You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Unless the data are dead wrong, it is increasingly clear that many of the U.S. states facing some of the greatest climate change hazards appear to be the ones most virulently opposed to environmental, social and governance (ESG) policies.

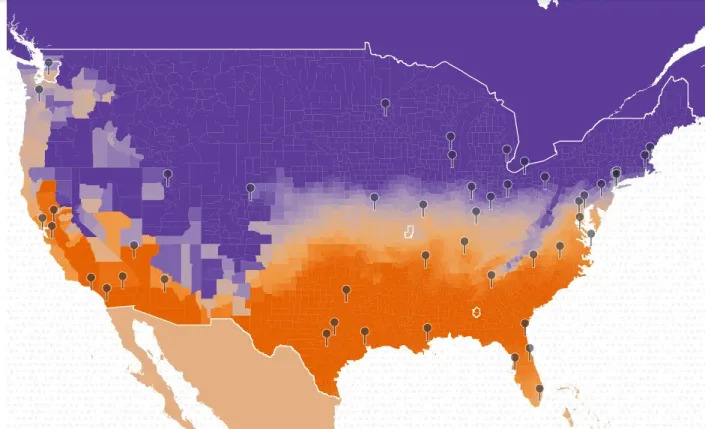

The data also show something else that we don't like to talk about: Americans are already dying due to climate change and have been since around 2005. U.S. cities from coast to coast are experiencing fatalities in the double digits yearly, especially south of the Mason-Dixon line, according to an in-depth project surveying more than 24,000 regions of the world, led by the United Nations Development Program and New York-based Rhodium Group, a provider of independent research, data and analytics tackling mission-critical global topics.

In Texas, the fatality rate due to climate change – for instance, from heat stroke or other underlying causes – is estimated to be 14 people a year per 100,000 of the population in both Dallas and Austin. Those numbers will rise to 38 and 39, respectively, by 2040, and leap to 130 and 131 people a year, respectively, by 2080, according to the data.

The situation in Phoenix is even more dire, with an annual fatality rate of 17 people per 100,000 of the population, climbing to 46 by 2040 and 148 people a year by 2080. In Atlanta, the fatality rate is estimated to be around 10 people a year per 100,000, with that number at 29 by 2040 and shooting to 100 people by 2080.

"The mortality impact is some of the most striking of the data," says Hannah Hess, associate director at Rhodium, who worked on the project. "When you look at the year 2040, it can seem really far out and distant in the future, but the people most affected by the heat are 65 and older – those are people in their 40s today who will be impacted."

By the same token, those in their 20s and 30s will be confronting even higher temperatures, and those who are currently in their teens or younger will be forced to contend with some of the most extreme climate challenges of anyone alive.

This week, President Biden cast his first veto since taking office, rejecting a bill that would have scuttled a Labor Department rule he put in place allowing money managers to account for climate change when making investment decisions for their clients' retirement savings. The Biden rule supplanted a Trump-era rule that sought to impede the consideration of ESG principles in investing, "even in cases where it is in the financial interest of plans to take such considerations into account."

In issuing the veto, Biden blasted "MAGA House Republicans" and others for risking Americans' retirement plan savings by making it illegal to weigh ESG principles. "Your plan manager should be able to protect your hard-earned savings, whether Rep. Marjorie Taylor Greene likes it or not," he said, noting strong opposition from the Republican congresswoman from Georgia.

Two Democrats also backed the bill. Sen. Joe Manchin of West Virginia, who charged that Biden's veto was "absolutely infuriating" and denounced the administration's "radical" and "progressive agenda," and Jon Tester of Montana, who voted alongside the Senate's Republicans to overturn the Biden rule.

Both Georgia and West Virginia are forecast to sustain pronounced effects from climate change relative to northern states, like Montana.

The ESG fight, not surprisingly, is focused on money – primarily, how resources will be marshaled or redirected in anticipation of future shifts that are expected to devastate real estate, housing and jobs markets. "Without concerted and urgent action, climate change will exacerbate inequalities and widen gaps in human development," the UNDP projected at the end of last year.

