By Matt Corley

August 13, 2021

Last year, Nevada Gold Mines, a mining company that describes itself as “the single largest gold-producing complex in the world,” deposited $750,000 into a dark money nonprofit that spent significant sums of secretly-sourced funds backing Republican candidates during the 2020 election. The disclosure of the contribution marks the first known revelation of a donor to the dark money group, the American Exceptionalism Institute, Inc., which gained notice in 2020 with large, anonymously-sourced contributions to super PACs.

The funds Nevada Gold Mines provided the dark money group appear to have flowed into a political committee that worked to elect Republicans to the Nevada state legislature. In 2020, the Democratic-led state legislature took initial steps that could ultimately lead to the state’s mining industry having its taxes raised for the first time in more than a century, which may help explain the company’s significant financial investment in state-level political committees.

Nevada Gold Mines is a joint venture between two mining companies, Newmont and Barrick. Newmont, which owns 38.5% of Nevada Gold Mines, disclosed the contribution to the American Exceptionalism Institute in a voluntary report the company released on its policy influence in 2020. Barrick operates the venture and owns 61.5% of the company.

In a footnote attached to Newmont’s description of its 2020 political giving, the company said that in 2020 Nevada Gold Mines “made $1,991,250 in political contributions to Nevada candidates and political action committees associated with Nevada campaigns.” The disclosure added that the total “included $750,000 to the American Exceptionalism Institute, a 501(c)(4) fund commonly referred to as a ‘dark money’ fund.”

The footnote in Newmont’s disclosure suggests that the dark money contribution was a point of contention in the relationship between the two companies that own Nevada Gold Mines. After noting that it has “no control over the political activities of Nevada Gold Mines,” Newmont stated that it was “not involved in and did not approve of any of” Nevada Gold Mines’ contributions and that its own political contributions policy “does not allow contributions to dark money funds.” Newmont said it informed Barrick’s management that it “does not support such contributions” and that it would disclose the contribution in the company’s annual sustainability report.

Organizations that are tax-exempt under section 501(c)(4) of the tax code are not required to disclose their contributors, which is why they are often described as “dark money” groups when they engage in political activity. Advocates warn that the secrecy provided by dark money groups poses a serious corruption risk, a position that was validated last month when an energy company was required to issue a public statement as part of a settlement with the Justice Department stating that it “used the 501(c)(4) corporate form as a mechanism to conceal payments for the benefit of public officials in exchange for official action.”

Silver state spending

Newmont’s description of the contribution to the American Exceptionalism Institute makes clear that the money is related to state level political activity in Nevada, but it doesn’t spell out exactly how the dark money group was involved in the state’s elections — whether the group spent it directly or subsequently used the money to contribute to political committees. Additional available information suggests, however, that the Nevada Gold Mines contribution helped fund political contributions the American Exceptionalism Institute made in the state.

While there are no indications that the dark money group paid for any political ad campaigns or other election-focused communications in the state, the American Exceptionalism Institute did contribute a little more than $1 million in 2020 to Stronger Nevada PAC, a political action committee affiliated with former Nevada Lt. Governor Mark Hutchison, according to records filed with the Nevada Secretary of State’s office. The American Exceptionalism Institute was the largest contributor to Stronger Nevada PAC, accounting for 38.5% of the more than $2.6 million the committee raised in 2020.

At least, American Exceptionalism Institute was the largest contributor publicly reported by Stronger Nevada PAC. The committee’s second largest reported donor was Nevada Gold Mines, which gave $500,000 in two contributions. If $750,000 of the American Exceptionalism Institute’s contributions were reattributed to Nevada Gold Mines, as Newmont’s disclosure suggests it arguably should be, then Nevada Gold Mines would become the PAC’s top donor, accounting for 47% of the PAC’s total revenue. Notably, one of the American Exceptionalism Institute’s contributions, $760,000 given on September 21, 2020, nearly matches the $750,000 Newmont reported Nevada Gold Mines giving to the dark money fund.

