%. Strategic buyers accounted for $149 billion in total deal value, though the number of Canadian deals larger than $30 million increased just 8% from the prior year.

Beyond Canada, Bain highlights Evolution Mining (ASX: EVN) as an example of repeatable, strategic M&A done well. The company focuses on building regional, long-life operating hubs where adjacent assets and shared expertise compound value. Rather than relying on top-down cost cutting, Evolution emphasizes operating leverage —shared infrastructure, transferable mining methods and portfolio mix— to strengthen margins across cycles.

Looking ahead, dealmakers remain optimistic about 2026 but warn that macroeconomic and geopolitical uncertainty could still temper market momentum, particularly for capital-intensive sectors such as mining.

Anglo-Teck merger would create a ‘global minerals family’ HQ’d in Vancouver, CTO says

Anglo American’s chief technical officer Tom McCulley used his first appearance at the Association for Mineral Exploration (AME) Roundup to deliver a clear message to the industry: the global energy transition will fail without faster, deeper and more innovative mineral discovery.

Speaking at the annual conference in Vancouver on Monday, McCulley said the pace of global change – driven by electrification, artificial intelligence, population growth and geopolitical uncertainty – is accelerating demand for critical minerals at a time when supply is falling behind.

“The world needs more critical minerals, and it needs them faster, safer and more sustainably,” he told delegates, warning that declining ore grades, deeper and more complex deposits, rising capital costs and lengthening permitting timelines are tightening the supply outlook.

Copper, McCulley noted, illustrates the scale of the challenge. While developed economies have roughly 230 kilograms of installed copper per person, the global average is closer to 70 kilograms, he said.

Closing that gap would require installed copper stocks to rise from about 500 million tonnes today to more than 2 billion tonnes in the coming decades, a figure likely to increase further with the expansion of data centres, electrification and grid infrastructure.

Against that backdrop, exploration remains the industry’s most critical lever, McCulley said. Anglo American’s approach, he noted, is built around scale, discipline and innovation, supported by an integrated discovery and geosciences team that combines global exploration, near-asset discovery and advanced geoscience capabilities.

McCulley highlighted several proprietary technologies that Anglo American is deploying to improve discovery success, highlighting the Spectrum airborne system, which collects high-resolution electromagnetic, magnetic and radiometric data in a single pass; a highly sensitive ground-based magnetometer known as “low-temperature SQUID” used to detect metallic sulphides in complex geological settings; and AI-assisted core logging, which can reduce weeks of manual relogging work to a single day.

While technology is critical, he stressed that trust and community relationships ultimately determine whether discoveries become mines. Drawing on his experience at Anglo American’s Quellaveco copper mine in Peru, commissioned in 2022, he said early and sustained engagement with communities and government was essential to managing social and environmental risks – particularly water access in arid regions.

At Quellaveco, Anglo American worked with local communities to design water diversion and storage infrastructure that prioritised community needs, including a 60-million-cubic-metre dam largely dedicated to regional water supply.

“The community feels this is their dam,” he said, describing the project as a model for future developments across the company’s global portfolio.

“This dam, known as the Vizcachas dam, we did this all because of open dialogue with the community. The majority of the water from that dam is for the community – not the mine. The community not only worked with us, but helped us design – this is their dam.”

Mega-merger with Teck

Turning to Canada, McCulley said the country is uniquely positioned to supply critical minerals for the energy transition, citing its geological endowment, regulatory framework and commitment to responsible mining.

He pointed to the federal government’s 2025 budget, which earmarks more than $2 billion to enhance mining competitiveness and accelerate critical minerals investment.

Anglo American’s proposed $53-billion mega- merger with Teck Resources, announced last September, would create a global copper giant.

The Canadian government has approved the Anglo-Teck merger, clearing the way for the creation of one of the world’s largest copper producers as demand accelerates.

“We have a long history of partnerships…and this year’s theme: Materials for a changing world, couldn’t be more fitting for us at Anglo American, but us as an industry.”

“We announced the merger with Teck, to form ‘Anglo-Teck’. This will be a global minerals family – based right here in Vancouver,” McCulley said. That’s something we all can be proud of.”

As part of the strategy, the company plans to invest $300 million over five years in exploration and technology in Canada, establish a $100 million global institute for critical minerals research, and continue supporting the junior mining ecosystem, McCulley said.

“Discovery is about more than finding ore bodies,” he said. “It’s about creating enduring economic, environmental and social value for future generations.”

No comments:

Post a Comment