Tech execs race to save startups from 'extinction' after SVB collapse

Reuters

March 12, 2023

By Jeffrey Dastin, Anna Tong and Krystal Hu

PALO ALTO, California (Reuters) - Technology executives, prominent venture capitalists and founders including OpenAI CEO Sam Altman raced this weekend to keep alive companies caught up in the collapse of Silicon Valley Bank.

Friday's dramatic failure of the bank, which focuses on tech startups, was the biggest since the 2008 financial crisis. It roiled global markets, walloped banking stocks and left California tech entrepreneurs worrying about how to make payroll.

Aiming to avoid what Garry Tan, the CEO of startup accelerator Y Combinator, called a potential "extinction level event" in the tech sector, industry executives moved quickly to do what they could to save small businesses.

Altman, who runs one of Silicon Valley's hottest companies, bailed out some entrepreneurs from his own pocket, according to a Twitter message by his brother and one beneficiary who spoke with Reuters.

"I was running out of options, and so I just emailed him," Doktor Gurson, CEO of Rad AI, said in an interview on Saturday. Within an hour or two, Altman responded, offering him six figures: enough to make payroll and no strings attached, just a request to return the funds once Gurson is able, he said.

Asked for comment, Altman told Reuters, "I remember the investors who helped me out when I was running a startup and I really needed it, and I always try to pay it forward."

Henrique Dubugras, co-CEO of fintech startup Brex, also spent the weekend working the phone after his company announced an emergency credit line on Friday to help startups get through their next payroll.

As of Saturday evening, he said Brex had received $1.5 billion in demand from nearly 1,000 companies. "We’re trying to sign up lenders by end of day tomorrow. Everybody is sprinting," he said.

Even small startups are getting in on the action to help others. Aleem Mawani, founder of Streak, a company with about 30 employees, tweeted Friday he would lend his personal cash free of any terms to other small startups worried about paying staff. He said he then had discussions with a few companies and was aiming to prioritize lending for those living paycheck to paycheck.

“I'm a founder and I know how awful it would be to not make payroll,” Mawani said in an interview.

'MALFEASANCE OR MISMANAGEMENT'

By late Saturday, more than 3,500 CEOs and founders representing some 220,000 workers had signed a petition started by Y Combinator appealing directly to U.S. Treasury Secretary Janet Yellen and others to backstop depositors, many of them small businesses who are at risk of failing to pay staff in the next 30 days.

The petition advocated "stronger regulatory oversight and capital requirements for regional banks" and an investigation into any "malfeasance or mismanagement" by SVB executives. More than 100,000 jobs could be at risk, the petition warned.

SVB did not reply to a request for comment, and Y Combinator did not elaborate on the petition.

Venture investors have advised startups to seek alternatives to gain short-term liquidity. Some, including Lowercarbon Capital, have offered loans to portfolio companies that have funds stuck at SVB.

Its partner Clay Dumas said Lowercarbon would provide payroll support for the next two weeks and was wiring funds out Monday.

Khosla Ventures told Reuters, “Given the rapidly evolving situation, we are talking to 100+ portfolio companies assessing their critical needs and plan to bridge where we are a lead or major investor."

'LIFELINE'

Rad AI's Gurson had not talked to Altman for years when he emailed the OpenAI chief Saturday morning, desperate for help. The startup relied on SVB, the sudden closure of which meant he lacked the money to pay some 65 employees on Monday, he said.

"People's livelihoods depend on us," said Gurson, whose San Francisco-based company helps radiologists work more efficiently and includes staff with wide-ranging roles and wherewithal. "They’ve got mortgages to pay; they’ve got bills."

Gurson's co-founder waited eight hours on a Federal Deposit Insurance Corporation hotline to no avail, he said. Multiple attempts to transfer funds out of SVB had failed.

But Gurson saw a Twitter post from Altman, whom he met as a founder participating in 2014 in Y Combinator, where Altman was president. The two men did not know each other very well, he said.

"It's like a lifeline," Gurson said of Altman's generosity.

