The World’s Economic Centre of Gravity Is Returning to Asia

Han Youngsoo (Republic of Korea), Seoul, Korea 1956–1963.

In October 2023, the United Nations Conference on Trade and Development (UNCTAD) published its annual Trade and Development Report. Nothing in the report came as a major surprise. The growth of the global Gross Domestic Product (GDP) continues to decline with no sign of a rebound. Following a modest post-pandemic recovery of 6.1% in 2021, economic growth in 2023 fell to 2.4%, below pre-pandemic levels, and is projected to remain at 2.5% in 2024. The global economy, UNCTAD says, is ‘flying at “stall speed”’, with all conventional indicators showing that most of the world is experiencing a recession.

The latest notebook from Tricontinental: Institute for Social Research, The World in Depression: A Marxist Analysis of Crisis, questions the use of the term ‘recession’ to describe the current situation, arguing that it acts as ‘a smokescreen meant to hide the true nature of the crisis’. Rather, the notebook explains that ‘the prolonged and profound crisis that we are experiencing today is… a great depression’. Most governments in the world have used conventional tools to try and grow their way out of the great depression, but these approaches have placed an enormous cost on household budgets, which are already hit hard by high inflation, and have curbed the investments needed to improve employment prospects. As UNCTAD notes, central banks ‘prioritise short-term monetary stability over long-term financial sustainability. This trend, together with inadequate regulation in commodity markets and continuous neglect for rising inequality, are fracturing the world economy’. Our team in Brazil explores these matters further in the recently launched Financeirização do capital e a luta de classes (‘Financialisation of Capital and the Class Struggle’), the fourth issue of our Portuguese-language journal Revista Estudos do Sul Global (‘Journal of Global South Studies’).

There are some exceptions to this rule, however. UNCTAD projects that five of the G20 countries will experience better growth rates in 2024: Brazil, China, Japan, Mexico, and Russia. There are different reasons why these countries are exceptions: in Brazil, for instance, ‘booming commodity exports and bumper harvests are driving an uptick in growth’, as UNCTAD writes, while Mexico has benefited from ‘less aggressive monetary tightening and an inflow of new investment to establish new manufacturing capacity, triggered by the bottlenecks that emerged in East Asia in 2021 and 2022’. What seems to unite these countries is that they have not tightened monetary policy and have used various forms of state intervention to ensure that necessary investments are made in manufacturing and infrastructure.

