TVO Nuclear Services (TVONS) is a consulting company wholly owned by Finnish utility Teollisuuden Voima Oyj (TVO), owner of the Olkiluoto nuclear power plant.

The agreement gives Steady Energy access to TVO's expertise in the planning and implementation of nuclear power plant projects as well as the operation, maintenance and service life management of the plants.

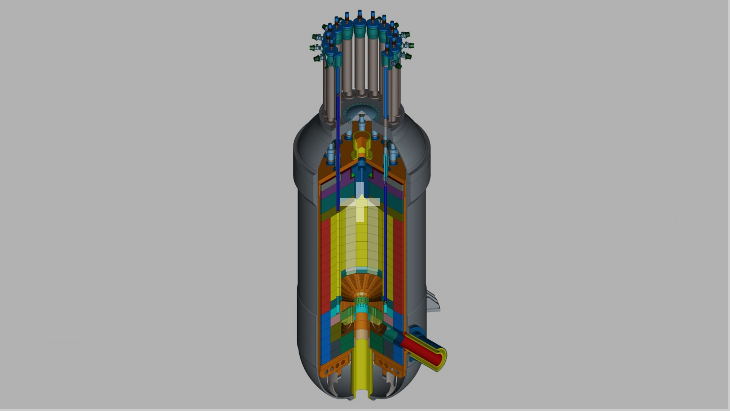

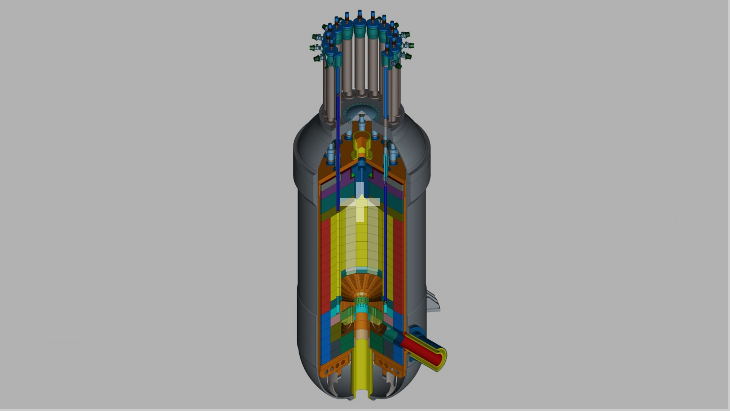

Steady Energy - which last year was spun out from the VTT Technical Research Centre of Finland - aims to construct the first of several district heating plants based on its LDR-50 small modular reactor (SMR) technology in Finland by 2030.

"Steady Energy is working on a very interesting project, and we are glad to be involved by offering our expertise in its various areas," said TVONS Managing Director Ari Leppänen. "This allows us to participate in the clean transition also through small modular reactor projects."

"The collaboration agreement with TVONS is a significant opportunity for Steady Energy," said Steady Energy CEO Tommi Nyman. "It will further strengthen our ability to develop and, in time, to construct a small nuclear power plant that is completely based on Finnish design. The agreement also sends a strong message that Steady Energy's project is important for the development of the entire Finnish nuclear energy industry."

The LDR-50 district heating SMR - with a thermal output of 50 MW - has been under development at VTT since 2020. Designed to operate at around 150°C and below 10 bar (145 psi), Steady Energy says its "operating conditions are less demanding compared with those of traditional reactors, simplifying the technical solutions needed to meet the high safety standards of the nuclear industry".

The LDR-50 reactor module is made of two nested pressure vessels, with their intermediate space partially filled with water. When heat removal through the primary heat exchangers is compromised, water in the intermediate space begins to boil, forming an efficient passive heat transfer route into the reactor pool, the company said. The system does not rely on electricity or any mechanical moving parts, which could fail and prevent the cooling function.

ČEZ highlights benefits of increasing output of existing units

11 April 2024

The modernisation of existing nuclear power units in the Czech Republic has added extra capacity equivalent to the output of a large coal-fired power plant, operator ČEZ has said.

(Image: ČEZ)

(Image: ČEZ)The company said that the latest development was Dukovany's third unit achieving a thermal output of 1475 MWt - equivalent to 511 MWe - a 2.3% increase achieved without any increase in fuel consumption or emissions.

The units at the Dukovany nuclear power plant started up between 1985 and 1987 and are VVER-440 reactors, originally rated at 440 MWe. The installed capacity of each of them was increased after a nine-year modernisation programme to 500 MWe in 2009. The units at the Temelin nuclear power plant were also upgraded from 981 MWe to 1086 MWe.