Gurson estimated "conservatively" that Altman has given more than $1 million to support other startups in similar need.

"The crazy thing here is he's not an investor in our company," Gurson said. "He didn’t ask for anything."

Altman did not comment on how much he had given companies but said he did not view his contributions as risky.

"Even if SVB can't find a buyer or a loan over the weekend, a lot of the money startups have on deposit will be made available to them. But in the meantime, people are facing a real liquidity crunch through no fault of their own, and employees need to get paid," he said.

(Reporting by Jeffrey Dastin in Palo Alto, Anna Tong and Krystal Hu in San Francisco; Additional reporting by Tatiana Bautzer; Writing by Kenneth Li; Editing by William Mallard)

Silicon Valley Bank's demise began with downgrade threat

2023-03-11

Peder B. Helland - Hope

In the middle of last week, Moody's Investors Service Inc delivered alarming news to SVB Financial Group (SIVB.O), the parent of Silicon Valley Bank: the ratings firm was preparing to downgrade the bank's credit.

That phone call, described by two people familiar with the situation, began the process toward Friday's spectacular collapse of the startup-focused lender, the biggest bank failure since the 2008 financial crisis.

Friday's collapse sent jitters through global markets and walloped banking stocks. Investors worry that the Federal Reserve's aggressive interest rate increases to fight inflation are exposing vulnerabilities in the financial system.

Details of SVB's failed response to the prospect of the downgrade, reported by Reuters for the first time, show how quickly confidence in financial institutions can erode. The failure also sent shock-waves through California's startup economy, with many companies unsure how much of their deposits they can recover and worrying about how to make payroll.

The Moody's call came after the value of the bonds where SVB had parked its money fell due to the higher interest rates.

Worried the downgrade could undermine the confidence of investors and clients in the bank's financial health, SVB Chief Executive Greg Becker's team called Goldman Sachs Group Inc (GS.N) bankers for advice and flew to New York for meetings with Moody's and other ratings firms, the sources said.

The sources asked not to be identified because they are bound by confidentiality agreements.

SVB then worked on a plan over the weekend to boost the value of its holdings. It would sell more than $20 billion worth of low-yielding bonds and reinvest the proceeds in assets that deliver higher returns.

The transaction would generate a loss, but if SVB could fill that funding hole by selling shares, it would avoid a multi-notch downgrade, the sources said.

REUTERS

Silicon Valley Bank staff offered 45 days of work at 1.5 times pay, FDIC email shows

LANANH NGUYEN AND PETE SCHROEDER

REUTERS

Employees of Silicon Valley Bank were offered 45 days of employment at one and a half times their salary by the Federal Deposit Insurance Corp, the U.S. regulator that took control of the collapsed lender on Friday, according to an email to staff seen by Reuters.

Workers will be enrolled and given information about benefits over the weekend by the FDIC, and healthcare details will be provided by the former parent company SVB Financial Group, the FDIC wrote in an email entitled “Employee Retention” late on Friday. SVB had a workforce of 8,528 at the end of last year.

Staff were told to continue working remotely, except for essential workers and branch employees.

The FDIC did not immediately respond to a request for comment.

Silicon Valley Bank imploded after depositors, concerned about the lender’s financial health, rushed to withdraw their deposits. The frenetic two-day run on the bank blindsided observers and stunned markets, wiping out more than $100 billion in market value for U.S. banks. SVB ranked as the 16th biggest bank in the United States at the end of last year, with about $209 billion in assets and $175.4 billion in deposits.

Members of California’s congressional delegation are set to be briefed by FDIC officials on Saturday, according to a report by Politico, which cited two people familiar with the situation.

The lender’s main office in Santa Clara, California, and all of its 17 branches in California and Massachusetts will reopen on Monday, the FDIC said in a statement on Friday.

ABC host slams regulation cuts 'under President Trump' after Silicon Valley Bank collapse

David Edwards

March 12, 2023

ABC/screen grab

ABC host Martha Raddatz noted that Trump-era regulation cuts may have contributed to the rapid collapse of Silicon Valley Bank last week.