What kind of activity did these contributions, both disclosed and undisclosed, support? According to the Nevada Independent, Stronger Nevada PAC, which paid for ads in several races, has been credited for “Republican success in down-ballot races” during the 2020 election when the GOP gained seats in both the state Assembly and the state Senate.

Republican state Sen. Ben Kieckhefer, who reportedly worked with former Lt. Gov. Hutchison on the PAC efforts, praised Stronger Nevada PAC’s impact to the Nevada Independent while attributing some of its financial success to business interests who were wary of Democratic power in the state legislature. “This was an instance where businesses that were feeling under attack by their state government decided to step up and take a stand,” Kieckhefer said. “And part of that was investing in the effort to gain legislative seats for Republicans. And we did that. So, this was a statement, and hopefully people are paying attention.”

When the Nevada Independent highlighted Nevada Gold Mines’ financial support for Stronger Nevada PAC, the nonprofit news outlet contextualized the contributions by noting that Nevada’s “mining industry soured on legislative Democrats after the 2020 summer session, where lawmakers pushed through three proposed constitutional amendments that would remove the cap on net proceeds of minerals,” which effectively meant the industry’s taxes could potentially be raised. Additional news reports on the mining industry’s 2020 political giving in the state, which included significant contributions from Nevada Gold Mines, also framed the spending around the potential for future fights over changes to industry’s tax liabilities.

Now, with Newmont’s disclosure of Nevada Gold Mines’ previously hidden contribution to the American Exceptionalism Institute, the mining industry’s investment in the 2020 elections are even more significant. Still unknown, however, is who else funded the little known dark money group’s spending in the state and if the other donors, like Nevada Gold Mines, have interests that could be affected by the lawmakers the money helped elect.

A rising dark money player

On its own, the American Exceptionalism Institute had no clear interest in the outcome of Nevada’s elections. When the group initially formed in 2017, it told the IRS in its application for tax-exempt status that it “was founded with the goal of researching and proposing domestic and foreign policies that promote the general welfare of the American people and assert America’s traditional role as a leading nation on the world stage.” Though the organization held out the possibility that it might engage in political activity in the future, the American Exceptionalism Institute told the tax agency it did not then have “any specific plans” to do so at the time.

For the first few years of its existence, the American Exceptionalism Institute largely stayed under the political radar. The group gained a little national attention in 2018 when it paid less than $100,000 to run an attack ad against Sen. Rand Paul (R-KY) tied to a Senate nomination fight, but otherwise remained quiet until 2020 when its political contributions began to draw attention.

While the American Exceptionalism Institute maintained a nearly invisible public profile in 2019 and early 2020, that doesn’t mean it wasn’t active. Though its most recently filed tax return, covering May 1, 2019 through April 30, 2020, is not yet publicly available, the topline information from the return is available through an IRS database called the Exempt Organizations Business Master File Extract. It’s also visible in the search results of databases like ProPublica’s Nonprofit Explorer and Guidestar that aggregate and summarize nonprofit data.

The data is eye popping. It shows that the American Exceptionalism Institute raised $13 million dollars by the end of April 2020 after raising no more than $50,000 the year before.

It didn’t take long for the group to start spending that money. In addition to the more than $1 million the American Exceptionalism Institute contributed to Stronger Nevada PAC in 2020, the dark money group gave $2.7 million to two federal super PACs, most of which went to a group called Security is Strength PAC that backed Sen. Lindsey Graham’s (R-SC) reelection campaign. The group also gave to Georgia United Victory, which supported then-Sen. Kelly Loeffler (R-GA).

It’s not altogether surprising that the American Exceptionalism Institute, which recently paid for emblazoned trucks criticizing Rep. Mo Brooks (R-AL) ahead of his announcement of a Senate campaign, would become a larger dark money player. What little was known about the American Exceptionalism Institute when it first appeared in public indicated that it had wider connections in the world of anonymous political spending.