Preparation for the latest capacity increase started in full in 2020 as part of a programme which also included the switch from an 11-month to a 16-month fuel cycle. Preparations included modernisation of some technological and safety systems, with the temperature of the water at the outlet of the reactor increased from 298.4°C to 300.4°C.

ČEZ says it expects the annual production of Dukovany to increase in 2025 by about 300,000 MWh after all the units are modified.

Daniel Beneš, Chairman and CEO of ČEZ Group, said the modernisation of their nuclear power plants had increased capacity by as much as building "a large coal-fired power plant or a smaller nuclear unit". He added that "of course, the absolute priority is safety, we would never take such a step without confirming the safety parameters".

Bohdan Zronek, director of the nuclear energy division, said: "Seemingly small changes in parameters will bring us hundreds of thousands of megawatts of electricity per year. Preparation for increased performance required confirmation of safety analyses, but no large-scale investment was required. The entire project fulfills the task of safely operating all our nuclear units for at least 60 years."

Roman Havlín, director of the Dukovany power plant, said the aim was to increase the outputs of the first and second units later this year and complete the project next year.

Four VVER-440 units are currently in operation at the Dukovany site. Two VVER-1000 units are in operation at Temelín, which came into operation in 2000 and 2002. The Czech Republic uses nuclear power for 34% of its electricity. Its current new nuclear plans include up to four new units, as well as a possible roll-out of small modular reactors.

Digital control system installation begins at Chinese SMR

11 April 2024

Installation of the digital control system has begun at the ACP100 small modular reactor demonstration project at the Changjiang site on China's island province of Hainan, China National Nuclear Corporation (CNNC) has announced.

(Image: CNNC)

(Image: CNNC)

The first cabinet of the digital control system system - the 'nerve centre' of nuclear power plant operation - was moved into place at 9.58am on 10 April, and installation and debugging work has now started, CNNC said.

The digital control system (DCS) system for the ACP100 - referred to as the Linglong One - adopts two domestically-developed platforms: the Dragon Scale platform (safety level) and Dragon Fin platform (non-safety level). The Dragon Scale platform can realise reactor safety control under various working conditions and ensure the safe operation of the nuclear power plant. Meanwhile, the Dragon Fin platform is responsible for operation and management and is an important guarantee for the efficient and economical operation of the nuclear power plant. Between them, the two platforms control hundreds of systems within the nuclear power plants, nearly 10,000 equipment operations and various operating conditions.

The first Dragon Fin platform cabinet that has now been put in place is a plant-wide non-safety control system specially developed by CNNC for large nuclear facilities, such as nuclear power plants. The company said this platform inherits and develops the nuclear power instrumentation and control experience and key technologies accumulated by CNNC over the years, integrating the latest advanced technologies such as data collection, process control, large-scale networking and information management to meet the requirements of high reliability and safety of nuclear facilities.

.jpg)

(Image: CNNC)

"The smooth introduction of the first DCS cabinet in Linglong One, the world's first land-based commercial small modular reactor, marks the transition of DCS to the on-site installation stage, laying the foundation for subsequent work such as the availability of the main control room," CNNC said.

CNNC announced in July 2019 the launch of a project to construct an ACP100 reactor at Changjiang. The site is already home to two operating CNP600 pressurised water reactors (PWRs), while the construction of the two Hualong One units began in March and December 2021. Both those units are due to enter commercial operation by the end of 2026.

First concrete for the ACP100 was poured on 13 July 2021, with a planned total construction period of 58 months. Equipment installation work commenced in December 2022 and the main internal structure of the reactor building was completed in March 2023.

Under development since 2010, the 125 MWe ACP100 integrated PWR's preliminary design was completed in 2014. In 2016, the design became the first SMR to pass a safety review by the International Atomic Energy Agency.

Once completed, the Changjiang ACP100 reactor will be capable of producing 1 billion kilowatt-hours of electricity annually, enough to meet the needs of 526,000 households. The reactor is designed for electricity production, heating, steam production or seawater desalination.

The project at Changjiang involves a joint venture of three main companies: CNNC subsidiary China National Nuclear Power as owner and operator; the Nuclear Power Institute of China as the reactor designer; and China Nuclear Power Engineering Group being responsible for plant construction.

New Chinese reactor begins supplying power

11 April 2024

Fangchenggang unit 4 - the second demonstration Hualong One (HPR1000) reactor at the site in China's Guangxi Autonomous Region - has been connected to the grid, China General Nuclear (CGN) announced.

_1.jpg?ext=.jpg) Fangchenggang units 3 and 4 (Image: CGN)

Fangchenggang units 3 and 4 (Image: CGN)

The company said the 1180 MWe (gross) pressurised water reactor was successfully connected to the grid at 8.29pm on 9 April, "marking that the unit has the power generation capability and has taken another key step towards the goal of commercial operation".