While speaking to Sen. Mark Warner (D-VA), Raddatz wondered about the downfall of the go-to bank for tech startups.

"Senator, after the financial crisis in 2008, regulations were put into place to make sure banks could weather large losses," Raddatz told Warner on Sunday. "Under President Trump, some of those were rolled back, and in 2018, you were one of only 17 Democrats who voted for the bill that rolled back some banking rules, including for institutions the size of Silicon Valley Bank."

"Do you regret that vote?" the host asked.

Warner defended the vote: "I do think these mid-sized banks needed some regulatory relief."

"So, Senator, you don't regret that vote?" Raddatz pressed.

"I don't regret that vote," he insisted.

Watch the video below from ABC or at the link.

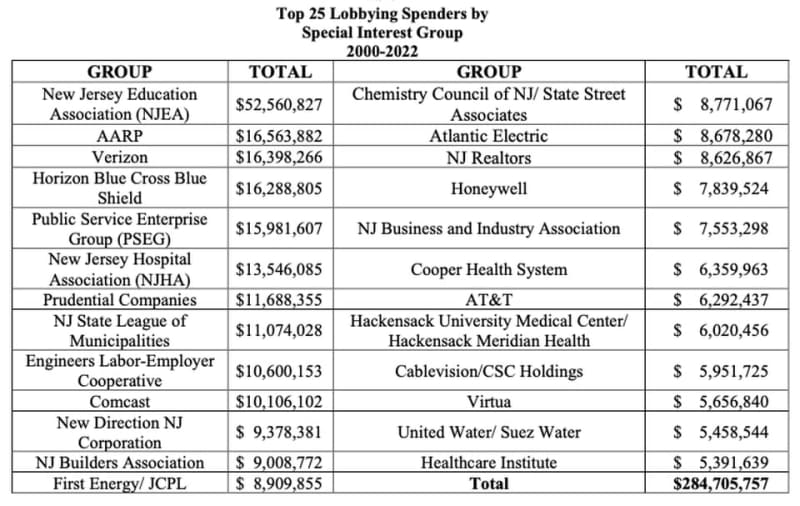

SILICON VALLEY BANK USED FORMER MCCARTHY STAFFERS TO WEAKEN REGULATIONS, LOBBY FDIC

Two senior aides to House Speaker Kevin McCarthy were among the top lobbyists for the bank at the center of a new financial crisis