In fact, CREW has since identified the group as part of a dark money network that’s responsible for tens of millions of secretly-sourced funds entering American elections. With several of the entities in the network shutting down recently, including some that had been targeted by Federal Election Commission complaints filed by CREW, the American Exceptionalism Institute may be stepping in to fill the void.

With all these groups, the ever-present question is who is funding their efforts to impact elections. In the case of the American Exceptionalism Institute at least, the public now knows that one of the group’s funders was a mining company with a major stake in the outcome of the elections.

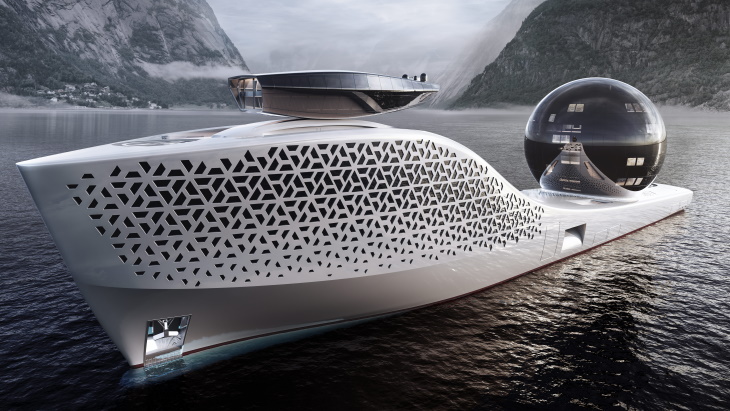

In March this year, plans were announced for the Earth 300 - a 300-metre-long, nuclear-powered research ship - scheduled to launch in 2025 (Image: Earth 300 Ventures)

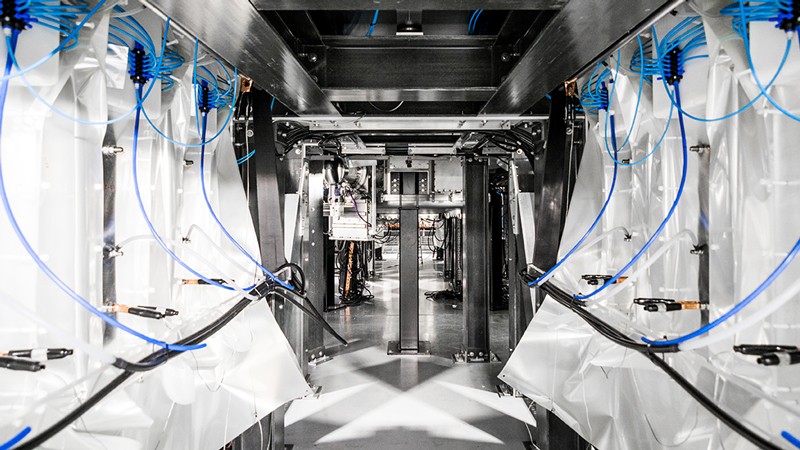

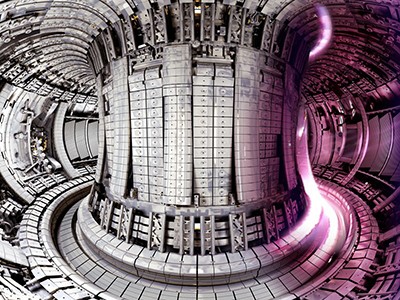

In March this year, plans were announced for the Earth 300 - a 300-metre-long, nuclear-powered research ship - scheduled to launch in 2025 (Image: Earth 300 Ventures).jpg?ext=.jpg) Bruce (Image: Bruce Power)

Bruce (Image: Bruce Power).jpg?ext=.jpg) Seawater samples being taken near the Fukushima Daiichi plant (Image: IAEA)

Seawater samples being taken near the Fukushima Daiichi plant (Image: IAEA)