CGN noted that a series of subsequent tests will be carried out to further verify the various performances of the unit with commercial operating conditions. It said the reactor is expected to be put into "high-quality production" in the first half of this year.

First concrete was poured for the nuclear island of Fangchenggang unit 3 - 39% owned by Guangxi Investment Group and 61% by CGN - in December 2015, while that for unit 4 was poured a year later. Unit 3 was originally expected to start up in 2019, with unit 4 scheduled to start up in 2020. Both their start-ups were subsequently postponed until 2022.

However, in January 2022, CGN announced that the start-up of Fangchenggang 3 and 4 had been put back again due to delays caused by the COVID-19 pandemic. Unit 3 achieved first criticality - a sustained chain reaction - on 27 December 2022 and was synchronised with the grid on 10 January 2023. It entered commercial operation on 25 March.

China's National Nuclear Safety Administration (NNSA) granted CGN an operating licence for Fangchenggang 4 on 27 February, allowing the loading of fuel into the reactor's core to begin. The fuel loading process was completed on 2 March. The reactor reached first criticality on 3 April.

The Fangchenggang plant is planned to house six reactors. The first phase comprises two CPR-1000 units which were put into commercial operation in 2016. Units 5 and 6 are expected to feature Hualong One reactors.

The first two units of China National Nuclear Corporation's version of the Hualong One design at the Fuqing plant in Fujian province have both already started up. Unit 5 entered commercial operation on 30 January 2021, with unit 6 following on 25 March 2022.

Second CGN Hualong One starts up

09 April 2024

Unit 4 of the Fangchenggang nuclear power plant in China's Guangxi Autonomous Region has attained a sustained chain reaction for the first time, China General Nuclear (CGN) announced. The unit is the second of two demonstration CGN-designed Hualong One (HPR1000) reactors at the site.

.jpg?ext=.jpg) Workers in the control room mark the unit's attainment of first criticality (Image: CGN)

Workers in the control room mark the unit's attainment of first criticality (Image: CGN)

China's National Nuclear Safety Administration (NNSA) granted CGN an operating licence for Fangchenggang 4 on 27 February, allowing the loading of fuel into the reactor's core to begin. The fuel loading process was completed on 2 March.

The NNSA subsequently conducted an inspection of Fangchenggang 4 from 26-29 March to assess its readiness for criticality. The regulator announced on 1 April that the start up of the reactor could commence.

CGN said the 1180 MWe (gross) pressurised water reactor reached criticality for the first time at 7.08pm on 3 April, "marking that the unit officially entered the power operation state".

.jpg)

Fangchenggang units 3 and 4 (Image: CGN)

First concrete was poured for the nuclear island of Fangchenggang unit 3 - 39% owned by Guangxi Investment Group and 61% by CGN - in December 2015, while that for unit 4 was poured a year later. Unit 3 was originally expected to start up in 2019, with unit 4 scheduled to start up in 2020. Both their start-ups were subsequently postponed until 2022.

In January 2022, CGN announced that the start-up of Fangchenggang 3 and 4 had been put back again due to delays caused by the COVID-19 pandemic. Unit 3 achieved first criticality - a sustained chain reaction - on 27 December 2022 and was synchronised with the grid on 10 January 2023. It entered commercial operation on 25 March.

Hot functional testing of unit 4 began on 25 September last year. These tests involve increasing the temperature of the reactor coolant system and carrying out comprehensive tests to ensure that coolant circuits and safety systems are operating as they should. Carried out before the loading of nuclear fuel, such testing simulates the thermal working conditions of the power plant and verifies that the nuclear island and conventional equipment and systems meet design requirements.

The Fangchenggang plant is planned to house six reactors. The first phase comprises two CPR-1000 units which were put into commercial operation in 2016. Units 5 and 6 are expected to feature Hualong One reactors.

Economic benefits of Polish AP1000 deployment highlighted

10 April 2024

The construction of six Westinghouse AP1000 reactors would contribute more than PLN118.3 billion (USD30.2 billion) in GDP for Poland, while their subsequent operation would generate PLN38 billion in GDP annually, an independent study has found.

.jpg?ext=.jpg) Westinghouse CEO Patrick Fragman and US Ambasador Mark Brzezinski discussed the new report at a press meeting in Poland (Image: US Embassy in Warsaw)

Westinghouse CEO Patrick Fragman and US Ambasador Mark Brzezinski discussed the new report at a press meeting in Poland (Image: US Embassy in Warsaw)

Poland has set out a pathway to develop new nuclear power, with the aim of building six to nine GWe of nuclear capacity, using pressurised water reactor technology. According to latest Polish Nuclear Power Programme timeline, published in 2020, construction is due to begin in 2026, with commissioning of the first unit targeted for 2033.