Ken KlippensteinMarch 11 2023AFTER SUCCESSFULLY LOBBYING, for the rollback of new rules applied to Wall Street in the wake of the financial crisis, lobbyists for Silicon Valley Bank immediately began pressing their case further to the federal authority that insures bank deposits in the event of another crisis, according to lobbying disclosures reviewed by The Intercept. The lobbying effort managed to exempt banks the size of SVB from more stringent regulations, including stress tests aimed at uncovering the type of weaknesses that led to the bank’s implosion last week. Two of the bank’s top lobbyists previously served as senior staffers for House Speaker Kevin McCarthy, who himself pushed for the repeal of significant pieces of the landmark Wall Street reform legislation known as Dodd-Frank.The meltdown of Silicon Valley Bank on Friday represents the second largest bank collapse in American history and the first since the 2008 financial crisis. Over 90 percent of SVB’s deposits exceed the amount federally guaranteed by the FDIC, meaning those people may never see their money again, or may lose substantial amounts.SVB’s president, Greg Becker, himself pushed for weaker banking regulations, telling congress to lift “enhanced prudential standards…given the low risk profile of our activities,” as The Lever reported.A chief culprit, economists say, is legislation signed into law by President Trump in 2018, which rolled back key parts of the Dodd-Frank banking regulations passed in the wake of the 2008 financial crisis. That 2018 legislation, called the Economic Growth, Regulatory Relief, and Consumer Protection Act, passed with strong support from the Republican Party and critical support from some Democrats. Among those leading the charge was then-House Majority Leader Kevin McCarthy, who is now House Speaker.“We’re going to move this Senate bill directly to the president’s desk to ensure these reforms help the economy to grow further by making community banks stronger,” McCarthy said of the legislation in 2018. “This is going to free up a great deal of capital and this will help a lot.”Two former staffers for House Speaker Kevin McCarthy are registered lobbyists for Silicon Valley Bank, with one specifically lobbying on the 2018 Dodd-Frank repeal law that experts say made this crisis more likely, according to federal lobbying disclosures reviewed by The Intercept.Other SVB lobbyists worked for political figures cutting across both parties including President Bill Clinton, former Sen. Mike Enzi, R-Wy., former Sen. Tom Coburn, R-Okla., Rep. Joe Courtney, D-Conn., former Sen. Arlen Specter D/R-Pa., and former Rep. Jay Inslee, now governor of Washington.Brian Worth served as coalitions director for McCarthy from January 2011 to May 2014, when he was House Republican Whip. Since March of 2017 he’s been a partner at Franklin Square Group, where he’s worked as a lobbyist for SVB. Wes McClelland served as a policy advisor and senior policy advisor for McCarthy from April 2011 to September of 2015 and joined Franklin Square in January of last year, where he has also lobbied on SVB’s behalf.Franklin Square is the only lobby group that SVB has used in over a decade, having lobbied on its behalf every year from 2009 to 2023. The only other lobby shops SVB has employed were DLA Piper from 2009-2010 and McGuireWoods consulting from 2010-2011.A spokesperson for McCarthy did not immediately respond to a request for comment.Worth lobbied on the repeal law beginning on October 1, 2017, right up to its passage on May 24, 2018. Then, starting on July 1, 2018, SVB began lobbying the FDIC — the very same federal agency responsible for insuring bank deposits, which was tasked with implementing critical portions of Dodd-Frank.Though Franklin Square has lobbied on behalf of SBV since 2009, the 2018 filing represents the first time it had ever lobbied the FDIC.Beginning on April 20, 2022, McClelland also began lobbying the FDIC on SBV’s behalf, which both he and Worth continued doing right up until SBV’s last lobbying filing this year.The lobbying disclosures do not provide any more detail about the work. Neither Worth nor McClelland immediately responded to requests for comment.“This was a 100 percent avoidable problem,” economist Dean Baker told The Intercept in an email, pointing to the Dodd-Frank repeal bill. “That bill raised the asset threshold above which banks have to undergo stress tests from $50 billion to $250 billion. SVB would have been required to undergo regular stress tests before the revision; among the stresses you look at are sharp rises in interest rates, which is apparently what did in SVB. Presumably, if its books had been subject to this test, the risk would have been detected and they would have been required to raise more capital and/or shed deposits.”

Twitter slams 'moron' Charlie Kirk for suggesting Silicon Valley Bank crashed because of 'DEI' efforts

Maya Boddie, Alternet

March 12, 2023

Charlie Kirk speaking with attendees at the 2021 Southwest Regional Conference hosted by Turning Point USA at the Arizona Biltmore in Phoenix, Arizona. (Photo credit: Gage Skidmore)

Turning Point USA founder and conservative, Charlie Kirk, suggested Silicon Valley Bank collapsed due to the lender's diversity, equity and inclusion commitment statement on its website.

Kirk tweeted, "It is a mystery why Silicon Valley Bank collapsed," along with a screenshot of the banks Diversity, Equity and Inclusion statement.

NBC reporter Ben Collins responded to Kirk's tweet, writing, "On the right-wing internet, SVB collapsed because of DEI and ESG, which is just SBF's version of CRT. This is the kind of sentence you're gonna start hearing from presidential candidates, and they're going to wonder why nobody cares. It's meaningless acronyms all the way down."

Other Twitter users chimed in to criticize the right-wing activist's theory, calling it "embarrassing, even for you."

@williamlegate: "to suggest that this is the reason is absurd, but it was also very predictable. I called it yesterday that you all would blame this on DEI"

@holman: "it's okay to admit you don't understand banking!"

@Cassizzi: "Frankly it would be a bigger mystery if a community college dropout like yourself knew anything about liquidity risk management in a financial institution. But nice try, Charlie."