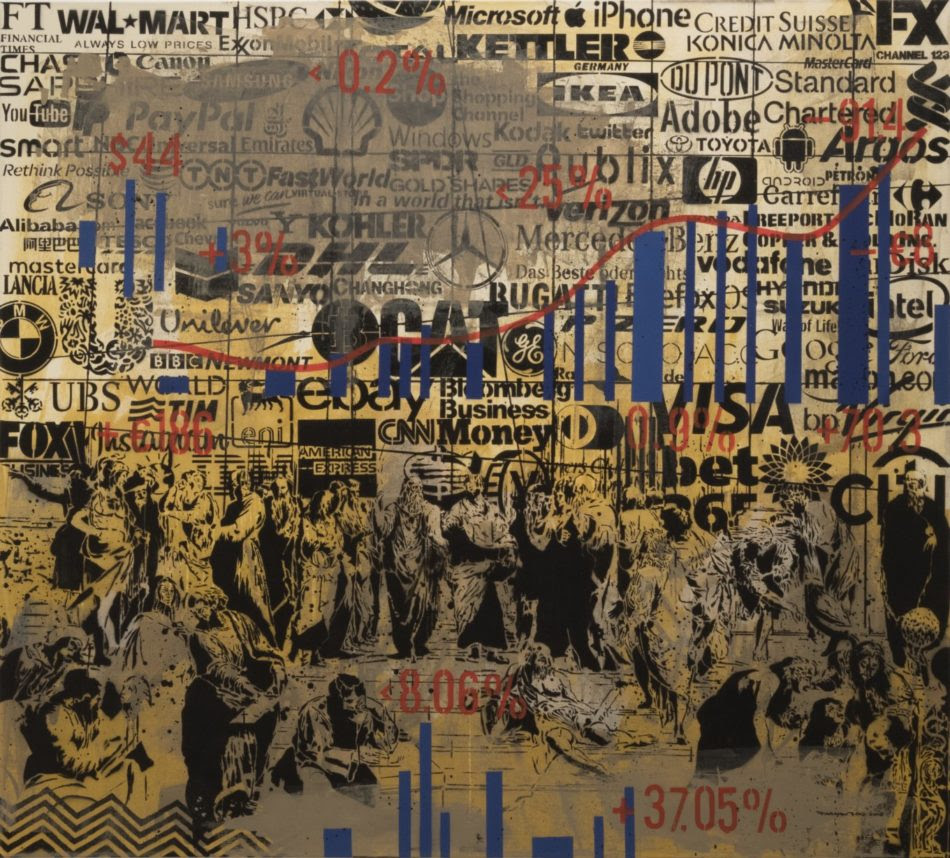

Farhan Siki (Indonesia), Market Review on School of Athens, 2018.

The OECD’s Economic Outlook, published in November 2023, is consistent with UNCTAD’s assessment, suggesting that ‘global growth remains highly dependent on fast-growing Asian economies’. Over the next two years, the OECD estimates that this economic growth will be concentrated in India, China, and Indonesia, which collectively account for nearly 40% of the world population. In a recent International Monetary Fund assessment entitled ‘China Stumbles But Is Unlikely to Fall’, Eswar Prasad writes that ‘China’s economic performance has been stellar over the past three decades’. Prasad, the former head of the IMF’s China desk, attributes this performance to the large volume of state investment in the economy and, in recent years, to the growth of household consumption (which is related to the eradication of extreme poverty). Like others in the IMF and OECD, Prasad marvels at how China has been able to grow so fast ‘without many attributes that economists have identified as being crucial for growth – such as a well-functioning financial system, a strong institutional framework, a market-oriented economy, and a democratic and open system of government’. Prasad’s description of these four factors is ideologically driven and misleading. For instance, it is hard to think of the US financial system as ‘well-functioning’ in the wake of the housing crisis that triggered a banking crisis across the Atlantic world, or given that roughly $36 trillion – or a fifth of global liquidity – is sitting in illicit tax havens with no oversight or regulation.

What the data shows us is that a set of Asian countries is growing very quickly, with India and China in the lead and with the latter having the longest sustained period of rapid economic growth over at least the past thirty years. This is uncontested. What is contested is the explanation for why China, in particular, has experienced such high rates of economic growth, how it has been able to eradicate extreme poverty, and, in recent decades, why it has struggled to overcome the perils of social inequality. The IMF and the OECD are unable to formulate a proper assessment of China because they reject – ab initio – that China is pioneering a new kind of socialist path. This fits within the West’s failure to comprehend the reasons for development and underdevelopment in the Global South more broadly.

Over the past year, Tricontinental: Institute for Social Research has engaged with Chinese scholars who have been trying to understand how their country was able to break free of the ‘development of underdevelopment’ cycle. As part of this process, we collaborate with the Chinese journal Wenhua Zongheng (文化纵横) to produce an international quarterly edition that collects the work of Chinese scholars who are experts on the respective topics and brings voices from Africa, Asia, and Latin America into dialogue with China. The first three issues have looked at the shifting geopolitical alignments in the world (‘On the Threshold of a New International Order’, March 2023), China’s decades-long pursuit of socialist modernisation (‘China’s Path from Extreme Poverty to Socialist Modernisation’, June 2023), and the relationship between China and Africa (‘China-Africa Relations in the Belt and Road Era’, October 2023).

The latest issue, ‘Chinese Perspectives on Twenty-First Century Socialism’ (December 2023), traces the evolution of the global socialist movement and tries to identify its future direction. In this issue, Yang Ping, the editor of the Chinese-language version of Wenhua Zongheng, and Pan Shiwei, the honorary president of the Institute of Cultural Marxism, Shanghai Academy of Social Sciences, contend that a new period in socialist history is currently emerging. For Yang and Pan, this new ‘wave’ or ‘form’ of socialism, following the birth of Marxism in nineteenth-century Europe and the rise of many socialist states and socialist-inspired national liberation movements in the twentieth century, began to emerge with China’s period of reform and opening up in the 1970s. They argue that, through a gradual process of reform and experimentation, China has developed a distinct socialist market economy. The authors both assess how China can strengthen its socialist system to overcome various domestic and international challenges as well as the global implications of China’s rise – that is, whether or not it can promote a new wave of socialist development in the world.