In November 2022, the then Polish government selected the Westinghouse AP1000 reactor technology for the country's first nuclear power plant, at the Lubiatowo-Kopalino site in the Choczewo municipality in Pomerania in northern Poland. An agreement setting a plan for the delivery of the three-unit plant was signed in May last year by Westinghouse, Bechtel and Polskie Elektrownie Jądrowe (PEJ). The country's Ministry of Climate and Environment in July issued a decision-in-principle for PEJ to construct the plant. The aim is for Poland's first AP1000 reactor to enter commercial operation in 2033.

PricewaterhouseCoopers LLC (PwC) has produced a report - titled The Economic Impact of a Westinghouse AP1000 Reactor Project in Poland - for Westinghouse and its owners, Brookfield and Cameco.

PwC assessed the jobs, GDP, labour income and tax revenue associated with the AP1000 project arising from both capital expenditures and ongoing operations. It also considered the broader impacts of developing the AP1000 project, focusing on its impact on skills, training and development, support for local industry clusters, contribution to Poland's climate change efforts, and its adherence to high safety standards in power plant operations.

The study projects that the 20-year manufacturing, engineering and construction phase of six AP1000 units will produce more than PLN118.3 billion of GDP impact and more than 204,990 person-years of direct employment in Poland.

Once operational, these units will create a minimum of PLN38 billion in GDP and support 16,300 jobs annually. During a minimum operating period of 60 years, the cumulative undiscounted economic footprint is estimated to be PLN2282 billion in GDP, 978,000 person-years of employment, PLN363 billion in labour income and PLN981 billion in total taxes in Poland, when taking into account direct, indirect, and induced effects. Extended operation would increase these impacts.

The report also says Poland's supply chain can support new global AP1000 deployments, generating an additional PLN1.9 billion in GDP per unit. Additional opportunities will also be available with eVinci microreactor and AP300 small modular reactor deployments in Europe.

Westinghouse also announced the selection of seven Polish suppliers to support the Lubiatowo-Kopalino site and other European projects: Polimex Mostostal Siedlce, Baltic Operator (Grupa Przemyslowa Baltic), Mostostal Kielce, Mostostal Krakow, ZKS Ferrum, Famak and Energomontaz-Polnoc Gdynia.

The company said "the down selection process was conducted in a transparent and competitive manner, considering requirements of quality assurance applicable to nuclear island equipment. This is a part of the process of preparation for the execution phase of the project in Lubiatowo-Kopalino".

"Deploying our AP1000 technology in Poland represents a 100-year partnership between the United States and Poland on energy security," said David Durham, president of Westinghouse Energy Systems. "This study further underlines the significant and long-term economic, human capital and climate benefits that this technology can provide for the country, its people and deeply experienced supply chain. The involvement of leading suppliers like those we announced today will be critical as Westinghouse advances this visionary nuclear power plant project."

Partnership aims to drive forward HTMR-100 SMR in South Africa

10 April 2024

Koya Capital has signed a partnership agreement to work with Stratek Global to secure financing and construction of a ZAR9 billion (USD480 million) first-of-a-kind reactor in South Africa.

A cutaway of the reactor, much of which would be underground (Image: Stratek Global)

A cutaway of the reactor, much of which would be underground (Image: Stratek Global)

The reactor is the Pretoria-developed HTMR-100 which produces 100 MW of heat and 35 MW of electricity and which is derived from the South African Pebble Bed Modular Reactor (PBMR) programme, which was to have been a small-scale high-temperature reactor using graphite-coated spherical uranium oxycarbide tristructural isotropic (TRISO) fuel, with helium as the coolant, able to supply process heat as well as generating electricity. South Africa had been working on the PBMR project since 1993, however, in 2010 the government formally announced its decision no longer to invest in the project, which was then placed under 'care and maintenance' to protect its intellectual property and assets.

Chairman and CEO of Stratek Global, Kelvin Kemm, a former chairman of the South African Nuclear Energy Corporation, told World Nuclear News last year that thanks to the experience and legacy of the PBMR programme - which was at the start of the pilot plant stage when it was paused - the aim was to have a first HTMR-100 plant built within five years.

The new partnership follows what Stephen Edkins, head of CleanTech at tech consultancy Koya Capital, told Biznews was a period of due diligence which has convinced them of the potential of the technology and they will now work to ensure Stratek Global's project is investor-ready, and to recommend the project to its investors, with a "strong commitment to break ground before the end of the year".