@buccocapital: "you are a true moron"

READ MORE: 'War on white people': Charlie Kirk's train derailment conspiracy theory

David Burrows: "Hilarious. Now tell us why CPAC collapsed"

@MikieAndTheVibe: "im not sure if this post just makes 0 sense or if you’re saying that the company failed because they attempt to include gay and black people"

Andy Brining: "Yeah, everything with you is a mystery for some reason. I wish we could discover the common factor."

READ MORE: Silicon Valley Bank becomes 'largest bank' to collapse 'since 2008' financial catastrophe: report

@e_michael1: "In case people were wondering, this is *not* why SVB failed."

@RagingGinge: "c'mon Charlie this is embarrassing even for you."

READ MORE: Silicon Valley Bank's collapse triggers concern over potential 'bloodbath' and risk to broader markets

Inside the Silicon Valley Bank failure: A tech industry in shock as it awaits a government response

People stand outside of an entrance to Silicon Valley Bank in Santa Clara, California, 10 March 2023 - Copyright AP Photo/Jeff Chiu

By Aleksandar Brezar • Updated: 11/03/2023 -

The news out of California that authorities shut down Silicon Valley Bank (SVB) on Friday shocked the tech start-up and venture capitalist world, with its sudden collapse over the course of two days roiling the market by Saturday.

SVB - the 16th largest bank in the US but a crucial one for the startup community - was closed down by regulators on Friday after a bank run dealt it a lethal blow following attempts to recover deposit losses and the sale of treasury bonds and securities.

"SVB was obviously the beacon of the start-up venture community for four decades. Almost, you know, one of those institutions that everyone viewed as too big and too strong to fail," Samir Kaji, a former banker who spent more than 20 years in the industry, told Euronews Next.

Silicon Valley Bank collapse: Fears of financial crisis after bank used by US tech sector fails

Yet SVB was hit hard by funding drying up over the past year in the tech and startup sector as well as the Federal Reserve's plan to aggressively increase interest rates to combat inflation.

The bank was backed by billions of dollars worth of bonds, but in having to sell them at a time when interest rates were high, they sold them at a significant loss.

But SVB’s customers were largely startups and other tech-centric companies that started becoming needier for cash over the past year.

A Brinks truck is parked outside of Silicon Valley Bank in Santa Clara, 10 March 2023

AP Photo/Jeff Chiu

"When they had the announcement of the capital reshuffling [on Wednesday]," he recalled, "what ended up happening there was a 'town hall' call with their clients which are mainly these VC firms".

And it actually incited more panic than it did to reassure, Kaji explained.

"There were torrents of emails, voicemails, calls, Slacks, text messages, where all of the VCs were imploring their companies to move capital out of SVB, which created that $42 billion leaving the bank".

SVB's 'specific' problems to result in only pockets of instability?

SVB is expected to re-open Monday with the FDIC in charge. It said all insured depositors would have full access to insured deposits no later than Monday morning.

"While there are no guarantees, it is very likely that the FDIC - which is the institution created in the New Deal to deal with bank runs and prevent bankruptcy - will likely resolve the situation," Armand Domalewski, a data analyst with a background in economic policy told Euronews Next.

There were torrents of emails, voicemails, calls, Slacks, text messages, where all of the VCs were imploring their companies to move capital out of SVB, which created that $42 billion leaving the bank.

Samir Kaji

Former banker

"People in the US think that their deposits are only insured up to $250,000 [€234,000], which is legally true. But in general what the FDIC tries to do since 2008 is arrange sales to other banks so that the customers are transitioned overnight. They don't lose their deposits".

The people who invested directly in SVB are going to get wiped out, but depositors have reasons to be hopeful, Domalewski explained.

The Silicon Valley Bank failure is the largest since Washington Mutual’s demise in 2008 - a watershed moment that triggered a major financial crisis and crippled the world’s markets since.

Yet SVB’s failure is expected to result only in pockets of instability, mostly due to its nature as a "boutique" bank and specific portfolio favoured by US tech startups and venture capital, servicing nearly half of the market.