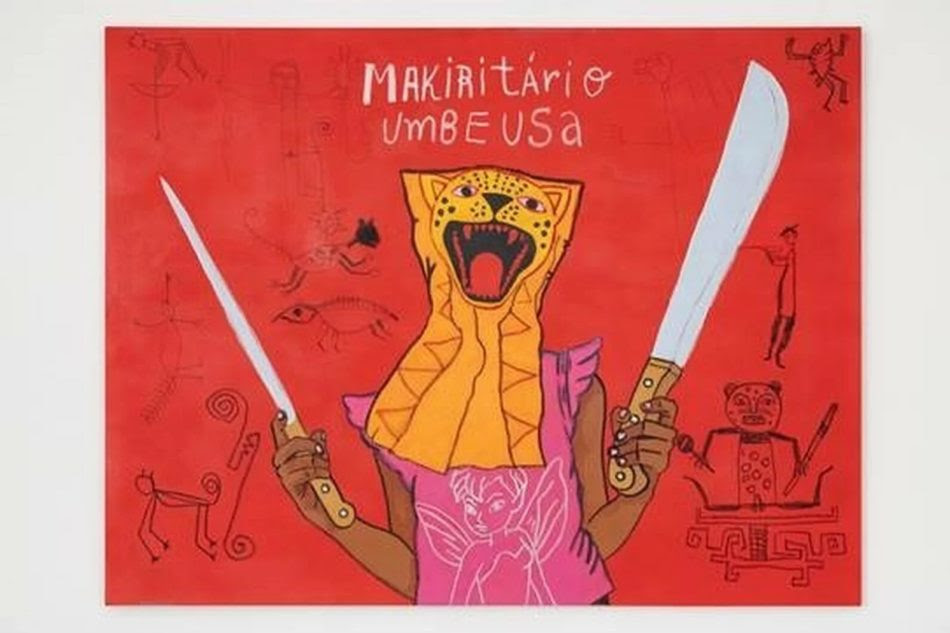

Denilson Baniwa (Brazil), The Call of the Wild//Yawareté Tapuia, 2023.

In the introduction to this issue, Marco Fernandes, a researcher at Tricontinental: Institute for Social Research, writes that China’s growth has been sharply distinct from that of the West since it has not relied upon colonial plunder or the predatory exploitation of natural resources in the Global South. Instead, Fernandes argues that China has formulated its own socialist path, which has included public control over finance, state planning of the economy, heavy investments in key areas that generate not only growth but also social progress, and promoting a culture of science and technology. Public finance, investment, and planning allowed China to industrialise through advancements in science and technology and through improving human capital and human life.

China has shared many of its lessons with the world, such as the need to control finance, harness science and technology, and industrialise. The Belt and Road Initiative, now ten years old, is one avenue for such cooperation between China and the Global South. However, while China’s rise has provided developing countries with more choices and has improved their prospects for development, Fernandes is cautious about the possibility of a new ‘socialist wave’, warning that the obstinate facts facing the Global South, such as hunger and unemployment, cannot be overcome unless there is industrial development. He writes:

this will not be attainable merely through relations with China (or Russia). It is necessary to strengthen national popular projects with broad participation from progressive social sectors, especially the working classes, otherwise the fruits of any development are unlikely to be reaped by those who need them the most. Given that few countries in the Global South are currently experiencing an upsurge in mass movements, the prospects for a global ‘third socialist wave’ remain very challenging; rather, a new wave of development with the potential to take on a progressive character, seems more feasible.

This is precisely what we indicated in our July dossier, The World Needs a New Socialist Development Theory. A future that centres the well-being of humankind and the planet will not materialise on its own; it will only emerge from organised social struggles.

Philip Fagbeyiro (Nigeria), Streets of Insignificance, 2019.

Vijay Prashad is an Indian historian and journalist. Prashad is the author of twenty-five books, including The Darker Nations: A People’s History of the Third World and The Poorer Nations: A Possible History of the Global South. Read other articles by Vijay, or visit Vijay's website.

No comments:

Post a Comment