Edkins added: "This collaboration transcends mere reactor construction, it is about establishing a benchmark in clean, dependable energy for Africa and the wider world, and we are thus excited to work alongside Stratek Global in this innovative endeavour. There is a growing realisation that nuclear energy is the best way to address the substantial demand for clean base-load power in Africa and around the world."

Stratek stresses the low cooling-water needs - which vastly increases the numbers of potential sites in Africa and elsewhere - and the reactor's ability to power, for example, a remote mine and community without requiring long-distance power distribution network lines. Differences between the PBMR and the HTMR-100 include the gas outlet temperature being reduced from 940°C to 750°C, and, while the PBMR used a direct helium cycle through the reactor and into the turbines, the HTMR-100 instead takes the heat into a water heat exchanger or steam generator, which produces steam for conventional steam turbines or process heat. This means all the equipment downstream of the heat exchanger can be purchased off-the-shelf, reducing design time and costs.

Romania's SMR site selection process gets IAEA approval

10 April 2024

An International Atomic Energy Agency follow-up mission has concluded that the selection of Doicesti as the site for deployment of small modular reactors complied with the agency's safety standards.

.jpg?ext=.jpg) How a NuScale SMR plant could look (Image: NuScale)

How a NuScale SMR plant could look (Image: NuScale)

The IAEA Site and External Events Design (SEED) follow-up mission's conclusion was announced by Romania's nuclear power company Nuclearelectrica and RoPower Nuclear, the small modular reactor (SMR) project company.

The mission was requested by Nuclearelectrica to independently assess the process against the IAEA's safety standards, before moving on to the next phase of the site evaluation ahead of applying for a site licence at Doicesti, where a thermal power plant will be replaced.

Paolo Contri, mission leader and Head of the External Events Safety Section in the IAEA's Department of Nuclear Safety and Security, welcomed the steps taken to conduct "an objective, feasible and safety-oriented site selection process" and the request for a follow-up mission to the 2022 one was the "best evidence" of a "commitment to safety and to ... minimise the risk that safety issues discovered at a later stage may challenge the smooth and safe project implementation. The experience under development in Romania can be of great value for the nuclear community".

Nuclearelectrica CEO Cosmin Ghita said: "Nuclear projects, regardless of the technology, have one essential thing in common: nuclear safety, and we are keen on developing an exemplary project by using a high-level nuclear safety technology, rigorous site selection, complete and safe site-specific external events consideration. In addition to Romanian experts, we very much appreciate international objective, independent expertise to make sure that all safety-related issues are considered and addressed from the early stages of the project."

Melania Amuza, CEO of RoPower Nuclear, thanked the IAEA and Nuclearelectrica for reviewing the site selection process and said: "We believe we have a solid project, and the current IAEA evaluation gives us even more confidence ... We are also certain that current evaluations, recommendations, and studies will contribute and act as a catalyst for current and future SMR projects."

Romania's SMR project is aiming for 462 MW installed capacity, using NuScale technology with six modules, each with an installed capacity of 77 MW. The SMR project is estimated to create nearly 200 permanent jobs, 1500 construction jobs and 2300 manufacturing and component assembly jobs, as well as facility operation and maintenance jobs over the 60-year life of the facility.

Researched and written by World Nuclear News

.jpg?ext=.jpg) The LDR-50 reactor design (Image: Steady Energy)

The LDR-50 reactor design (Image: Steady Energy) (Image: ČEZ)

(Image: ČEZ) (Image: CNNC)

(Image: CNNC).jpg)

_1.jpg?ext=.jpg) Fangchenggang units 3 and 4 (Image: CGN)

Fangchenggang units 3 and 4 (Image: CGN).jpg?ext=.jpg) Workers in the control room mark the unit's attainment of first criticality (Image: CGN)

Workers in the control room mark the unit's attainment of first criticality (Image: CGN).jpg)

.jpg?ext=.jpg) Westinghouse CEO Patrick Fragman and US Ambasador Mark Brzezinski discussed the new report at a press meeting in Poland (Image: US Embassy in Warsaw)

Westinghouse CEO Patrick Fragman and US Ambasador Mark Brzezinski discussed the new report at a press meeting in Poland (Image: US Embassy in Warsaw) A cutaway of the reactor, much of which would be underground (Image: Stratek Global)

A cutaway of the reactor, much of which would be underground (Image: Stratek Global).jpg?ext=.jpg) How a NuScale SMR plant could look (Image: NuScale)

How a NuScale SMR plant could look (Image: NuScale)