Additionally, US and international regulators have introduced more stringent rules since the last financial crisis, aimed at ensuring that one bank’s failure would not trigger a cascade event, harming the broader economic system.

An FDIC sign is posted on a window at a Silicon Valley Bank branch in Wellesley, Massachusetts, 11 March 2023

AP Photo/Peter Morgan

The problems encountered by the bank "are very specific" and are not likely "to affect the entire banking sector, let alone the major banks," Ken Leon, an analyst with the firm CFRA, told AFP.

Morgan Stanley's analysts echoed this view, insisting in a statement: "We want to be very clear... We do not believe that the banking sector is facing a liquidity crunch".

Authorities in the US have also expressed their confidence in the country’s banking sector, which is far more diversified across multiple industries, customer bases, and geographies.

US Treasury Secretary Janet Yellen said on Friday that the banking sector remained "resilient,” while White House economic adviser Cecilia Rouse said the sector was "fundamentally different from what it was 10 years ago".

'Businesses should not fail because their choice of bank failed'

Some high-tech companies were hit hard by the news of SVB’s failure, however. On Friday, streaming device maker Roku said they had "around $487 million" (€456.9 million), or 26 per cent of its cash reserves, deposited at SVB.

Roku’s shares have gone down 10 per cent in extended trading, but the company said that "it continues to believe that its existing cash and cash equivalents balance and cash flow from operations will be sufficient […] for the next twelve months and beyond".

Requiring every individual business to do constant due diligence wherever they put their money creates a huge amount of stability.

Armand Domalewski

Data analyst

But smaller companies spent Saturday in heightened panic, as some of the startups depending on SVB became concerned over their ability to pay their employees post-shutdown.

Others scrambled to look for a bank to replace SVB even before markets reopen on Monday.

This is understandable, according to Domalewski, as fairly small businesses feeding a hundred employees feel "they’ll run out of money very very fast".

"Businesses should not fail because their choice of bank failed," Domalewski said.

"Requiring every individual business to do constant due diligence wherever they put their money creates a huge amount of stability".

"But I do think also, they should just wait to see what happens till Monday".

'Irrational' premise still led to 'rational' movement of cash

Yet the freakout persisted throughout Saturday, with emails from various firms said to have been circulating imploring companies to move their cash from other specialised banks to a top four bank as soon as possible.

"What this really cascaded into then is all of the regional banks being reviewed and many of the VCs have now looked at all this and said, 'Okay, well my distrust is not only with SVP, but it's actually with the broader read of the banking sector outside of the top four,'" Kaji explained.

Santa Clara Police officers exit Silicon Valley Bank in Santa Clara, 10 March 2023

AP Photo/Jeff Chiu

"And so everyone right now is looking at their company's funds and saying we simply just can't take a chance".

"When you have mass hysteria, the cat's already out the bag... the premise based on which people moved money was probably irrational, but once it started the movement of the cash it became rational".

"Because you never want to be the last one out. No one wants to be stuck in that same position with another bank" that is failing in the same way, Kaji concluded.

Protections in place to make all the difference?

In Europe, German and UK regulators are said to be monitoring the fallout of the SVB Group, although expectations of its overseas future were mostly optimistic on Saturday.

The group has offices in both European countries, as well as Ireland, Denmark, and Sweden, but its international arm is thought to represent a minor part of its overall business, with just 3 per cent of its total client funds coming from abroad.

On Friday afternoon CET, SVB’s UK branch said in a statement that it "has been an independent subsidiary since August 2022 with a separate balance sheet to the SVB Financial Group and an independent UK Board of directors".

And Domalewski believes that the protections in place since 2008 will make all the difference come Monday.

"There's a reason that we did all this since 2008 — passed a lot of new financial regulations formally and informally to make our banking systems a little more boring, a little more arduous, but to like prevent things like this from causing a full-scale crisis," he explained.

"It's been a long time since we've had a bank failure,” Domalewski said, “and people have forgotten what that's like".

Additional sources • AFP