A smattering of top money managers and private equity firms have begun to prepare for the transition, touting pro-ESG investing principles that aim to capture a profit. But they have also warned adopting these strategies poses heightened financial and reputational risks with the growing anti-ESG backlash.

The world's biggest private-equity firm, Blackstone, disclosed in a recent filing that pushback from states across the country over so-called "boycotts" of investments in the fossil fuel industry could affect the company's fundraising and revenue and will be perceived negatively by some stakeholders. Others signaling similar headwinds include KKR & Co., State Street, Carlyle Group, T. Rowe Price, TPG Inc., Ares Private Equity Group, Raymond James, and BlackRock.

While partisanship seems to be ruling the debate, it's worth looking closely at what is forecast for some of the states that are most assiduously pursuing anti-ESG legislation, many of which are expected to experience some of the most serious fallout of climate change. Among them are Texas, Arizona, Oklahoma, Idaho, Louisiana, Arkansas, Tennessee, Kentucky, West Virginia, South Carolina and Florida.

Over the past few years, these states have sought to introduce or pass legislation barring companies from discriminating against investing in fossil fuel developers or energy companies contributing to climate change. Those succeeding in passing legislation against so-called "woke capitalism" include Texas, Arizona, Oklahoma, Idaho, Louisiana, Tennessee, Kentucky, West Virginia, South Carolina and Florida.

Other states that have tried or are still trying to pass anti-ESG legislation include North Dakota, South Dakota, Colorado, Wyoming, Montana, Arkansas, Nebraska, Minnesota, Pennsylvania and New Hampshire, according to the National Conference of State Legislatures, a Denver nonpartisan research organization. Meanwhile, Arizona, Texas, Oklahoma, South Carolina, Tennessee and Florida have more anti-ESG legislation pending, in addition to what they've already enacted, even though all of them are now dealing with fatalities from climate change.

Hess says research shows that some states' attitudes may change on climate change as "those places start to feel the impact," but, until then, states suffering the ongoing fatalities of climate change while fighting to ban ESG-friendly policies, sustainability practices and "social credit scores" to protect investments in fossil fuels is "an odd reality."

Worth noting are the states that have pursued anti-ESG legislation, but will not feel the impact of climate change as strongly as some of the states mentioned above. They are Pennsylvania, New Hampshire, Indiana, Missouri, Kansas, Nebraska, Utah, Wyoming, Montana, Minnesota, North Dakota, South Dakota and Alaska.

The one state that will be hard hit by climate change but is working to bolster pro-ESG initiatives – and block any attempts to stop it from doing so – is California. According to the UNDP-Rhodium data, the state's cities are already sustaining some of the highest annual fatality rates in the country due to climate change. At present, the death toll is estimated to be around a dozen people per 100,000 of the population in San Francisco and Sacramento, but is seen rising to 30 and 33, respectively, by 2040, and 104 and 113 people a year, respectively, by 2080.

Other cities that are being impacted by climate change include Los Angeles, Houston, San Antonio, Las Vegas, Nashville, Memphis, New Orleans, Miami, Virginia Beach, Raleigh, Charlotte and Washington, DC, according to the data.

Interestingly, the data show a handful of states will see some benefits from climate change, at least in theory. Rising temperatures likely will contribute to fewer mortality rates in cooler cities such as Seattle, Portland, Denver, Kansas City, Minneapolis, Milwaukee, Chicago, Indianapolis, Louisville, Cincinnati, Pittsburg, Philadelphia, New York and Boston. These benefits stem from the fact that, as temperatures rise, annual fatality rates resulting from cold weather will ease, Hess says.

Even with fewer fatalities in some regions, by the end of the century, the effects of climate change will eventually overtake much of the U.S., whether through rising temperatures, changes in precipitation, droughts, serious weather patterns, or what is expected to be an influx of displaced populations – also known as "climate refugees" – who will need to migrate to safer locations to survive. That means anyone living in safe zones will find their regions more and more crowded.

"Income will matter a lot in how people will be able to adapt and respond to the impact of climate," Hess says.

No comments:

Post a Comment