Substations for First US Offshore Wind Farms Ready for Installation

The first substations of the U.S.’s commercial offshore wind farms have been completed and are being moved from Texas and Denmark to the locations for their installations. These projects signal several key milestones in the U.S. offshore wind sector including the completion of the first American-built substation. They are also a significant step for the offshore projects in New York and Massachusetts both of which are scheduled to be the first to be completed in the United States and generate power this year.

The first American-built offshore wind substation departed a Texas fabrication facility on May 24. The substation is transiting across the Gulf of Mexico and then up the East Coast for installation at the South Fork Wind project site off New York in a few weeks. Designed and built by Kiewit Offshore Services, the 1,500-ton, 60-foot-tall substation left Kiewit’s Ingleside facility near Corpus Christi, Texas.

“The completion of South Fork Wind’s offshore wind substation is yet another first for this groundbreaking project and moves us one step closer to the project’s first ‘steel in the water’,” said David Hardy, Group EVP and CEO Americas at Ørsted.

South Fork Wind, which is a project from joint development partners Ørsted and Eversource, is now in its offshore construction phase, first with work to install the project’s 68-nautical mile submarine cable from its landfall below Wainscott Beach, in East Hampton, New York to the wind farm site roughly 35 miles east of Montauk. Cable laying is underway and installation of monopile foundations will begin in the coming weeks. Vessels from several Gulf ports are supporting the construction of South Fork Wind.

According to the companies, South Fork Wind is on track to be the first completed utility-scale offshore wind farm in federal waters, with the project expected to be operational by the end of 2023. The project consists of 12 turbines to provide 132 MW.

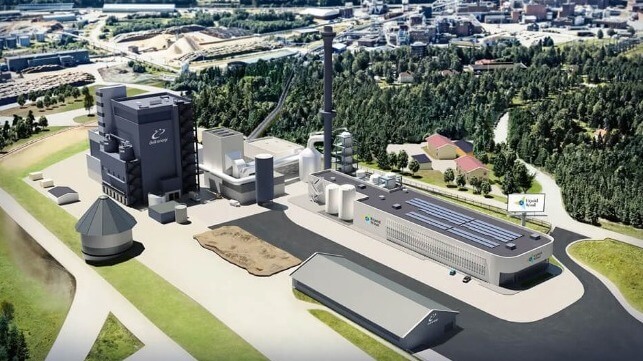

Substation for Vineyard 1 departed from Denmark today (Semco Maritime)

Today, May 25, in Denmark, they also marked the departure of the substation for the Vineyard Wind 1 project to be located approximately 35 miles offshore in Massachusetts. Sail-away for the 3,200-ton substation is reported to be on time according to the original schedule and is a major milestone for the project team from Bladt Industries, Semco Maritime, and ISC Consulting Engineers. The project is being developed in a 50-50 partnership between Copenhagen Infrastructure Partners and Avangrid Renewables.

Vineyard Wind 1 is carried out as an EPC contract, with ISC as a subcontractor, covering the design, procurement, and construction of the 3,200 tons offshore substation and a 2,000 tons jacket foundation with four piles, which form the permanent anchorage to the seabed. Bladt handled the steel manufacturing of the substation. Design and engineering were carried out by Semco Maritime and ISC, and installation of the electrical system was also carried out by Semco Maritime.

After arrival at the installation site, Vineyard Wind will install the substation. Semco Maritime and Bladt Industries will oversee the offshore commissioning during the summer.

Vineyard Wind 1 will consist of an array of 62 wind turbines, which will generate 800 MW of electricity annually. It is also scheduled to deliver the first power to the grid in 2023.

BOEM Completes Environmental Review for New Jersey Offshore Wind Farm

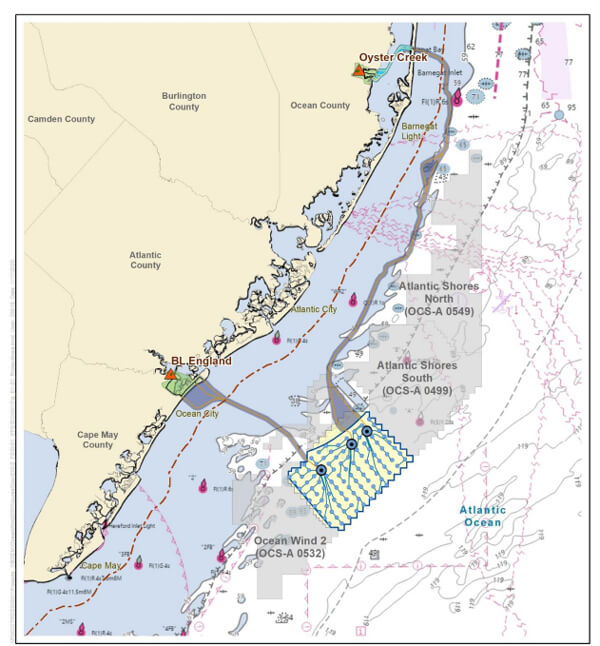

The Bureau of Ocean Energy Management (BOEM) reported that it has completed its environmental analysis of the proposed Ocean Wind 1 wind project offshore New Jersey. The bureau plans to issue its decision this summer to approve the project, which would be New Jersey’s first commercial-scale offshore wind farm.

Eleven months ago, BOEM published its draft of the Environmental Impact Statement for the project. It was followed by a public comment period as well as three virtual meetings to solicit additional feedback on the draft. BOEM reports it received a total of 1,389 comment submissions from government agencies, non-governmental organizations, and the public during the comment period and considered these comments and stakeholders’ feedback when developing the final EIS.

The final EIS is available on BOEM’s website and as required by law a notice will be published on May 26. The report analyzes the potential environmental impacts of the activities laid out in Ocean Wind’s Construction and Operations Plan.

“BOEM continues to make progress towards a once-in-a-generation opportunity to build a new clean energy industry in the United States,” said BOEM Director Elizabeth Klein.

Ocean Wind proposes to construct up to 98 wind turbines and up to three offshore substations within its lease area with an estimated capacity range will be from 1,215 to 1,440 megawatts, capable of powering up to 504,000 homes per year. At its closest point, the Ocean Wind 1 project will be at least 13 nautical miles southeast of Atlantic City, New Jersey. Export cables are anticipated to make landfall in Ocean County and Cape May County, New Jersey.

The project was proposed as a partnership between Ørsted and New Jersey power utility Public Service Enterprise Group (PSEG). However, in January 2023, they said that based on changes in the government financial support programs for offshore wind, they had determined that it would be best if Ørsted acquired PSEG’s 25 percent interest in Ocean Wind. PSEG said it had decided to step aside and allow for a better positioned tax investor to join the project so that it can proceed with an optimized tax structure.

Plans call for the installation of GE Haliade X 12 MW turbines. Ørsted had previously estimated that construction would take approximately two years with first operations beginning before the end of 2024 and full operations in 2025. At the end of April, the project cleared another key step with decisions from the New Jersey Department of Environmental Protection and the issuance of the first construction permits. Ørsted noted that additional federal, state, and local approvals, in addition to approval from the Bureau of Ocean Energy Management, were required before construction on Ocean Wind 1 can begin.

Ocean Wind 2 has also been proposed which would be located 15 miles off the coast of southern New Jersey, adjacent to Ocean Wind 1. The second phase project would generate an additional 1,148 megawatts of offshore wind energy, which would be enough to power more than 500,000 homes.